Oil prices advanced during Asian trading on Friday, extending the previous session’s rebound as investors focused on possible supply disruptions in Russia and Iran amid geopolitical risks.

At the same time, fears of an immediate rise in Venezuelan oil output subsided after the U.S. Senate approved a measure requiring congressional authorization for further military action by President Trump.

Analysts said oil production in the country is unlikely to increase sharply in the near term, even with U.S. intervention.

Brent crude futures for March rose 0.7% to $62.44 a barrel, while WTI futures gained 0.7% to $58.03 by 21:04 ET (02:04 GMT). Both benchmarks rebounded to levels seen before last week’s U.S. military action in Venezuela after posting more than 4% gains on Thursday.

Oil prices were supported by positive inflation data from China, the world’s top oil importer, signaling a tentative economic recovery. However, gains were limited as traders remained cautious ahead of key U.S. nonfarm payrolls data that could affect interest rate expectations.

Markets focus on potential supply disruptions in Russia and Iran

Concerns about possible supply disruptions in Russia and the Middle East lent support to oil prices this week.

The conflict between Russia and Ukraine showed little sign of resolution, with ongoing military actions. A drone strike on a tanker headed to Russia in the Black Sea heightened fears of further interruptions to Russian crude supplies.

Compounding these concerns, reports indicated that U.S. President Donald Trump plans to endorse a bipartisan bill imposing even tougher restrictions on countries trading with Russia, aiming to increase pressure on Moscow to seek a ceasefire.

Meanwhile, Iraq’s government approved a move to nationalize operations at the West Qurna 2 oilfield—one of the world’s largest—in an effort to avoid supply disruptions stemming from U.S. sanctions on Russia.

In Iran, escalating nationwide anti-government protests have raised worries about potential impacts on oil production. The government responded with a countrywide internet blackout as demonstrations spread across major cities protesting the Nezam regime.

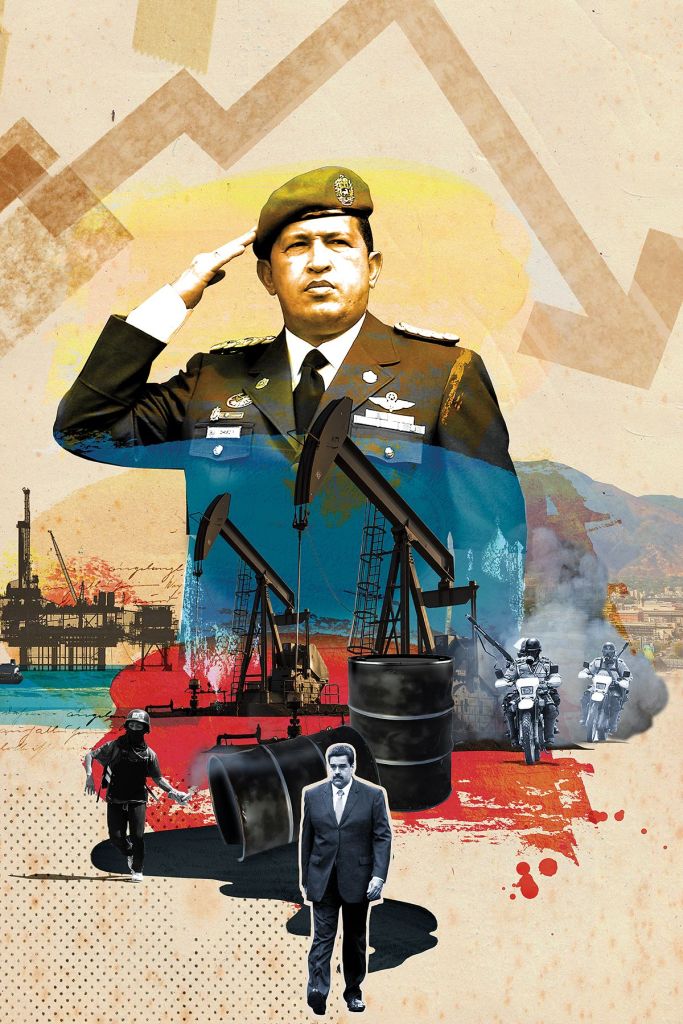

Market concerns over Venezuelan oil supply ease

Oil prices benefited from easing worries that a U.S. intervention in Venezuela would lead to a significant near-term surge in global crude supply.

Earlier this week, Trump stated that Caracas could deliver up to $3 billion worth of oil to the U.S. and indicated plans for long-term U.S. influence over the country.

However, Congress has advanced legislation that may restrict U.S. military involvement in Venezuela.

Many analysts noted that while U.S. involvement could eventually help boost Venezuelan oil production, persistent political turmoil and deteriorated infrastructure make any near‑term surge in output unlikely.

Oil prices initially plunged after the U.S. detained Venezuelan President Nicolás Maduro and signaled control over the country’s oil industry, but prices had fully recovered by Friday as markets judged immediate changes to supply to be limited.

Still, crude prices were experiencing their steepest annual decline in five years in 2025, weighed down by concerns over a widening supply glut and sluggish demand growth—an outlook echoed by major global institutions forecasting continued oversupply into 2026.

Sources: Investing

Leave a comment