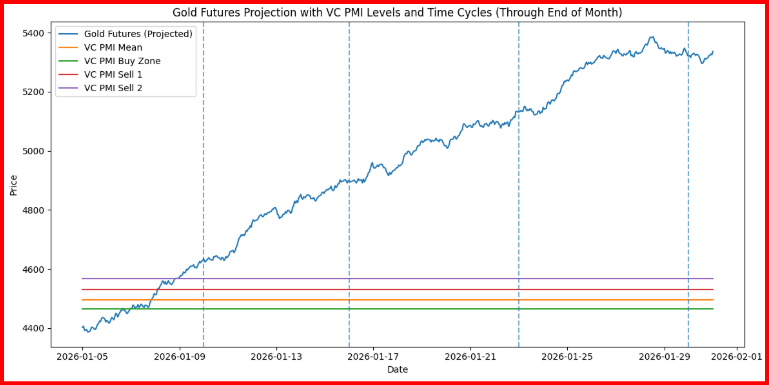

Gold futures have entered a crucial expansion phase, with prices accelerating beyond key VC PMI levels on both daily and weekly charts, indicating momentum-driven growth rather than a mean-reversion scenario. The 15-minute /GC chart shows prices breaking through the VC PMI Daily Mean near $4,496 and pushing above the Sell 1 Daily level at $4,531, confirming robust upward price acceptance. Such moves typically happen when price action and timing converge, creating what traders call “escape velocity.”

According to the VC PMI framework, the market is currently trading near the upper probability band, approaching Sell 2 Daily around $4,561 and Sell 1 Weekly near $4,567, with Sell 2 Weekly projected at about $4,633. Historically, these levels mark significant zones of exhaustion or pause, where momentum traders tend to take profits and the risk of mean reversion rises. Although strong trends can push prices beyond these points, the odds favor increased volatility followed by consolidation once these upper bands are tested.

Time cycle analysis highlights the significance of the present period. The current advance is reaching a short-term cycle peak that aligns with the mid-January rhythm, typically linked to sharp intraday moves and heightened emotional trading. When price momentum accelerates into a cycle window while nearing VC PMI sell bands, markets often shift from trend continuation to sideways rotation. This doesn’t signal a major top but does indicate a high-risk zone for initiating new long positions, emphasizing the need for disciplined trade management.

From the Square of 9 perspective, the current price range corresponds with significant harmonic rotations stemming from previous major swing lows. The $4,560–$4,640 zone marks an important angular relationship where price, time, and geometric factors intersect. Such geometric convergence points often serve as critical decision areas, influencing whether the market pauses, pulls back to the VC PMI mean, or accelerates into a larger upward move.

In summary, gold maintains its bullish structure but is currently trading within a statistically and geometrically significant high zone. Traders are advised to focus on risk management, gradually take profits, and consider the likelihood of mean reversion around the VC PMI levels, while closely watching cycle developments to confirm whether the trend will continue.

Sources: Investing

Leave a comment