Oil prices are rising sharply, as WTI nears $62 and Brent crude moves up toward $66 per barrel. These increases highlight the market’s responsiveness to geopolitical tensions, despite no actual disruptions in supply. The question remains: where will prices go from here?

Main Highlights of WTI Crude Oil

- WTI Crude Oil prices are sharply rising amid concerns that ongoing protests in Iran might escalate and impact production or disrupt the Strait of Hormuz.

- However, this upward pressure is balanced by underlying fundamentals and a global surplus.

- The current price around $62 is a crucial threshold: surpassing this resistance level could pave the way for a rally toward the six-month highs near $66.

In today’s trading environment, it can be difficult for market participants to isolate the key drivers of price action on a day‑to‑day basis. Beyond enduring themes like economic growth trajectories, inflation trends, the expansion of AI infrastructure, and sovereign debt pressures, fresh geopolitical tensions seem to emerge almost daily.

Amid simmering issues in places like Venezuela — and speculation about other potential flashpoints — Iran has become the dominant focus for energy markets. Nationwide protests there, sparked by severe economic strains and a collapsing currency, have raised serious questions about stability in one of the world’s most influential oil‑producing countries.

Although these demonstrations have not yet led to direct disruptions in oil output, the unrest has prompted traders to price in a growing geopolitical risk premium. Concerns about possible escalation — including the risk of broader conflict or disruption to key infrastructure such as the Strait of Hormuz, through which a large share of global seaborne oil exports transit — are contributing to recent volatility in crude prices.

As a reminder, Iran remains a key influence on global energy markets due to both its oil production capacity and its control over the Strait of Hormuz — a vital maritime chokepoint through which nearly 20 million barrels per day of crude and petroleum products transit, representing a large share of seaborne global oil flows. Any actual or perceived threat to exports or shipping through this route can have outsized impacts on pricing and risk sentiment.

Against this backdrop, oil prices have recently climbed, with Brent trading in the mid‑$60s and WTI previously approaching the $62 per barrel area, as traders price in geopolitical risk tied to the unrest in Iran. This reflects markets’ sensitivity to potential escalations, even though there have been no confirmed widespread production outages to date.

However, this upside is balanced by broader market fundamentals. Global oil inventories remain substantial, and additional output from other producers — including resumed Venezuelan exports and lingering oversupply concerns — continues to temper the rally. This backdrop helps explain why prices have fluctuated and, at times, pulled back when geopolitical anxieties ease.

Looking ahead, the future direction of crude prices is likely to hinge on developments in Iran’s domestic unrest and whether tensions translate into actual disruptions in oil production or interference with key export infrastructure such as the Strait of Hormuz. So far, most of the price appreciation has been driven by risk premium and sentiment rather than physical losses of barrels.

If broader instability were to disrupt supply routes or exports, markets could respond with a more pronounced and sustained price surge, particularly given the strategic importance of Middle East exports to the global oil system. However, short‑term moves are also currently influenced by macro factors such as inventory data and demand signals, as well as comments from policymakers that can quickly recalibrate risk perceptions.

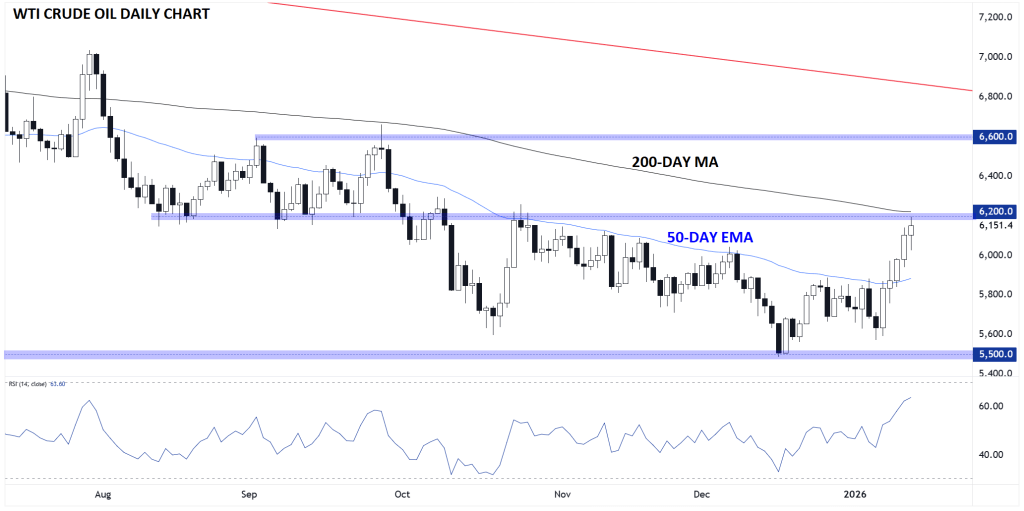

Technical Analysis of Crude Oil: Daily Chart for WTI

Looking at the technicals, WTI Crude Oil is on a five-day winning streak, climbing from the lower end of its three-month trading range between $55 and $62 up to the upper boundary. Chart-wise, the current price level is a crucial threshold: a break above the $62 resistance — which also aligns with the 200-day moving average — could open the door for further gains toward the six-month highs around $66, where it would face resistance from the longer-term bearish trend line drawn from the second half of 2023’s peak.

Conversely, if indications emerge that the protests are easing and stability is being restored in Iran, the geopolitical risk premium currently weighing on crude prices may diminish. This could trigger a reversal, causing prices to retreat below the $60 mark. Regardless of the outcome, oil traders should closely monitor developments in Iran in the days ahead.

Sources: StoneX

Leave a comment