Bitwise’s Chief Investment Officer, Matt Hougan, criticized the notion that Bitcoin is unsuitable for investment and 401(k) plans due to its volatility, pointing out that certain stocks can experience even greater price fluctuations.

Hougan’s remarks came on the same day that U.S. Senator Elizabeth Warren urged the Securities and Exchange Commission (SEC) to clarify how it plans to manage the risks associated with including cryptocurrencies in retirement funds.

In August of last year, U.S. President Donald Trump signed an executive order directing the Labor Department to reconsider restrictions on alternative assets in defined-contribution plans, potentially allowing cryptocurrencies to be included in 401(k) retirement accounts.

In a Monday interview with Investopedia Express Live, Matt Hougan criticized previous efforts by management firms like Vanguard and regulatory advice discouraging Bitcoin’s inclusion in 401(k)s as “ridiculous.”

“This is simply another asset class. Yes, it experiences price fluctuations and carries risk. However, over the past year, Bitcoin has been less volatile than Nvidia stock, yet there are no restrictions preventing 401(k) providers from offering Nvidia stock,” Hougan stated.

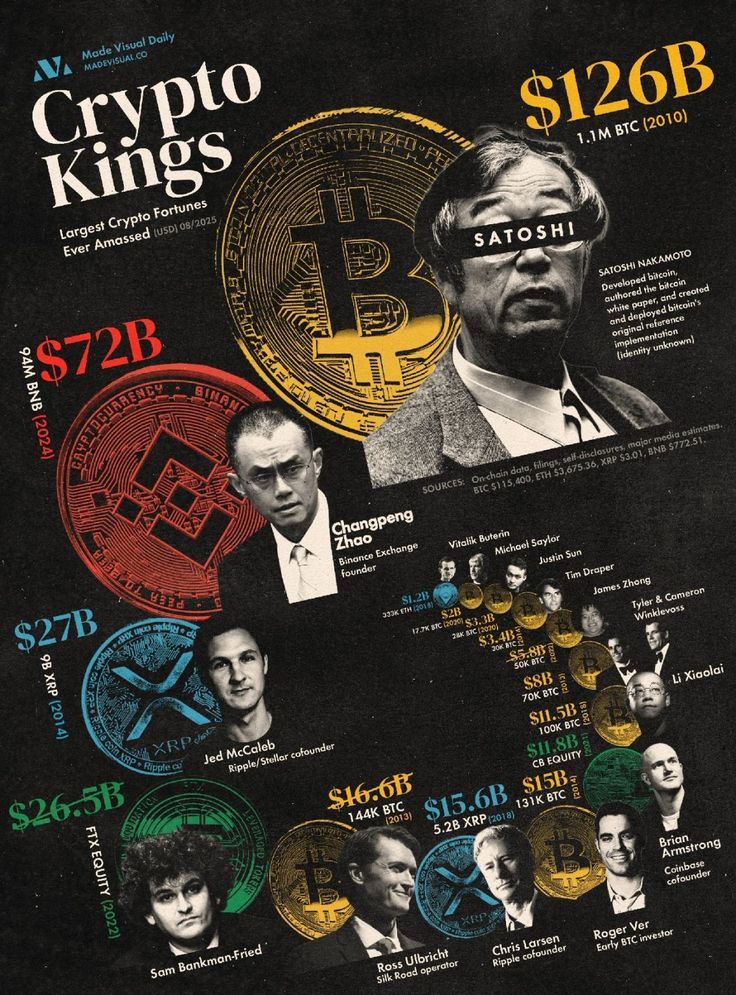

In 2025, Nvidia’s stock experienced a dramatic 120% price swing, dropping to around $94.31 in April before surging past $207 by October. During the same period, Bitcoin fluctuated between $76,000 and $126,080, a 65% swing. The inclusion of crypto assets in 401(k) retirement plans remains a key goal for crypto companies seeking wider retail adoption and increased legitimacy within the financial system.

Warren demands SEC answers on crypto in 401(k)

Meanwhile, U.S. Senator Elizabeth Warren is pressing the SEC for clarity on how it plans to manage risks associated with 401(k) plans investing in “alternative investments” like cryptocurrencies.

In an open letter released Monday, Warren expressed concerns that including crypto in retirement accounts may not benefit participants due to higher fees and expenses typically associated with these assets, alongside crypto’s inherent volatility.

“For most Americans, their 401(k) is a crucial source of retirement security, not a venue for risky financial speculation. Introducing crypto into these accounts could expose workers and families to significant losses,” she warned.

Warren has called on SEC Chair Paul Atkins to confirm by January 27 whether the regulator considers volatility when valuing crypto holdings of publicly traded companies.

She also seeks information on whether the SEC has evaluated manipulative practices in crypto markets and if it plans to publish research and educational materials to improve investor awareness.

Cryptocurrency Inclusion in 401(k) Plans Will Become Standard Over Time

Beyond President Trump’s executive order, in May the Department of Labor’s Employee Benefits Security Administration took a neutral position on cryptocurrency in 401(k) plans. They neither endorsed nor opposed it, having withdrawn a 2022 compliance guidance that previously discouraged crypto investments in retirement accounts.

Hougan noted that while it’s uncertain whether 401(k) providers will begin investing in crypto during 2026, he expects it to happen eventually and become normalized.

“These institutions move slowly, but the trend is clear. Over time, crypto will be treated like any other asset — which is exactly how it should be,” he added.

Sources: Fxstreet

Leave a comment