Critics of fiat currency have repeatedly tried—and failed—to call a peak in gold and silver. Once again, their arguments were derailed by geopolitical developments in Venezuela and beyond. The repercussions could prove even more supportive for the world’s most powerful form of money: Gold.

Iran is increasingly becoming a flashpoint of unrest, with protesters chanting “Death to the dictator!” while the U.S. government threatens action against the regime. Meanwhile in Asia, Chinese social media is circulating alleged plans to remove Taiwan’s leadership in a manner similar to what happened to Maduro. At the same time, President Trump’s earlier claim that he could end the war in Ukraine within 24 hours has clearly proven unrealistic. The conclusion is straightforward: geopolitical forces are now providing exceptionally strong support for gold—arguably outweighing, at least for the moment, concerns over government debt.

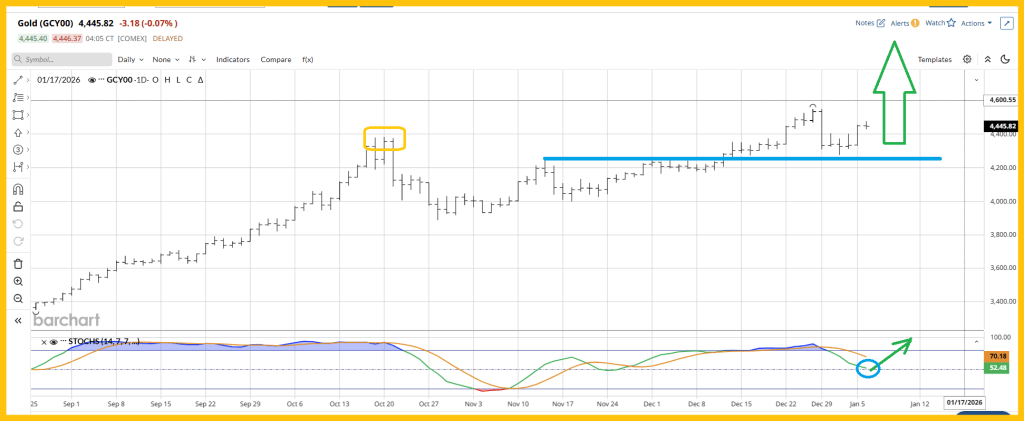

Gold appears to have broken higher from its October peak, and the pullback toward my $4,260 “speculator buy zone” is a technically normal correction. Investors who currently hold no gold should not wait around for a major selloff before entering the market. A small starter position is a better way to gain initial exposure to this exceptional asset. From there, larger allocations can be added during deeper pullbacks into strong support levels.

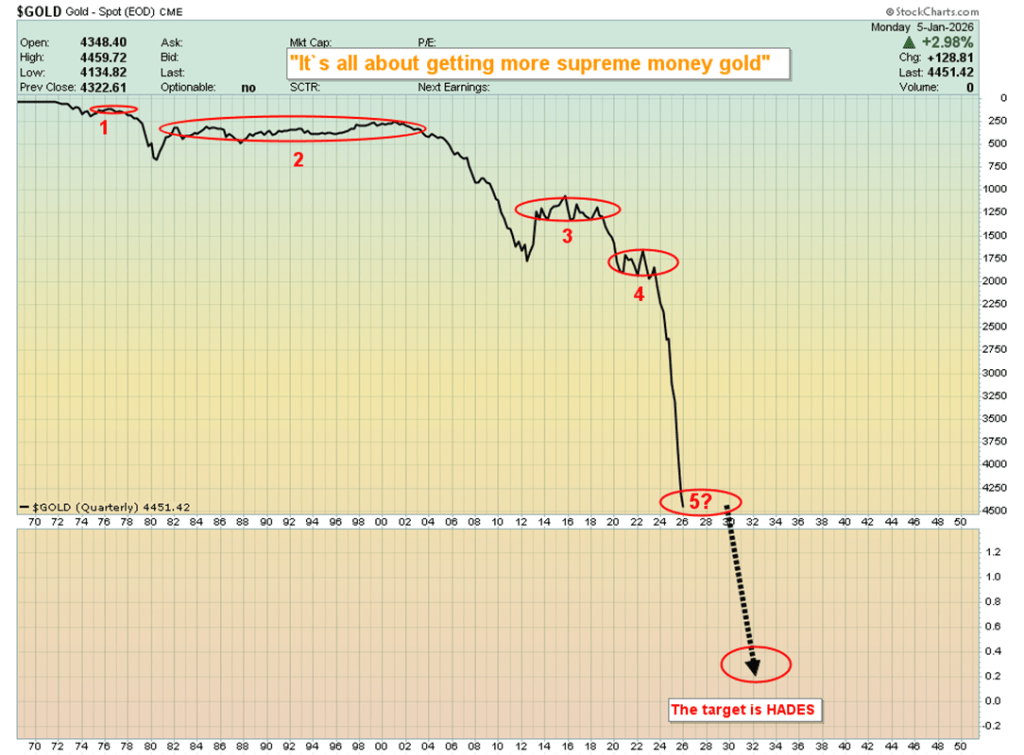

Because people are forced to purchase nearly everything using their government’s debased fiat currency, their attention in the early phase of a fiat system is directed toward acquiring more fiat rather than accumulating gold.

Over time, the purchasing power of fiat currency deteriorates rapidly, eventually pushing people to shift their focus toward gold. This is the phase America is expected to enter within the coming years. For those who have already adopted gold as their preferred currency, it will be a rewarding period—while for others, the transition may prove unsettling.

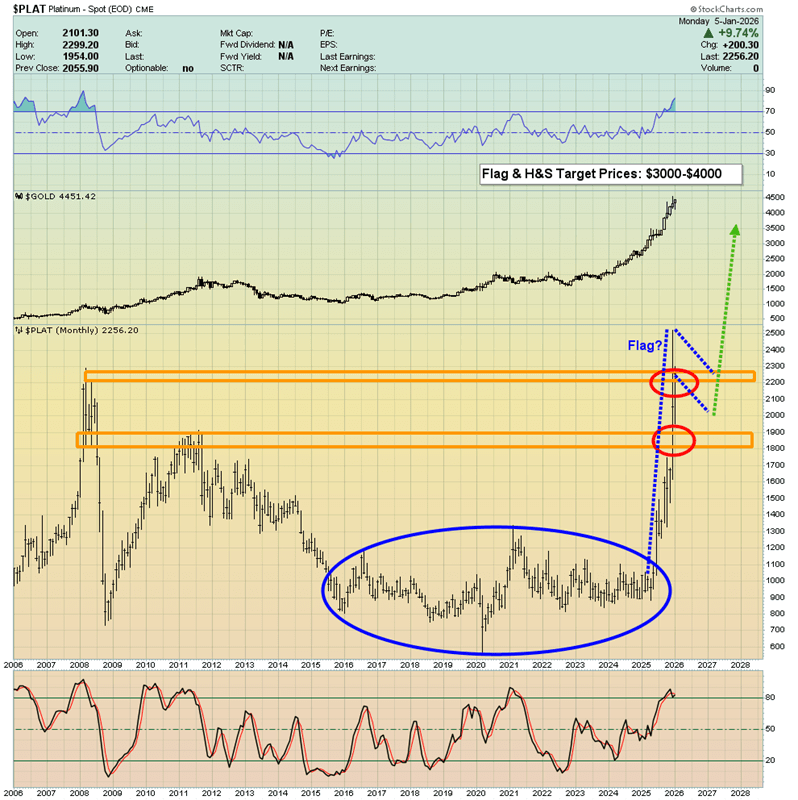

The platinum chart looks impressive. While platinum isn’t considered money, it remains a valuable metal and a useful means to acquire more gold. My recommendation was to buy platinum when prices are below $1,000 and then sell 30% to 70% of holdings between $1,800 and $2,400, using the proceeds to purchase gold. Personally, I opted to sell 70% and keep the remaining 30% as a long-term investment.

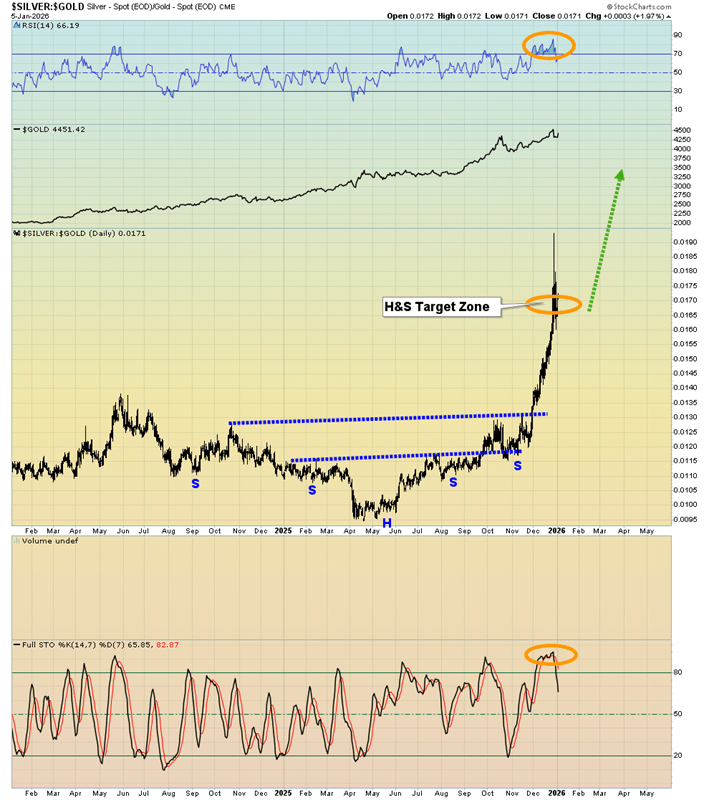

As for silver, there’s promising news: it might reclaim its role as a form of money. Rumors persist about central banks’ growing interest in this remarkable metal. Additionally, the era of robotics is dawning, with millions of robots set to replace human workers. Most will likely run on electricity generated by solar panels, which require silver for their production. While some manufacturers may switch to copper, a $100 price floor for silver appears inevitable.

Examining this metal’s impressive price movement relative to gold, and with silver’s potential to regain recognition as money, my advice is to sell no more than 30% of your holdings during the current upward rally, which has brought prices into my targeted zone on the chart. Similar to platinum, gains should be reinvested not into depreciating fiat currencies, but into gold.

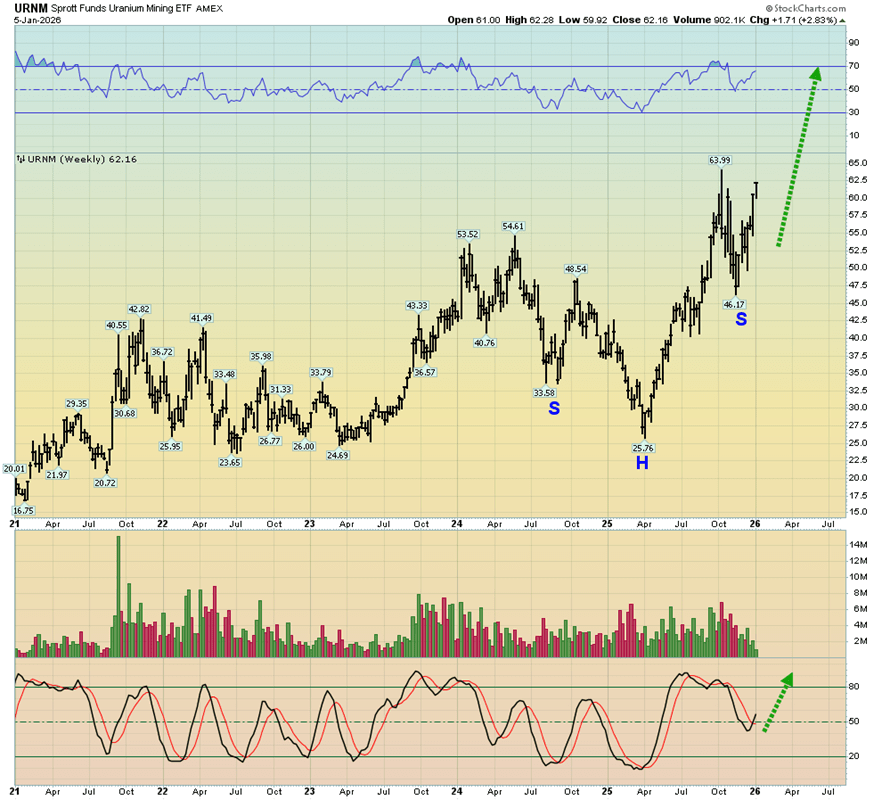

Another important asset for investors focused on gold is uranium. The chart for yellowcake stocks (URNM ETF) is striking, displaying a bullish inverse Head & Shoulders continuation pattern with a notably strong high right shoulder. Additionally, the Stochastics (14,7,7) indicator is signaling a buy at the chart’s lower levels. Simply put, yellowcake stocks present one of the clearest momentum-driven buying opportunities available.

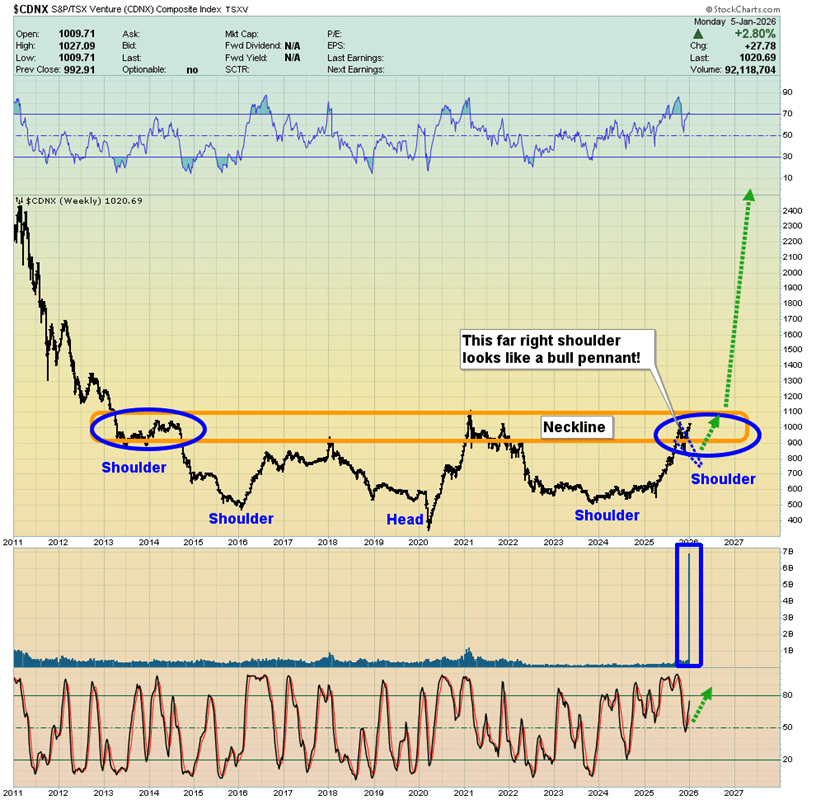

What about the miners? This could be one of the most bullish charts worldwide. I’ve advised investors in mining stocks to watch the CDNX closely as a key indicator of upside potential for gold and silver miners across the board. The right shoulder appears to form a bull wedge, poised to trigger a powerful breakout for these significantly undervalued miners.

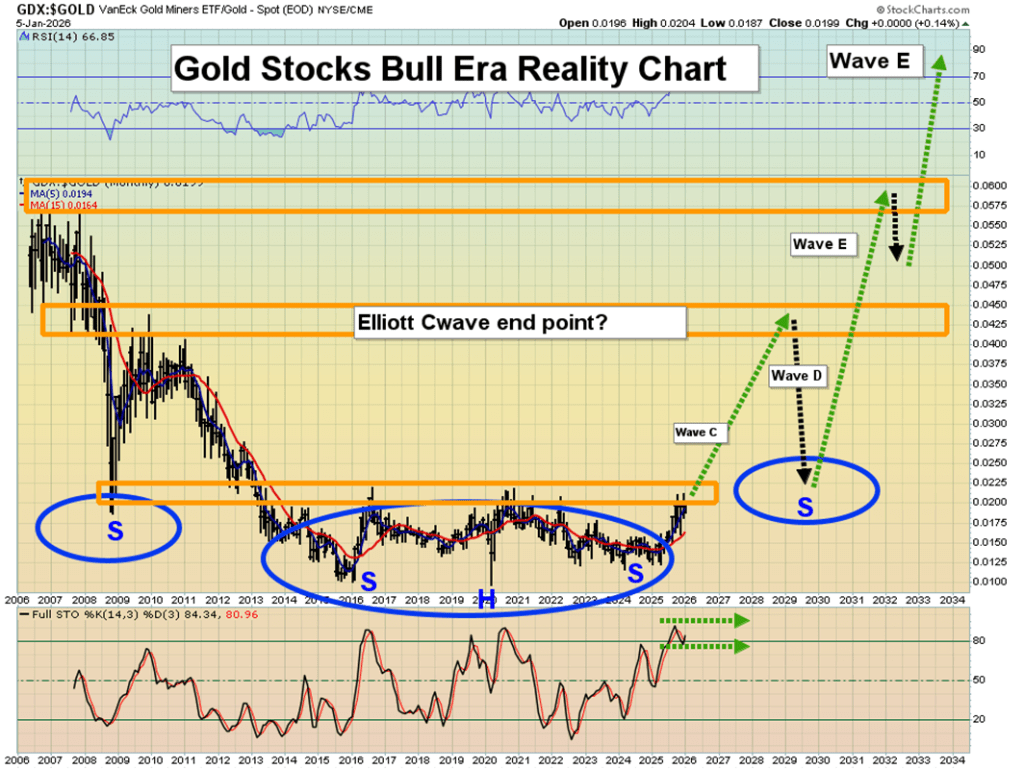

The “mouthwatering” GDX versus gold chart has caught my attention. I urged investors to look for a Stochastics (14,3,3) flatline signal, which has now appeared. A breakout above the neckline of the large inverse Head & Shoulders pattern seems imminent.

Put simply, if an investment cannot outperform gold—the ultimate store of value—there’s little reason to buy it; investors might as well hold gold directly. In the case of mining stocks, they seem poised to deliver one of the most significant wealth-building opportunities in market history. The key question remains: are informed investors ready to take advantage?

Sources: Investing

Leave a comment