This is shaping up to be a highly unpredictable week for U.S. and global markets, with numerous wildcard risks—largely tied to developments from the White House.

Investors will be closely watching for any developments related to the Justice Department’s investigation into Federal Reserve Chair Jerome Powell. Attention will also turn to the Supreme Court on Wednesday, when it hears arguments concerning President Trump’s attempt to remove Fed Governor Lisa Cook.

Trade policy remains a major wildcard, with tariff headlines likely to emerge rapidly after Trump threatened over the weekend to impose a new 10% levy on imports from eight European countries opposing his push on Greenland. The Supreme Court could also rule this week on the legality of Trump’s tariffs. Meanwhile, fresh rhetoric around Iran, renewed intrigue involving Venezuela, or actions targeting other geopolitical flashpoints could further unsettle markets.

In Japan, the Bank of Japan is widely expected to keep interest rates unchanged on Friday. However, a weakening yen has revived speculation about possible intervention, leaving the future of the massive yen carry trade hanging in the balance. In China, fourth-quarter GDP growth slowed amid the ongoing property downturn, potentially prompting a policy response.

All of this sets the stage for a busy week in Davos, where global leaders and policymakers are gathering, with President Trump scheduled to address the forum.

In the United States, a slate of economic data will keep both investors and Federal Reserve officials engaged during the holiday-shortened week. A revision to third-quarter GDP could clarify whether the initially reported 4.3% growth overstated the economy’s strength or accurately reflected underlying momentum.

Below are the key data releases this week that are most likely to shape the FOMC’s outlook ahead of its January 27–28 policy meeting.

GDP Update: Growth Momentum in Focus

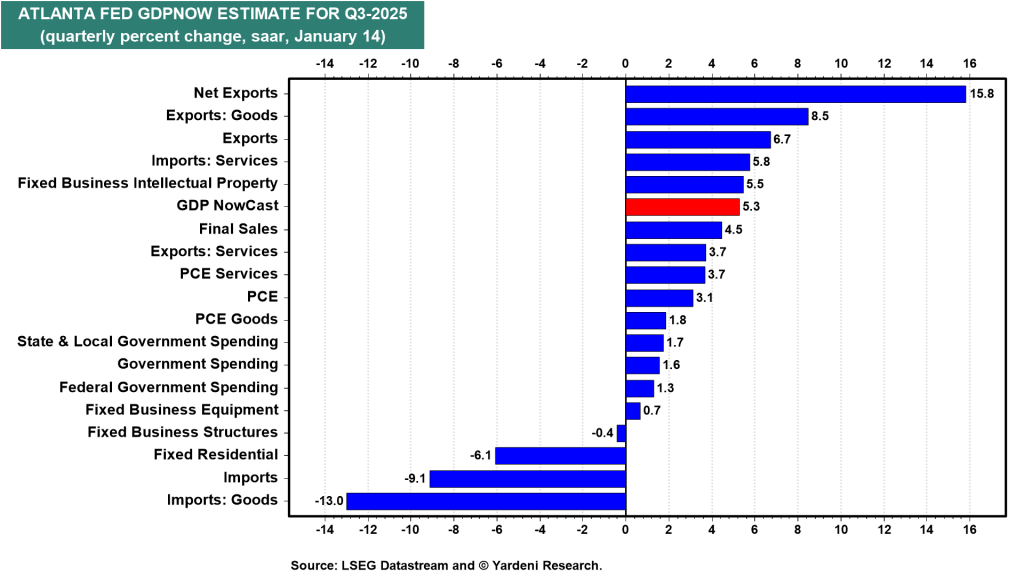

Overall data indicate the economy stayed resilient through the final three quarters of 2025. Despite a notable slowdown in employment growth, household demand exceeded expectations, while AI-related capital investment surged. Although a modest upward or downward revision to Q3 real GDP (Thursday) is possible, Q4 real GDP is currently tracking at a strong 5.3% annualized pace (see chart).

Personal income, consumption, and saving

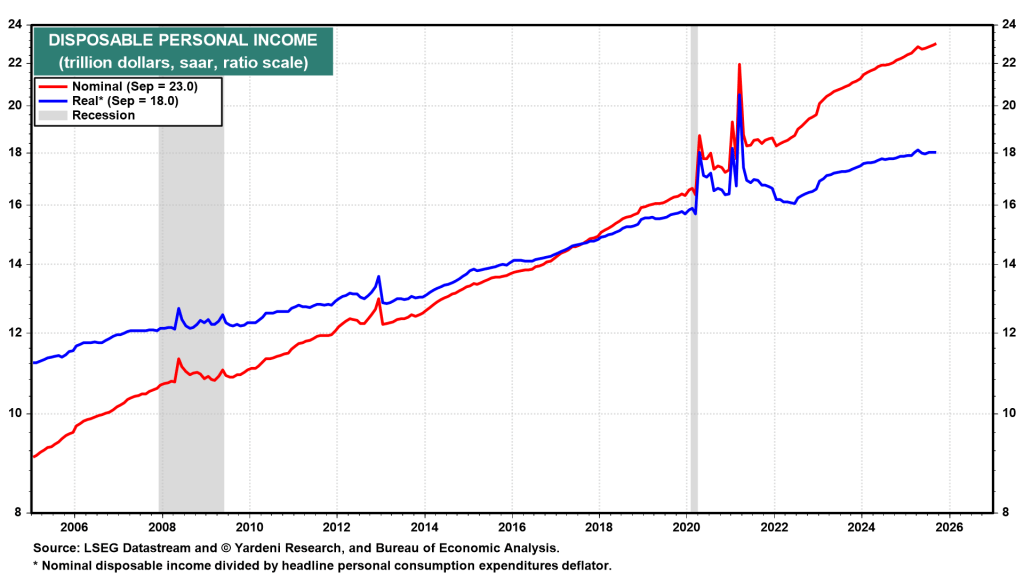

Personal income data for October and November (Thu) may reinforce the view that real disposable income growth has stalled. This likely reflects demographic effects, as retiring Baby Boomers exit the labor force and no longer generate wage income. If consumer spending remains resilient, it would suggest households—particularly retirees—are increasingly drawing on retirement savings.

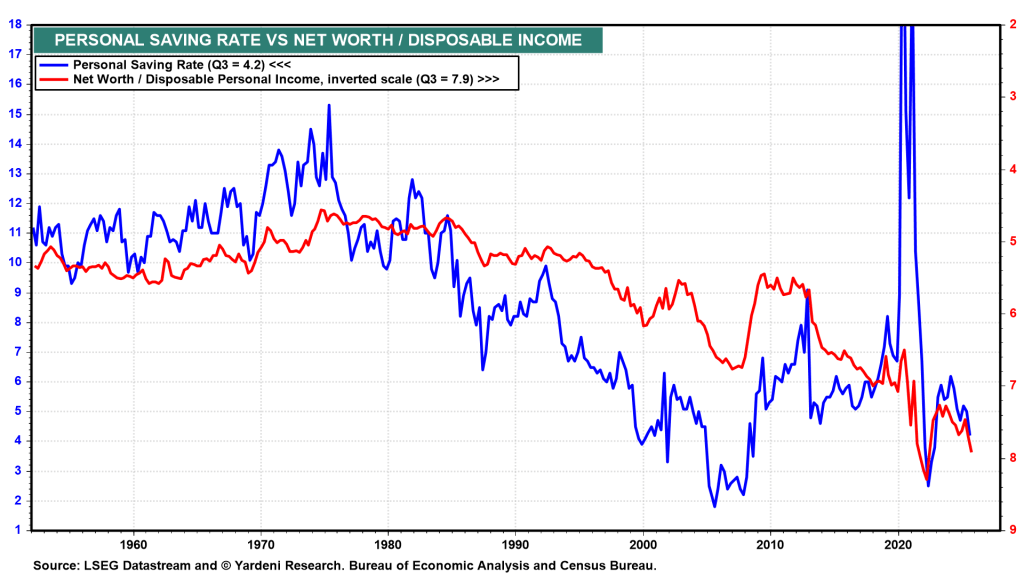

The personal saving rate (Thu) is likely to continue declining under our framework, particularly if household net worth keeps rising to record levels relative to disposable income (chart).

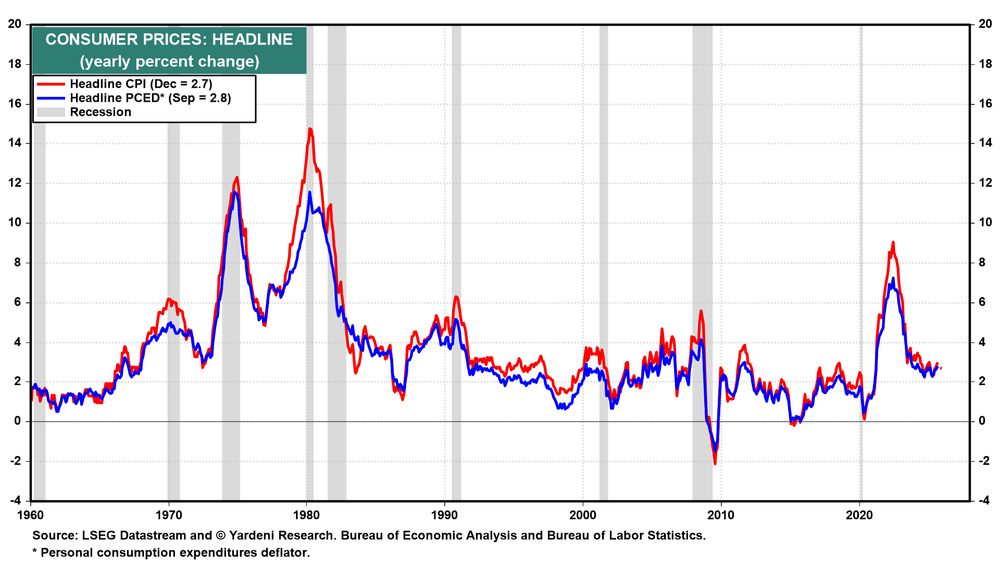

PCE inflation

The Bureau of Economic Analysis will calculate October PCE inflation (Thu) using the average of September and November CPI data. Meanwhile, the Cleveland Fed’s Inflation Nowcasting model projects headline and core PCE inflation at 2.65% y/y and 2.70% in November (chart).

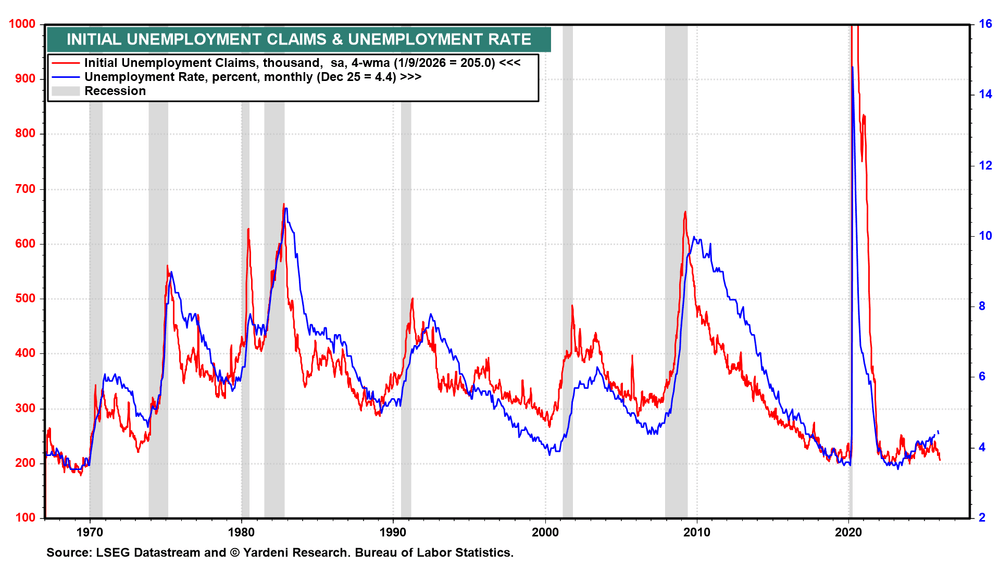

Unemployment claims

Initial jobless claims (Thu) have declined in recent weeks, indicating that January’s unemployment rate likely edged lower from December’s 4.4% (chart).

Sources: Yardeni

Leave a comment