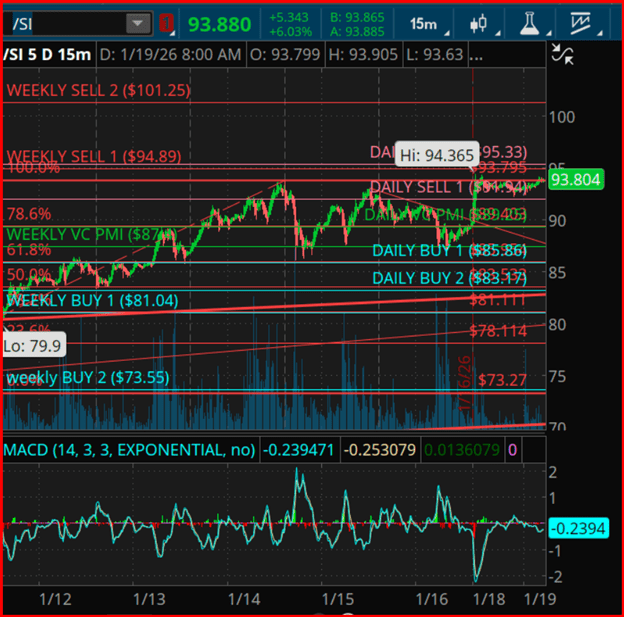

Silver remains in a high-momentum price-discovery phase, holding above the Daily VCPMI mean in the upper $89–$90 area, signaling sustained bullish momentum across both short- and intermediate-term timeframes.

The current structure points to strong participation on corrective pullbacks, increasing the likelihood that dips remain brief as buyers continue to defend the Daily Buy 1 and Weekly VCPMI support zones between $85 and $87.

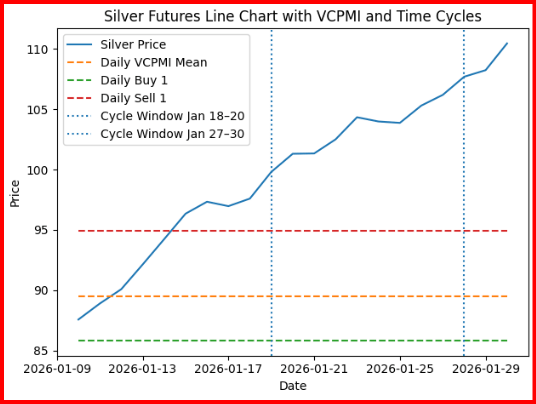

From a time-cycle standpoint, the dominant 30-, 60-, and 90-day harmonic cycles remain in alignment with the broader expansion phase that began in early Q4. The market is now entering a near-term inflection window projected for January 18–20, a period that historically aligns with volatility compression and subsequent directional resolution. Should price sustain closes above the Daily Sell 1 level, the probability outlook shifts toward trend continuation, with upside targets extending to the Weekly Sell 1 and Weekly Sell 2 zones.

Square of 9 price geometry identifies $93.75, $94.80, and $95.40 as key harmonic resistance levels—rotational nodes where trend acceleration or rejection is most likely to occur. A sustained acceptance above this zone would open the technical pathway toward the $98–$101 range, aligning with the upper Weekly Sell 2 projection and longer-term cycle expansion targets.

Conversely, failure to rotate higher through this resistance band would favor a mean-reversion move back toward the Daily VCPMI mean and the Weekly Buy 1 support zone near $81–$83.

From a structural perspective, silver’s resilience amid elevated volatility and margin pressure continues to validate a supported trend environment, with accumulation behavior dominating corrective phases. Rising open interest and consistent closes above the Weekly VCPMI further support the view that the broader market remains positioned for higher price discovery rather than distribution.

Looking ahead, the secondary momentum window from January 27–30 marks the next key timing convergence, where the interplay between Square of 9 resistance and cyclical factors could drive either a decisive breakout or a rotational pullback.

Traders applying the VC PMI framework should maintain discipline, executing systematically at predefined probability levels while separating emotional bias from structured risk and money management.

Sources: Patrick MontesDeOca

Leave a comment