- Pi Network rebounded about 1% on Tuesday from a key support level after falling roughly 4% on Monday.

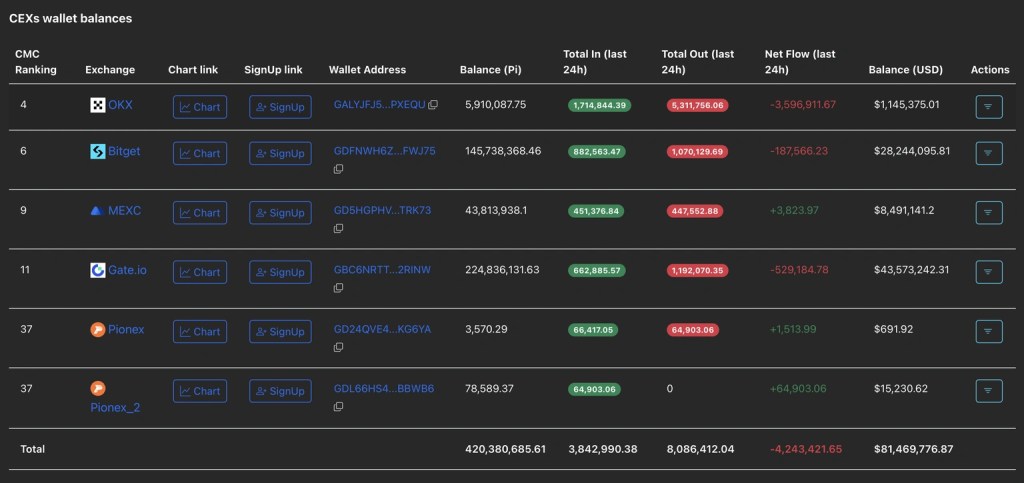

- Data from PiScan showed more than 4 million PI tokens were withdrawn over the past 24 hours, signaling retail efforts to hedge against further downside.

- From a technical perspective, PI remains under heavy selling pressure, with momentum turning bearish and leaving the token vulnerable to additional losses.

Pi Network (PI) was up about 1% at press time on Tuesday, marking a modest rebound after hitting a new record low of $0.1502 on Monday. Over the past 24 hours, mainnet holders have withdrawn more than 4 million PI tokens from centralized exchanges that support Pi Network. Despite the slight recovery, the technical outlook for PI remains bearish, with momentum indicators pointing to sustained selling pressure.

Retail buying limits further downside

PiScan data shows that centralized exchange reserves fell by 4.24 million PI tokens over the past 24 hours, signaling substantial withdrawals. This points to strong buying interest, which helped cap losses and secure a daily close above $0.1900. A continued decline in exchange reserves could ease supply pressure and raise the chances of a rebound in PI.

Technical outlook: Is PI at risk of further downside?

Pi Network was holding above the $0.1900 level at the time of writing on Tuesday, roughly 30% above Monday’s low of $0.1502. The rebound coincided with sizable exchange withdrawals and helped prevent a breakdown below the $0.1919 support level.

However, the downward-sloping 20-day and 50-day Exponential Moving Averages (EMAs) continue to point to a prevailing downtrend.

Momentum indicators on the daily chart remain decisively bearish. The Moving Average Convergence Divergence (MACD) has turned lower from the zero line, crossing below the signal line with an expanding negative histogram. Meanwhile, the Relative Strength Index (RSI) sits near 30, hovering around oversold territory and reflecting the recent selloff.

A daily close below $0.1919 could deepen the bearish trend, exposing downside targets at the S1 and S2 Pivot Points of $0.1835 and $0.1632, respectively.

PI/USDT daily price chart.

Any rebound in PI is likely to encounter resistance at the falling 20-day and 50-day EMAs, currently at $0.2045 and $0.2116, respectively.

Sources: Fxstreet

Leave a comment