It’s been a long, cold and snowy weekend in New York—just enough snow to keep most people glued to the couch. For anyone hoping for a brief break from markets, U.S. trading is closed on Monday.

For committed market watchers, however, Weekend Wall Street and Weekend Tech offer little comfort. Both have been under pressure following the latest developments around Greenland, with Weekend U.S. Tech CFDs down roughly 75 basis points as of 8:30 a.m. ET on Sunday. While this move is not definitive, it suggests futures could open lower when trading resumes Sunday evening at 6:00 p.m. ET.

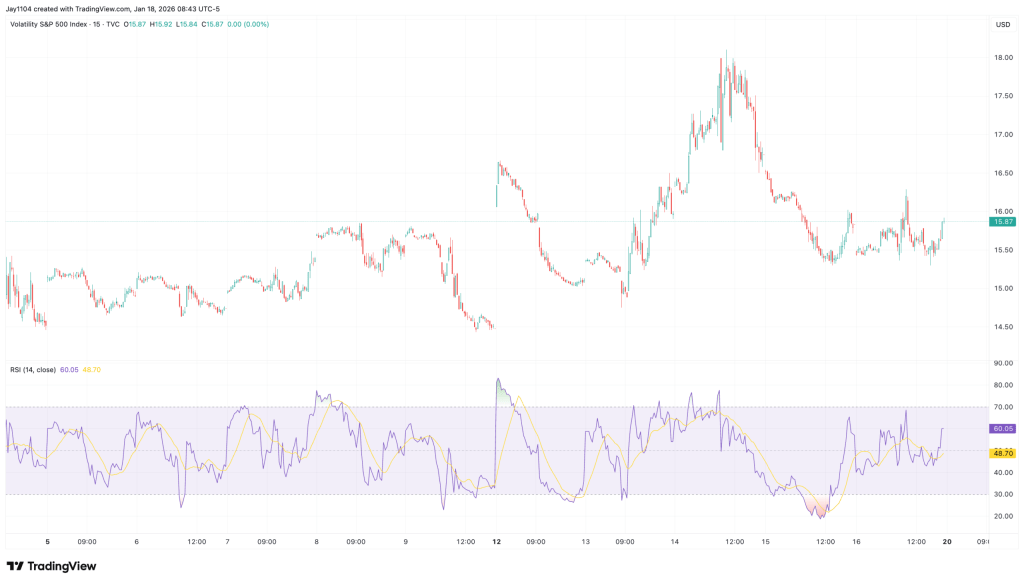

Attention also turns to Tuesday, when the Supreme Court may issue another opinion. Given how volatility was priced on Friday, it would not be surprising to see overnight volatility dynamics re-emerge, potentially pushing implied volatility higher into the 10:00 a.m. release window.

Tuesday also marks a $14 billion Treasury bill settlement, which is expected to tighten liquidity conditions further. As a result, the session could be eventful from the outset. If overnight funding rates begin to climb this week, pressure on usage of the Federal Reserve’s Standing Repo Facility would likely increase, with the key threshold for the overnight rate seen above 3.75%.

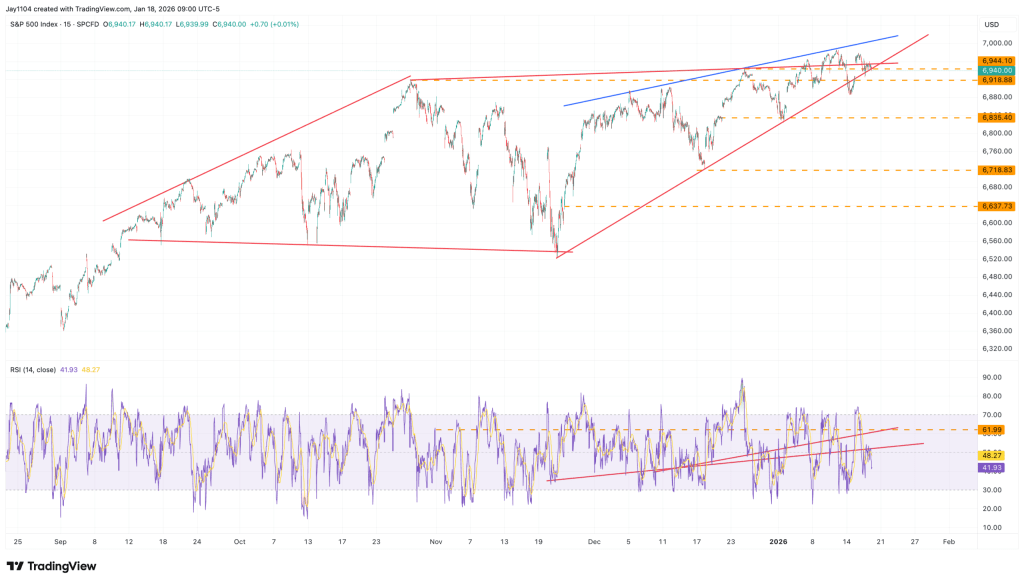

From my perspective, the technical setup in the S&P 500 looks fragile. The index appears likely to be in negative gamma when trading resumes on Tuesday, which could further amplify volatility. The rising wedge pattern remains intact, and a decisive break below the 6,900 support level would raise the risk of a more pronounced pullback.

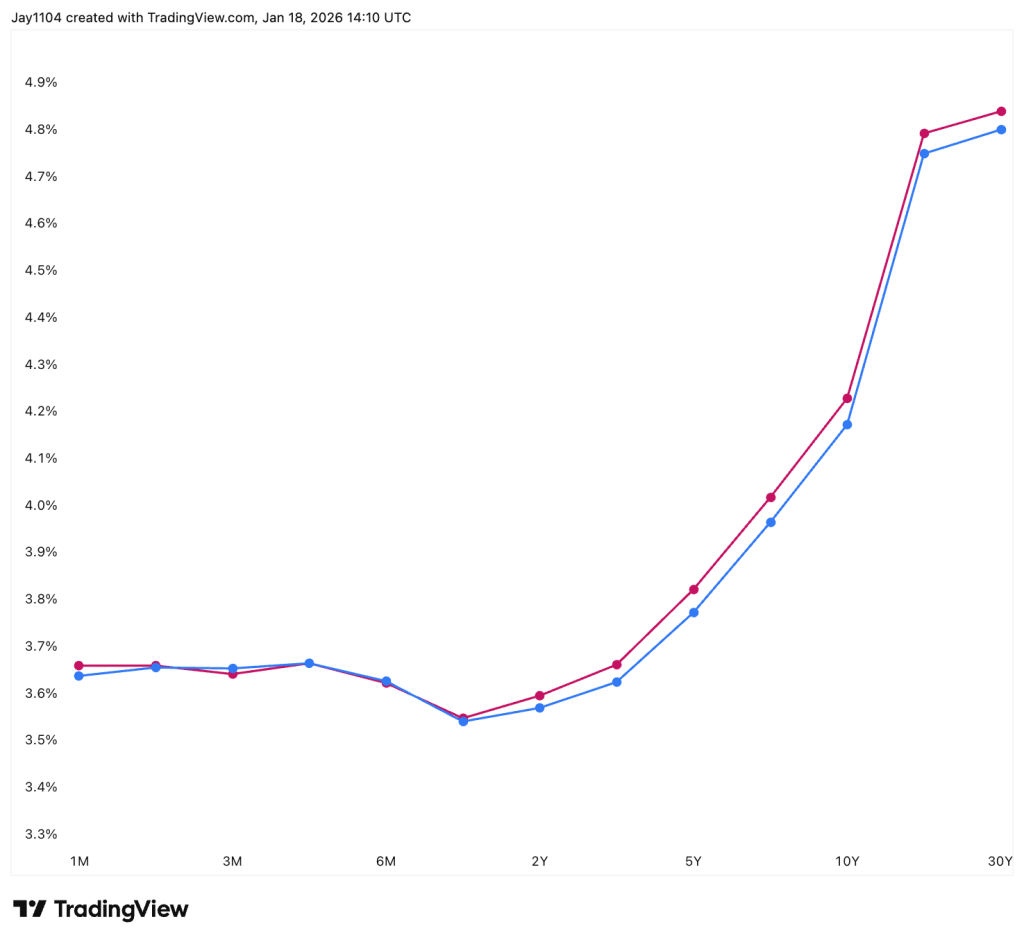

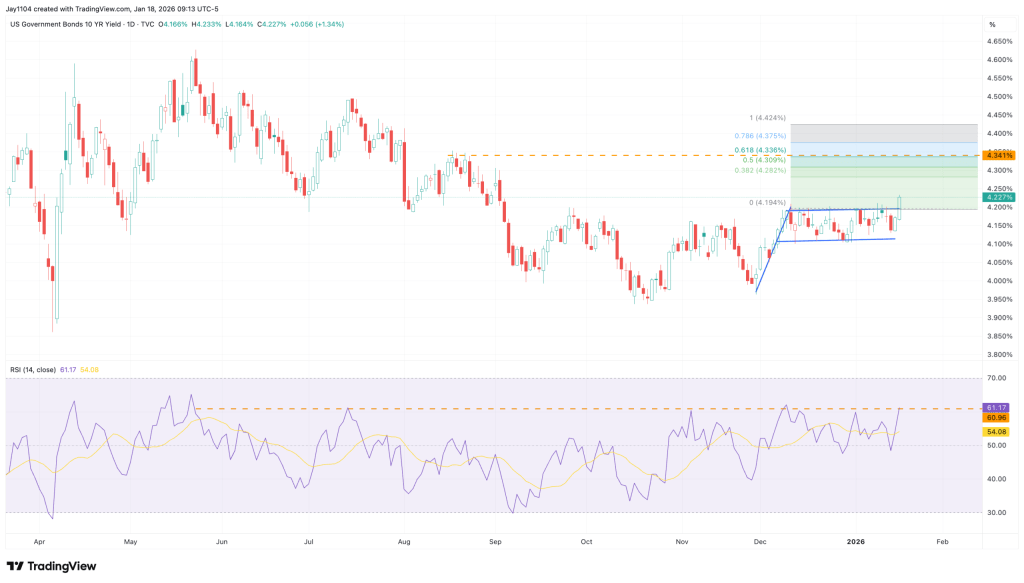

Ten-year Treasury yields broke higher on Friday, and much of that move may have been linked to the quarterly refunding questionnaire sent to primary dealers later in the afternoon. The most notable steepening in the yield curve occurred in the belly, which would be consistent with speculation that the Treasury is considering shifting the 7-year note from a monthly new issue to a quarterly issuance with two reopenings.

This suggests the Treasury could be preparing the market for potential adjustments to issuance size or duration in the near to medium term, though that view remains speculative. Notably, yields rose most sharply in the 5- to 7-year sector, reinforcing this interpretation.

Had the move instead been driven by expectations around Kevin Hassett no longer being considered for Fed chair, yields would likely have increased more at the front end of the curve.

Regardless of the catalyst, the key point is that the 10-year yield has broken out in a meaningful way, suggesting that a move higher may now be unfolding. While confirmation on Tuesday will be important, it is clear that market dynamics have shifted.

Sources: Michael Kramer

Leave a comment