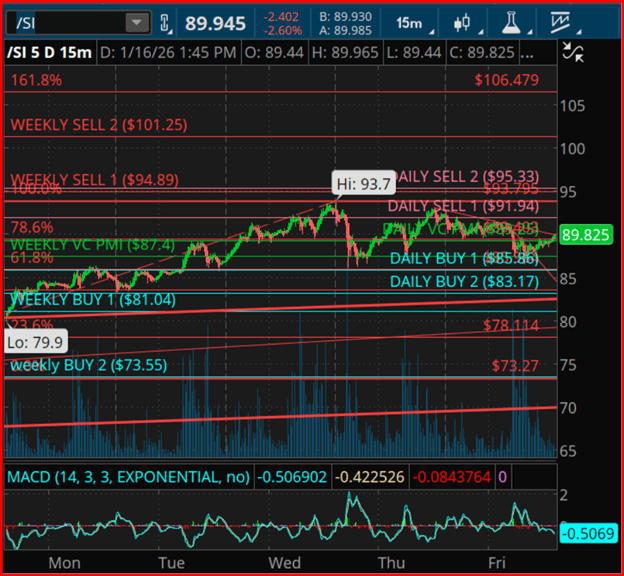

Silver remains within a clearly defined VC PMI probability structure, consolidating around the Daily VC PMI mean near the $89.25 area. This zone represents the market’s equilibrium level, where directional momentum is established. A sustained close above the mean would trigger bullish momentum, statistically favoring a move toward the Daily Sell 1 level near $91.94, followed by the Daily Sell 2 region around $95.33.

These upside targets also align with Square of 9 harmonic resistance levels, implying that any rally into these zones could be accompanied by heightened volatility and increased profit-taking.

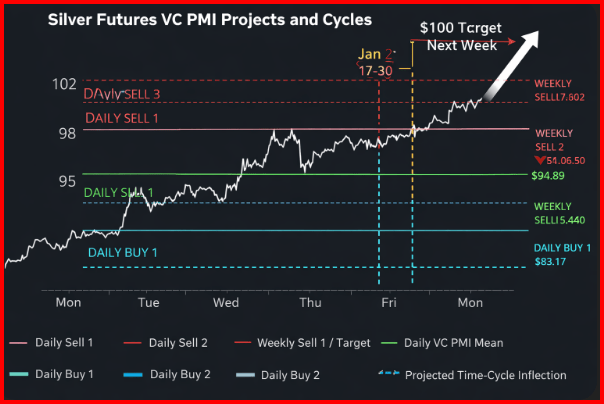

Time-cycle analysis points to a near-term inflection window between January 18 and 20, followed by a secondary momentum window from January 27 to 30. These periods align with current Square of 9 price geometry, where 45-degree and 90-degree harmonic rotations from the recent swing low intersect with the Daily and Weekly VC PMI bands.

Historically, when these time and price relationships converge, markets tend to experience either an expansion in momentum or a corrective pause ahead of the next directional move.

On the downside, corrective phases remain brief and shallow, underscoring a structurally supported trend. The Daily Buy 1 level near $85.86 and Daily Buy 2 around $83.17 mark high-probability accumulation areas, where the VC PMI model assigns a 90–95% likelihood of mean reversion back toward the daily equilibrium. These levels are further supported by the Weekly VC PMI mean near $87.40, which continues to function as dynamic support within the broader trend framework.

From a higher-timeframe perspective, the Weekly Sell 1 level near $94.89 and Weekly Sell 2 around $101.25 represent the next key upside reference points should daily bullish momentum evolve into a sustained trend. A weekly close above both the daily and weekly means would confirm a structural shift, clearing the way toward these upper harmonic targets derived from Square of 9 geometry and Fibonacci extensions.

Sources: Patrick MontesDeOca

Leave a comment