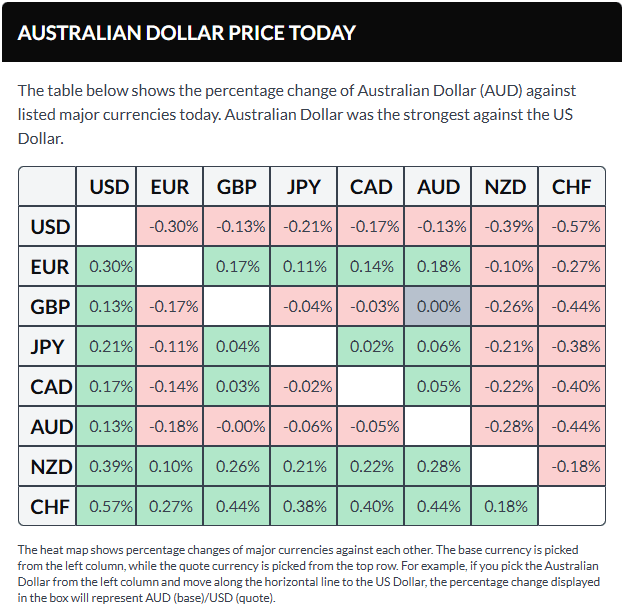

- The Australian dollar advanced after the TD-MI Inflation Gauge rose to 3.5% year-on-year in December.

- China’s GDP grew 1.2% quarter-on-quarter in the fourth quarter of 2025, accelerating from the previous quarter and exceeding market expectations.

- Meanwhile, the U.S. dollar struggled as risk aversion intensified amid escalating uncertainty surrounding U.S.–Greenland developments.

The Australian dollar strengthened against the U.S. dollar on Monday after Australia’s TD-MI Inflation Gauge rose to 3.5% year-on-year in December, up from 3.2% previously. On a monthly basis, inflation jumped 1.0% in December 2025, marking the fastest pace since December 2023 and a sharp acceleration from the 0.3% increases seen in the prior two months.

AUD/USD also found support from China’s key economic data, with developments in the Chinese economy closely watched given Australia’s strong trade links with China.

Data from China’s National Bureau of Statistics showed industrial production grew 5.2% year-on-year in December, accelerating from 4.8% in November, supported by resilient export-led manufacturing activity.

China’s GDP expanded 1.2% quarter-on-quarter in the fourth quarter of 2025, up from 1.1% in Q3 and above the market consensus of 1.0%. On an annual basis, GDP rose 4.5% in Q4, easing from 4.8% in the previous quarter but beating expectations of 4.4%.

Meanwhile, retail sales rose 0.9% year-on-year in December, falling short of forecasts for a 1.2% increase and November’s 1.3% reading. In contrast, industrial output exceeded expectations, rising 5.2% YoY versus estimates of 5.0% and improving from 4.8% a month earlier.

U.S. Dollar softens amid escalating uncertainty over the U.S.–Greenland dispute

The US Dollar Index (DXY), which tracks the Greenback against six major currencies, is under pressure and hovering near 99.20 at the time of writing. US financial markets remain closed on Monday in observance of Martin Luther King Jr. Day, resulting in thinner liquidity.

The Dollar has come under renewed pressure amid rising risk aversion, fueled by growing uncertainty surrounding the US–Greenland dispute. Over the weekend, US President Donald Trump reiterated plans to impose tariffs on eight European nations that have opposed his proposal for the United States to acquire Greenland.

According to Bloomberg, Trump said the US would levy a 10% tariff starting February 1 on imports from EU members Denmark, Sweden, France, Germany, the Netherlands, and Finland, as well as Britain and Norway. The tariffs would remain in place until Washington is allowed to proceed with the Greenland acquisition.

Meanwhile, recent US labor market data have pushed expectations for additional Federal Reserve rate cuts further into the year. Fed officials have indicated limited urgency to ease policy until there is clearer evidence that inflation is sustainably returning to the 2% target.

Reflecting this shift, Morgan Stanley revised its 2026 outlook, now projecting two rate cuts in June and September, compared with its prior forecast that anticipated cuts in January and April.

Data from the US Department of Labor showed that Initial Jobless Claims unexpectedly declined to 198K for the week ending January 10, well below market expectations of 215K and down from the prior week’s revised 207K. The figures suggest layoffs remain subdued and the labor market continues to show resilience despite prolonged tight financial conditions.

Inflation data offered mixed signals. Core CPI, excluding food and energy, rose 0.2% month-over-month in December, below expectations, while annual core inflation held steady at 2.6%, matching a four-year low. Headline CPI increased 0.3% MoM, in line with forecasts, leaving annual inflation unchanged at 2.7%. The data reinforced signs of easing price pressures after earlier readings were distorted by shutdown-related effects.

In Australia, Reserve Bank of Australia (RBA) policymakers acknowledged that inflation has eased substantially from its 2022 peak, though recent data point to renewed upside risks. Headline CPI slowed to 3.4% YoY in November, the lowest level since August, but remains above the RBA’s 2–3% target range. Trimmed mean CPI edged down to 3.2% from 3.3% in October.

The RBA noted that inflation risks have modestly shifted to the upside, while downside risks—particularly from global developments—have diminished. Policymakers currently expect only one additional rate cut this year, with underlying inflation projected to stay above 3% in the near term before easing toward 2.6% by 2027. Reflecting these expectations, ASX 30-Day Interbank Cash Rate Futures for February 2026 were trading at 96.35 as of January 16, implying a 22% probability of a rate hike to 3.85% at the next RBA policy meeting.

The Australian Dollar approaches the 0.6700 level, facing resistance near the nine-day EMA

The AUD/USD pair trades near 0.6680 on Monday, with daily chart signals showing consolidation around the nine-day Exponential Moving Average (EMA), pointing to a near-term neutral outlook. The 14-day Relative Strength Index (RSI) stands at 52.78, remaining above the neutral level and indicating underlying upside momentum.

A sustained move below the short-term moving average could bring the 50-day EMA at 0.6642 into focus as initial support. Deeper declines may extend toward 0.6414, the lowest level recorded since June 2025.

Conversely, a decisive break above the nine-day EMA at 0.6690 would strengthen the bullish case, potentially opening the way for a move toward 0.6766, the highest level since October 2024.

AUD/USD: Daily Chart

Sources: Fxstreet

Leave a comment