- Silver is being boosted by expectations of interest rate cuts, a weaker US dollar, and increasing geopolitical tensions.

- Limited supply combined with record-high industrial demand make silver very responsive to changes in market risk sentiment.

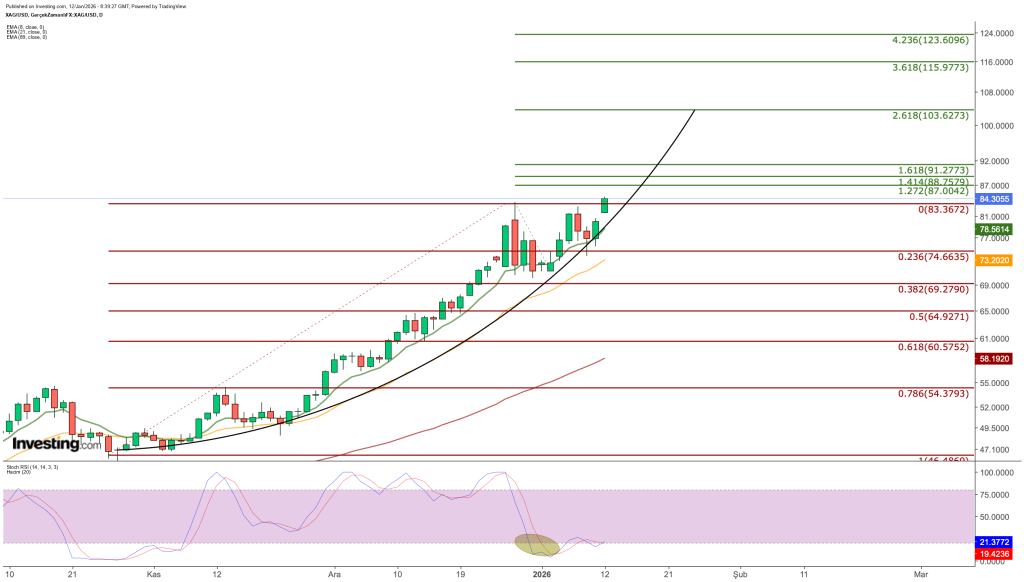

- Staying above $83.36 maintains potential for further gains, while dips toward $75 are likely to draw in buyers.

Silver kicks off the week with robust momentum, fueled by multiple factors converging simultaneously. Safe-haven demand is increasing due to geopolitical tensions, the broader economic environment supports expectations of US interest rate cuts, and supply remains constrained amid strong industrial demand.

As a metal that bridges both precious and industrial categories, silver typically reacts more quickly than many other assets to changes in market risk sentiment.

Interest Rates, US Dollar, and Risk Sentiment Are Aligning Together

Last week’s US December jobs report indicated a cooling labor market. Non-farm payrolls increased by only 50,000, while the unemployment rate fell to 4.4%, revealing softer underlying growth despite the headline figures.

This data boosted market expectations for an earlier Federal Reserve interest rate cut. As rate cut bets rose and the US dollar weakened, demand grew for non-yielding assets like silver, giving prices fresh support.

At the same time, increased judicial scrutiny of Jerome Powell and escalating tensions between the Federal Reserve and the administration have added more pressure on the US dollar. Rising political and institutional uncertainty has driven investors toward safe-haven assets, a trend that often causes sharper price swings not just in gold but also in silver, which typically experiences greater volatility.

Safe Haven Demand Returns to Center Stage

Uncertainty in the Middle East and global politics continues to drive safe haven demand in commodity markets. Rising protests in Iran and renewed tensions between Tehran and the US have pushed investors toward gold and silver.

Recent moves by the Trump administration involving Venezuela and Iran, including plans for Venezuelan oil exports and new sanctions threats, have added further uncertainty. In this context, silver’s rebound above $80 an ounce shows how quickly changes in risk sentiment impact prices. Ongoing geopolitical risks from the Russia-Ukraine war and the Gaza conflict also reinforce the environment supporting strong demand for safe haven assets.

Industrial Demand and Supply Challenges

Attributing silver’s rise solely to macroeconomic and geopolitical factors overlooks a key part of the picture. Industrial demand for silver is projected to hit record highs in 2025 and remain strong into 2026. Currently, about 58% of global silver demand comes from industrial uses, driven by rapid growth in sectors like solar panels, electric vehicles, electronics, and AI-related hardware.

This evolving demand profile is making silver a more strategic commodity, which helps explain why its prices often react faster and with greater volatility when risk appetite or commodity exposure shifts.

On the supply side, constraints persist. Only around 27% of silver production comes from primary silver mines; the majority is a byproduct of copper, lead, zinc, and gold mining, limiting the ability to quickly ramp up output. Following several years of supply deficits from 2021 to 2024, total silver supply in 2025 is estimated at about 813 million ounces, compared to demand of roughly 1.24 billion ounces.

Inventories in London, China, and the United States have dropped to low levels, underscoring the tight market conditions. China’s new export licensing system, implemented on January 1, has added extra pressure by complicating shipments, particularly for smaller producers. Meanwhile, silver’s designation as a critical mineral in the US, along with consistent physical buying in China and India, continues to bolster fundamental demand.

Silver’s Technical Outlook

On the daily chart, silver spent much of last week trading sideways between $74.66 and $83.36 while maintaining its overall uptrend. This consolidation above the rising trendline suggests a temporary pause rather than a reversal. Strong buying interest near $74 late last week, followed by a renewed push toward new highs this week, indicates that short-term momentum has shifted back to the buyers.

Technically, the $83.36 level is crucial. A decisive break and sustained trading above this point would turn previous resistance into support. As long as silver stays above $83.36, any pullbacks are likely profit-taking rather than a trend change, keeping the bullish outlook intact.

In this scenario, silver could pick up pace toward the Fibonacci extension targets at $87, $88.76, and $91.28. Holding above $91 would further strengthen the case for a run toward the psychological $100 mark, with a potential next target around $103.63 if momentum continues.

Momentum indicators back this positive outlook. The Stochastic RSI has been hovering near oversold levels, increasing the chance of an upside signal if silver stays above $83.36. The moving averages remain bullish, with short-term exponential moving averages trending upward and price holding above the 8-day EMA at 78.56 and the 21-day EMA at 73.20, reinforcing the prevailing upward trend.

On the downside, daily closes below $83 would raise concerns about breaking the short-term rising trend. In that case, the first support to watch is 78.56, aligning with the 8-day EMA. If that fails, the 74.50 to 74.66 zone becomes crucial, marking the base of recent consolidation and a key Fibonacci retracement level.

A decisive break below this support band could lead to a deeper correction toward 69.28 and potentially 64.93. However, if the broader fundamentals remain supportive—such as expectations for rate cuts, a weaker dollar, elevated geopolitical risks, and ongoing supply constraints—any pullbacks near $75 are likely to attract buyers.

In summary, fundamentals continue to favor silver, but technically, holding above $83.36 is critical to confirm the uptrend. As long as this level holds, silver’s path higher remains open for gradual gains.

Sources: Investing

Leave a comment