Bitcoin’s price trend moved differently as Nasdaq futures dropped by nearly 0.8%.

Bitcoin increased by 1% amid growing tensions between President Trump and Fed Chairman Powell, which rattled markets and led to declines in U.S. stock futures and the dollar. Powell described the legal challenge as politically driven, intended to pressure the central bank into aggressive interest rate cuts. However, prediction markets do not anticipate this conflict resulting in Powell leaving his position prematurely.

Bitcoin climbed 1% Monday afternoon Hong Kong time as escalating tensions between President Donald Trump and Federal Reserve Chairman Jerome Powell unsettled investors, pushing both U.S. stock futures and the dollar index down.

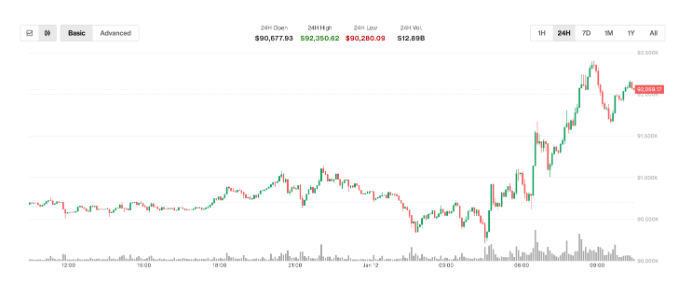

Bitcoin reached $92,000 but remained within last week’s range of $89,000 to $95,000, according to CoinDesk data. Meanwhile, Nasdaq futures declined 0.8%, S&P 500 futures dropped 0.5%, and the dollar index eased to 99.00 from Friday’s high of 99.26.

Typically, BTC tends to follow the Nasdaq’s movements, but this time it diverged, suggesting growing safe haven demand for the cryptocurrency as investors seek a “hideout” amid the intensifying Trump-Powell conflict. Supporters of BTC have long praised it as an anti-establishment asset and a safeguard against reckless fiscal and monetary policies. Meanwhile, gold, a classic safe haven, also climbed to a record high of $4,600 per ounce.

Tensions between the Federal Reserve and the White House intensified over the weekend after Powell revealed that the Trump administration had threatened him with a criminal indictment related to the renovation of the Fed’s headquarters.

Powell dismissed the indictment as politically motivated, aimed at pressuring the Fed into cutting interest rates.

Trump has long been critical of Federal Reserve policies, especially its hesitance to aggressively lower rates to stimulate economic growth. Since taking office in 2025, he has frequently pushed Fed Chair Jerome Powell to reduce rates more sharply, labeling him a “numbskull” and threatening to make changes to increase White House influence over monetary policy.

Trump has consistently called for interest rates to fall to 1% or below. Although the Fed cut rates by 25 basis points last month to 3.5%, it is expected to hold steady at least until March and is unlikely to return to ultra-low levels anytime soon.

Despite the escalating attacks from Trump’s team, prediction markets do not anticipate an early departure for Powell, whose term ends in May this year.

However, persistent assaults on central banks, especially amid ongoing inflation, can undermine investor confidence and destabilize the domestic currency.

The sharp decline of Turkey’s lira in recent years, triggered by President Recep Tayyip Erdogan’s interference with central bank independence, stands as a cautionary example. Still, the dollar’s position as the global reserve currency makes a severe collapse in the U.S. less likely.

Sources: Coindesk

Leave a comment