Leading indicators suggest this month’s NFP report could exceed expectations, with headline job growth potentially landing in the 80–120K range. Read on for a deeper breakdown.

NFP Highlights

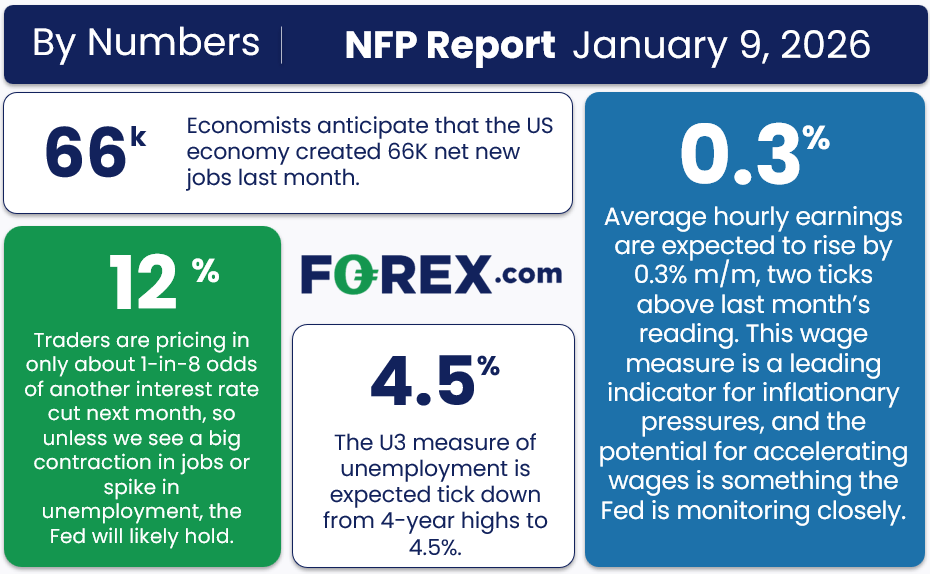

- Consensus forecast: +66K jobs, earnings up +0.3% m/m, unemployment rate at 4.5%.

- Outlook: Forward-looking data point to a stronger-than-expected result, with payroll gains possibly reaching between 80K and 120K.

- Market impact: A positive surprise could allow AUD/USD to continue its rebound toward the mid-0.6600s, or even retest former resistance now acting as support near 0.6600.

Release timing

The December NFP report is scheduled for Friday, January 9, at 8:30 a.m. ET.

NFP Report Expectations

Market participants anticipate the NFP report will show the U.S. economy added around 66K jobs, with average hourly earnings increasing 0.3% month-on-month (3.6% year-on-year) and the U-3 unemployment rate edging lower to 4.5%.

NFP Overview

Economic data releases are gradually normalizing after the U.S. government shutdown disrupted—and in some cases eliminated—Q4 statistics. Ahead of the latest labor market update, economists expect conditions in December to reflect a continued “low hiring, low firing” environment.

As illustrated in the graphic below, traders are largely confident that the Federal Reserve will hold off on further rate cuts this month. Only a significant downturn in the labor market—such as a clear drop in job numbers or unemployment climbing above 4.7%—would likely undermine this confidence.

Consequently, market reactions to the NFP release may be muted, particularly since the anticipated Supreme Court ruling on President Trump’s “emergency” tariffs—due about 90 minutes later—is likely to dominate attention.

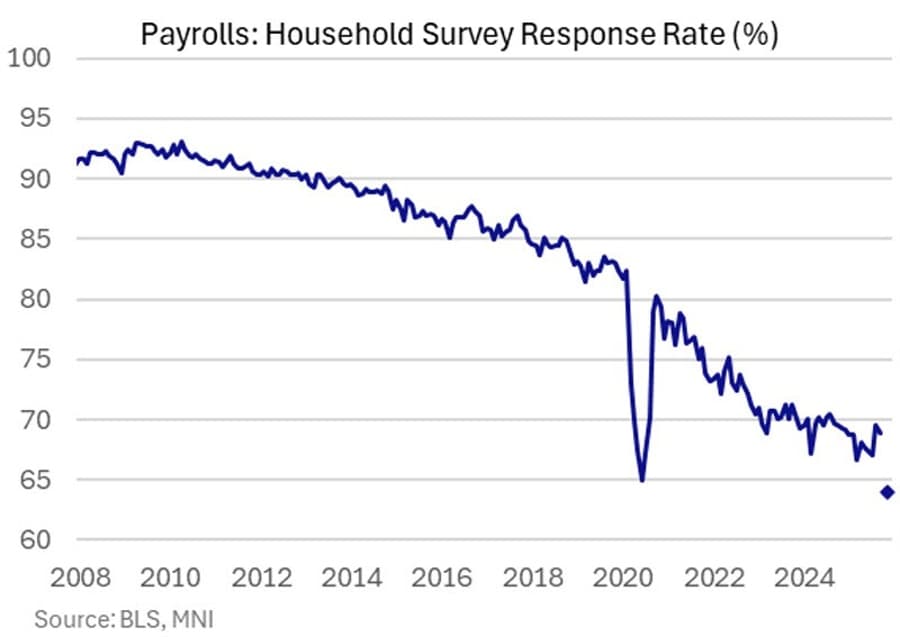

Another factor dampening trader response is the long-term decline in survey response rates for the NFP. As the chart below illustrates, the Bureau of Labor Statistics (BLS) has experienced a significant drop in response rates over the past decade, increasing uncertainty around the accuracy of the jobs data compared to previous years.

Looking ahead into 2026 and beyond, readers are advised to approach all survey-based economic data with greater skepticism and to rely on a diverse range of data sources when drawing robust conclusions about the U.S. economy.

Nonfarm Payrolls Outlook

As our regular readers know, we rely on four historically dependable leading indicators to assess each month’s NFP report:

- The ISM Services Employment subindex rose to 52.0 from 48.9 last month.

- The ISM Manufacturing Employment subindex increased slightly to 44.9 from 44.0.

- The ADP Employment report showed 41K jobs added, improving from last month’s -29K but still below economists’ forecast of 49K.

- The 4-week moving average of initial unemployment claims dropped to 212K from 217K last month.

Considering these data points and our internal models, the indicators suggest that this month’s NFP report could exceed expectations, with job gains potentially in the 80–120K range. However, a wide margin of uncertainty remains due to declining survey response rates.

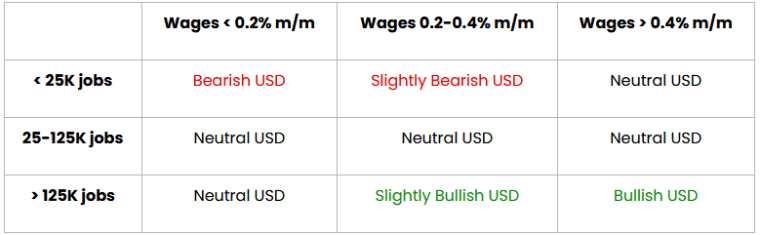

That said, month-to-month variations in the NFP report are notoriously unpredictable, so it’s wise not to place too much confidence in any forecast—even ours. As always, other components of the release, such as the closely monitored average hourly earnings and the unemployment rate, will also influence market reactions.

Possible Market Response to NFP

From a technical perspective, the US dollar is trading close to one-month highs against several major currencies but remains near the midpoint of its three-month range, resulting in a balanced risk outlook ahead of the release.

Technical Overview of the US Dollar: AUD/USD Daily Chart

From a technical standpoint, AUD/USD finds itself in a notable position ahead of the jobs report. Earlier this week, the pair reached a 15-month high near 0.6800 but then formed a “Dark Cloud Cover” pattern on Wednesday, indicating an intraday shift from buying to selling pressure. This reversal is further supported by a triple bearish divergence on the 14-day RSI, suggesting waning bullish momentum and reinforcing the possibility of a near-term peak.

Should the jobs data surpass expectations, it may diminish the likelihood of a January Fed rate cut and raise doubts about March, thereby strengthening the US dollar. In that case, AUD/USD could continue its decline toward the mid-0.6600s or revisit the former resistance level, now acting as support, near 0.6600. Conversely, a strong report pushing the pair back above the 78.6% Fibonacci retracement at 0.6725 would negate the near-term bearish outlook.

Sources: Investing @ Forex

Leave a comment