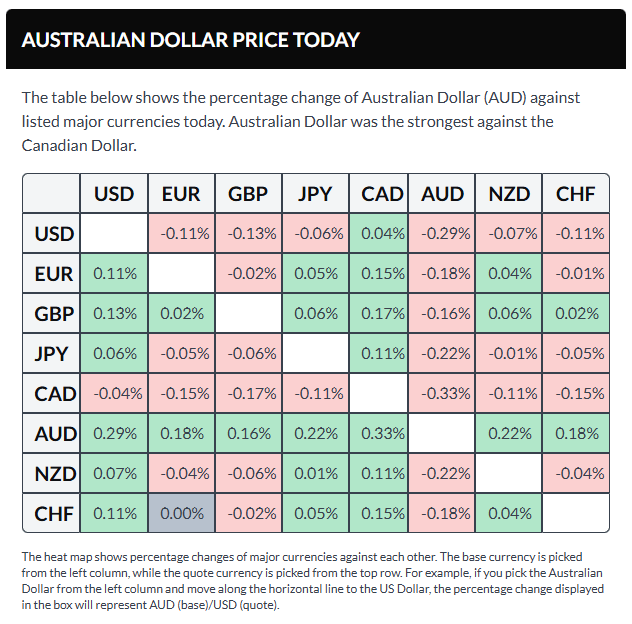

- The Australian Dollar gains ground amid a hawkish outlook on the Reserve Bank of Australia (RBA).

- Australia’s CPI slowed to 3.4% year-over-year in November, below expectations but still above the RBA’s target range.

- Traders now turn their attention to Wednesday’s US ISM Services PMI and JOLTs job openings reports for further market cues.

The Australian Dollar (AUD) extended its winning streak for the fourth consecutive session on Wednesday, gaining against the US Dollar (USD) despite easing inflation figures for November. Traders are now focused on the upcoming full fourth-quarter inflation report due later this month. Analysts caution that a core inflation increase of 0.9% or more could prompt the Reserve Bank of Australia (RBA) to consider further tightening at its February meeting.

Meanwhile, the Australian Financial Review (AFR) highlighted that the RBA may not be finished with its rate hikes this cycle. A recent poll suggests inflation is likely to remain persistently high over the coming year, supporting expectations for at least two more rate increases.

The Australian Bureau of Statistics (ABS) reported on Wednesday that Australia’s Consumer Price Index (CPI) rose 3.4% year-over-year (YoY) in November, easing from 3.8% in October. This figure missed market expectations of 3.7% but stayed above the Reserve Bank of Australia’s (RBA) target range of 2–3%. It marked the lowest inflation rate since August, with housing costs rising at their slowest pace in three months.

Month-on-month (MoM), Australia’s CPI remained flat at 0% in November, matching October’s reading. Meanwhile, the RBA’s Trimmed Mean CPI increased 0.3% MoM and 3.2% YoY. In a separate report, seasonally adjusted building permits surged 15.2% MoM to a near four-year high of 18,406 units in November 2025, bouncing back from a downwardly revised 6.1% decline the previous month. Annual approvals jumped 20.2%, reversing a revised 1.1% drop in October.

US Dollar declines ahead of ISM Services PMI

The US Dollar Index (DXY), which tracks the US Dollar’s value against six key currencies, is slightly declining after posting small gains in the previous session, currently hovering near 98.50. Market participants are awaiting US economic releases that may influence Federal Reserve (Fed) policy outlooks. Later today, attention will be on the ISM Services Purchasing Managers’ Index (PMI) and JOLTs job openings data. The upcoming US Nonfarm Payrolls (NFP) report, due Friday, is forecasted to show an increase of 55,000 jobs in December, a decrease from 64,000 in November.

Fed Governor Stephen Miran stated on Tuesday that the central bank should pursue aggressive interest rate cuts this year to bolster economic growth. Conversely, Minneapolis Fed President Neel Kashkari cautioned that unemployment could unexpectedly rise. Richmond Fed President Tom Barkin, who is not voting on this year’s rate decisions, emphasized that rate changes will need to be carefully calibrated to incoming data, pointing to risks affecting both employment and inflation targets, per Reuters.

According to CME Group’s FedWatch tool, futures markets assign roughly an 82.8% chance that the Fed will keep rates steady at the January 27–28 meeting.

On the geopolitical front, the US launched a significant military strike on Venezuela last Saturday. President Donald Trump announced that Venezuelan President Nicolas Maduro and his wife were captured and removed from the country. However, Maduro pleaded not guilty on Monday to US narcotics-terrorism charges, signaling a high-stakes legal confrontation with wide geopolitical consequences, Bloomberg reports.

Traders anticipate two more Fed rate cuts in 2026. Markets also expect Trump to nominate a new Fed chair to succeed Jerome Powell when his term expires in May, potentially steering monetary policy toward lower rates.

In China, the Services PMI from RatingDog fell slightly to 52.0 in December from 52.1 in November, while Manufacturing PMI rose to 50.1 from 49.9 the previous month. Given China’s close trade ties with Australia, shifts in the Chinese economy may affect the Australian Dollar.

The Reserve Bank of Australia’s December meeting minutes revealed readiness to tighten monetary policy further if inflation does not ease as expected. Greater attention is now on the Q4 Consumer Price Index report scheduled for January 28, with analysts warning that a stronger-than-anticipated core inflation figure could prompt a rate hike at the RBA’s February 3 meeting.

The Australian Dollar has reached new 14-month highs, climbing above the 0.6750 level

On Wednesday, AUD/USD is trading near 0.6750. Technical analysis of the daily chart shows the pair moving upward within an ascending channel, indicating a continued bullish trend. However, the 14-day Relative Strength Index (RSI) at 70 signals that the pair may be overbought.

Since October 2024, AUD/USD has hit new highs and is now aiming for the upper boundary of the ascending channel around 0.6830.

Initial support is found at the nine-day Exponential Moving Average (EMA) near 0.6708, followed by the lower boundary of the ascending channel at about 0.6700. A drop below this combined support zone could push the pair down toward the 50-day EMA level at approximately 0.6625.

AUD/USD: Daily Chart

Sources: Fxstreet

Leave a comment