- PCE inflation data, the start of the fourth-quarter earnings season, a Supreme Court ruling on tariffs, and the Davos World Economic Forum will all be in focus during the holiday-shortened week ahead.

- GE Aerospace appears well positioned for an earnings-driven rally, while United Airlines may face downside pressure amid weaker results and persistent sector headwinds.

U.S. equities slipped on Friday, ending the week with modest declines across the Dow Jones Industrial Average, S&P 500, and Nasdaq, as investors digested President Donald Trump’s latest remarks on the Federal Reserve and broader geopolitical developments.

For the week, the Dow Jones Industrial Average slipped 0.3%, the S&P 500 eased 0.4%, and the Nasdaq Composite declined 0.7%, while the small-cap Russell 2000 gained 2% to notch another record close on Friday.

Volatility may pick up in the week ahead as investors evaluate prospects for economic growth, inflation, interest rates, and corporate earnings against a backdrop of persistent trade and geopolitical tensions.

Over the weekend, President Donald Trump said eight NATO member countries could face tariffs of up to 25% unless an agreement is reached allowing the United States to purchase Greenland.

U.S. financial markets will be closed on Monday in observance of the Martin Luther King Jr. Day holiday. On the economic front, Thursday’s core PCE price index— the Federal Reserve’s preferred inflation measure—will be the key data release to watch.

The fourth-quarter earnings season also ramps up, with results due from several high-profile companies, including Netflix (NASDAQ:NFLX), Intel (NASDAQ:INTC), United Airlines (NASDAQ:UAL), Procter & Gamble (NYSE:PG), Johnson & Johnson (NYSE:JNJ), GE Aerospace (NYSE:GE), and 3M Company (NYSE:MMM).

Investors are additionally awaiting a U.S. Supreme Court ruling on the legality of President Donald Trump’s global tariffs, after the court declined to issue a decision last week. The justices are also set to hear arguments related to Trump’s effort to remove Federal Reserve Governor Lisa Cook.

Attention will also turn to Davos, Switzerland, where Trump is scheduled to attend the World Economic Forum, potentially generating fresh headlines.

Against this backdrop, regardless of broader market direction, I outline below one stock that appears positioned for upside demand and another that could face renewed downside pressure. These views are strictly short-term, covering the week ahead from Monday, January 19 through Friday, January 23.

Top Pick: GE Aerospace Poised for Gains

GE Aerospace is set to report earnings this week, with expectations calling for another strong quarter. Analysts are forecasting solid results, supported by robust aerospace demand and a new wave of engine orders, including Delta’s recent selection of GE’s GEnx engines for its expanding Boeing 787 fleet.

The company is scheduled to release its fourth-quarter update before the market opens on Thursday at 6:30 a.m. ET. Options markets are bracing for heightened volatility, with implied pricing suggesting a post-earnings move of approximately ±5.2% in GE shares.

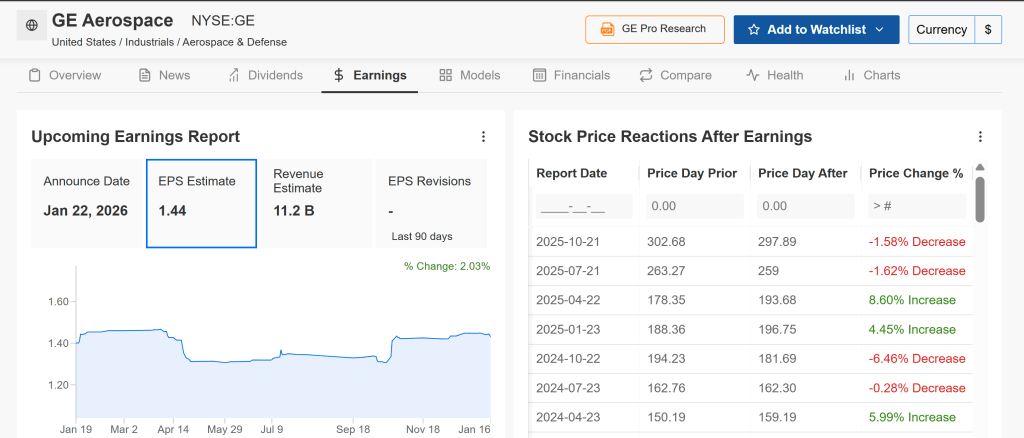

Analysts are forecasting another strong quarter, with consensus estimates pointing to adjusted earnings of $1.44 per share, up from $1.32 a year earlier, alongside revenue growth of roughly 13% year over year to about $11.2 billion. Performance is being underpinned by structural tailwinds, including sustained demand for LEAP and GEnx engines—both of which are sold out for the remainder of the decade—as well as rising engine deliveries.

Investor focus is expected to center as much on GE’s forward guidance as on its headline results. Recent announcements around new orders and capacity expansions have bolstered confidence in the outlook for 2026, with analysts projecting full-year earnings of approximately $7.01 per share.

As a global leader in jet engines and aerospace systems, GE Aerospace continues to benefit from a recovery in commercial air travel and strong growth in its high-margin aftermarket services business.

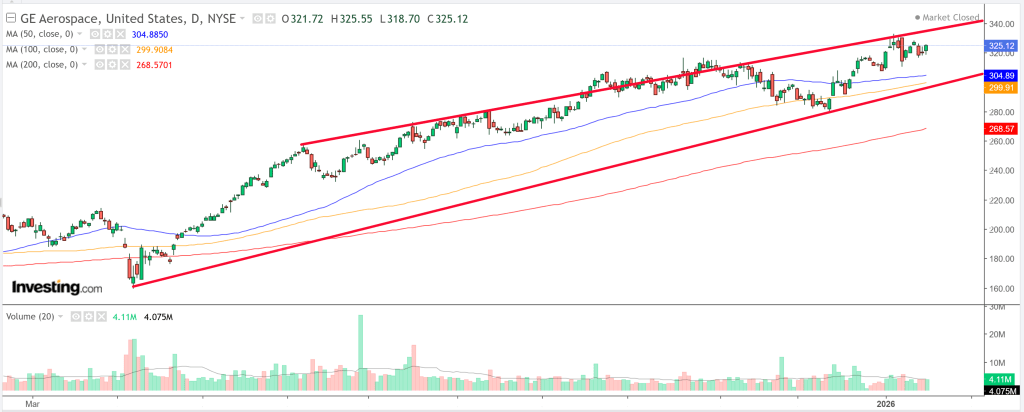

GE remains in a strong upward trend, with its share price up 78.8% over the past year and trading just 2.3% below its 52-week high. Momentum indicators continue to point higher, with technical signals flashing a “strong buy” across multiple timeframes.

If GE delivers the anticipated double-digit revenue growth, maintains or expands margins, and provides upbeat commentary on future demand, the stock could extend its rally as investors further re-rate GE Aerospace as a high-quality, cash-generative industrial leader.

Trade Setup:

- Entry: $326 (pre-earnings)

- Targets: $340 → $350 (gain ~5%-7%)

- Stop: $315 (risk ~3%)

Stock to Sell This Week: United Airlines

By contrast, United Airlines is confronting increasing headwinds ahead of its fourth-quarter earnings release, scheduled for Tuesday at 4:00 p.m. ET. While the carrier has demonstrated resilience in recent quarters, consensus expectations suggest growing challenges that could result in an earnings miss or a muted market response.

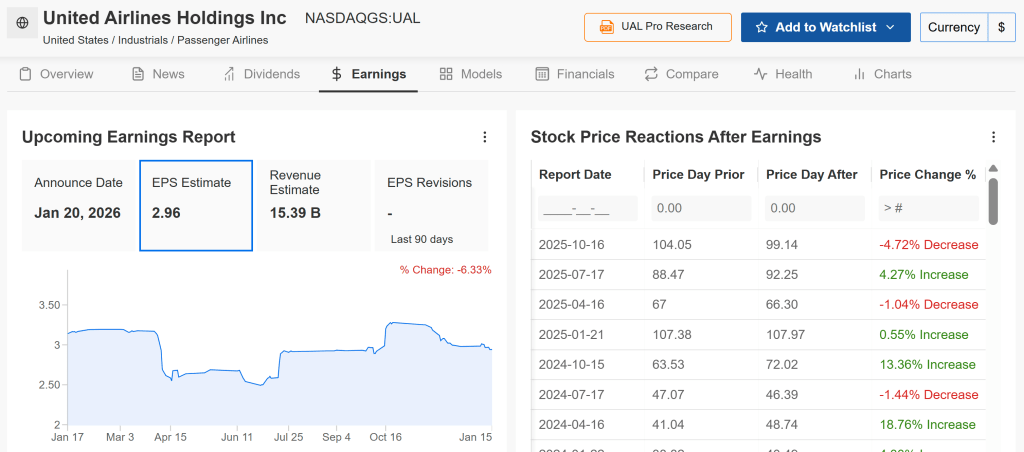

Options-implied volatility signals a potential post-earnings move of roughly ±5.9% in UAL shares, underscoring the elevated risk around the report.

Wall Street expects the Chicago-based carrier to post earnings of $2.96 per share, down 9.2% from $3.26 a year earlier. Revenue is forecast to come in around $15.4 billion, though rising operating costs, capacity-related pressures, and lingering issues such as service disruptions and softer international performance continue to cloud the outlook.

The broader airline industry remains challenged by ongoing operational strains, including flight delays, cancellations, and capacity constraints.

Adding to the uncertainty, renewed tariff pressures on European routes could further complicate United’s international operations. Heightened trade tensions and the risk of retaliatory measures may weigh on the airline’s sizable transatlantic network.

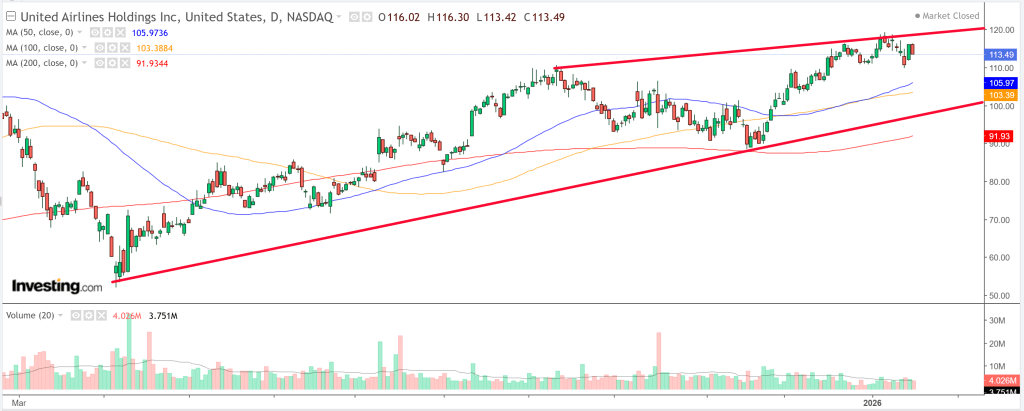

Recent technical signals reinforce the downside risk, with UAL’s one-hour indicators flashing a “strong sell” as both momentum and moving averages remain firmly tilted lower.

Against this backdrop, the stock appears vulnerable in the week ahead. Even if headline results come in near expectations, a cautious outlook or incremental pressure on key international routes could be sufficient to push shares lower.

Trade Setup:

- Entry: $113.50 (pre-earnings weakness)

- Targets: $105 → $95 (gain ~7.5%-16%)

- Stop: $120 (risk ~5%)

Sources: Investing

Leave a comment