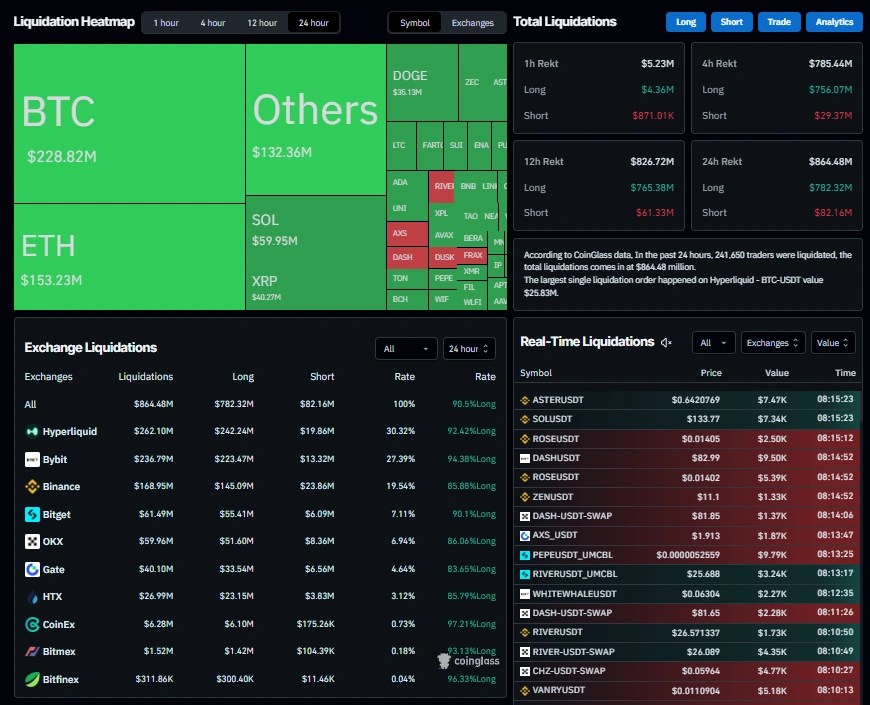

- Data from CoinGlass indicate that more than $800 million in leveraged positions were liquidated across the cryptocurrency market over the past 24 hours.

- Risk-off sentiment has intensified as European capitals weigh retaliatory tariffs of up to $101 billion against the United States, following tariff threats from President Donald Trump.

- Long positions accounted for 90.5% of total liquidations, with the largest single event being a $25.83 million BTCUSD liquidation on Hyperliquid.

The cryptocurrency market saw a sharp pullback on Monday, with total liquidations exceeding $800 million over the past 24 hours. The downturn was driven largely by rising risk-off sentiment, as escalating trade tensions between the European Union and the United States unsettled traders.

Escalating trade tensions dampen demand for risk assets

Cryptocurrency markets started the week under pressure, with Bitcoin (BTC) slipping below the $93,000 mark on Monday, dragging major altcoins—including Ethereum (ETH), Solana (SOL), and Cardano (ADA)—lower in tandem. The sell-off came amid escalating trade tensions between the United States and the European Union.

U.S. President Donald Trump announced plans to impose tariffs on eight European countries that have opposed his proposal for the United States to acquire Greenland. The measures include a 10% levy on goods from Denmark, Sweden, France, Germany, the Netherlands, Finland, the United Kingdom, and Norway, set to take effect on February 1 and remain in place until Washington is permitted to purchase the territory.

In response, the Financial Times reported on Sunday that EU capitals are weighing retaliatory measures, including up to €93 billion ($101 billion) in tariffs on U.S. goods or potential restrictions on American firms’ access to the European market.

The escalating trade dispute has fueled a risk-off mood among investors, weighing heavily on high-risk assets such as cryptocurrencies. This shift in sentiment triggered widespread liquidations across the crypto market, with more than $800 million in leveraged positions wiped out over the past 24 hours, according to CoinGlass data.

Long positions accounted for 90.5% of total liquidations, highlighting the market’s prior bullish positioning. The largest single liquidation was a $25.83 million BTCUSDT position on Hyperliquid.

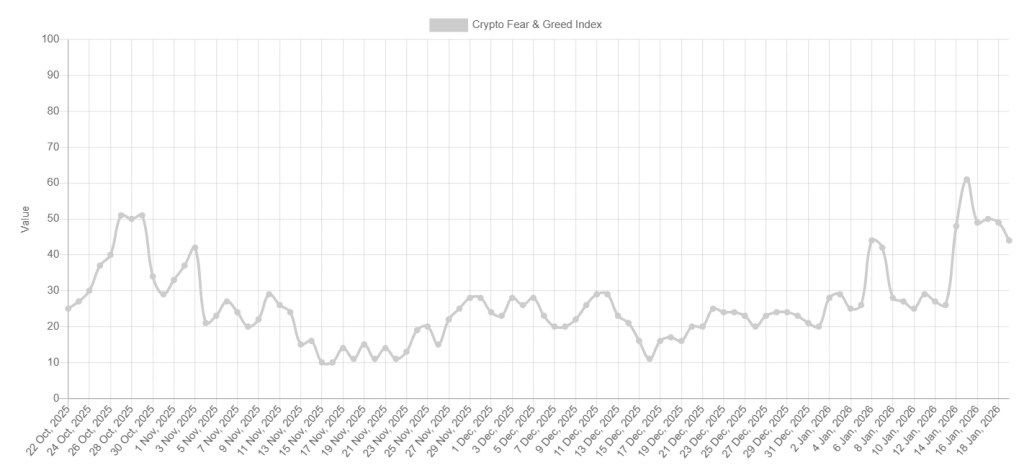

The Fear and Greed Index slipped to 44 on Monday from a high of 61 on Thursday, signaling a shift away from optimism toward a more cautious market mood.

Sources: Fxstreet

Leave a comment