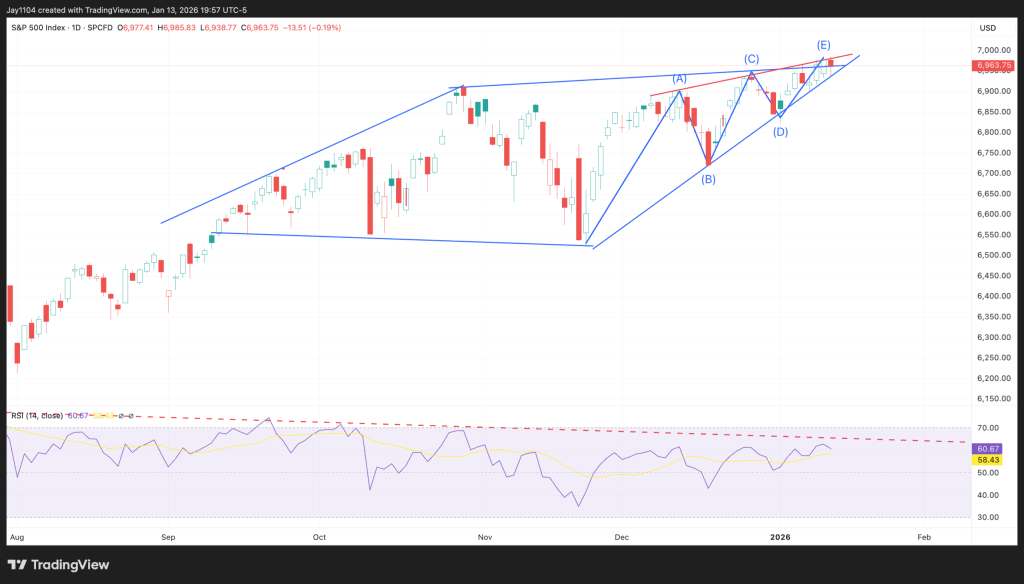

Today may bring another chance for the Supreme Court to issue a ruling on tariffs—we’ll know around 10:00 a.m. whether an opinion is released. The timing is notable for equities, as the S&P 500 is tightly consolidating and approaching a point where it must break in one direction. I still believe the setup looks more like a market top than the beginning of a melt-up. Technically, it could even be interpreted as a terminal diagonal triangle.

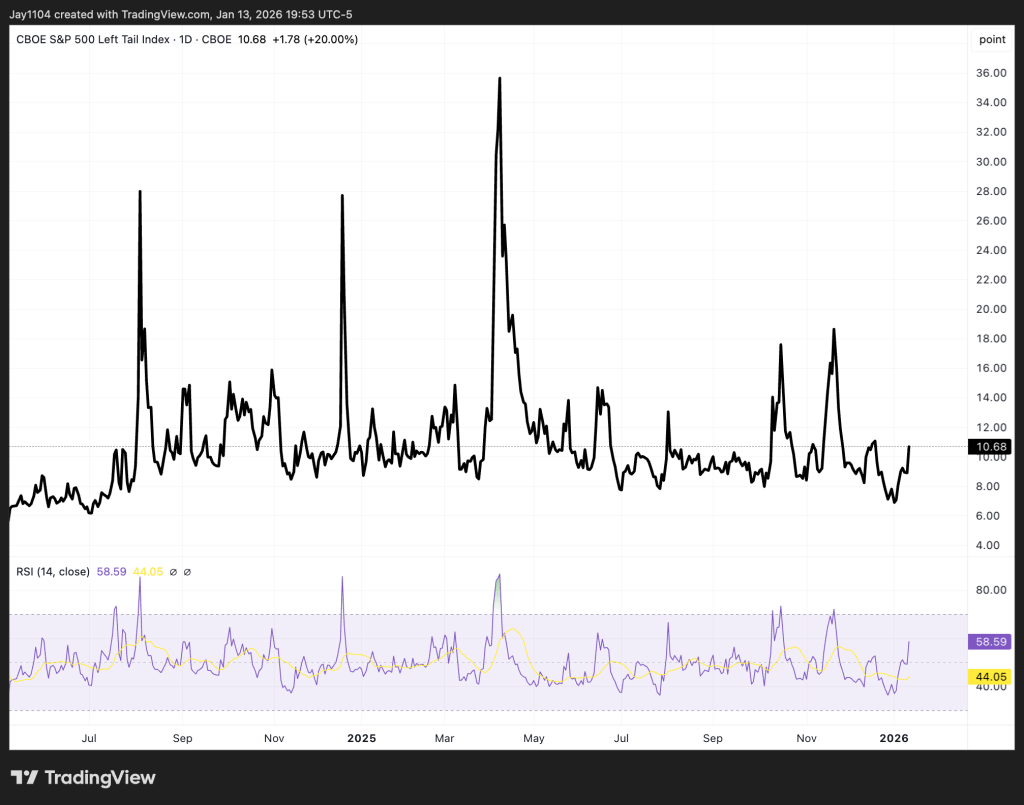

Ultimately, the key factor is volatility, which remains extremely subdued. While Tuesday did bring a notable rise in the left-tail index to 10.7—still a relatively low level—it was higher than before. In any case, we’ll find out today which way things break.

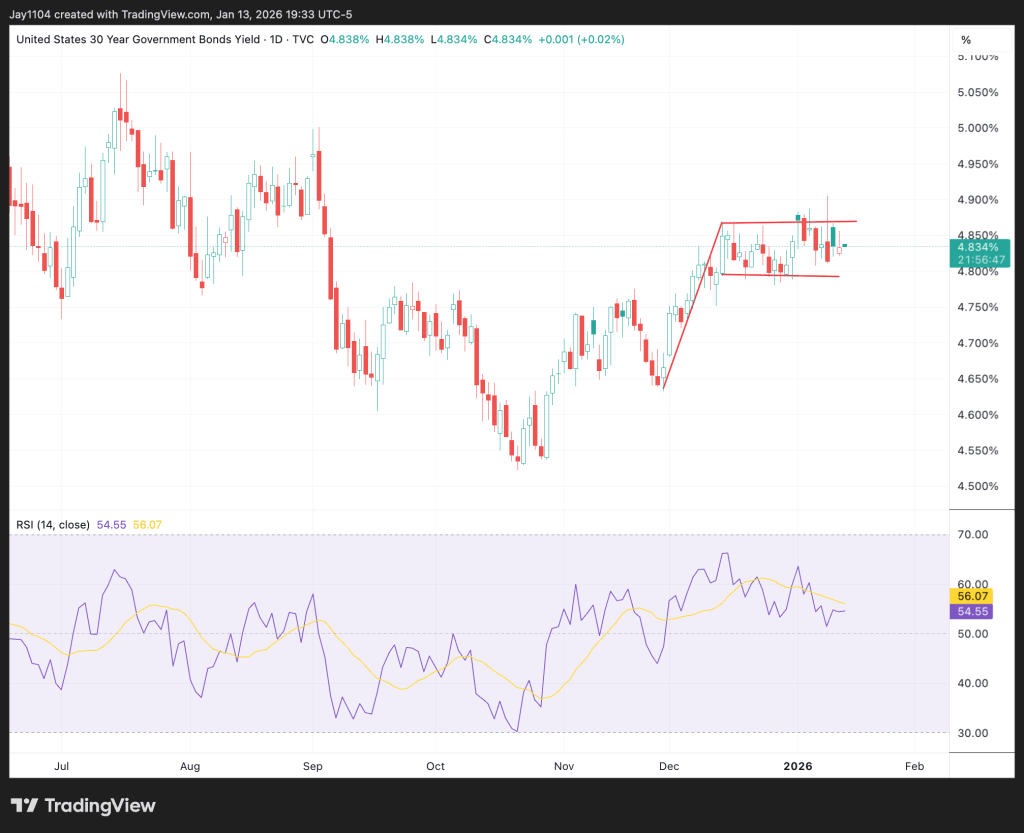

For now, interest rates seem stuck in place, with neither strong nor weak economic data moving the long end of the curve. Even the CPI report—despite undershooting on core inflation—failed to budge the 30-year yield. The setup still resembles a bull flag, but at the moment, there’s little follow-through.

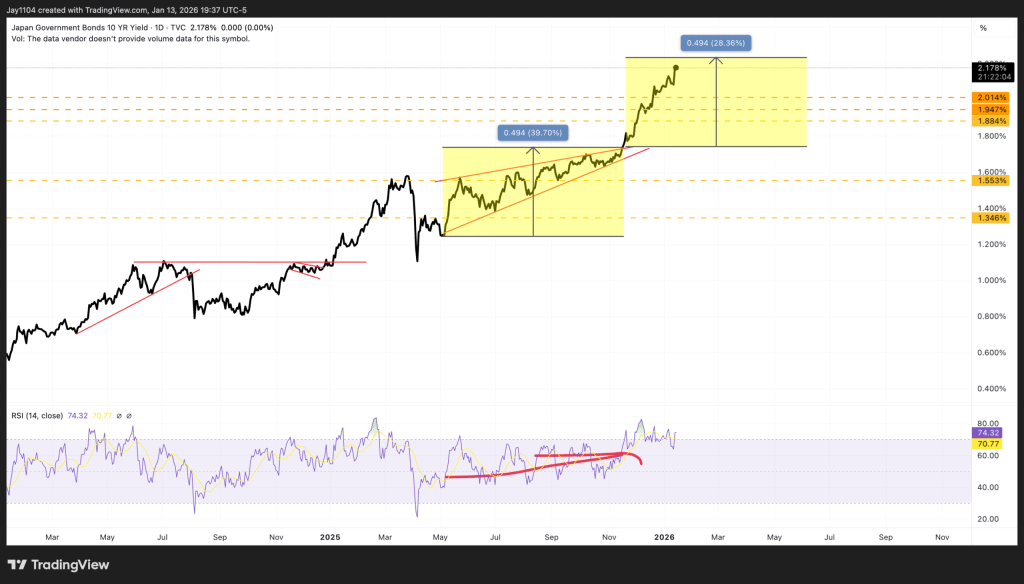

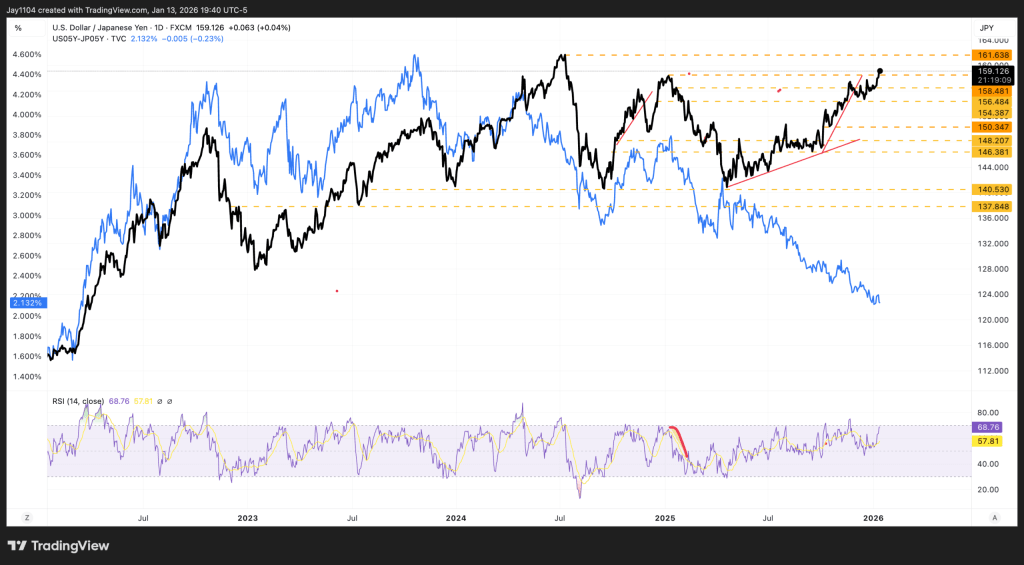

If you’re looking for rising yields, Japan is where to focus. The 10-year JGB continues its steady ascent and is now around 2.17%. Based on the wedge pattern and a forward projection, the yield could push toward 2.25%.

On Tuesday, USD/JPY broke out, climbing past the 159 resistance level. Currently, the market seems to be focusing more on Japan’s fiscal spending plans than on interest rate differentials. A move up to 162 is looking more and more probable.

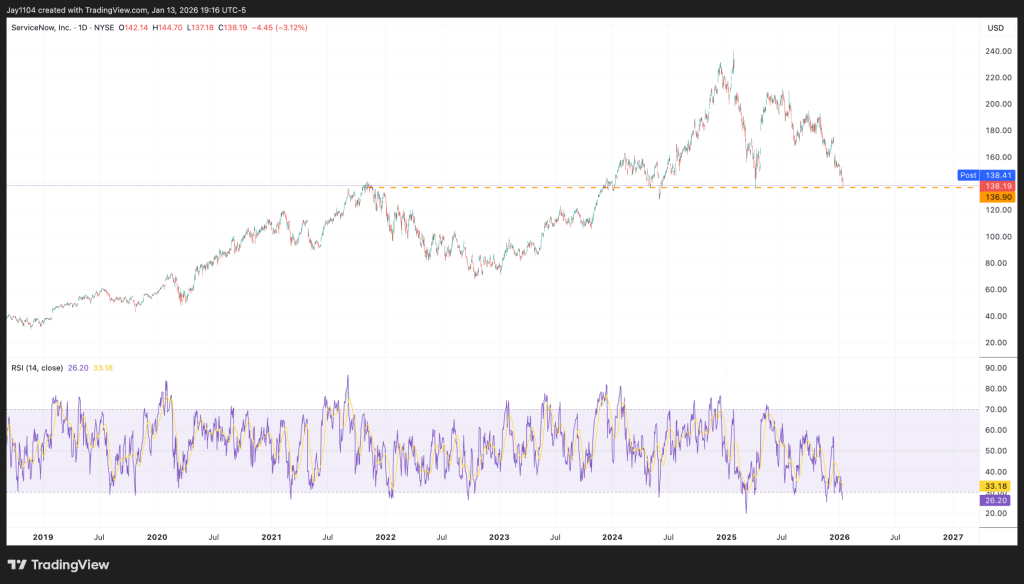

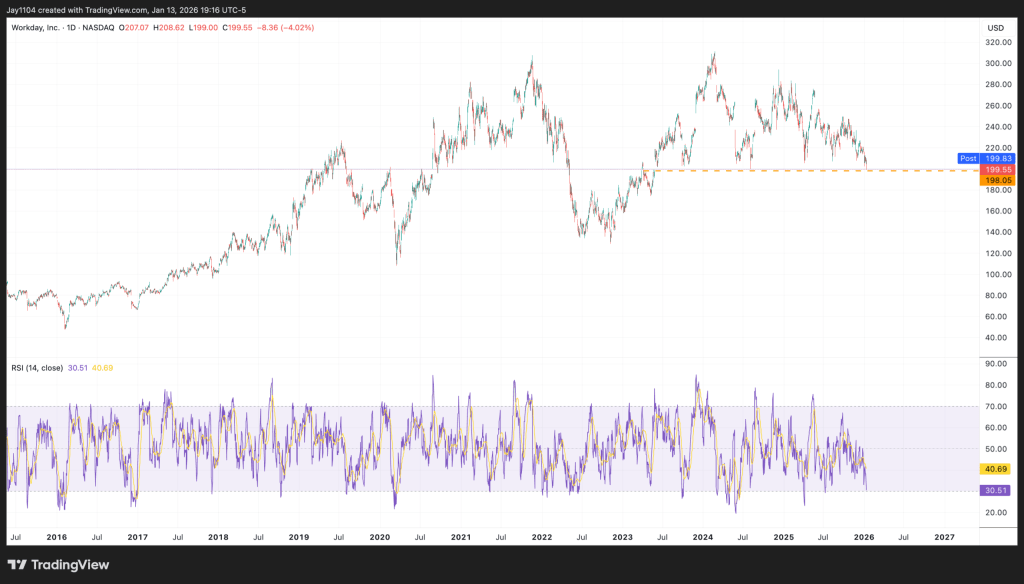

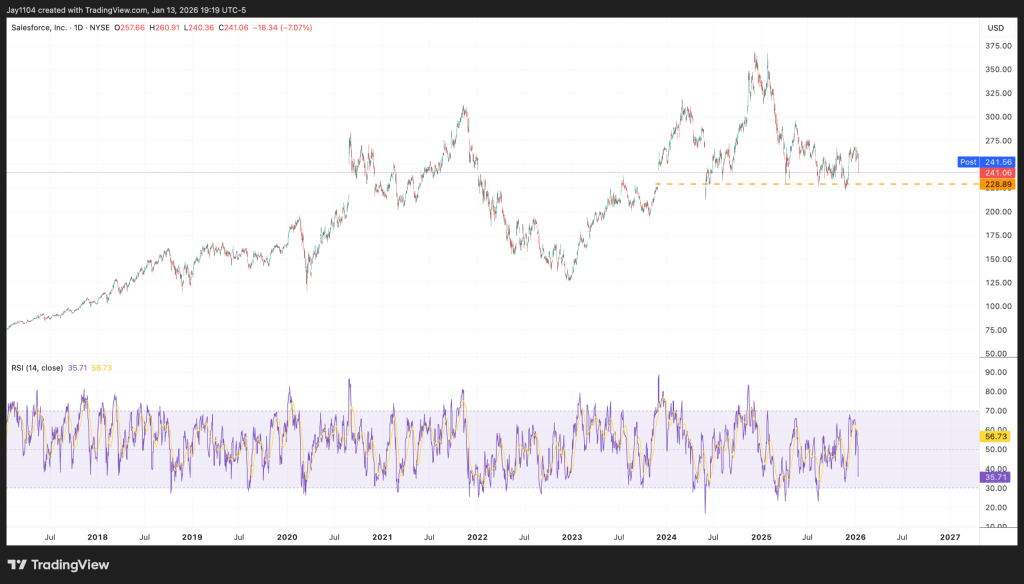

Software stocks took a severe hit. Shares of Salesforce (NYSE:CRM), ServiceNow (NYSE:NOW), and Workday (NASDAQ:WDAY) were heavily battered. Notably, ServiceNow has fallen back to its 2021 highs, which also align with the lows seen in April 2025.

Workday’s performance is actually even more troubling.

Salesforce seems to be holding up better than the others, but that’s not exactly reassuring. It looks like the market fears these companies might get disrupted or cannibalized by AI. Honestly, the charts across the board look pretty bleak.

Sources: Mott Capital Management

Leave a comment