China’s trade surplus widened in December, reaching CNY 808.80 billion, up from CNY 792.57 billion the previous month.

Exports grew 5.2% year-over-year in December, slightly lower than November’s 5.7% increase. Meanwhile, imports rose 4.4% year-over-year, accelerating from the 1.7% growth recorded in November.

In U.S. dollar terms, China’s trade surplus exceeded expectations, registering $114.10 billion compared to the forecasted $113.60 billion and $111.68 billion in the prior month. Exports increased 6.6% year-over-year, well above the 3.0% forecast and 5.9% last month. Imports also rose strongly by 5.7%, surpassing the anticipated 0.9% growth and previous 1.9% figure.

Market Reaction to China’s Trade Balance Data

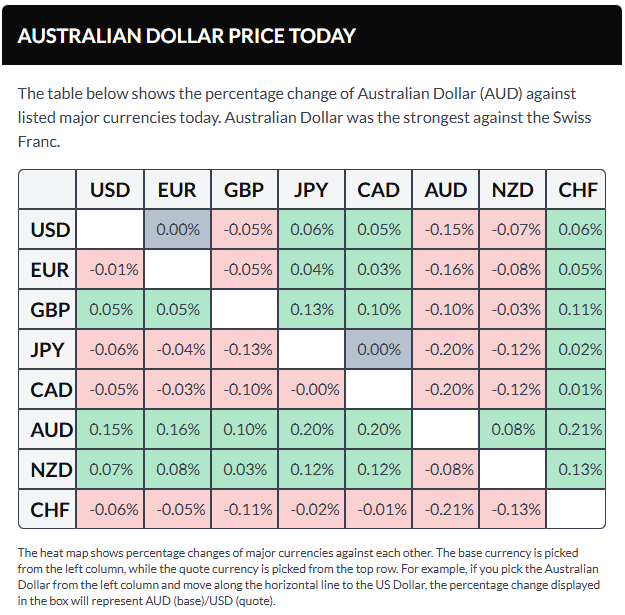

AUD/USD continued its upward momentum, trading near 0.6692 shortly after the release of China’s trade data. The pair is currently up 0.16% on the day.

This section was released on Wednesday at 00:52 GMT as a preview ahead of China’s Trade Balance report.

China’s Trade Balance Overview

The General Administration of Customs is scheduled to release December trade data on Wednesday at 03:00 GMT. Analysts expect the trade surplus to widen to $113.60 billion, up from $111.68 billion previously. Exports are forecasted to grow 3.0% year-over-year in December, while imports are projected to rise 0.9% over the same period.

Given China’s significant influence on the global economy, this data release is anticipated to impact the Forex market.

In what ways can China’s Trade Balance impact the AUD/USD exchange rate?

AUD/USD is trading with modest gains ahead of China’s Trade Balance release. The pair dipped slightly as the U.S. dollar strengthened, supported by Consumer Price Index (CPI) inflation data that largely met economists’ expectations last month.

Should the trade data exceed forecasts, it may boost the Australian dollar, with initial resistance seen at the January 12 high of 0.6722. Further upside targets include the January 6 high at 0.6742 and the January 7 peak at 0.6766.

On the downside, the January 9 low of 0.6663 could provide support for buyers. A deeper decline might push the pair down to the December 4 low of 0.6614, followed by the 100-day exponential moving average near 0.6587.

Sources: Fxstreet

Leave a comment