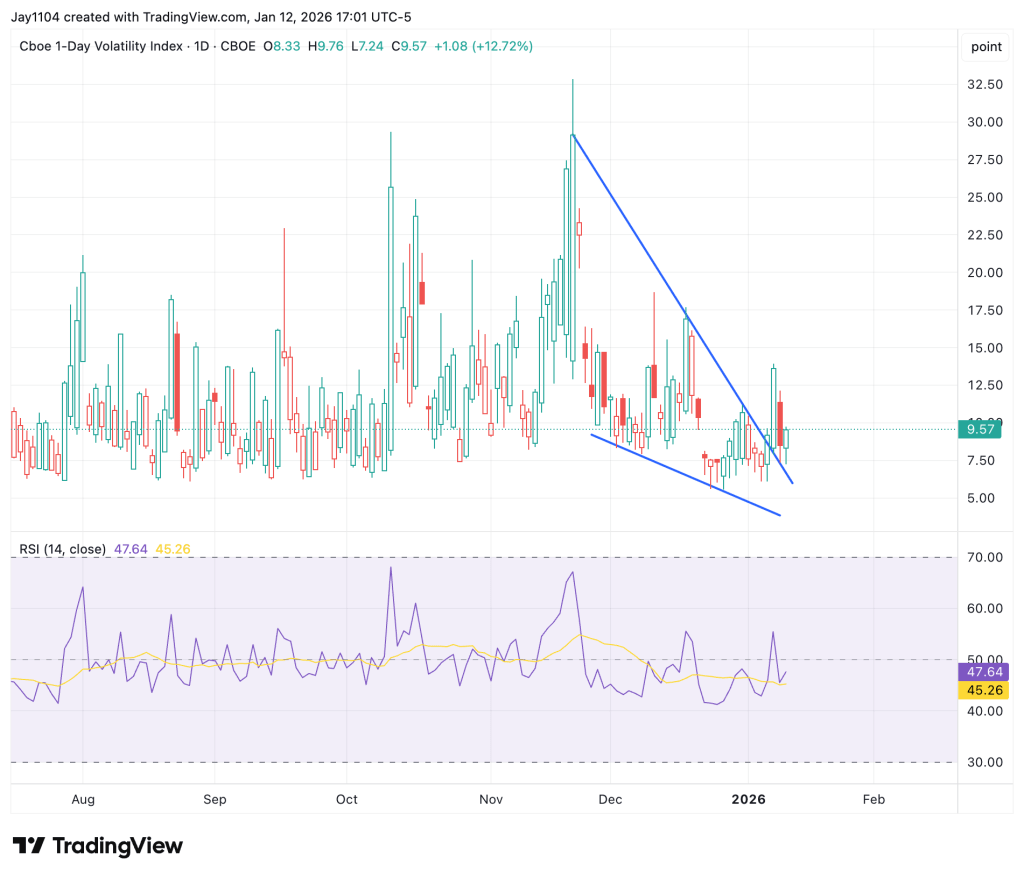

The VIX 1-Day index closed below 10 on Monday, indicating that if a significant price surge follows the CPI report, it is unlikely to be driven initially by increased implied volatility. Instead, any substantial move would need to be supported by actual buying activity rather than a rise in volatility. However, volatility could still spike overnight, setting the stage for the familiar CPI-driven market reaction.

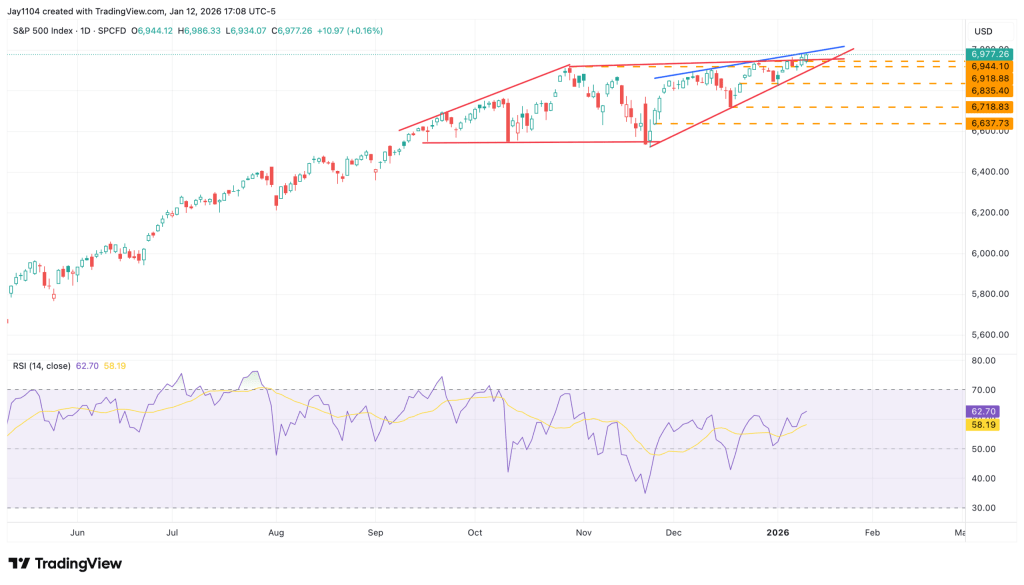

The S&P 500 appears stable for now, but I don’t believe this is the significant breakout many have anticipated since late October. Currently, the index hasn’t even fully cleared resistance at the trendline by a single bar. We witnessed similar patterns at the beginning of 2022 and 2025.

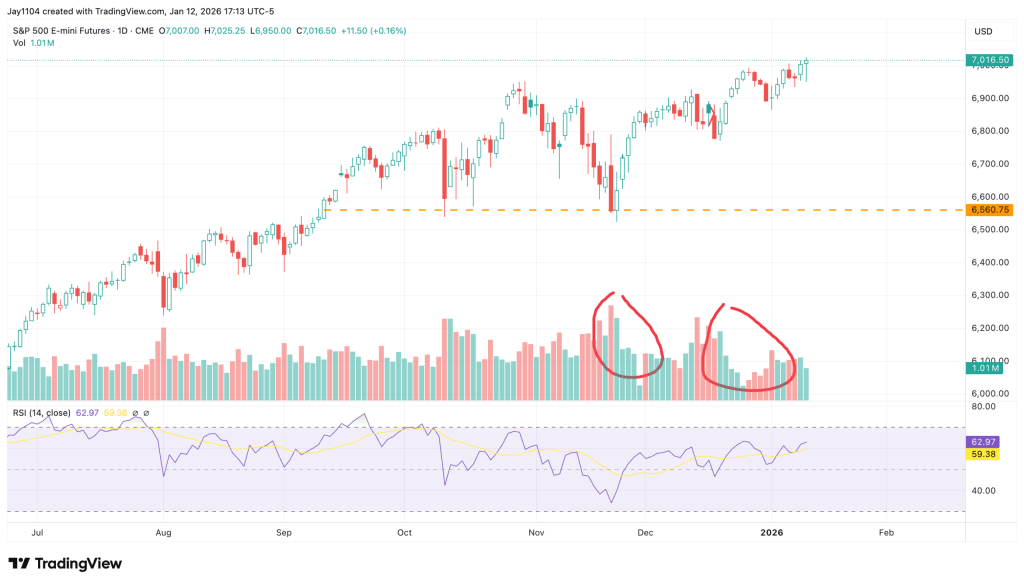

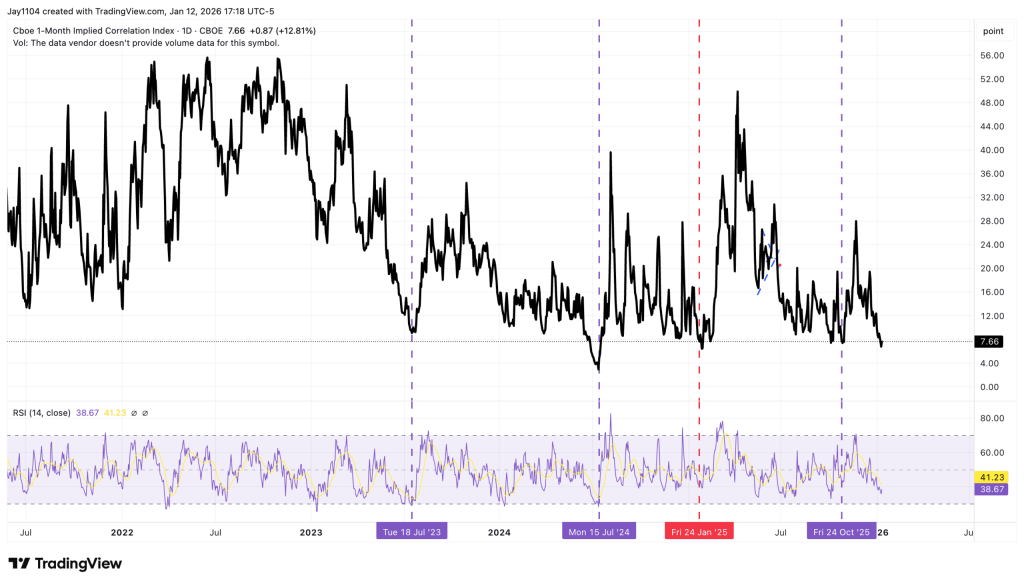

The market could keep inching up by 10, 20, or even 30 basis points, but considering the unusually low levels of both realized and implied volatility, along with one-month implied correlation at just 7, the odds aren’t in favor of a strong move. Monday’s trading volume in S&P 500 futures was so thin, it felt like December 22 all over again.

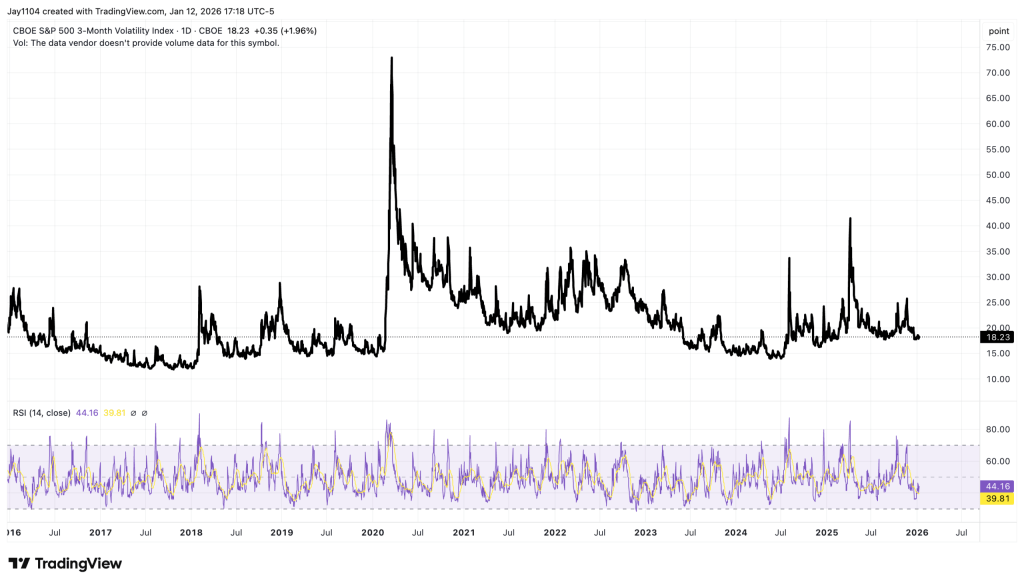

It seems the authorities have the ability to push the 3-month VIX back down to its July 2024 lows.

Perhaps those same market forces can drive the 1-month implied correlation down to 2.

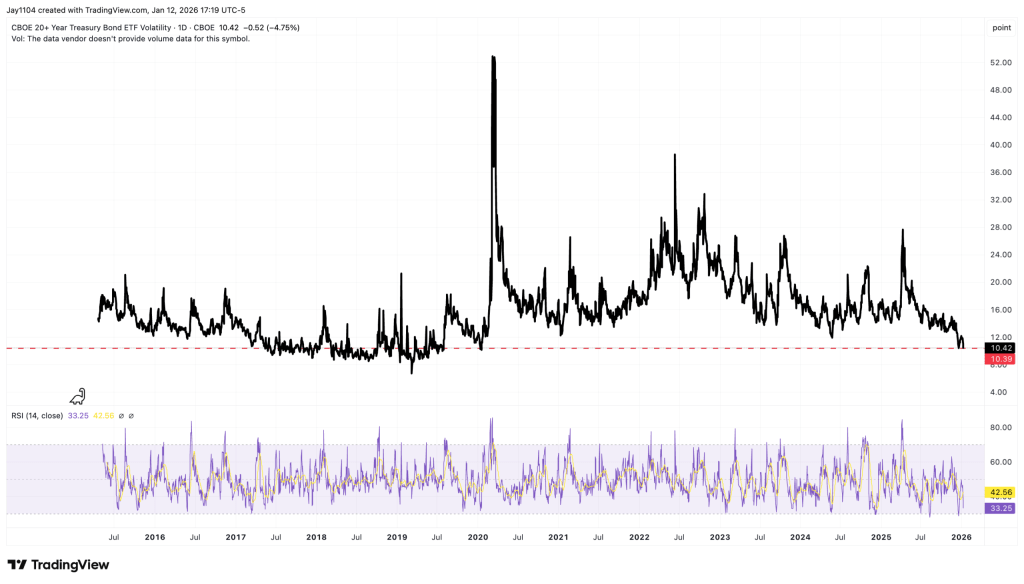

Alternatively, the VXTLT bond market volatility index might decline to levels unseen since 2019.

The main takeaway is that, in my opinion, the market’s current structure is not set up for a sharp, explosive rally. While it may continue to grind upward, eventually volatility is likely to mean-revert higher, triggering a pullback similar to the one seen from late October into November.

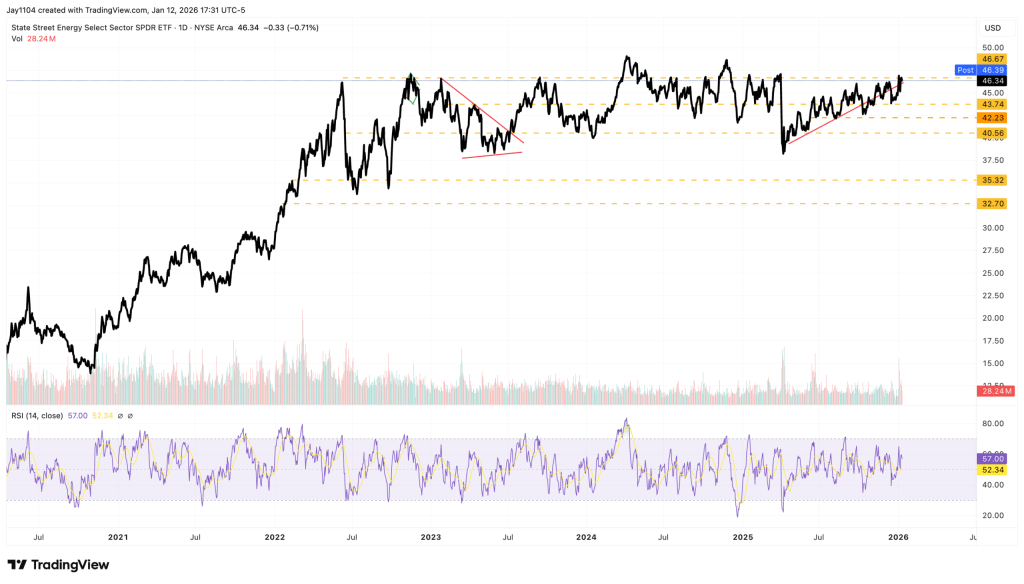

Interestingly, despite numerous challenges in the oil market over the past four years, XLE has largely avoided a significant breakdown, instead trading mostly sideways throughout this period. If oil prices were to break out decisively and start climbing, it could signal a strong bullish trend for the sector. Currently, XLE is approaching a critical resistance level and merits close attention.

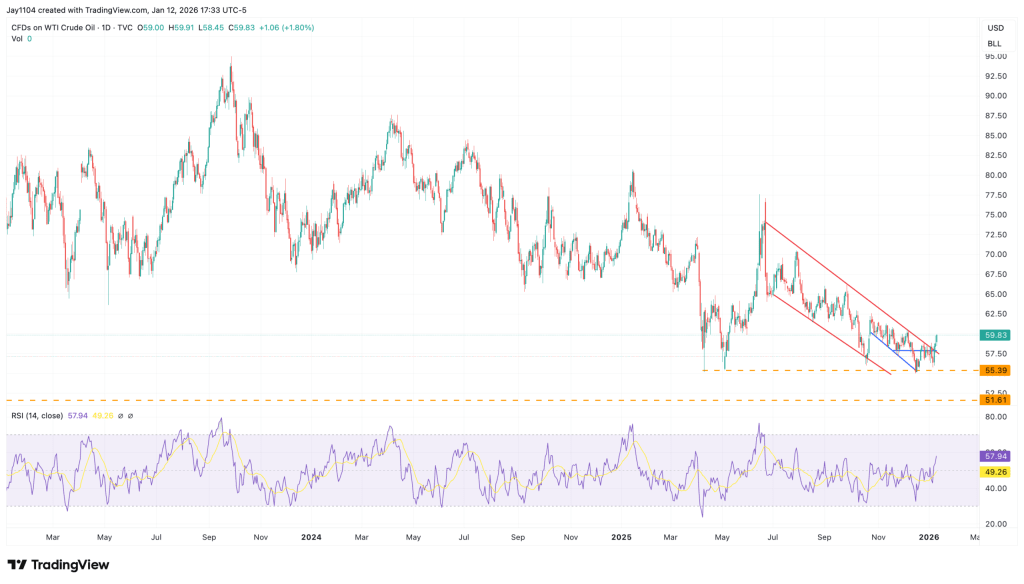

This could prove significant if oil’s breakout above the downtrend sustains and prices start climbing back into the $60 range. For now, $55 seems to be a support level, and oil remains one of the few commodities yet to make a notable upward move. It’s definitely worth monitoring for potential gains.

Sources: Mott Capital Management

Leave a comment