- On Tuesday, Cardano’s price approached a crucial support level at $0.38 after failing to break above the 50-day EMA at $0.41 last week.

- Metrics from on-chain data and derivatives present a mixed picture: selective accumulation by whales and an increase in long positions contrast with negative funding rates and falling social dominance.

- From a technical perspective, a rebound is possible if the $0.38 support holds, but a confirmed drop below this level could indicate a more significant correction.

On Tuesday, Cardano (ADA) price approached an important support level at $0.38, following rejection from the 50-day Exponential Moving Average (EMA) last week. Market indicators present a mixed picture: selective whale accumulation and increasing long positions point to underlying demand, while negative funding rates and decreasing social dominance reflect cautious market sentiment. Technically, ADA stands at a critical juncture—holding above support may lead to a price rebound, whereas falling below could trigger a more significant downturn.

Investor sentiment remains mixed

Data from Santiment’s Supply Distribution indicates a bullish sentiment for Cardano, with some whales accumulating ADA during recent price declines.

The data reveals that whales holding between 10 million and 100 million ADA tokens (represented by the blue line) have collectively acquired 180 million ADA from January 8 through Tuesday. Meanwhile, another group of whales holding between 1 million and 10 million ADA tokens (yellow line) and those with 100,000 to 1 million tokens (red line) have offloaded a total of 50 million tokens during the same period.

This suggests that the second group of whales may have experienced a capitulation event, while the first group capitalized on the opportunity to accumulate Cardano at discounted prices.

Cardano supply distribution chart. Source: Santiment

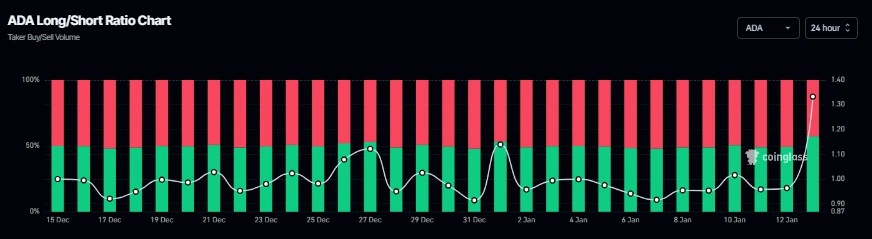

Coinglass reported that ADA’s long-to-short ratio reached 1.33 on Tuesday, marking its highest point in more than a month. A ratio above one indicates that a majority of traders are anticipating a price increase for Cardano.

Cardano’s long-to-short ratio chart. Source: Coinglass

Cardano’s social dominance measures the proportion of ADA-related conversations within the cryptocurrency media, currently signaling a bearish outlook. According to Santiment, ADA’s share of crypto media discussions stands at 0.037%, the lowest since early December, and has been steadily decreasing since early January. This downward trend reflects diminishing investor interest and lower speculative activity, which often correlates with weaker demand and reduced short-term price momentum.

Cardano Social Dominance chart. Data source: Santiment

Additionally, Cardano’s funding rates dropped into negative territory on Tuesday, as shown in the Coinglass chart below. Negative funding rates mean that short positions are paying long holders, signaling bearish sentiment toward ADA.

Cardano’s funding rate chart. Source: Coinglass

Cardano price outlook: ADA approaches critical $0.38 support level

On January 6, Cardano’s price was rejected at the 50-day EMA near $0.41 and subsequently dropped by almost 9% through Monday, retesting the daily support level at $0.38. As of Tuesday, ADA remains close to this key support.

A daily close below $0.38 could signal a further decline toward the December 31 low of $0.32.

The Relative Strength Index (RSI) on the daily chart is stabilizing around the neutral 50 level, reflecting trader indecision. Additionally, the Moving Average Convergence Divergence (MACD) lines are converging, which also points to a lack of clear direction.

ADA/USDT daily chart

If the $0.38 daily support level holds firm, ADA may rebound toward the 50-day EMA at $0.41.

Sources: Fxstreet

Leave a comment