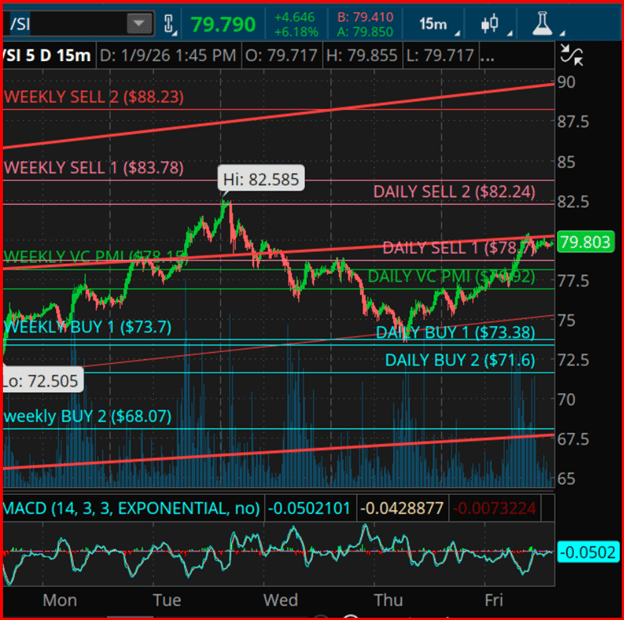

Silver futures continue their strong upward momentum, trading near $79.80 after a significant rally that pushed prices well above the VC PMI (Variable Changing Price Momentum Indicator) average and into the upper resistance zone.

This pattern indicates the market has entered what we call escape-velocity behavior—where the trend’s acceleration temporarily outweighs short-term oscillators but still respects longer-term geometry and cycle pressures.

Looking at the VC PMI, the daily mean is holding steady around $76.02, providing dynamic support throughout the week. The market also successfully defended the Daily Buy 1 level at $73.38, confirming the strength of the current bullish setup.

Now, prices are approaching the Daily Sell 1 zone near $78.70, with the Daily Sell 2 resistance at $82.24 closely matching the previous swing high of $82.58. This overlap suggests a higher likelihood of short-term profit-taking or consolidation, rather than a reversal of the uptrend.

On the weekly VC PMI framework, silver stays solidly above the Weekly Buy 1 level at $73.70, with the Weekly VC PMI mean around $78.15, reinforcing that the prevailing trend is upward. However, the Weekly Sell 1 level at $83.78 and Weekly Sell 2 at $88.23 mark key resistance zones where momentum typically slows and volatility tends to increase.

From a time-cycle perspective, silver is currently trading within a compressed late-week cycle window, a phase where markets often pause, rotate, or experience slight retracements before the next move. Such pauses are common in strong trends and usually serve to reset momentum for continuation rather than signaling a reversal.

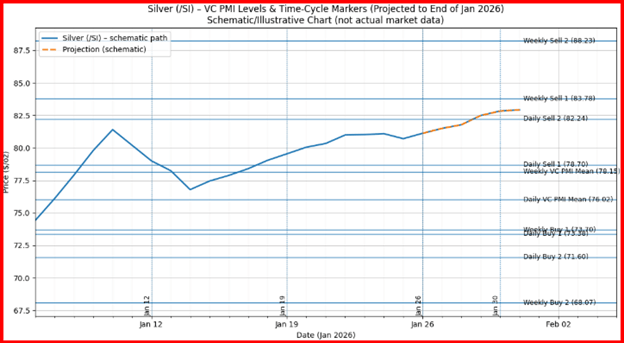

The present cycle alignment suggests an initial phase of range expansion, followed by consolidation, rather than signaling a trend exhaustion.

The Square of 9 geometry further supports this view. The $82–$83 area corresponds with a significant angular resistance band, while the $78–$76 range serves as a key rotational support zone. As long as prices stay above the VC PMI mean, the primary square rotation remains bullish, with higher-level targets pointing toward the mid-$80s in upcoming cycle windows.

In summary, silver maintains a strong bullish structure according to both the VC PMI and Square of 9 frameworks. Any short-term pauses or pullbacks should be seen as opportunities for mean reversion within the broader uptrend, rather than signs of trend reversal.

Sources: Investing

Leave a comment