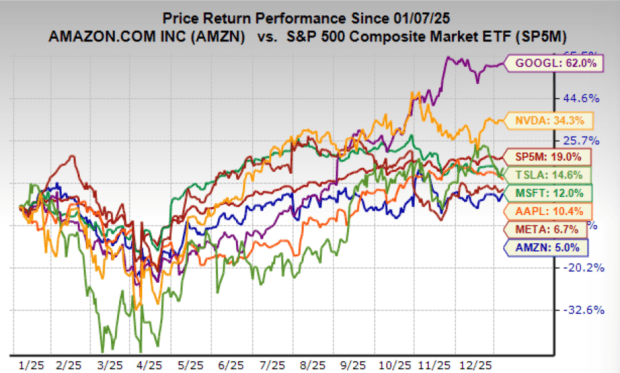

Last year was another strong period for the world’s top technology firms, known as the Magnificent 7. While artificial intelligence clearly provided a boost, these companies’ core business performance remained robust even without AI-driven growth, continuing to deliver steady revenue increases and strengthening competitive advantages that few rivals can match. They remain central to some of the most powerful and lasting secular trends shaping the global economy. This strong foundation persists as we enter 2026, though individual positioning within the group has started to vary.

Interestingly, Meta Platforms (META) and Amazon (AMZN)—which were the two weakest performers in 2025—now appear to be among the best positioned for gains in the coming year, along with Alphabet (GOOGL). This doesn’t rule out further upside potential for the rest of the group, but it does indicate a shift in relative opportunities. Below, I detail the changing dynamics for each of the Magnificent 7 and share insights on how to approach trading them in 2026.

Amazon, Meta Platforms, and Alphabet Stocks Take Center Stage

After trailing the broader group in 2025, Amazon and Meta Platforms seem poised for a strong recovery in the coming year. Both companies continue to show steady revenue and earnings growth, but their stock prices have lagged, resulting in some of the most attractive valuations seen in years. Meta is currently trading at about 21.9 times forward earnings, while Amazon is around 30.7 times—both significantly below their historical averages. According to analyst ratings, Meta holds a Zacks Rank of #3 (Hold), indicating stable earnings revisions, whereas Amazon has a more favorable Zacks Rank of #2 (Buy).

Technical indicators also favor both Meta and Amazon. Meta’s shares have been trading within a narrow range recently, a pattern that often signals an impending breakout. Amazon shows a similar pattern but has already begun to move upward, breaking out on strong volume just yesterday.

From a fundamental perspective, both companies have strong bullish catalysts. Amazon is actively pursuing various AI-driven growth opportunities, particularly through AWS, where demand for cloud computing services remains strong. Meta has been one of the most effective users of AI in its advertising platform, converting technological advances into better monetization and higher margins. Additionally, Meta’s recent acquisition of Manus AI, though relatively low-profile, could be strategically important. Manus stands out among large language model (LLM) applications for its sophistication and may help Meta reestablish itself as a serious competitor in consumer-facing AI, an area where it has previously fallen behind.

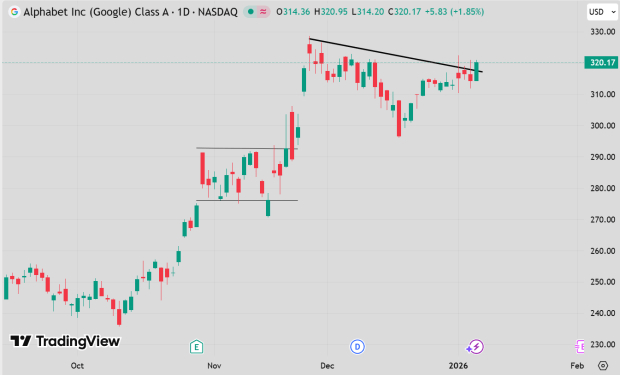

In contrast, Alphabet was the best performer in the group last year as the market finally recognized its AI strengths. Its large language model is among the industry’s top, and its vertically integrated hardware ecosystem—centered on proprietary TPUs—provides a strong and unique competitive edge. Alphabet’s shares are now emerging from their own consolidation phase, indicating potential for further gains.

Together, these three companies present a well-rounded investment opportunity: two former laggards with improving technical and valuation setups, and one established leader continuing to deliver. In all cases, AI acts as a powerful catalyst, but not the sole basis for investment.

Nvidia and Microsoft Continue to Show Strong Potential

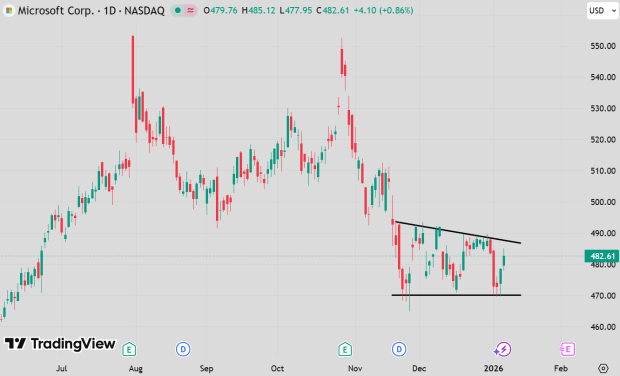

Microsoft (MSFT), a dominant force in global technology, has experienced a pause in its share price momentum in recent months, with little sustained progress since early summer and a slight decline during the fourth quarter. However, this consolidation seems to be settling. The stock has consistently tested a critical support level but has yet to break significantly below it, indicating that downward pressure may be easing.

On the fundamentals side, Microsoft’s outlook is strengthening. Earnings estimates have seen modest upward revisions, contributing to a Zacks Rank of #2 (Buy) for the stock. As long as the shares remain above the key support level around $470, the risk-to-reward ratio looks increasingly favorable.

Nvidia (NVDA) currently holds a Zacks Rank of #1 (Strong Buy), reflecting unanimous upward revisions to earnings estimates across various time frames. In just the past 60 days, analysts have increased next year’s EPS forecasts by about 16%, signaling continued positive surprises in its fundamentals.

The company’s valuation remains attractive relative to its growth prospects. Nvidia trades at roughly 40.1 times forward earnings, while its long-term EPS is expected to grow at an annualized rate of around 46% over the next three to five years. This results in a PEG ratio below 1—a rare and favorable setup for a company of this size.

Importantly, Nvidia is actively advancing despite its dominant position in the AI market. It is investing heavily across the entire AI technology stack, with a growing focus on next-generation architectures and inference optimization, which is set to become an increasingly lucrative area as AI workloads expand. This strategy was further supported by Nvidia’s recent acquisition and partnership with chip startup Groq, enhancing its capabilities in low-latency inference and performance-optimized chip design ahead of the upcoming Rubin architecture. These moves keep Nvidia firmly on investors’ radar.

Apple and Tesla Stocks Experience a Downward Trend

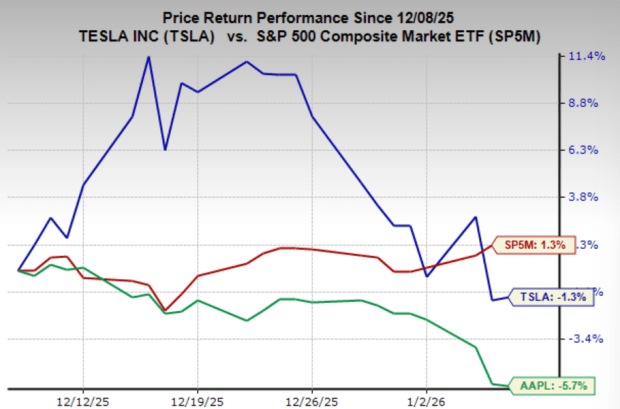

Although both Apple (AAPL) and Tesla (TSLA) experienced rallies late last year, their price trends remain concerning as we head into 2026. They are currently the only two stocks among the Magnificent 7 clearly trading in sustained downtrends, highlighting a shift in leadership within the group.

Tesla’s story remains ambitious, with Elon Musk emphasizing long-term prospects like autonomous driving and humanoid robots. However, investors are now focused more on near-term fundamentals, which have weakened. Tesla’s top-line growth has stalled since 2023, and its market share declined after being overtaken by BYD as the world’s largest EV producer last year. So far, there’s little sign of a meaningful rebound in vehicle demand.

Valuation also poses a major challenge for Tesla. It currently trades at over 200 times forward earnings and about 13 times forward sales—levels that surpass most high-growth, high-margin software firms. While Tesla has historically commanded premium valuations, slowing growth and changing market sentiment increase the risk of downside in the near to medium term.

Apple, on the other hand, doesn’t face the same fundamental risks but appears less attractive compared to its peers. The company has taken a cautious approach in the AI race, choosing not to match competitors’ aggressive infrastructure investments. Although this initially hurt sentiment amid fears Apple might fall behind, this strategy has proven more justifiable over time. Apple remains the world’s leading platform for mobile computing and consumer devices, positioning it as a key distribution channel for AI-powered applications in the future. Nevertheless, with fewer immediate catalysts and weaker momentum, Apple currently lags behind other Magnificent 7 stocks from a trading standpoint.

How Investors Can Position Themselves Within the Magnificent 7

As we enter 2026, the Magnificent 7 continue to present a wide range of opportunities. Variations in earnings momentum, technical trends, and near-term catalysts offer multiple ways for investors to engage—whether by riding the momentum of leaders or capitalizing on laggards poised for a rebound.

For investors, the key is to focus on areas where strong fundamentals align with positive price action. When approached thoughtfully, the Magnificent 7 should remain a central source of opportunity throughout 2026, not only as a group but also through the unique trajectories each company follows as the market cycle progresses.

Semiconductor Stocks to Consider Beyond Nvidia

The soaring demand for data is driving the next digital gold rush in the market. As data centers keep expanding and upgrading, the hardware suppliers behind these giants are set to become the NVIDIAs of the future.

One lesser-known chipmaker is uniquely poised to capitalize on this next phase of growth. It focuses on semiconductor products that industry leaders like NVIDIA don’t produce. This company is just starting to gain attention—exactly the kind of opportunity investors want to spot early.

Sources: Investing

Leave a comment