- EUR/USD is trading below the nine-day and 50-day EMAs, which stand at 1.1680 and 1.1696, respectively.

- The 14-day Relative Strength Index (RSI) is at 39, signaling weakening momentum and a bearish outlook.

- The pair could potentially decline further toward the six-week low of 1.1589.

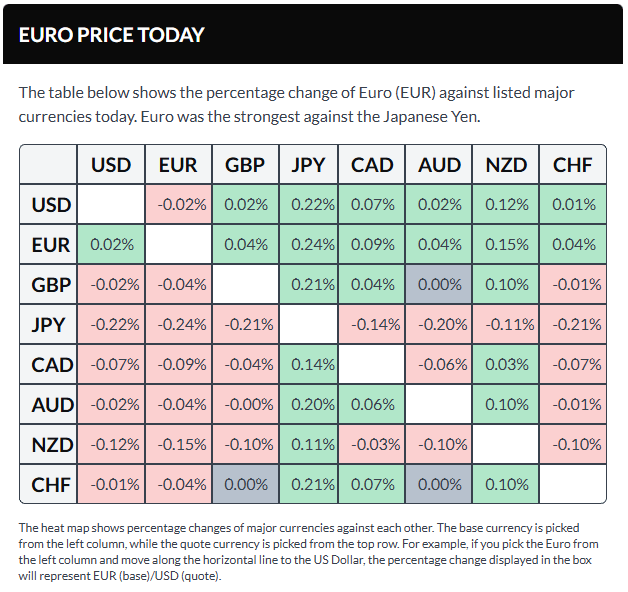

EUR/USD steadies near 1.1650 during Asian trading on Friday, following a five-day losing streak. The 14-day Relative Strength Index (RSI) sits at 39, indicating bearish momentum that is weakening rather than signaling oversold levels.

Technical analysis of the daily chart reveals the pair trading below both the nine- and 50-day Exponential Moving Averages (EMAs), with the short-term EMA rolling over at 1.1696 and the 50-day EMA flattening around 1.1680. While the crossover pattern remains positive, the lack of support from the moving averages leaves the short-term outlook vulnerable.

The EUR/USD pair may test the area near the six-week low of 1.1589, established on December 1. A daily close below this initial support could open the way to the next key level at 1.1468, the lowest point since August 2025.

On the upside, immediate resistance is found at the crossover of the medium- and short-term moving averages around 1.1680 and 1.1696, respectively. A daily close above these levels would likely restore momentum, pushing EUR/USD toward the three-month high of 1.1808 reached on December 24, and potentially further to 1.1918, the highest level since June 2021.

EUR/USD: Daily Chart

Sources: Fxstreet

Leave a comment