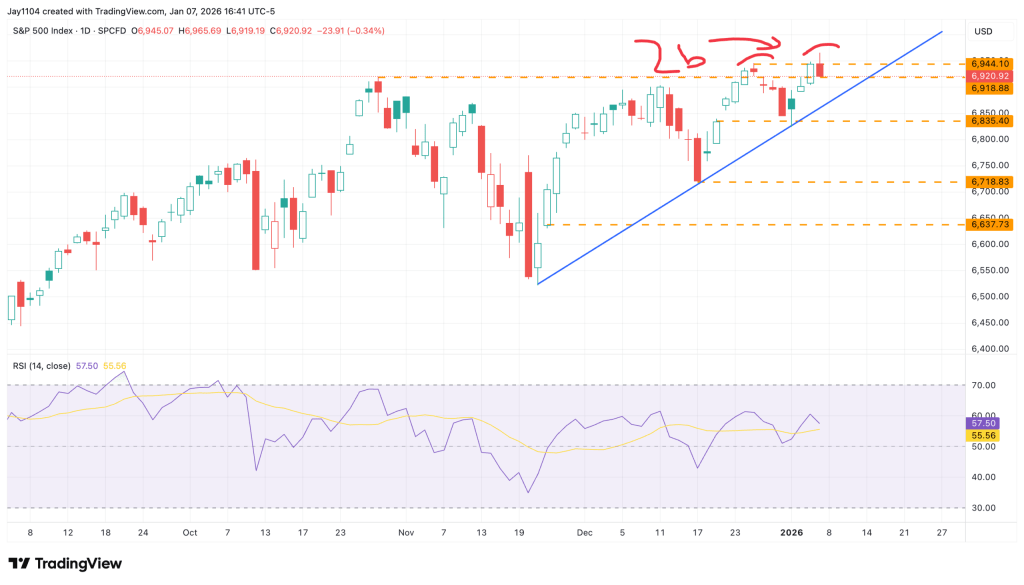

The S&P 500 ended Wednesday down roughly 34 basis points. The index now appears to be forming a possible 2B reversal top after failing to sustain a breakout to new highs. Instead, it turned lower and finished the session back near support around 6,920.

If the index cannot clear the 6,950 level and subsequently falls below 6,920, it could open the door toward the 6,835 area. More broadly, the S&P 500 has shown little net progress since late October, and such a move would also threaten the uptrend established from the November 21 lows. As a result, the index looks more exposed to downside risks than it might initially suggest.

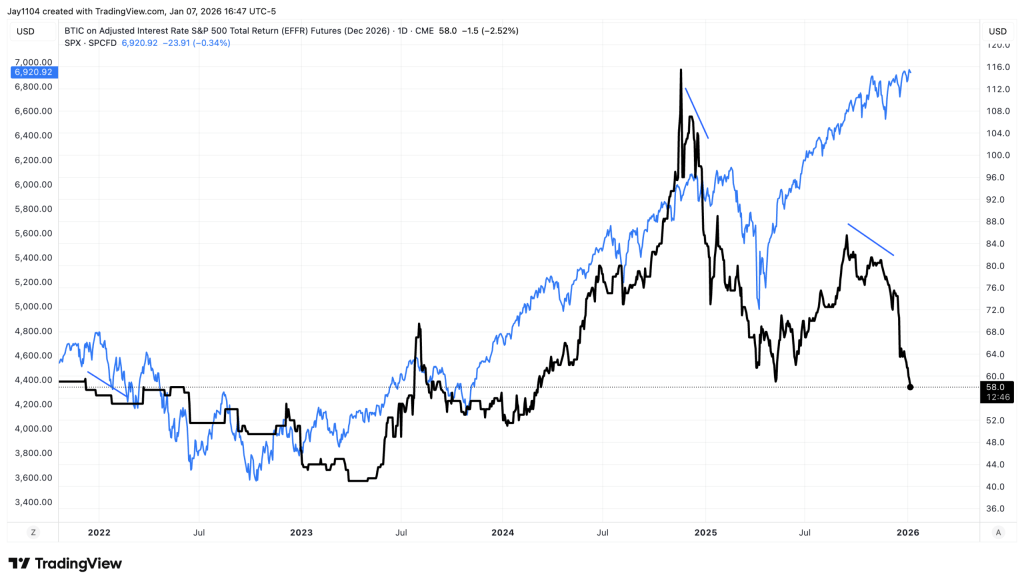

BTIC S&P 500 Total Return Futures (EFFR) for the December 2026 contracts declined again on Wednesday, reaching their lowest level since March 2024. While some may interpret this as bullish on the basis that financing costs are easing, it is difficult to identify periods when the S&P 500 advanced while these contracts were falling—at least based on my observations. To me, this is clearly bearish and suggests that demand for leverage is weakening or that positions are being unwound.

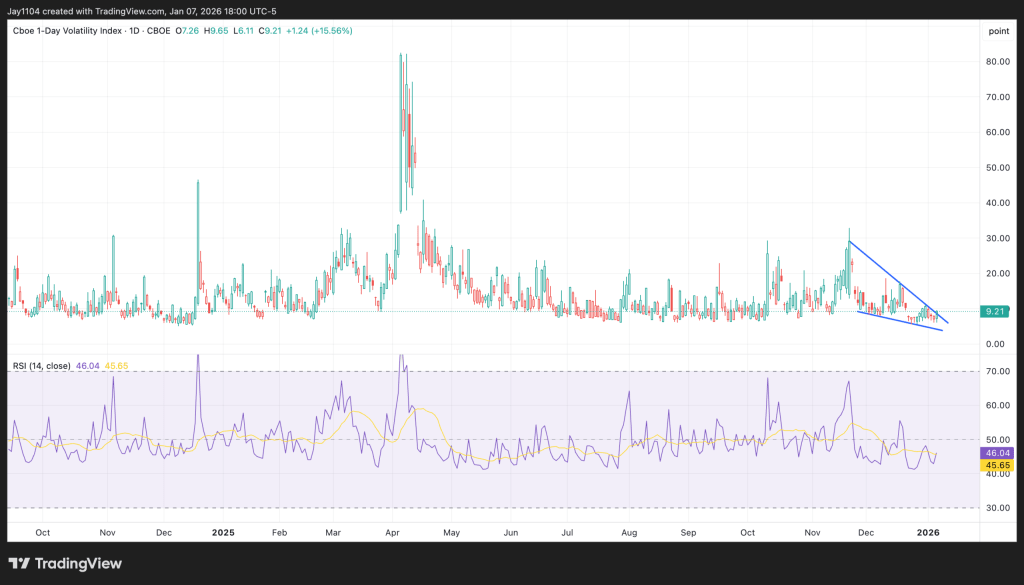

Implied volatility increased on Wednesday ahead of Friday’s employment report and upcoming Supreme Court opinions, which could include a ruling on tariffs. Kalshi currently assigns a 30% probability that the Court upholds the tariffs, implying a 70% likelihood that they are overturned.

I anticipate implied volatility will keep increasing as we approach this news event. The VIX 1-day is likely to rise significantly by Thursday afternoon and could continue climbing after the jobs report, given that the Supreme Court rulings are expected later that day. In my view, a VIX 1-day reading between 15 and 20 appears very probable.

Sources: Mott Capital Management

Leave a comment