Every January, it’s the same story: gym parking lots are packed like a Taylor Swift concert, salad aisles get wiped clean as if there’s a lettuce shortage, and suddenly half your coworkers are quoting Warren Buffett while buying shares in companies they can barely pronounce. Yep, it’s “New Year’s Resolution Season”—that magical time when we all vow to lose weight, get fit, and save money… until Valentine’s Day rolls around.

By February, reality hits hard. That treadmill you bought has become a fancy clothes rack, your credit card bill looks like you confused “budgeting” with “shopping spree,” and that grand investing plan? It’s now a Coinbase account loaded with meme coins, a YouTube playlist of gurus, and a browser stuck on Reddit’s WallStreetBets.

So why do we do this every year? Blame it on history and human nature.

The tradition started with the Babylonians, who promised their gods to return borrowed tools—not a bad resolution, unless you were the poor soul who lent out a plow in 1900 B.C. and never got it back. Then the Romans made it official with oaths to Janus, the god of beginnings, who had two faces: one looking back at last year’s mess, the other pretending this year would be different. Fun fact: that’s where January gets its name—a month built on denial.

Back then, resolutions were about crops and keeping your ox alive. Now, it’s about getting washboard abs and beating the S&P 500 by following some “CryptoWolf69” on social media.

Why the obsession? Because average feels like failure. New Year’s resolutions give your brain a quick hit of motivation, tricking you into thinking momentum equals progress. You say you’ll track spending, invest regularly, and finally master options trading. But three weeks later, you’re impulse-buying crypto at midnight while binge-watching Shark Tank.

Here’s where it all falls apart. Resolutions don’t fail because you’re weak—they fail because they’re built on hope, caffeine, and Instagram quotes. You make grand plans after a couple of glasses of wine on New Year’s Eve but skip the hard parts—routine, discipline, and pushing through when things get tough. You want the six-pack but not the push-ups; you want the returns but not the risk management.

And investing is no different.

You promise yourself you’ll “invest for the long term.” But the moment the market dips 5%, you panic, move everything to cash, and start reading headlines like “Is This the Big One?” while watching YouTube channels declaring the apocalypse is near. Although you say retirement is a priority, you’ve never run the numbers or calculated how much you need to save. You make investment choices based on TikTok trends, then act surprised when your portfolio looks like it was managed by a teenager.

Most people don’t wreck their portfolios all at once. Instead, they do it gradually by:

- Developing bad habits

- Expecting motivation to last forever

- Mistaking effort for consistency

By the time they realize things aren’t working, the damage is already done.

Short-term enthusiasm isn’t a strategy—it’s a mirage.

If your investment goals revolve around the calendar instead of a disciplined plan, you’re not managing money—you’re chasing a feeling. And like that unused gym membership, this approach leads to frustration. Every. Single. Time.

So, why do we keep making poor investment decisions?

Why We Keep Making the Same Mistakes

Each year, Dalbar Research publishes a report that feels like a nightmare for investors. Different year, same takeaway: we’re often the biggest obstacle to our own financial success.

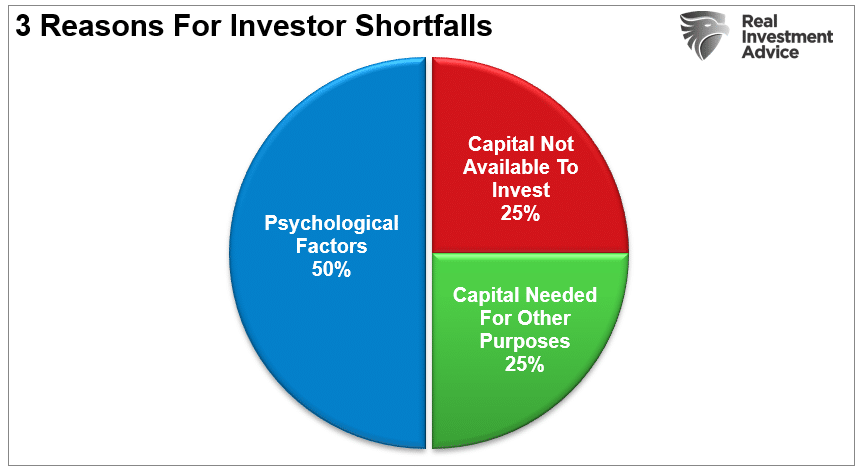

The issue isn’t just about having enough money—it’s what happens in your mind. Dalbar identified nine common investing habits that can derail your returns faster than you can say “buy the dip.”

- Loss Aversion – You’re so scared of losing money that you sell right before the market bounces back.

- Narrow Framing – You fixate on one stock and ignore the rest of your portfolio, slowly watching it unravel.

- Anchoring – You keep waiting for a stock to “return to even,” as if it owes you.

- Mental Accounting – You treat your retirement fund and crypto wallet as separate universes, even when both are crashing.

- Lack of Diversification – Owning five tech stocks doesn’t count as a balanced strategy.

- Herding – You invest just because everyone else is, and it ends exactly how you’d expect.

- Regret Aversion – You hesitate to act because you’re still haunted by selling Apple too early in 2012.

- Media Response – You treat every financial headline like a crisis, even when it’s just noise.

- Optimism Bias – You believe every investment will bounce back—yes, even the one currently under SEC investigation.

The biggest culprits are herding and loss aversion. Investors rush in during market highs but panic-sell at every dip. It’s like devouring a whole pizza and then blaming the scale. Yet we keep falling into these traps because markets mess with our minds. When prices climb, we convince ourselves the rally will last forever. When they fall, we believe recovery is impossible. We buy at the top, sell at the bottom, and then wonder why our portfolios never seem to grow.

That’s why you need a different kind of resolution—one grounded in the reality of how investors actually behave, not the fantasy of turning into the next Warren Buffett overnight.

Key Investor Resolutions to Consider in 2026

Let’s face it: emotions wreck portfolios. So in 2026, ditch the vague resolutions and focus on clear rules that can outsmart your worst impulses. Here’s a smarter list of resolutions designed for real investors—not fantasy league traders:

In 2026, I plan to (or at least make an effort to):

- Stick to what’s working and cut losses quickly. No more waiting for a turnaround that might never come.

- Respect the trend—fighting it is a quick way to lose money.

- Be either bullish or bearish, but never greedy. Greed leads to losses.

- Accept that paying taxes means you made a profit—and that’s a good thing.

- Buy gradually, use limit orders, and don’t chase prices like it’s a Black Friday sale.

- Look for real value, not companies in crisis with a slick PR team.

- Diversify—because trouble always hits somewhere.

- Set stop-losses, use them, and don’t argue with the results.

- Do your homework before hitting “buy.”

- Stay calm during market drops. Take a deep breath, then review your plan.

- Treat cash as a strategic position, not a failure.

- Expect market corrections and handle them maturely.

- Be ready to admit mistakes instead of stubbornly doubling down.

- Leave hope out of your investment decisions.

- Stay flexible—stubbornness is not a strategy.

- Practice patience—good results take time, not hype.

- Turn off the TV, log off TikTok, and focus on data over influencers.

I try to stick to this list every year, but, like everyone, I mess up on a few points. That’s okay. The goal isn’t perfection—it’s making fewer mistakes than the year before. Investing success doesn’t come from reading motivational quotes or binge-watching market TikToks at midnight.

Just like fitness, results don’t come from buying a gym membership—they come from showing up even when it’s tough. Investing works the same way. There are no shortcuts or magic tricks, only basic rules, steady discipline, and the patience to outlast everyone else.

Want to become a better investor? Then keep your resolutions—even when the market tries to convince you otherwise.

Sources: Investing

Leave a comment