In trading (especially Forex), pips and lots are basic units used to measure price movement and trade size.

What is a Pip?

Pip = Percentage in Point

It is the smallest standard price movement in a currency pair.

Standard rules

- For most currency pairs:

1 pip = 0.0001- Example: EUR/USD moves from 1.1000 → 1.1001 = +1 pip

- For JPY pairs:

1 pip = 0.01- Example: USD/JPY moves from 145.20 → 145.21 = +1 pip

Some platforms show pipettes (fractional pips):

- 1 pip = 10 pipettes

What is a Lot?

A lot measures the size of your trade (how much currency you are buying or selling).

Common lot sizes

| Lot Type | Units of Base Currency |

|---|---|

| Standard lot | 100,000 units |

| Mini lot | 10,000 units |

| Micro lot | 1,000 units |

| Nano lot | 100 units (some brokers) |

Pip Value (Why Lots Matter)

The pip value depends on the lot size.

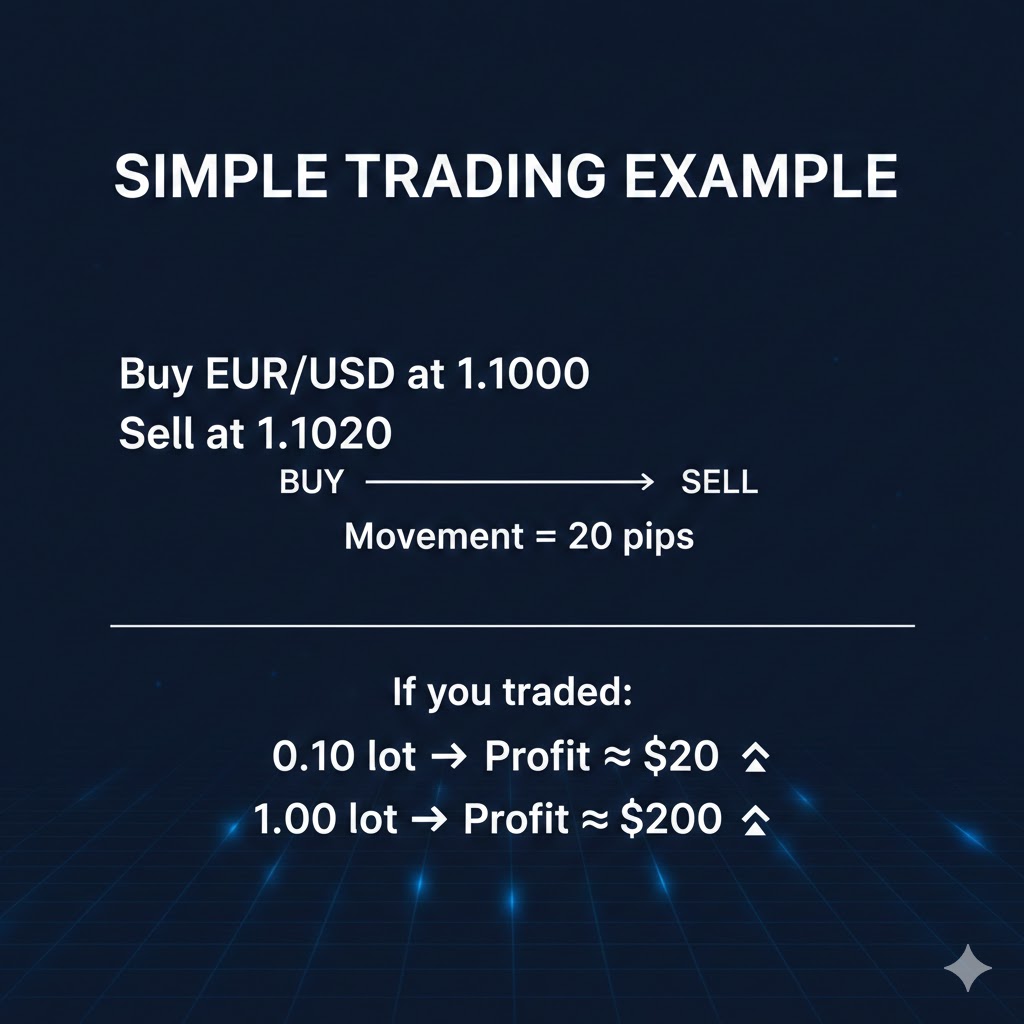

Example (EUR/USD)

| Lot Size | Pip Value |

|---|---|

| 1.00 lot | ≈ $10 per pip |

| 0.10 lot | ≈ $1 per pip |

| 0.01 lot | ≈ $0.10 per pip |

So:

- 20 pips profit with 1 lot ≈ $200

- 20 pips profit with 0.1 lot ≈ $20

Quick Summary

- Pip = how far price moves

- Lot = how big your trade is

- Pips × Lot size = Profit or Loss

Leave a comment