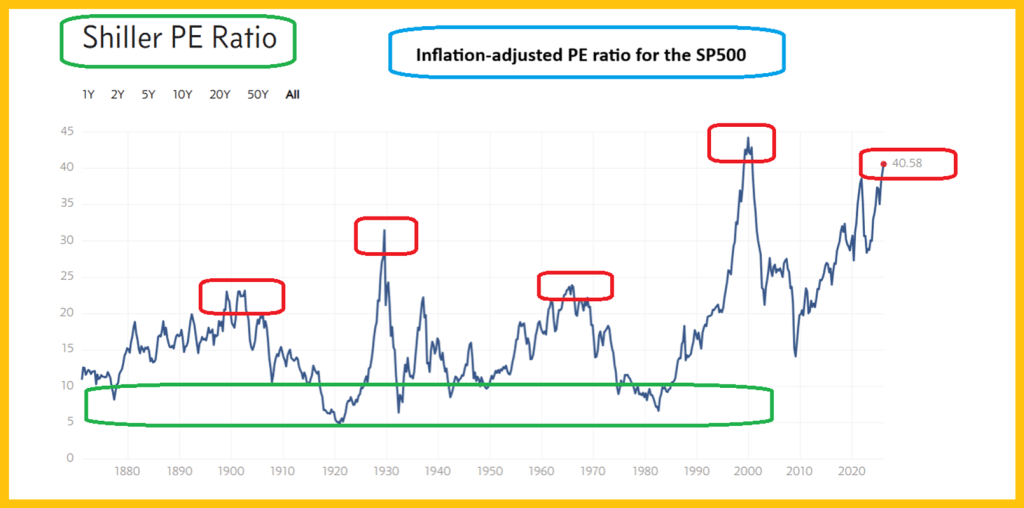

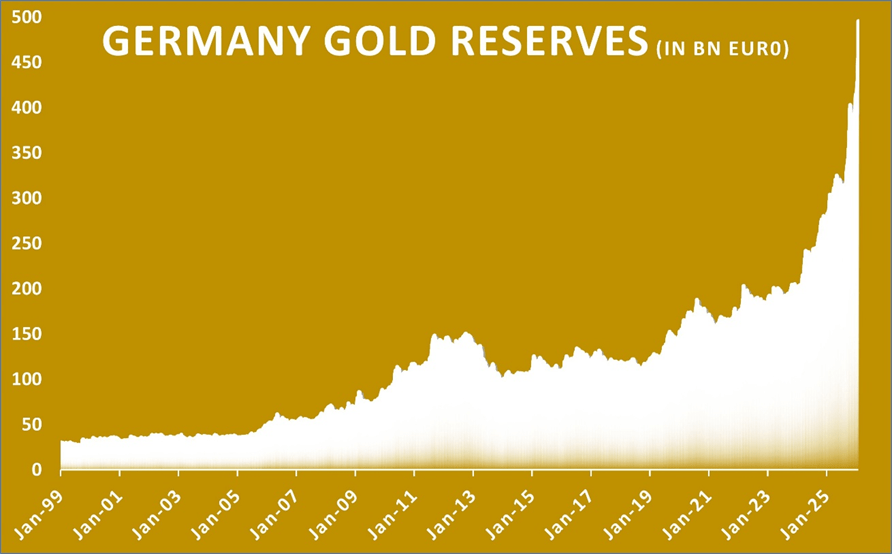

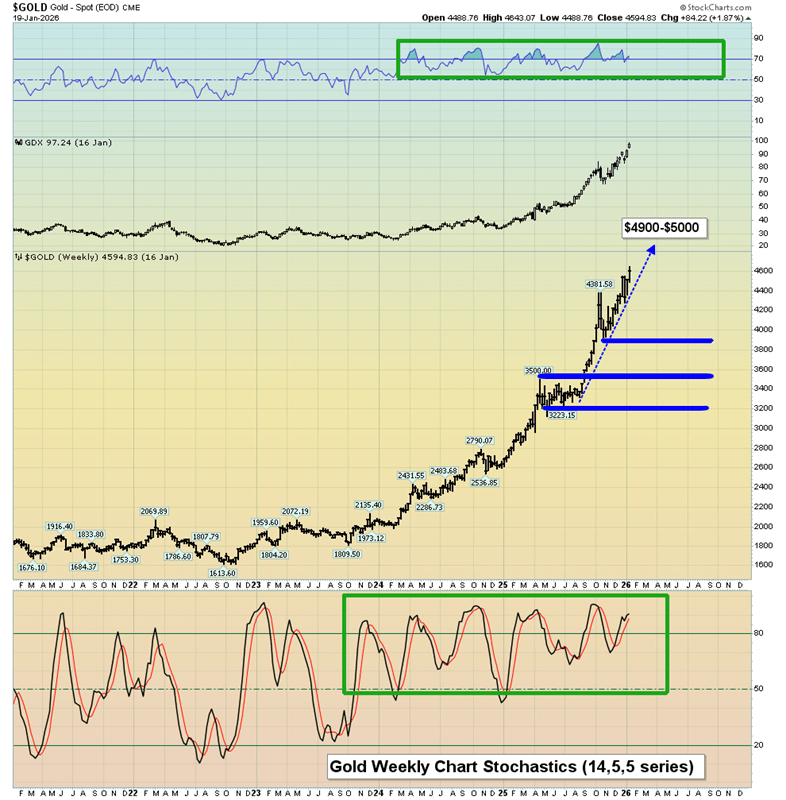

Gold continues to power higher like an unstoppable juggernaut, defying decades of historical precedent. After nearly tripling in just a couple of years, the metal has maintained relentless upside momentum — even as extreme overbought readings that historically triggered sharp corrections have repeatedly failed to spark a meaningful selloff.

The term “juggernaut” itself originates from the Hindu deity Jagannath, whose towering chariots are pulled during India’s Ratha Yatra festival — massive, nearly unstoppable structures once said to crush anything in their path. Gold’s current advance resembles that kind of force: powerful, slow-moving, and extraordinarily difficult to halt.

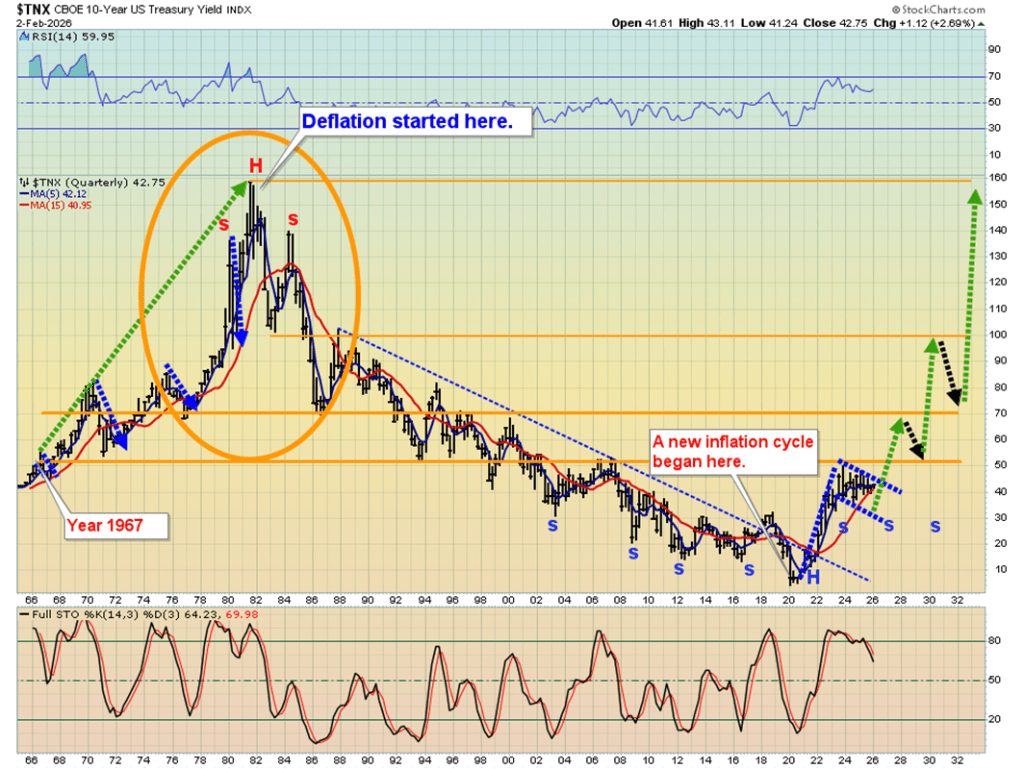

Defying half a century of cyclical behavior

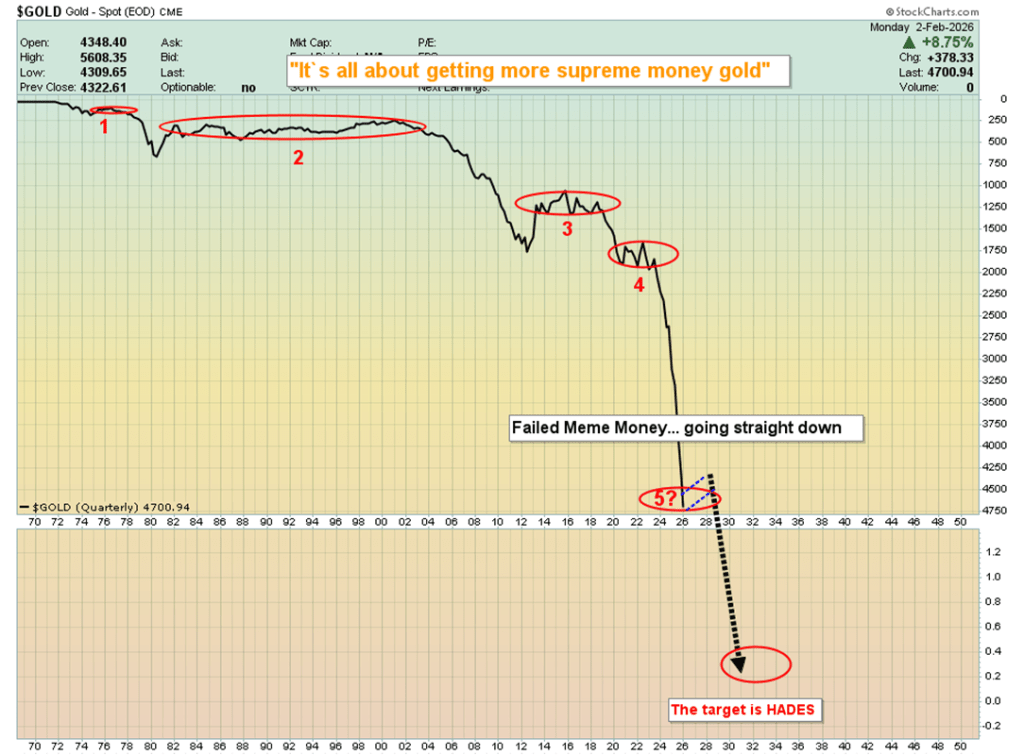

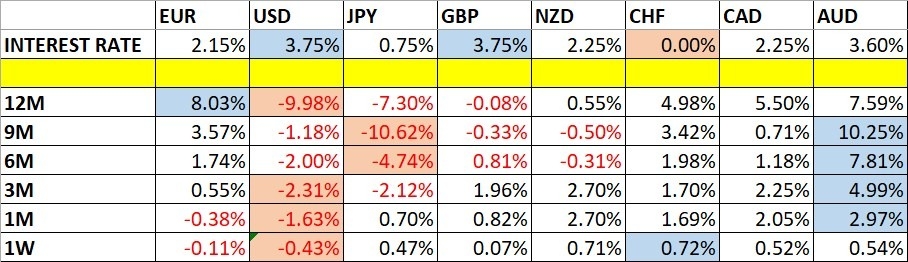

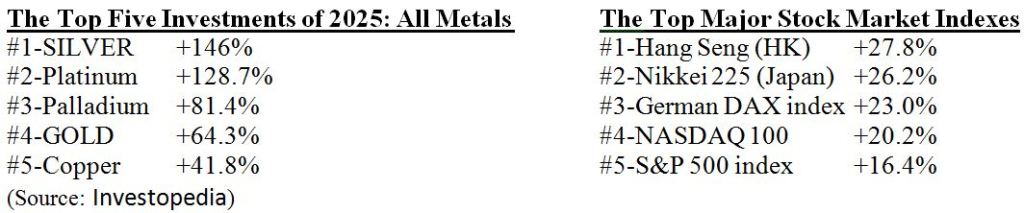

Since the U.S. abandoned the gold standard in August 1971, gold has moved in well-defined cycles. Over the past 55 years, dollar-denominated gold has recorded:

- 32 cyclical bull markets with gains exceeding 20%

- 11 additional uplegs of more than 10%

- 17 cyclical bear markets with losses over 20%

- 24 corrections of at least 10%

These alternating cycles make trading possible — buying low and selling high depends on gold’s historical tendency to mean-revert after extreme moves.

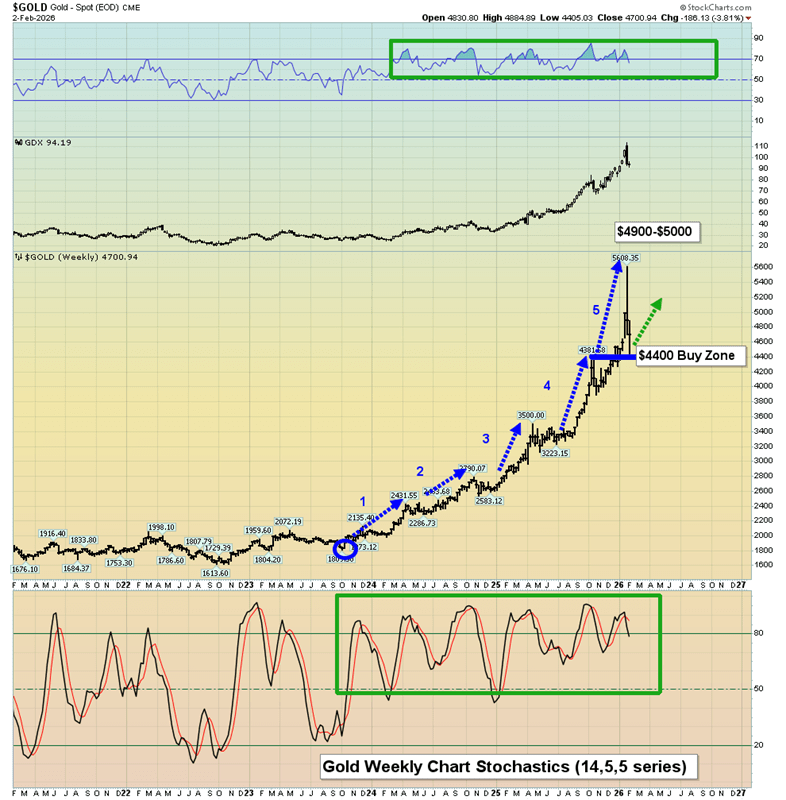

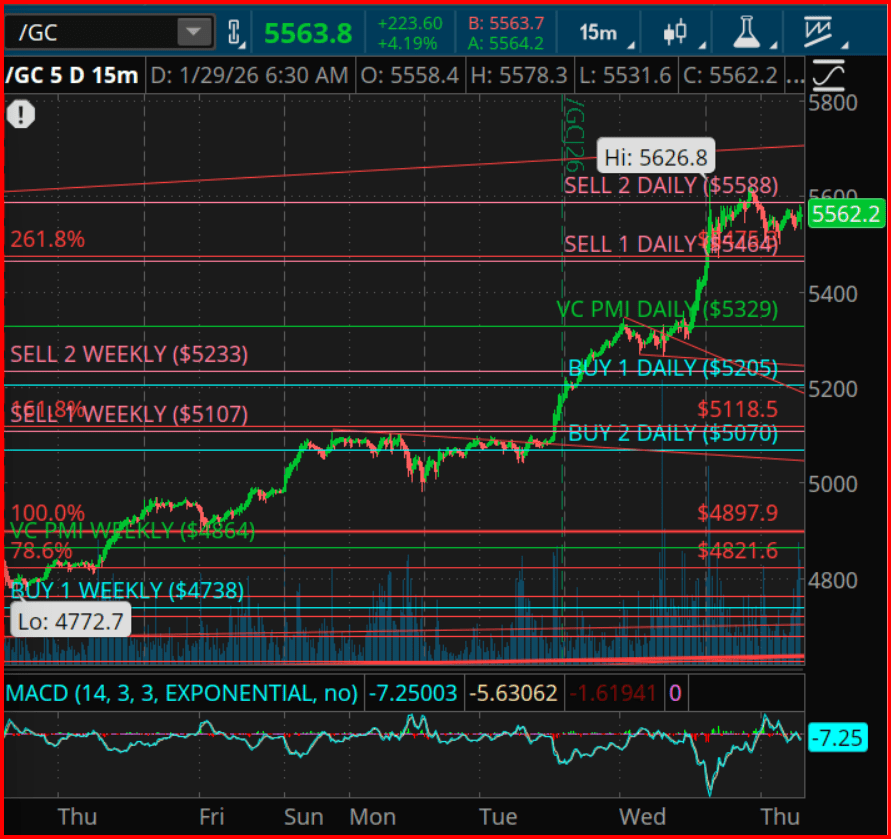

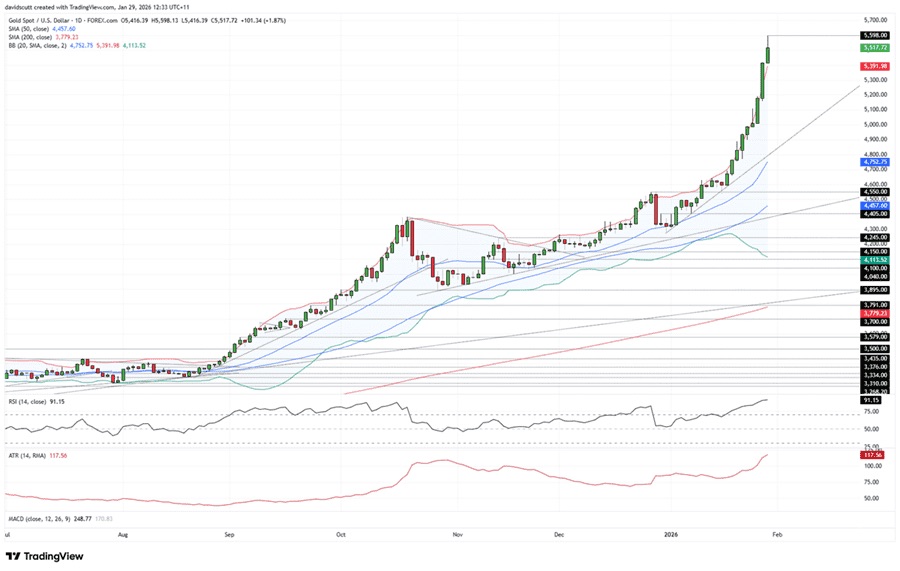

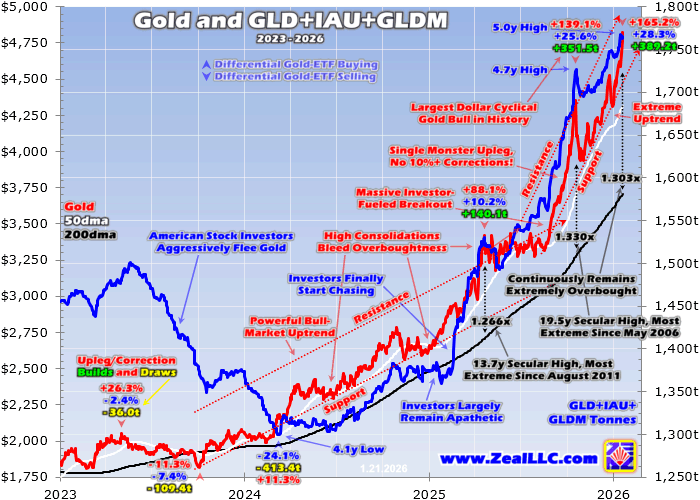

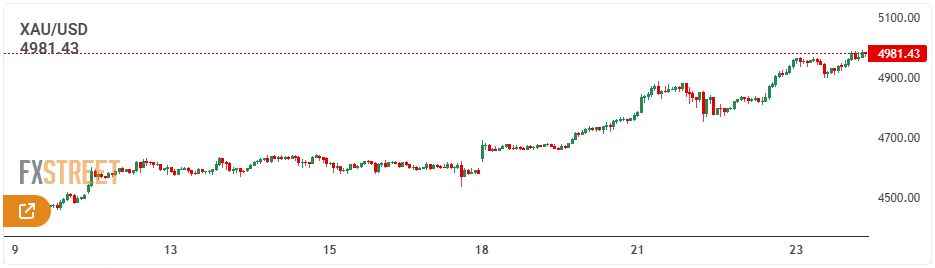

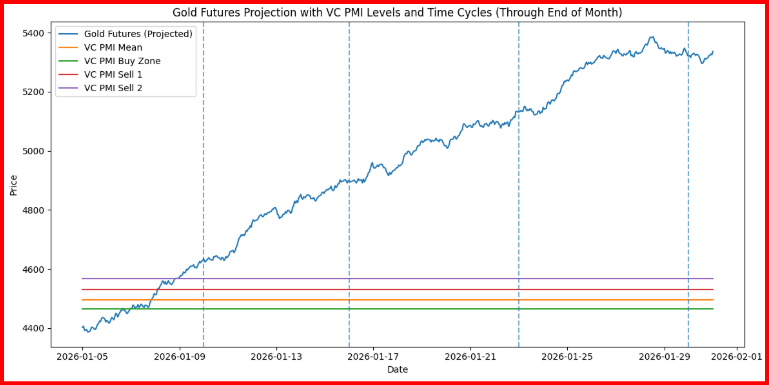

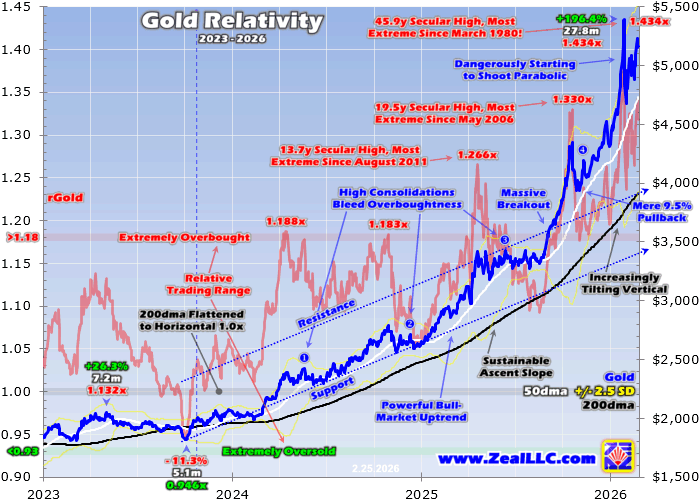

Yet the latest bull market has shattered prior benchmarks. From early October 2023 to late January 2026, gold surged an unprecedented 196.4% over 27.8 months — the largest cyclical bull on record. For comparison, the famed January 1980 surge gained 127.9% in just 2.6 months.

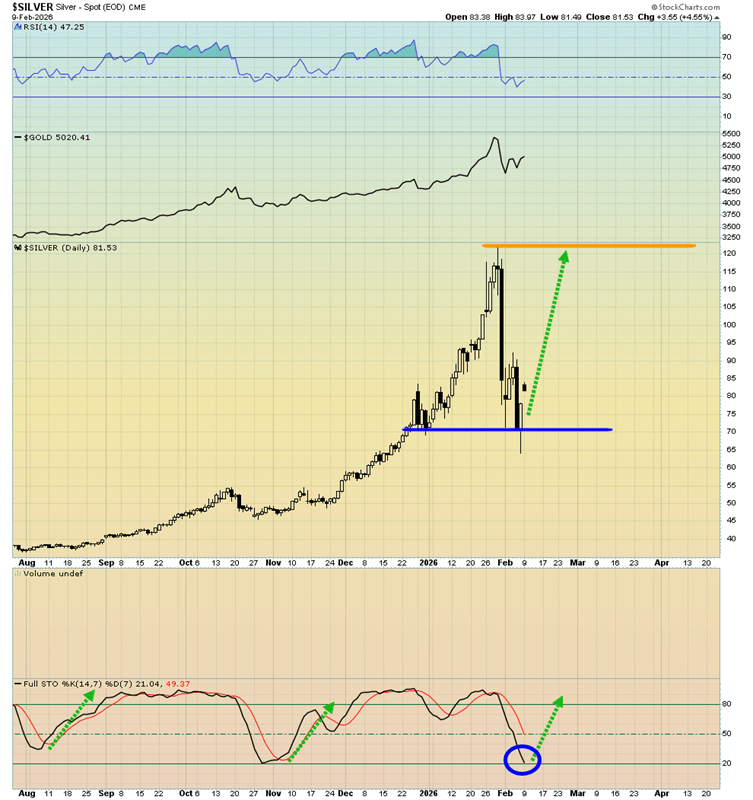

By late January 2026, gold reached one of its most overbought levels ever, trading 43.4% above its 200-day moving average — its most extreme reading since March 1980. Historically, such conditions have reliably preceded fast and deep corrections.

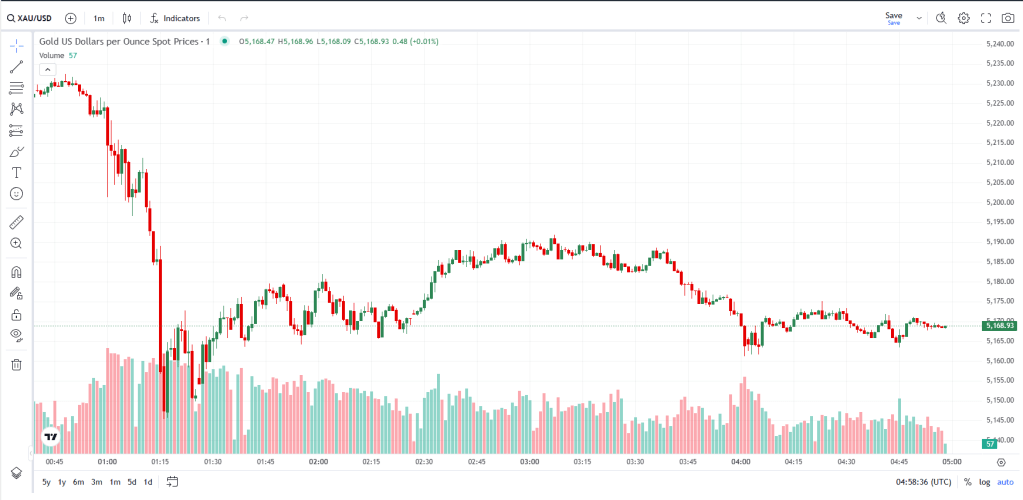

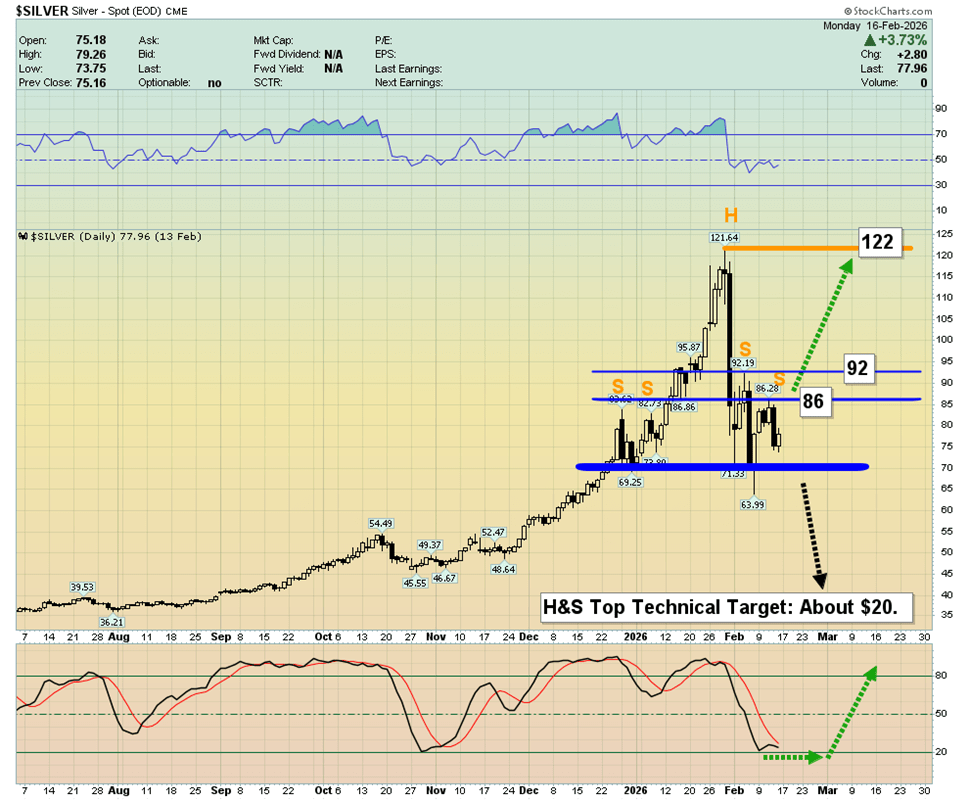

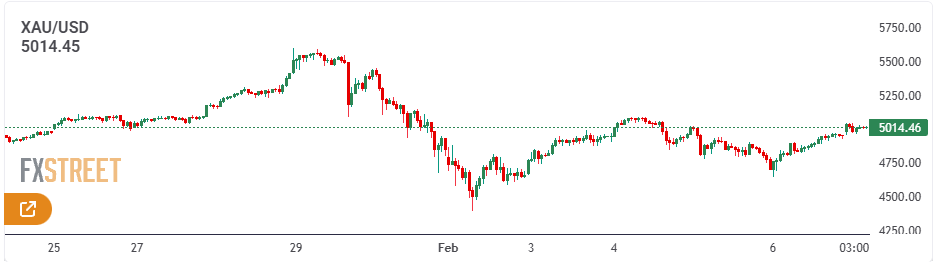

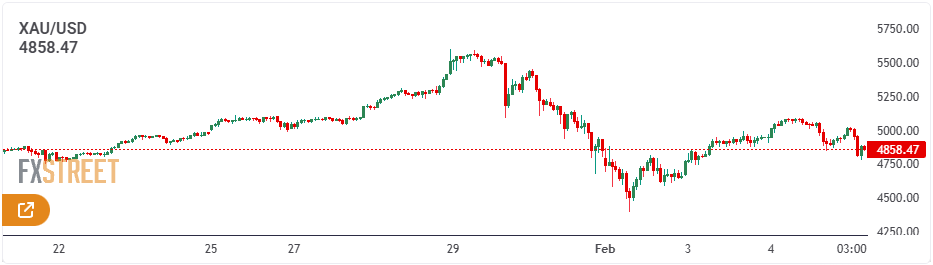

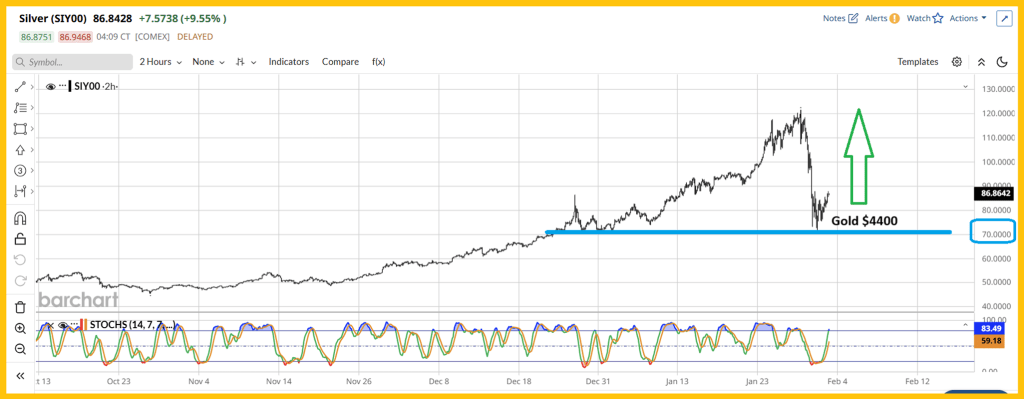

Indeed, gold briefly cracked — plunging 10.3% in a single session, its third-worst daily drop since 1971, followed by a 13.3% correction over two days. Based on historical patterns, such extremes have typically led to average declines of roughly 20% over the next two months.

But this time has been different.

A historically rare rebound

Instead of cascading lower, gold rebounded swiftly, recovering more than three-quarters of its two-day plunge and returning to within 3% of its record high. Rather than a full correction, the move increasingly resembles a high consolidation — a sideways digestion of gains rather than a deep retracement.

That possibility challenges over five decades of precedent.

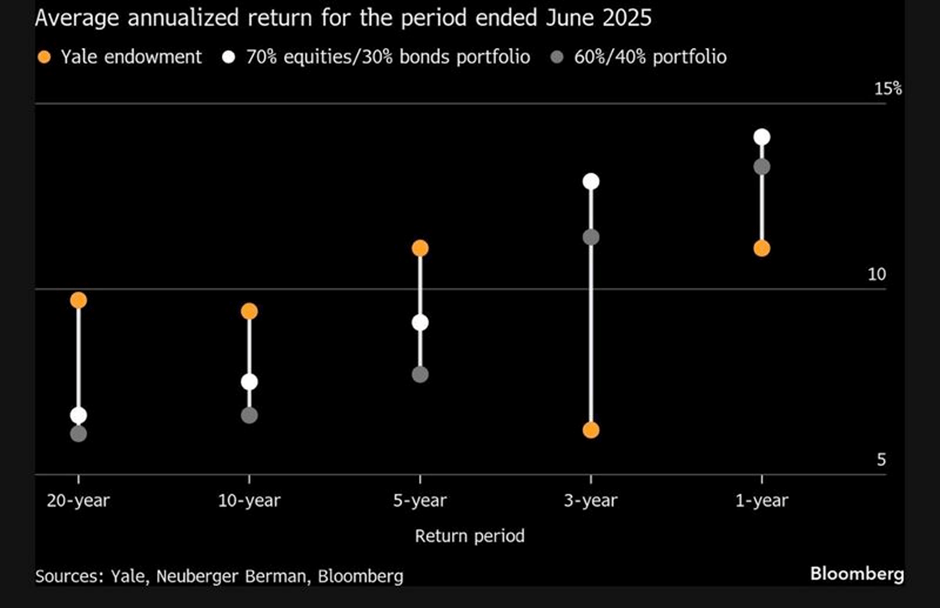

Market history teaches adaptability. As economist John Maynard Keynes famously observed, “When the facts change, I change my mind.” While history strongly argues for a larger correction, gold’s recent behavior suggests underlying structural demand may be altering the cycle’s dynamics.

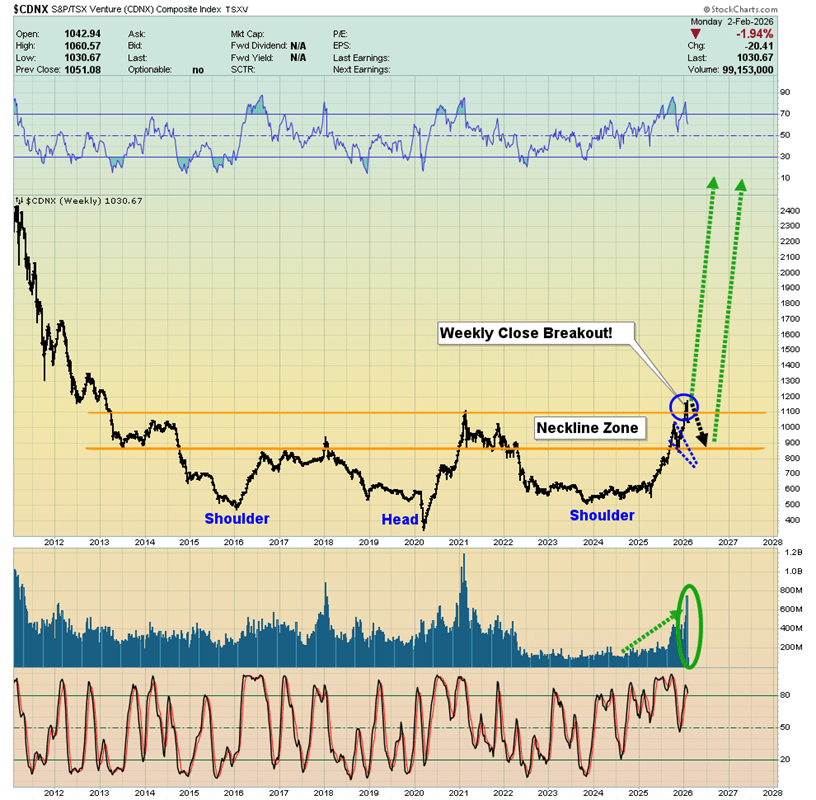

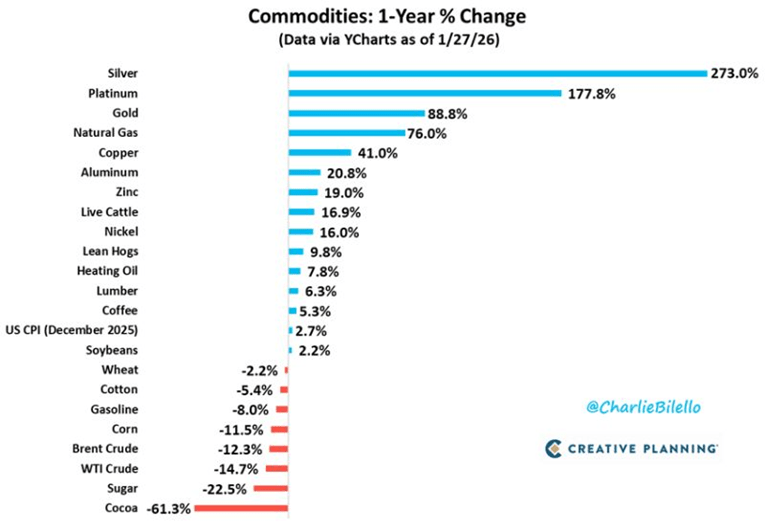

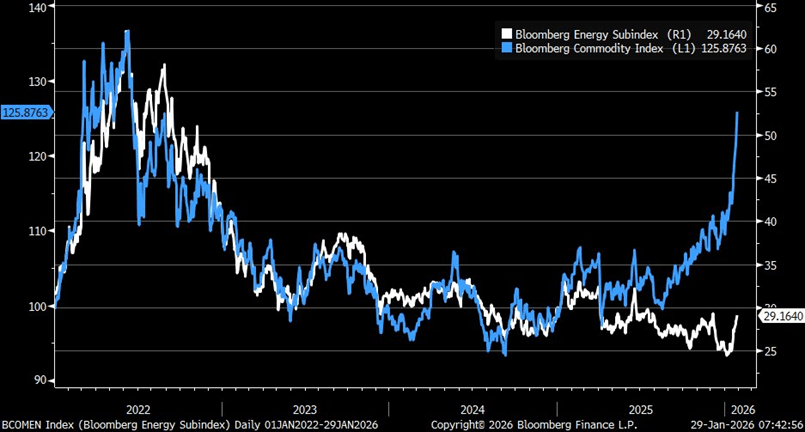

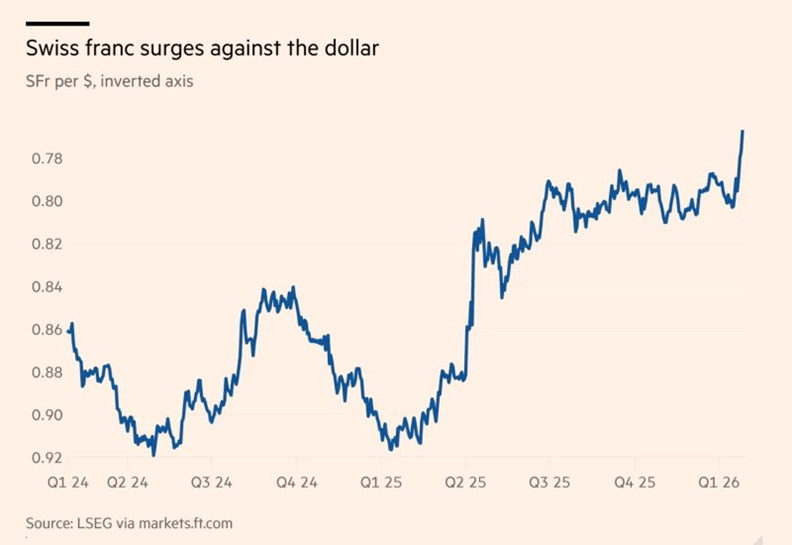

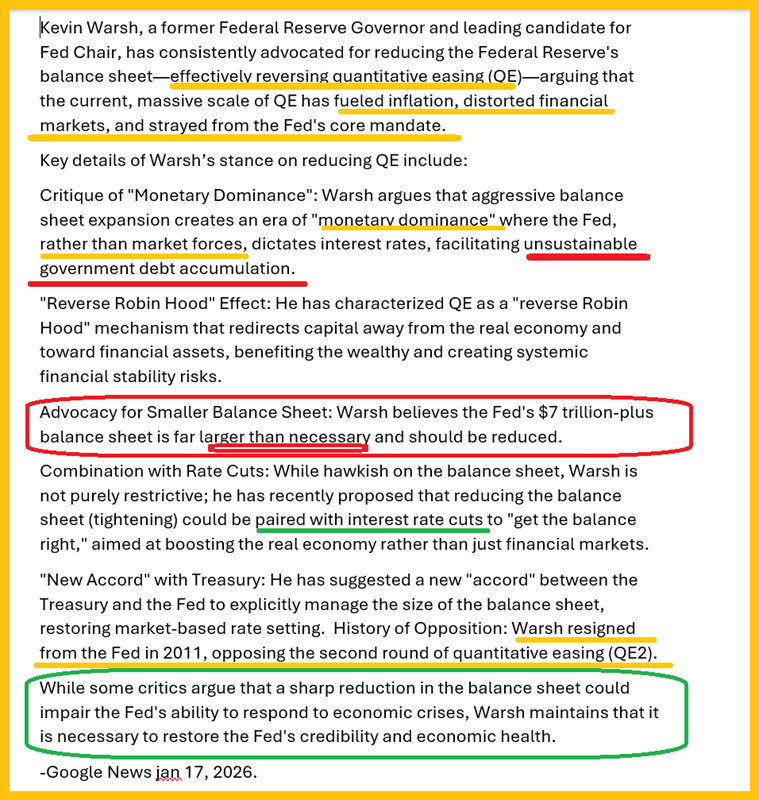

A structural shift in demand

Unlike earlier gold bull markets driven primarily by U.S. investors and futures speculation, this surge has been powered heavily by:

- Chinese and Indian investment and jewelry demand

- Strong central bank accumulation

- Reduced reliance on American speculative flows

That steady international buying appears to have smoothed volatility. Remarkably, from October 2023 to January 2026, gold did not experience a single correction exceeding 10% — an extraordinary deviation from historical norms.

During that stretch, gold reached extreme overbought conditions four separate times that typically would have required sharp pullbacks. Instead, it consolidated sideways, allowing technical excesses to normalize gradually rather than through panic selling.

Overbought — but not breaking

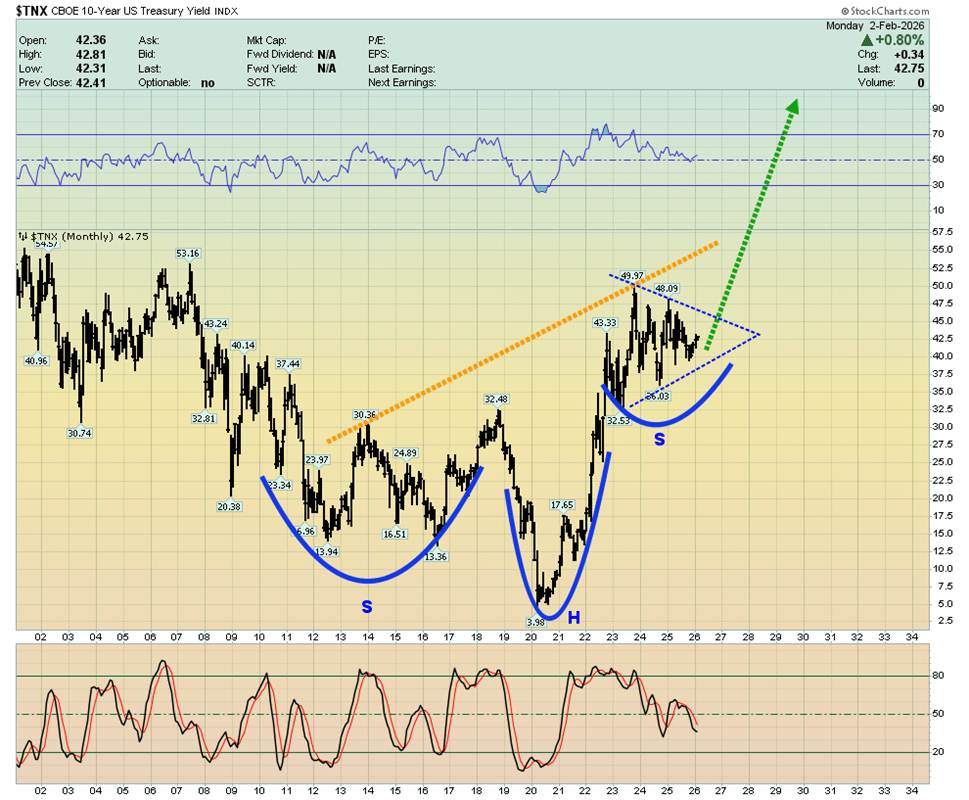

One widely used metric, “Relative Gold” (rGold), measures gold’s price relative to its 200-day moving average. Over the past five years, extreme overbought readings began near 1.18x that average. In January 2026, gold far exceeded that threshold — yet still refused to unravel.

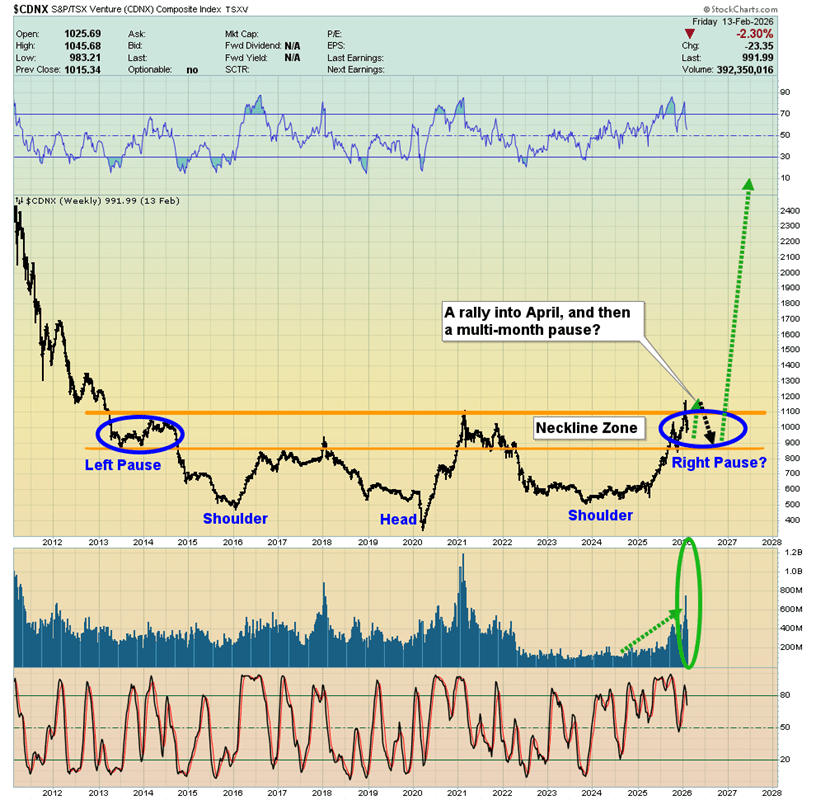

If gold successfully transitions from its most powerful cyclical bull ever into yet another high consolidation rather than a major bear phase, it would mark the fifth such episode in recent years — an extraordinary break from long-term statistical norms.

For traders expecting mean reversion, that presents real danger. Betting against momentum in a structurally supported market can be like stepping in front of a moving chariot.

Gold may still correct — history suggests it eventually will. But for now, extreme overbought conditions alone have proven insufficient to halt this advance.

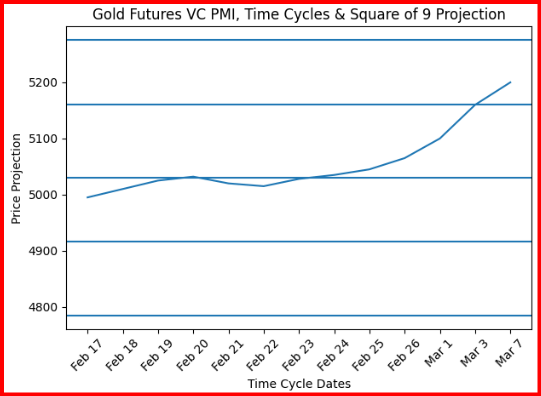

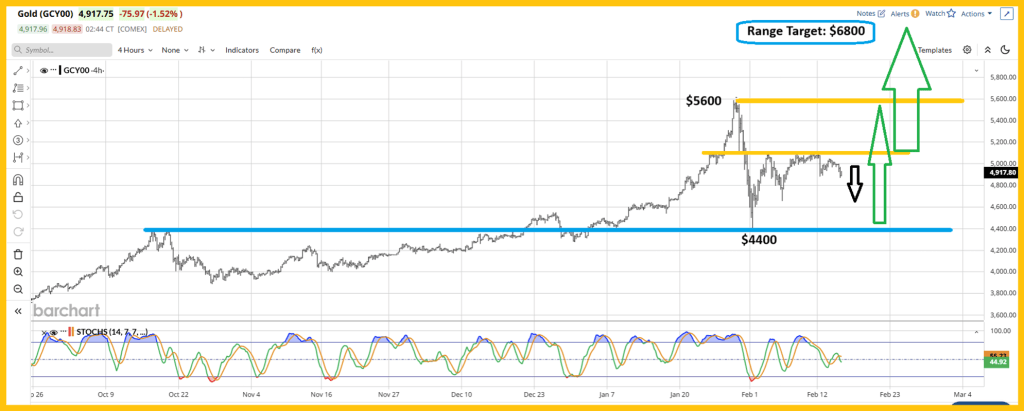

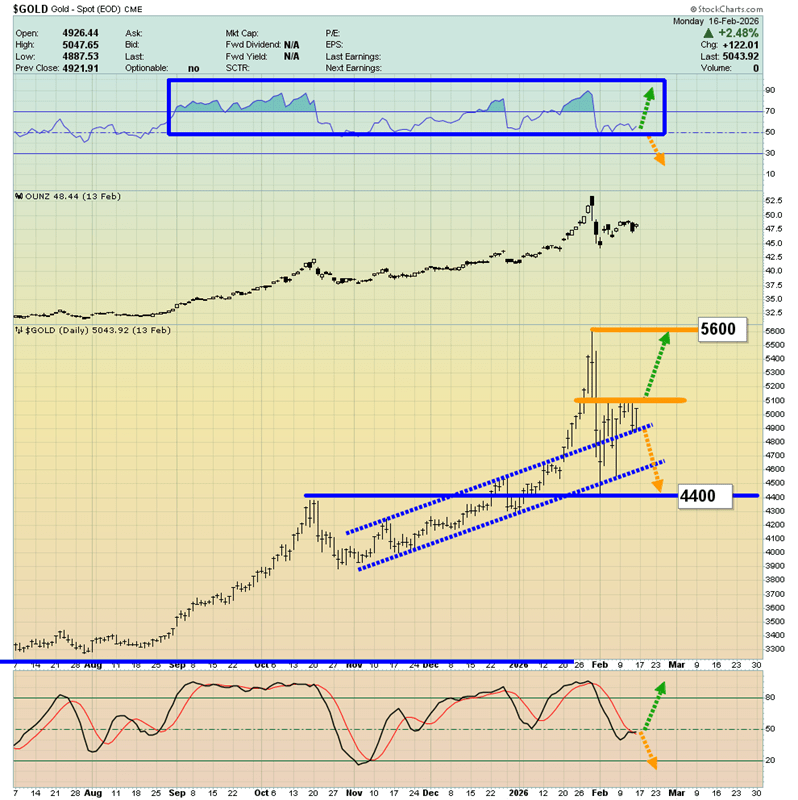

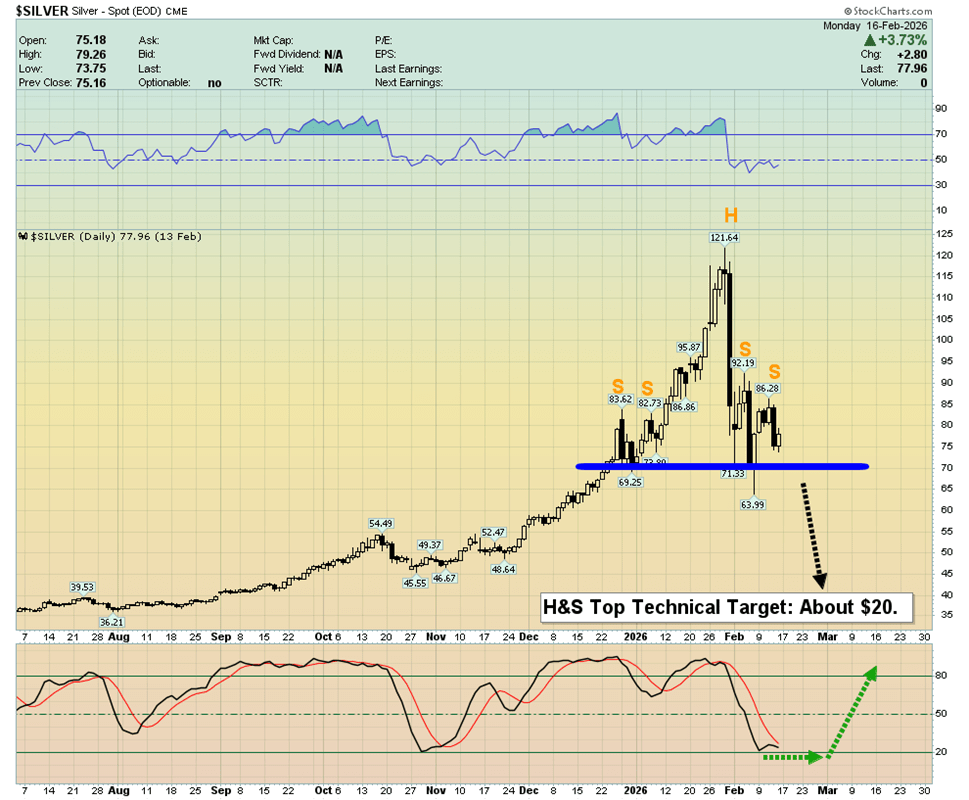

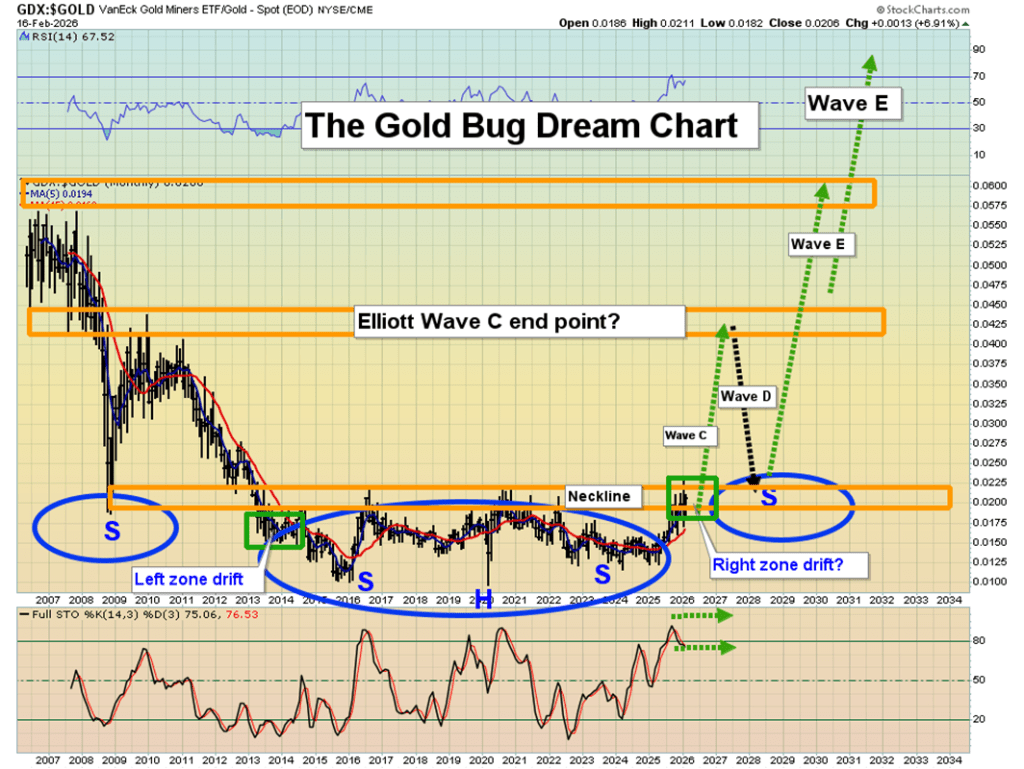

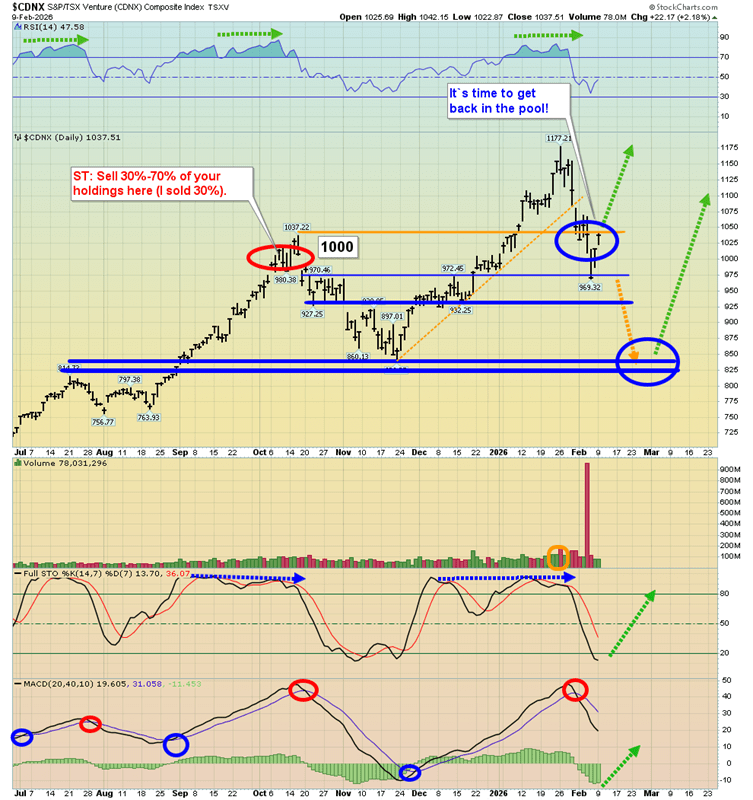

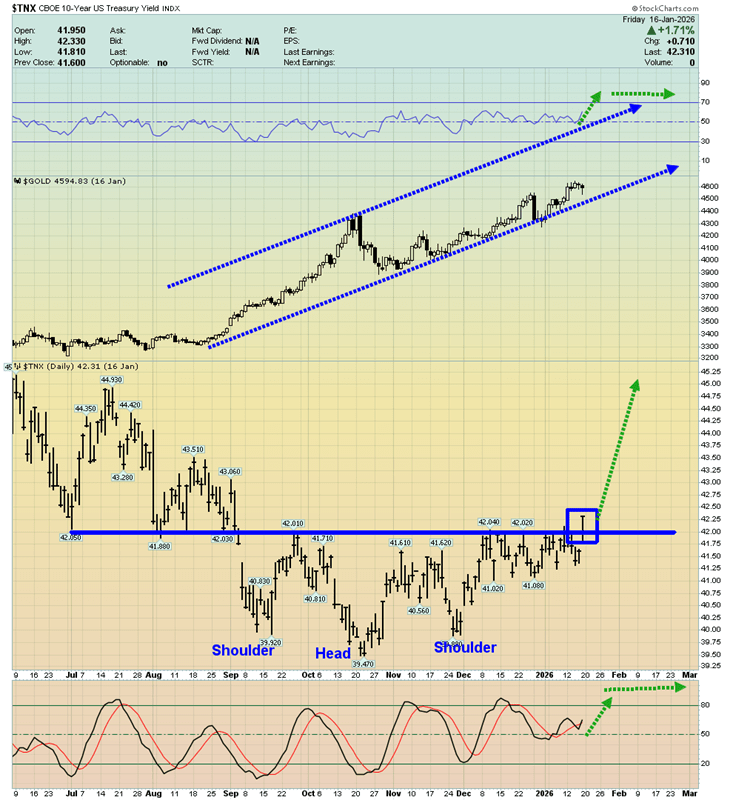

Gold’s refusal to break down from extreme overbought levels has now evolved into something historically extraordinary. What began as a powerful cyclical bull has repeatedly transitioned not into sharp corrections — as five decades of precedent would suggest — but into a series of high consolidations that preserved momentum and reset sentiment without deep damage.

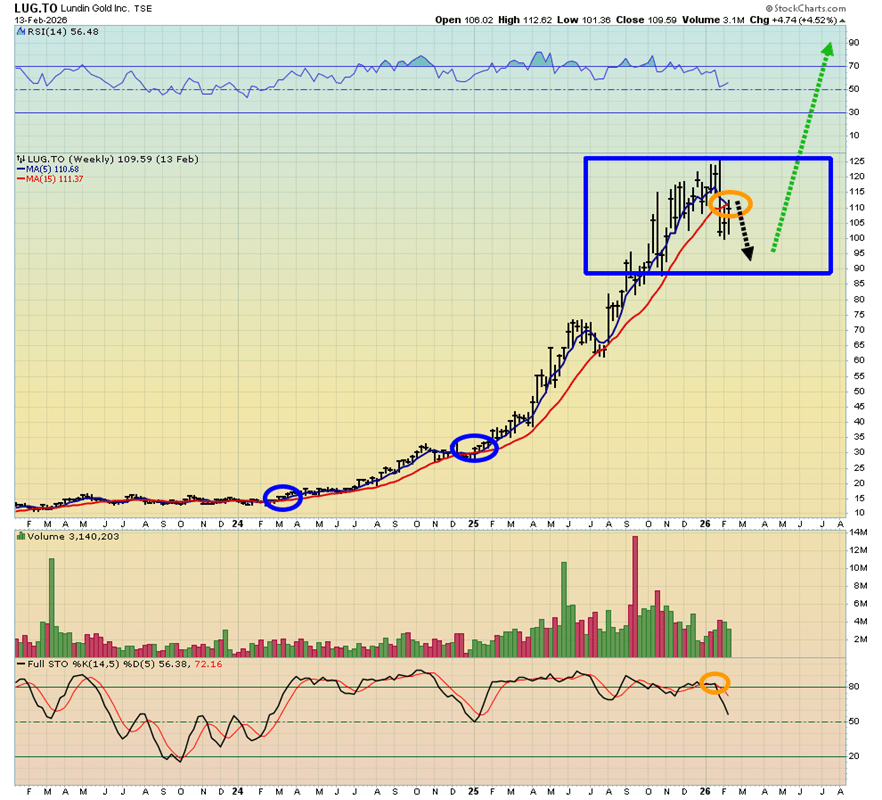

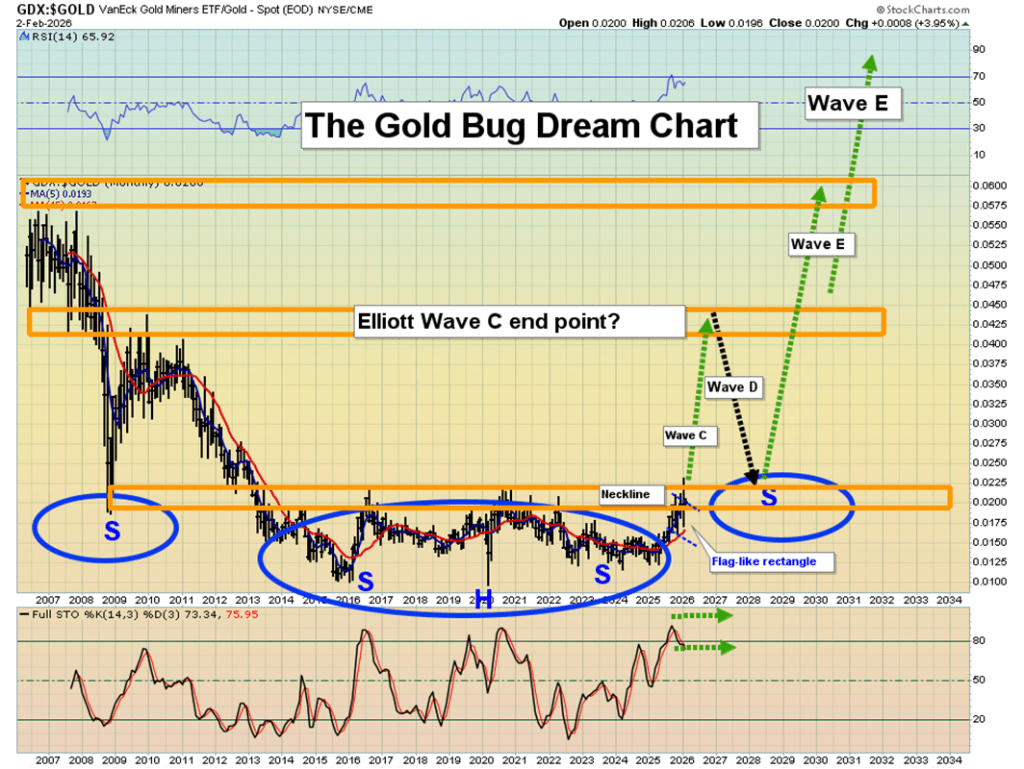

Four prior high consolidations — and counting?

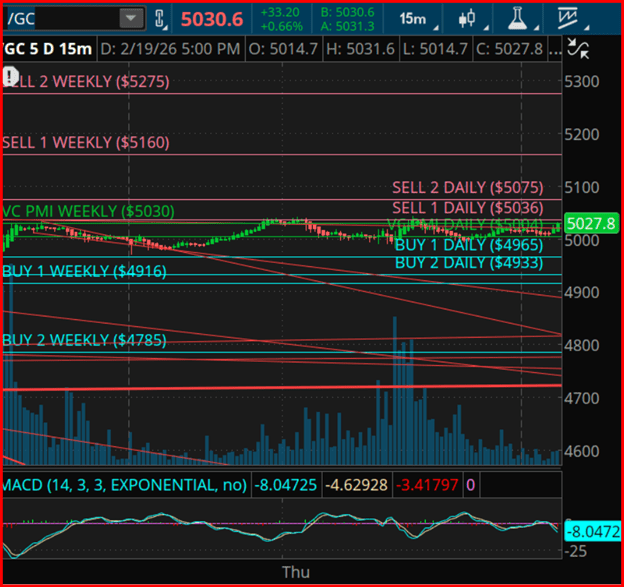

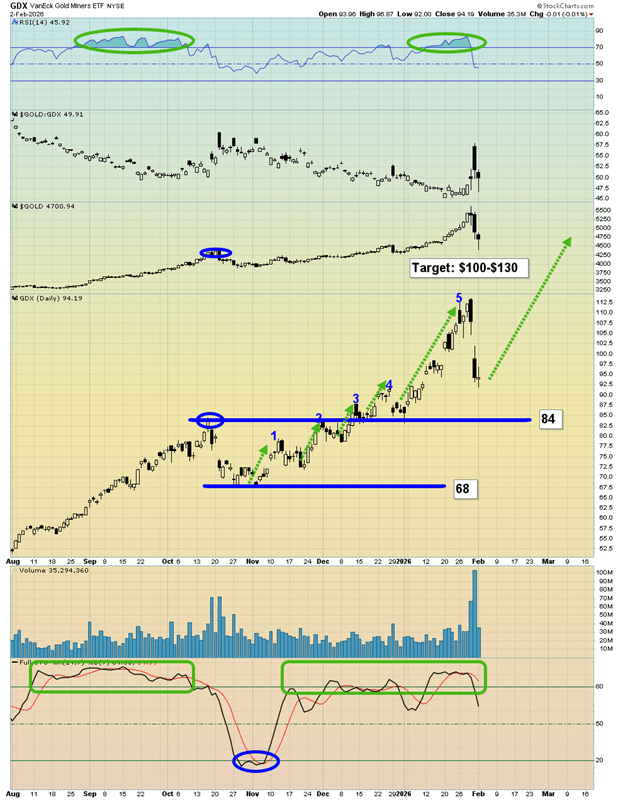

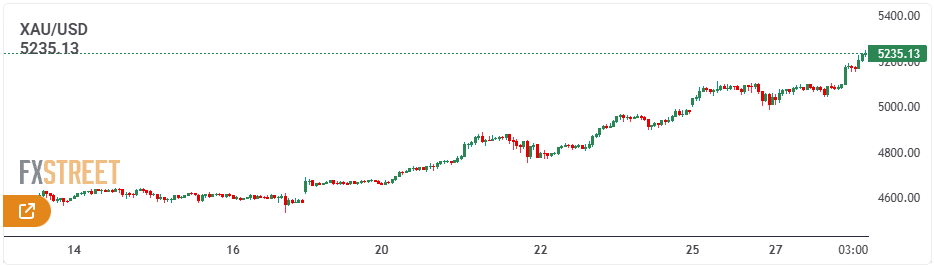

The first extreme-overbought episode of this monster bull emerged in mid-April 2024, when gold closed at 1.188x its 200-day moving average (200dma). That followed a 31.2% surge in just 6.4 months. Historically, that setup demanded a sharp correction. Instead, gold drifted sideways for 3.8 months, correcting only 5.7% at worst. During that span, rGold averaged 1.127x — elevated, but nowhere near oversold territory (which historically begins below 0.93x).

The second episode arrived in late October 2024, when gold again pierced extreme territory at 1.183x its 200dma, with gains reaching 53.1% over 12.9 months. Rather than collapse, gold entered another sideways drift lasting 3.0 months. The maximum pullback was 8.0%, and average rGold readings remained lofty at 1.090x.

By mid-April 2025, the bull extended to 88.0% gains, and gold reached 1.266x its 200dma — the most overbought level in 13.7 years. In prior cycles, similar extremes triggered double-digit selloffs. Instead, gold carved out a third high consolidation lasting 4.2 months. Even during that stretch, gold averaged 15.3% above its 200dma — remarkably elevated.

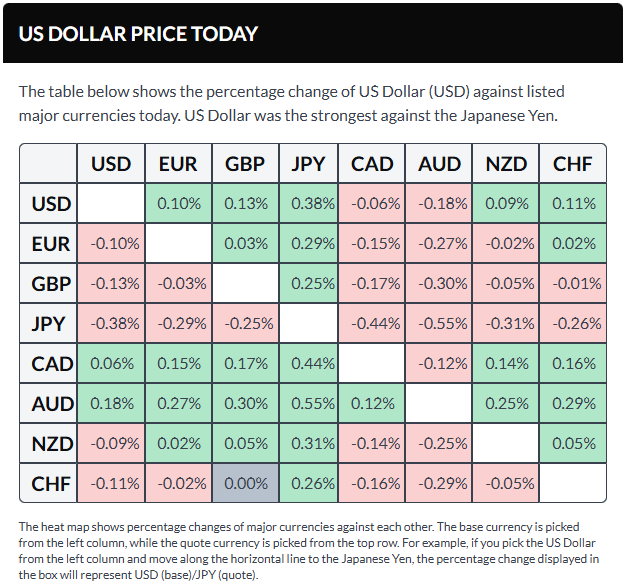

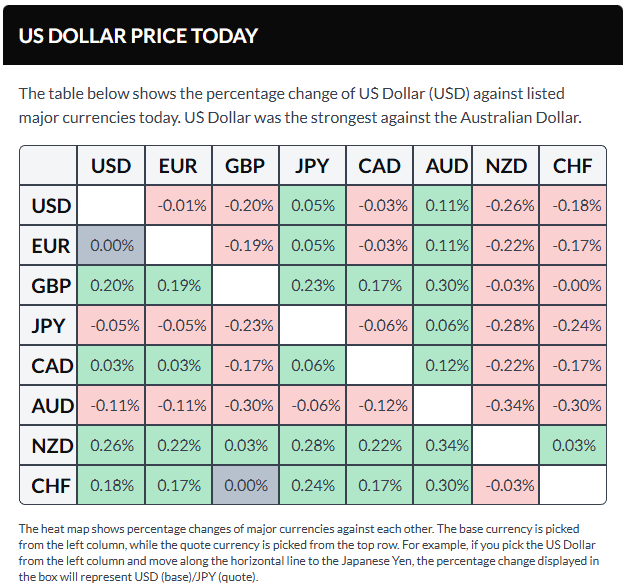

The fourth episode followed gold’s surge to 139.1% gains by mid-October 2025, when rGold hit 1.330x — the most extreme since 2006. An initial 9.5% drop threatened to spiral into a full correction, but aggressive Chinese buying — particularly into Mondays when Asian trading dominates price discovery — arrested the decline. That consolidation lasted just 2.0 months, the shortest yet, with rGold still averaging 1.211x.

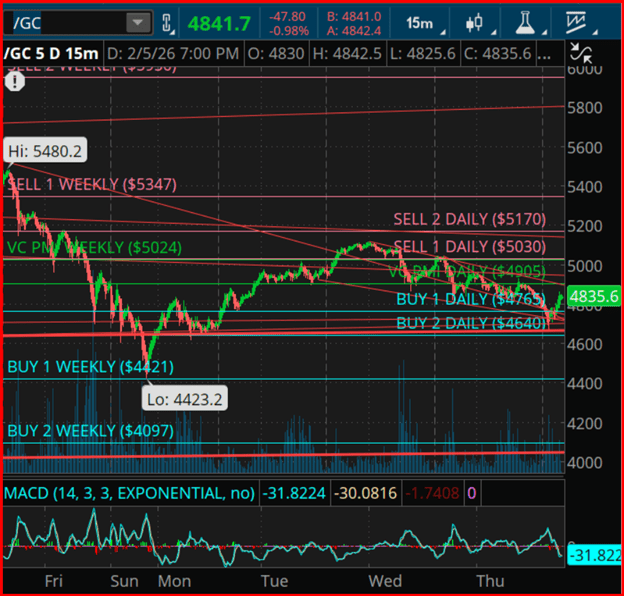

The January 2026 blowoff — and defiance

Then came the mania phase. In just five weeks into late January 2026, gold surged another 24.3%, extending total gains to 196.4% over 27.8 months — the largest cyclical bull in modern history. rGold spiked to an astonishing 1.434x, the most overbought reading in 45.9 years.

History strongly suggested a fast 20%+ cyclical bear was imminent.

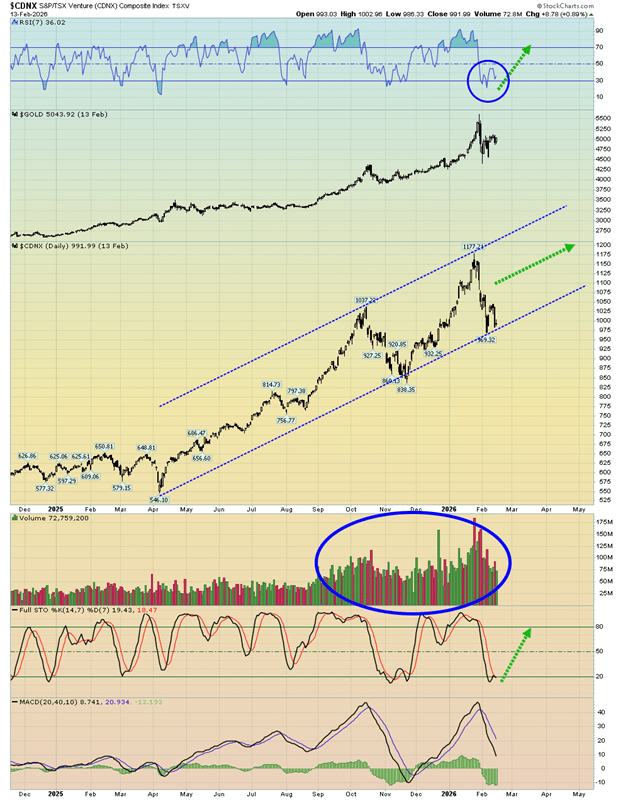

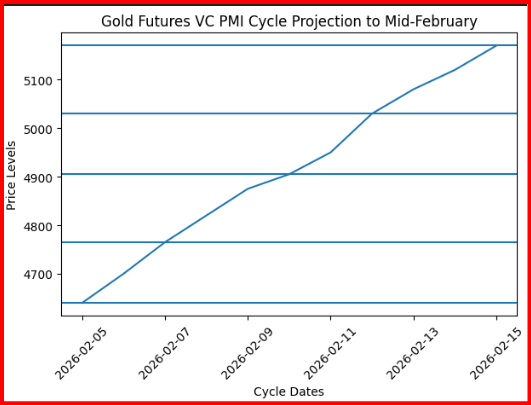

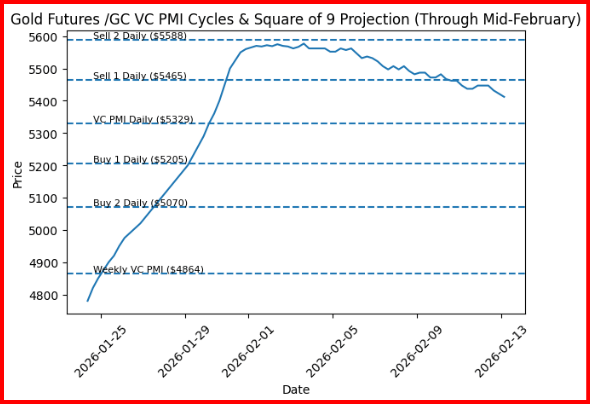

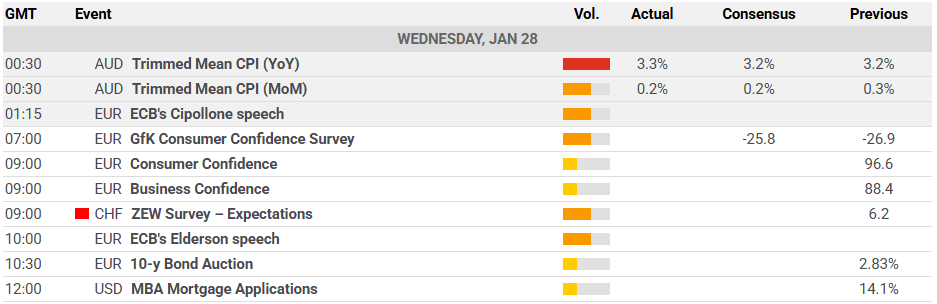

Gold did plunge 13.3% over two sessions, formally ending the bull. But once again, heavy Chinese demand — amplified by Lunar New Year buying — helped prices rebound rapidly. Rather than cascading lower, gold began what may be its fifth high consolidation from extreme levels.

As of midweek, that consolidation was just 0.9 months old, with average rGold near 1.298x — far above the 1.145x average of the prior four consolidations. By historical standards, that remains dangerously elevated and leaves meaningful downside risk intact.

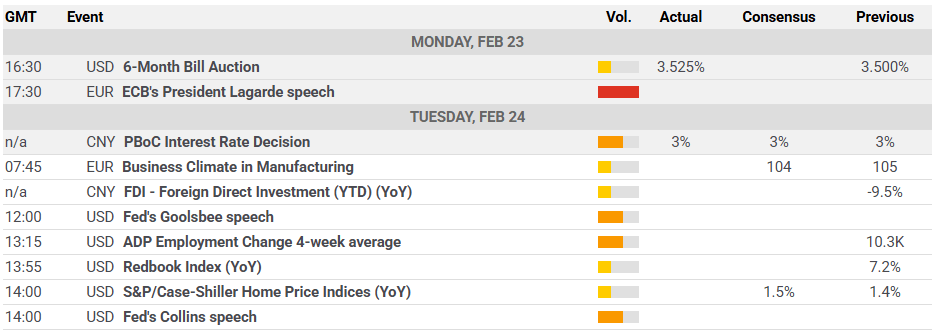

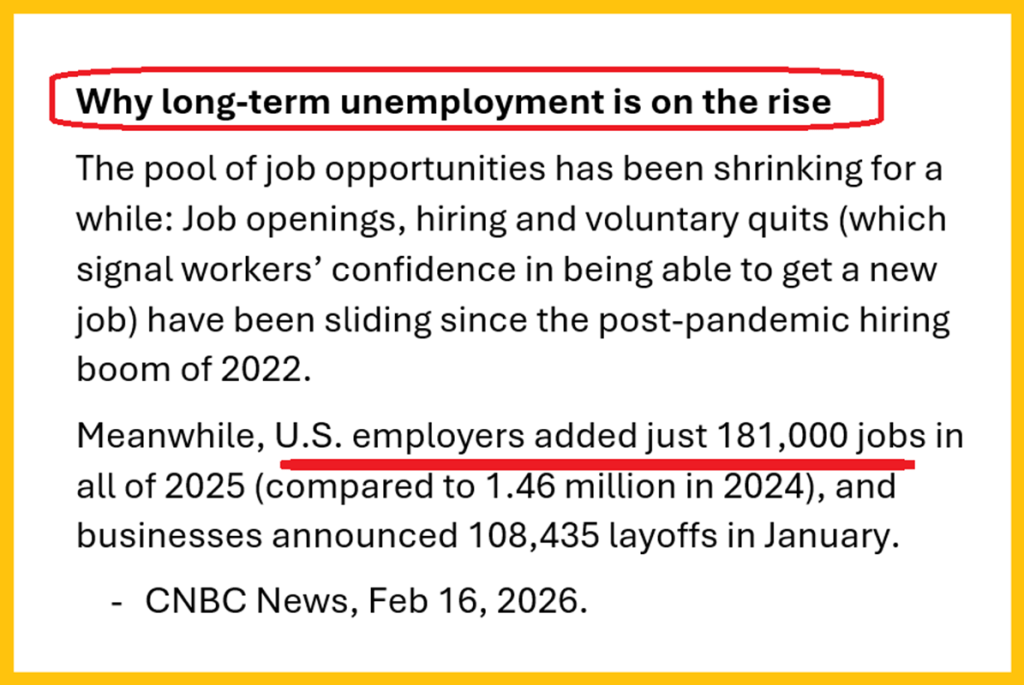

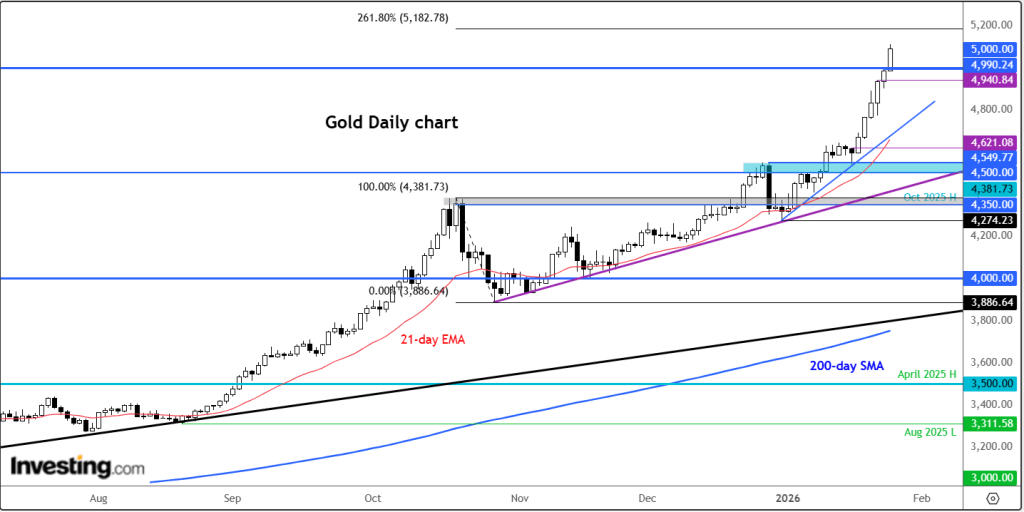

Seasonal and structural considerations

Chinese demand has been the defining structural shift of this cycle. Unlike earlier bulls driven primarily by U.S. futures traders and Western investors, recent gains have been heavily supported by Chinese investors, jewelry buyers, and central bank accumulation. That steady buying pressure has dampened volatility and truncated corrections.

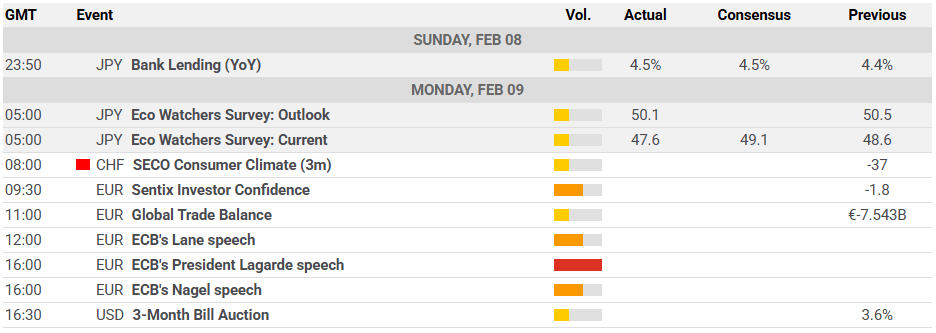

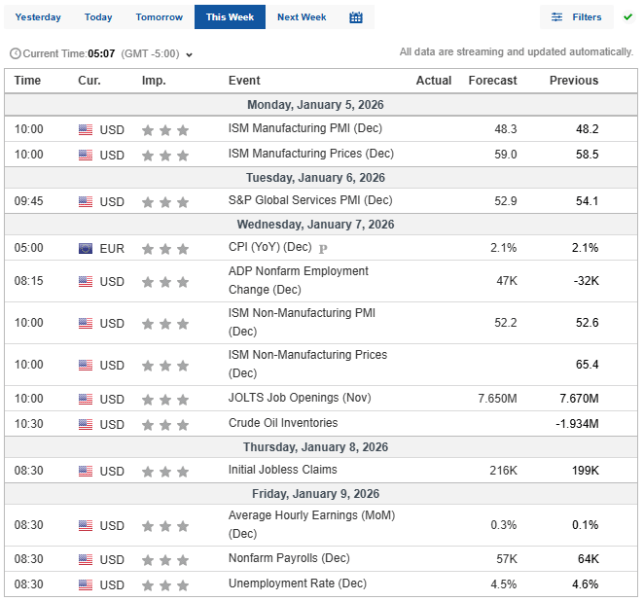

However, seasonality matters. Gold demand in China typically peaks into Lunar New Year and softens from late February into mid-March — historically one of gold’s weakest seasonal windows. A minimum six-week sideways period following a major peak is generally required to sufficiently reduce the odds of a serious correction. Gold is only about halfway through that threshold.

If prices can hold into mid-March, the typical spring rally — which has averaged about 4.3% gains during bull years over the past quarter century — could provide renewed upside momentum.

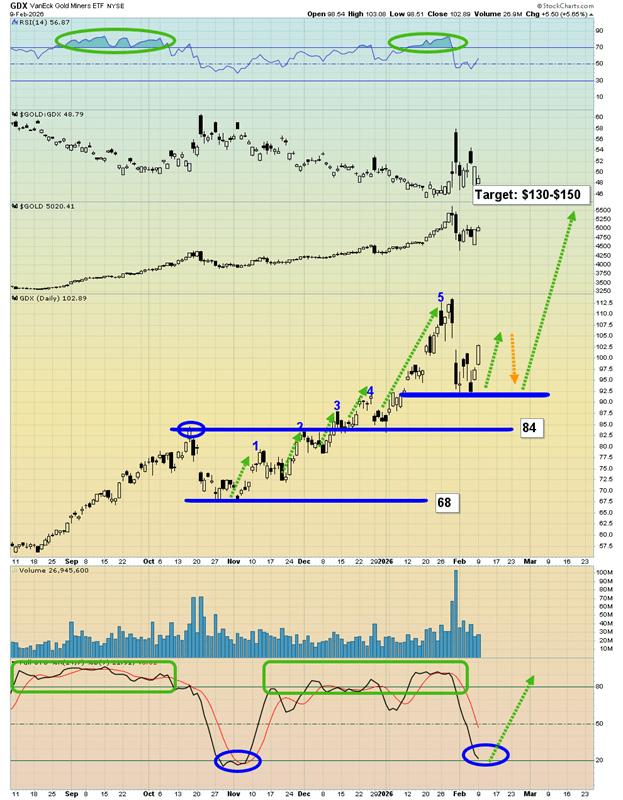

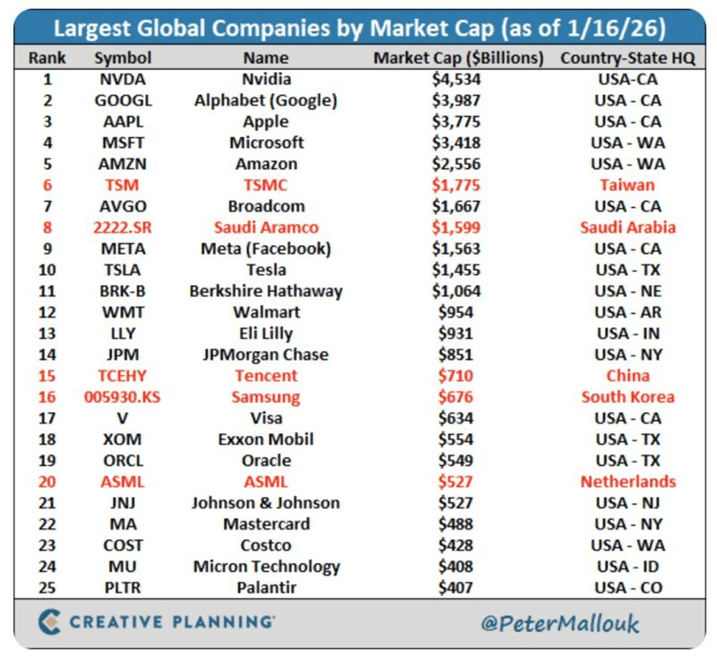

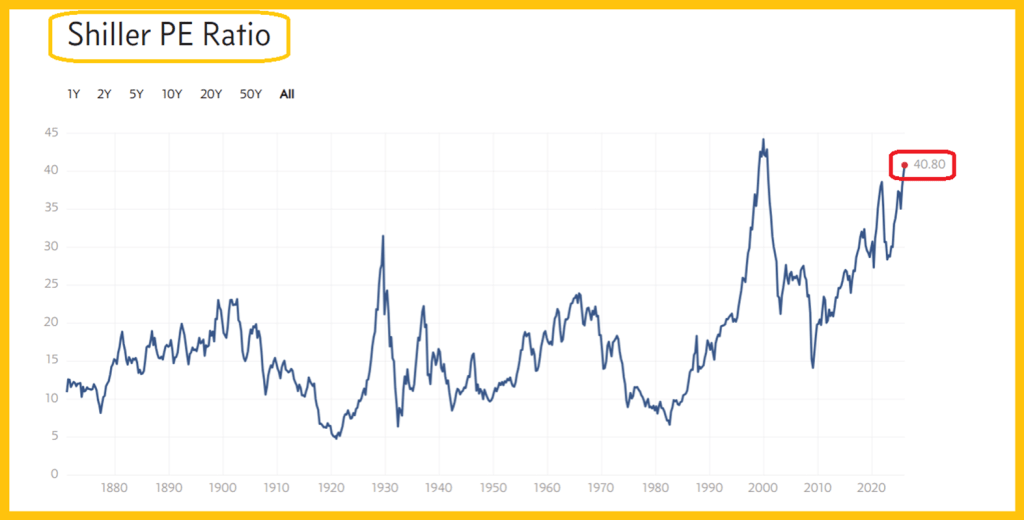

Risks remain asymmetric

Despite the juggernaut narrative, risks remain substantial. Gold has demonstrated it can drop 5%–10% in a single day when sentiment shifts. And gold miners amplify gold’s moves significantly: historically 2x to 3x. A 10% gold correction could translate into 20%–30% declines in miners; a 20% bear phase could mean 40%–60% drawdowns in gold equities.

Bottom line

Gold’s momentum continues to defy half a century of precedent. Extreme overbought conditions that once reliably triggered swift corrections have instead produced high consolidations — a structural shift likely driven by persistent Chinese demand and global diversification flows.

But while this fifth potential consolidation may ultimately prove successful, it remains young and statistically vulnerable. The juggernaut rolls on — yet markets can reverse suddenly.

Caution, patience, and adaptability remain essential.

Sources: Adam Hamilton