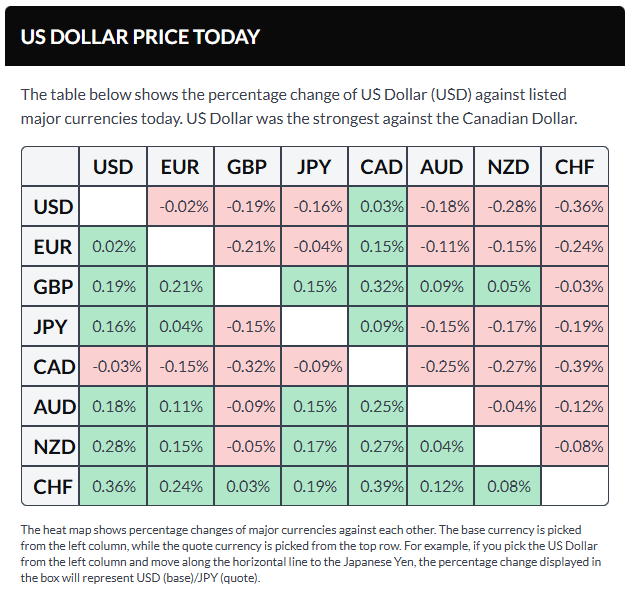

Financial markets extended the holiday-thinned mood on the first trading day of the new year, with investors largely staying on the sidelines. Markets remain in a wait-and-see mode ahead of a data-heavy week.

The US Dollar Index (DXY) traded near the 98.40 area on Friday, paring a significant portion of its New Year losses.

Gold (XAU/USD) traded around the $4,320 level, surrendering all intraday gains following the New Year’s break. Expectations of lower US interest rates and elevated geopolitical tensions have continued to support precious metals in recent sessions.

EUR/USD hovered near 1.1740 after edging lower earlier in the week, remaining under pressure as investors await upcoming economic data.

GBP/USD traded close to the 1.3480 area, little changed during the first US session of the year.

USD/JPY hovered around the 156.50 region, trading slightly lower on the day with limited intraday movement.

AUD/USD traded near the 0.6690 area on Friday, posting modest gains after paring nearly half of its intraday advance.

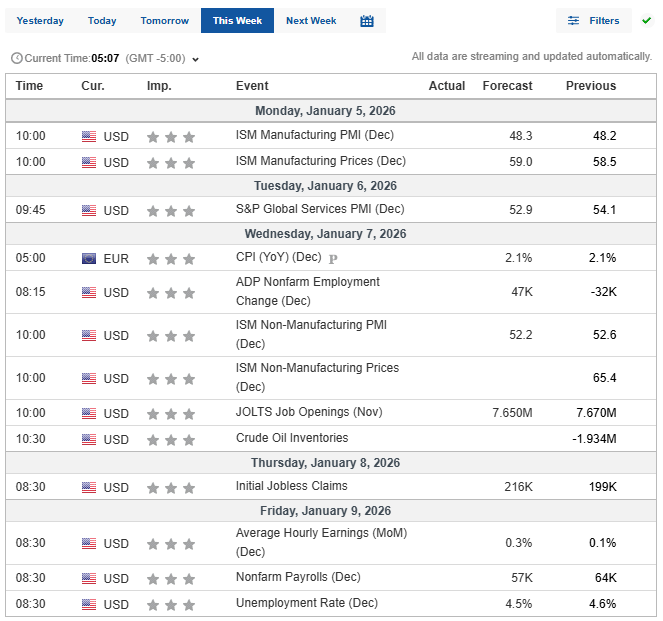

Key Economic Data Ahead: Upcoming Releases Set to Shape Market Sentiment

Over the coming days, investors will closely watch US employment figures and global inflation data, which are expected to influence central bank policies.

- Monday: The US Institute for Supply Management (ISM) releases the Manufacturing Purchasing Managers’ Index (PMI) for December.

- Tuesday: Germany’s Harmonized Index of Consumer Prices (HICP) and Australia’s Consumer Price Index (CPI) are scheduled for publication.

- Wednesday: The US ADP Employment Change report (December), ISM Services PMI (December), and the preliminary Eurozone HICP (December) will be released.

- Thursday: The US Trade Balance for October and Consumer Credit data for November are due.

- January 9: The highly anticipated US Nonfarm Payrolls (NFP) report for December and the preliminary January Michigan Consumer Sentiment Index will be published.

These releases are expected to set the tone for market direction and provide clues on the pace of monetary tightening by major central banks.

Sources: Fxstreet