Key Highlights

- Stock futures remained mostly flat after Trump’s meeting with Ukraine’s President Zelensky to discuss a peace plan.

- Silver surged past $80 an ounce, hitting a record high fueled by strong speculative flows and persistent supply-demand imbalances.

- Asian mining stocks rallied Monday following the record spike in silver prices.

- Bitcoin climbed above $90,000 in Asian trading, signaling a potential breakout after missing the recent Santa rally in stocks.

- Last week, the Dow Jones rose 1.2%, the S&P 500 gained 1.4%, and the Nasdaq added 1.2%.

- The U.S. dollar closed out its worst week since June as investors shifted focus to upcoming economic data releases.

- Markets are awaiting the Federal Reserve’s December meeting minutes and November pending home sales, with particular attention on clues regarding interest rate policy.

- The S&P 500 is on track for its eighth consecutive monthly gain, supported by rotation into non-tech sectors.

Stock futures were flat to slightly higher Sunday evening during a New Year’s holiday-shortened week, following “productive” talks between Trump and Zelensky on a Russia-Ukraine peace plan.

Last week, U.S. stocks hovered near record highs amid thin holiday trading. The S&P 500 ended little changed, while the Nasdaq 100 slipped 0.1%, driven by strength in materials and tech sectors, contrasting with weaker performance in consumer discretionary and energy. Nvidia (NASDAQ: NVDA) gained on a new AI licensing deal, while precious metals surged to fresh record highs, with gold, silver, and platinum all reaching new peaks.

Market optimism remains linked to seasonal trends, as bulls anticipate a potential Santa Claus Rally—the final trading sessions of the year and the first two of January—to fuel further gains, even as enthusiasm around AI and the Federal Reserve’s rate outlook faces growing scrutiny.

Fed Minutes Arrive as Investors Monitor Jobless Claims and Home Sales Data

No major corporate earnings are scheduled for release this week, but investors will focus on key economic reports.

Monday’s pending home sales report for November will provide insight into housing market activity, which remains challenged by affordability concerns. On Tuesday, the S&P Case-Shiller home price index is expected to reveal a cooling trend in home price growth, reflecting buyers’ increasing constraints.

Also on Tuesday, the Federal Reserve’s December FOMC minutes will offer fresh perspectives on policymakers’ economic outlook ahead of their late-January meeting. Wednesday’s weekly jobless claims report will shed light on the labor market—a critical factor influencing the Fed’s interest rate decisions. From April to September, the U.S. economy likely lost an average of 20,000 jobs per month.

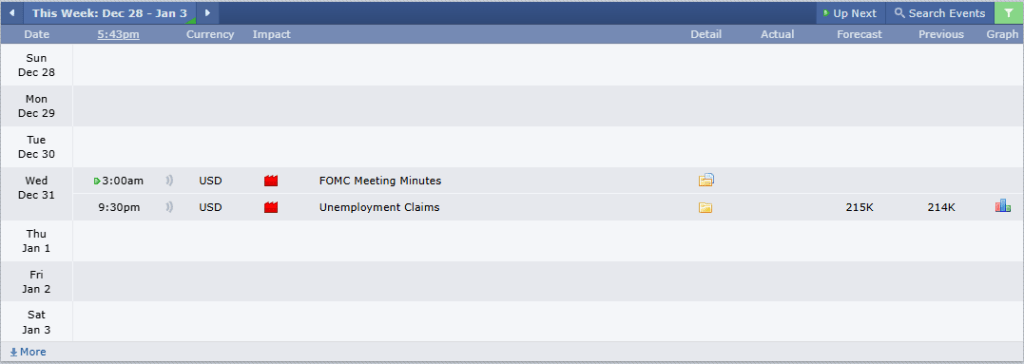

Economic Calendar

As the new year begins, investors are focused on the timing of further Fed rate cuts. The central bank has reduced its benchmark rate by 75 basis points over the last three meetings of 2025, bringing it to 3.50%–3.75%. However, the most recent quarter-point cut at the December 9–10 meeting was a split decision, with policymakers presenting sharply divergent rate forecasts for the year ahead.

S&P 500: Earnings Momentum Set to Outweigh Policy Risks in 2026

Wall Street strategists generally expect the rally to continue, with Bloomberg’s average year-end 2026 S&P 500 target at 7,555 (range: 7,000–8,100), about 9% above the current close. Our own target of 7,700 implies an 11% gain. However, a notable rise in bond yields could spark a market correction in the first half of 2026 amid concerns that monetary and fiscal policies remain overly stimulative.

With just a few trading days left in 2025, the S&P 500 has gained nearly 18% for the year, while the tech-heavy Nasdaq Composite is up 22%.

Next week’s market activity could determine the fate of the emerging Santa Claus Rally, which runs from December 24 to January 5.

That said, the tech sector—the key driver of the more than three-year bull run—has weakened in recent weeks despite gains in other sectors. Although tech rebounded this week, the S&P 500 tech subindex remains down over 3% since early November, while financials, transportation, healthcare, and small-cap stocks have posted solid gains over the same period.

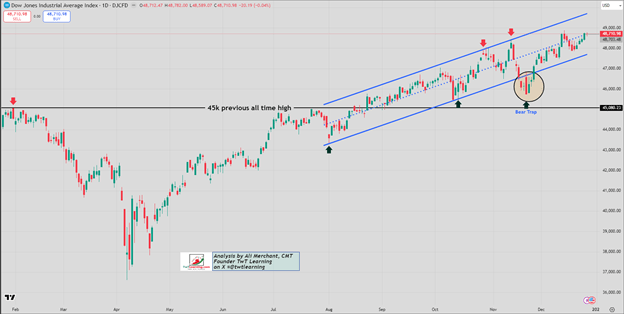

Technical Analysis: DJIA Index

- The DJIA remains within an upward channel that started at the August 2025 lows. Following a bear-trap move in mid to late November, the index has returned inside this channel.

- In the near term, the DJIA is expected to trade between 47,530 and 48,600. A decisive breakout above or below this range will likely determine the short-term trend.

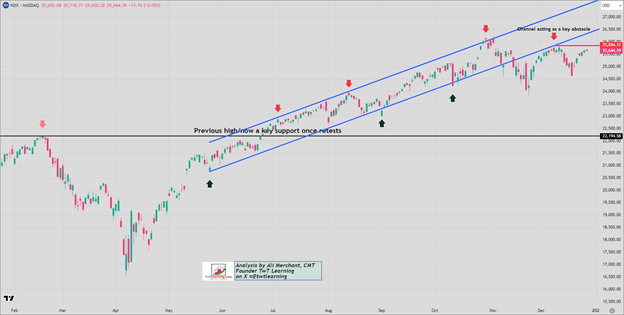

Nasdaq 100 Index

- The NDX has broken below its ascending channel, which now serves as strong resistance between 25,850 and 25,950.

If rallies fail to surpass this zone, a pullback toward 24,650, and possibly 24,200, remains likely. - However, a sustained break above 25,810–25,850 would invalidate the bearish outlook.

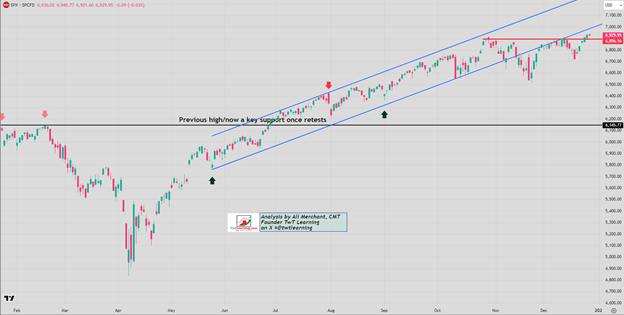

SPX Index

- The SPX rejected the lower boundary of the rising channel it broke below in mid-November. The index reached a new all-time high on Friday at 6,947.77 before retreating.

- It may extend further toward 6,980–6,990, although this advance could be short-lived ahead of the key psychological level at 7,000.

- This bullish scenario remains valid as long as support between 6,890 and 6,900 holds.

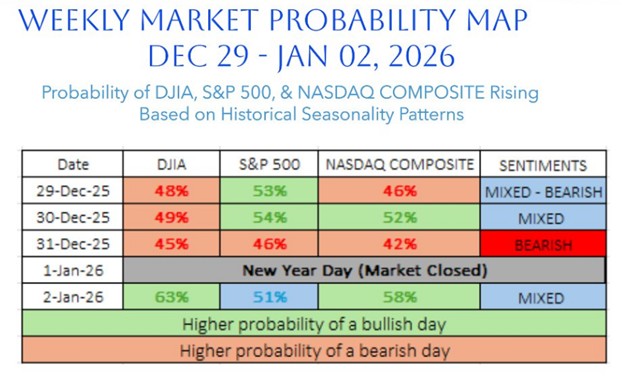

Weekly US Indices Probability Map

- The probability map for the week signals a mixed to bearish outlook, reflecting typical selling pressure associated with month-end, quarter-end, and year-end factors.

- These maps are based on historical seasonality patterns, with sentiment readings generated by a seasonality-driven scoring system.

Sources: Investing