A trend line is a straight line drawn on a chart that connects two or more significant price points (swing highs or swing lows) to show the overall market trend.

It helps traders:

- See the trend direction

- Identify entry and exit points

- Spot trend continuation or reversal

In greater detail

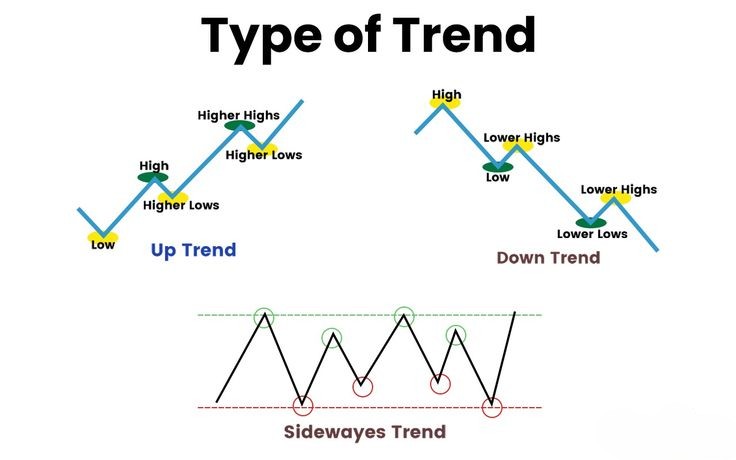

- Uptrend Line (Bullish Trend)

- Price tends to bounce upward from the line

- Drawn by connecting higher lows

- Acts as support

- Market is making higher highs & higher lows

- Downtrend Line (Bearish Trend)

- Drawn by connecting lower highs

- Acts as resistance

- Price tends to move downward from the line

- Market is making lower highs & lower lows

- Horizontal Trend Line (Sideways Market)

- Drawn across equal highs or equal lows

- Represents support or resistance

- Indicates range-bound (consolidation) market

- No clear trend

Why Trend Lines Matter

- Simple and visual

- Works in stocks, forex, crypto, commodities

- Combines well with:

- Support & resistance

- Candlestick patterns

- Indicators (RSI, MA, Volume)

Key Tip ⚠️

A trend line is a guide, not a guarantee. Always wait for confirmation before trading.