- This week’s highlights include the U.S. jobs report, ISM PMI surveys, and the CES Conference.

- AMD is a recommended buy, driven by expected AI innovations presented in CEO Lisa Su’s CES keynote.

- Cal-Maine Foods is a sell candidate ahead of a potentially disappointing earnings report and a weak outlook.

Wall Street’s major indexes closed mostly higher on Friday, the first trading day of 2026, boosted by gains in semiconductor and AI-related stocks. However, all three indexes still recorded slight declines for the week.

The Dow Jones Industrial Average slipped 0.7%, the S&P 500 dropped 1%, the tech-focused Nasdaq Composite fell 1.5%, and the small-cap Russell 2000 declined 1%.

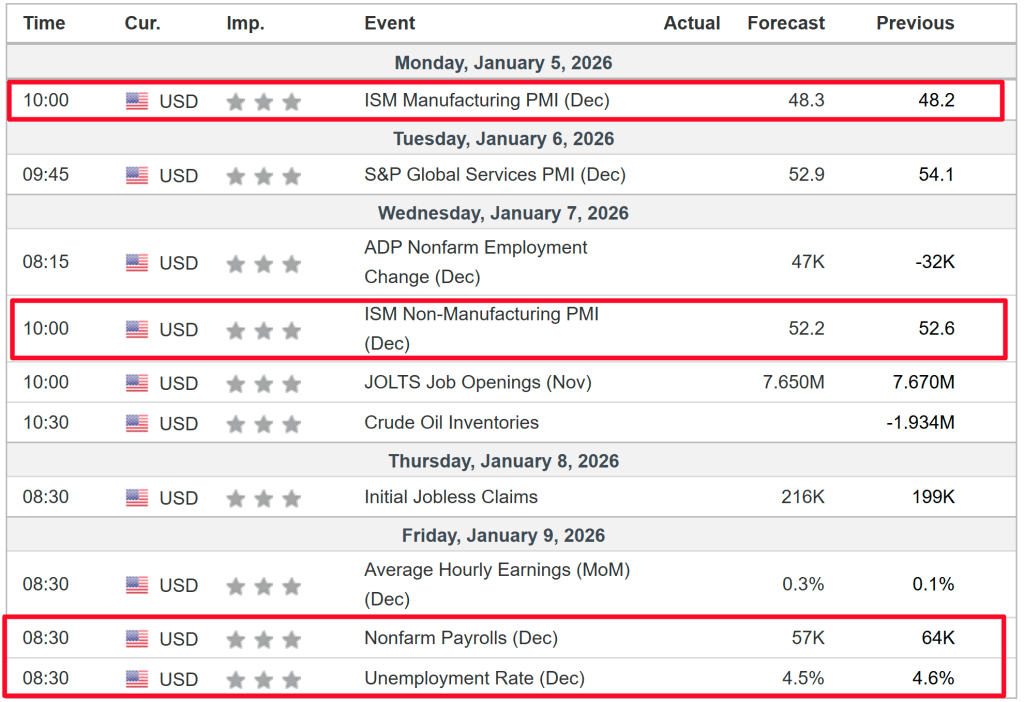

The first full trading week of 2026 promises to be busy, with monthly jobs data taking center stage. Economists forecast nonfarm job growth of 54,000 for January, down from 67,000 in December, while the unemployment rate is expected to decrease to 4.5% from 4.6%. Additionally, the ISM manufacturing and services PMIs will be closely monitored by investors.

On the earnings front, only a few companies are scheduled to report this week, including Constellation Brands, Cal-Maine Foods, Jefferies Financial Group, Albertsons, and Applied Digital.

Meanwhile, investors in the tech and consumer sectors will be closely watching the CES conference in Las Vegas. Key companies to watch for product launches, strategic updates, and AI developments include Nvidia, AMD, Intel, Qualcomm, Meta Platforms, Samsung, LG, Sony, and Motorola.

No matter how the market moves, below I highlight one stock expected to gain interest and another that may face further declines. Keep in mind, my outlook is limited to the upcoming week, Monday, January 5 through Friday, January 9.

Stock to Buy: Advanced Micro Devices

AMD stands out as a strong buy this week, with the 2026 Consumer Electronics Show (CES) acting as a key catalyst. The highlight will be CEO Dr. Lisa Su’s opening keynote on Monday at 6:30 PM PT (9:30 PM ET).

Su is expected to present AMD’s vision for AI solutions across cloud, enterprise, edge, and devices, potentially unveiling new advancements in AI chips and related technologies. Historically, AMD shares tend to rally during the week of its major product announcements, often followed by multiple analyst upgrades.

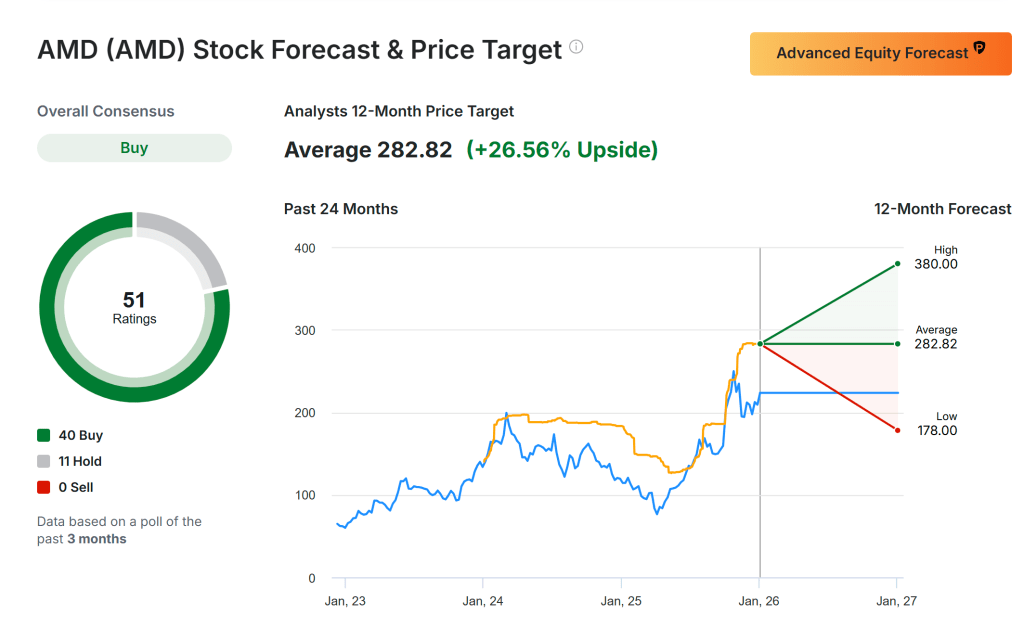

Analysts remain optimistic, with a consensus Strong Buy rating supported by 40 Buy and 11 Hold recommendations, suggesting a 26.5% upside potential for 2026. TD Cowen recently named AMD among its top AI picks, setting a price target of $290.

Fundamentally, AMD’s growth is driven by its AI product portfolio, including the MI300 series accelerators, which are gaining ground against rivals like Nvidia.

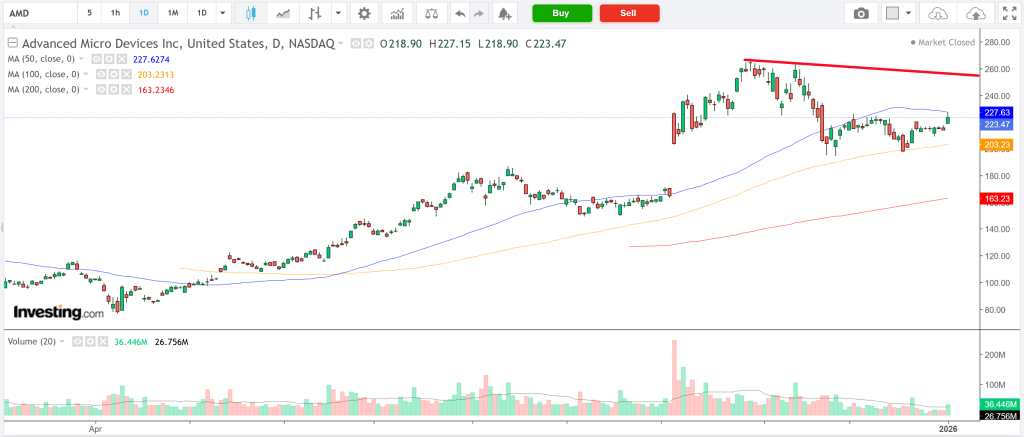

AMD shares closed Friday at $223.47. From a technical standpoint, the stock has demonstrated resilience, recovering from mid-2025 lows near $150 to its current level, supported by strong trading volume. If the upcoming keynote meets expectations with announcements like new partnerships or product roadmaps, AMD could soon challenge its 52-week high around $270.

AMD holds a Financial Health Score of 2.98 (“GOOD”), indicating a solid balance sheet and strong operating momentum driven by excitement around its next-generation AI products.

Stock to Sell: Cal-Maine Foods

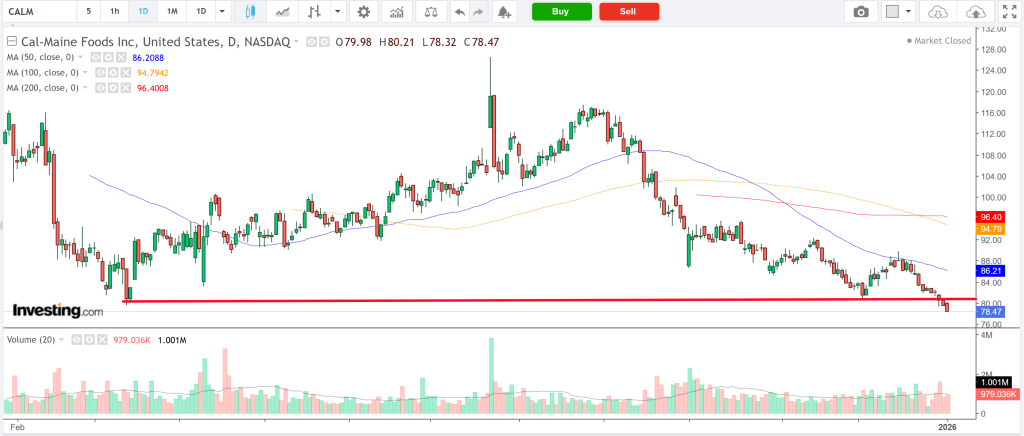

Cal-Maine Foods starts the week at $78.47, hovering near its 52-week low, as Wall Street anticipates a weak earnings report and a bleak outlook. The company faces headwinds including rising feed costs, supply chain challenges, and variable demand.

The largest U.S. producer and distributor of shell eggs is set to release its fiscal second-quarter results before the market opens on Wednesday at 6:00 AM ET, followed by a conference call at 9:00 AM ET.

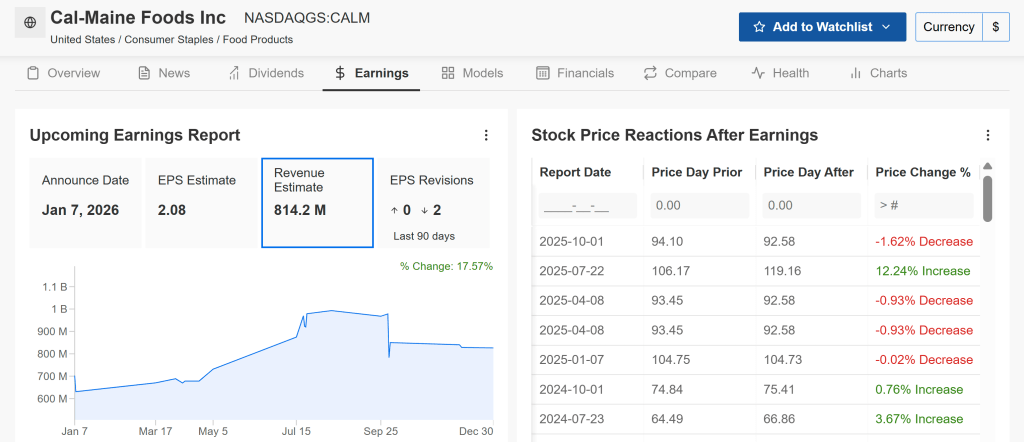

Cal-Maine is projected to report earnings of $2.08 per share, a sharp 53.5% decline from $4.47 a year ago, driven by higher input costs and fluctuating demand. Revenue is expected to drop 14.7% year-over-year to $814.2 million, amid ongoing egg price volatility and potential disruptions from recent avian flu outbreaks that have affected supply chains.

Looking forward, the company’s guidance is likely to reflect continued uncertainty around production normalization and cost control, posing further challenges for investor confidence and stock performance.

Technically, CALM has slipped below key support levels, accompanied by declining volume that indicates weakening investor interest. Its one-year target price of $95.50 offers limited upside, but the risks from a disappointing earnings report outweigh potential gains.

With the likelihood of underwhelming results and cautious guidance, CALM is a sell this week to avoid volatility driven by these events.

Whether you’re a beginner investor or an experienced trader, using InvestingPro can help you uncover investment opportunities while managing risks in this challenging market environment.

Sources: Investing