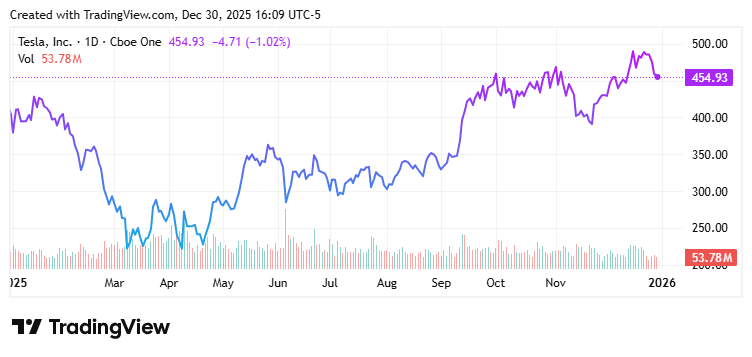

Shares of auto giant Tesla Inc. closed lower for the fourth consecutive session on December 29, signaling a notable shift in momentum just days after the stock reached a fresh all-time high. Since that peak just before Christmas, Tesla shares have declined nearly 8%, marking a sharp reversal after a hard-fought rally.

The timing of Tesla’s recent pullback makes it particularly notable. In a market hovering near record highs, Tesla’s sudden loss of momentum just as it enters blue sky territory raises a critical question: is this a healthy pause or an early sign that the rally is losing steam?

Let’s explore the arguments on both sides.

A Pullback Was Always Possible Amid Tesla’s Rapid Rally

Tesla has surged more than 100% since April, with its longer-term uptrend remaining firmly intact. Even after the recent decline, the stock has not broken any major trend structures—it simply looks more pronounced coming off a record high. Many investors had anticipated the rally to accelerate after Tesla finally cleared long-term resistance, rather than pull back.

From a technical perspective, a pullback of this magnitude is normal and consistent with previous corrections the stock has experienced this year. The latest rally phase was largely one-directional, making profit-taking after major milestones expected.

Tesla’s shares could fall another 8% and still remain within the rising trend channel that has supported the stock since spring. Viewed this way, the recent selloff represents a period of digestion rather than a breakdown. Healthy uptrends rarely move in straight lines—something Tesla investors are all too familiar with.

This outlook is further supported by Tradesmith’s Health Indicator, a volatility-based measure of stock price strength. According to this indicator, Tesla (TSLA) stock has remained in the green zone for four consecutive months, signaling a healthy underlying trend despite recent pullbacks.

A Change in Tone Marks Shift in Market Sentiment Around Tesla Stock

While a pullback is normal after reaching an all-time high, four consecutive lower closes suggest there is more at play than just short-term profit-taking. The sustained selling pressure indicates that bears have firmly taken control from the bulls, with little defense visible so far.

The critical question now is whether buyers will quickly re-enter the market. If they do, this pullback may be seen as a buying opportunity for long-term investors. If not, the market could begin to reassess the remaining upside potential ahead of the next major catalyst—January’s earnings report.

Analyst Support Remains Strong as Tesla Navigates Recent Price Decline

Despite recent weakness, analyst conviction in Tesla remains firm. Over the past week, both RBC and Canaccord Genuity reaffirmed their Buy ratings on the stock. Canaccord Genuity even raised its price target to $551, implying roughly 20% upside from current levels.

These positive calls suggest that the recent selloff is a minor pullback within a larger, ongoing uptrend that still has significant room to grow, even if near-term price action appears uncomfortable. While Sell ratings, such as one from UBS Group last week, persist, they remain rare exceptions in an otherwise solid analyst consensus.

This broader trend of sustained analyst support is particularly important during periods of market uncertainty like the current one.

Why the Next Few Trading Sessions Are Crucial for Tesla Stock

Despite the ongoing pullback, it would be a mistake to dismiss the recent price action entirely. Runs of consecutive red days like this are rare for Tesla, especially so soon after hitting new highs. The fact that this is occurring while the broader market remains strong adds an extra layer of concern.

Tesla’s high valuation intensifies this tension. Trading with a price-to-earnings ratio above 300, the stock leaves little margin for error. Any sign of disappointment in the company’s upcoming earnings report at the end of January could lead to a swift selloff. Confidence, not just momentum, is now a crucial factor.

This makes the upcoming sessions particularly important. How Tesla performs through the remainder of the holiday week and into early January will provide vital clues about the health of the rally. Stabilization or a quick rebound would suggest the pullback is routine. Continued weakness, however, would encourage bearish sentiment and shift the narrative from consolidation to growing doubt.

Sources: Investing