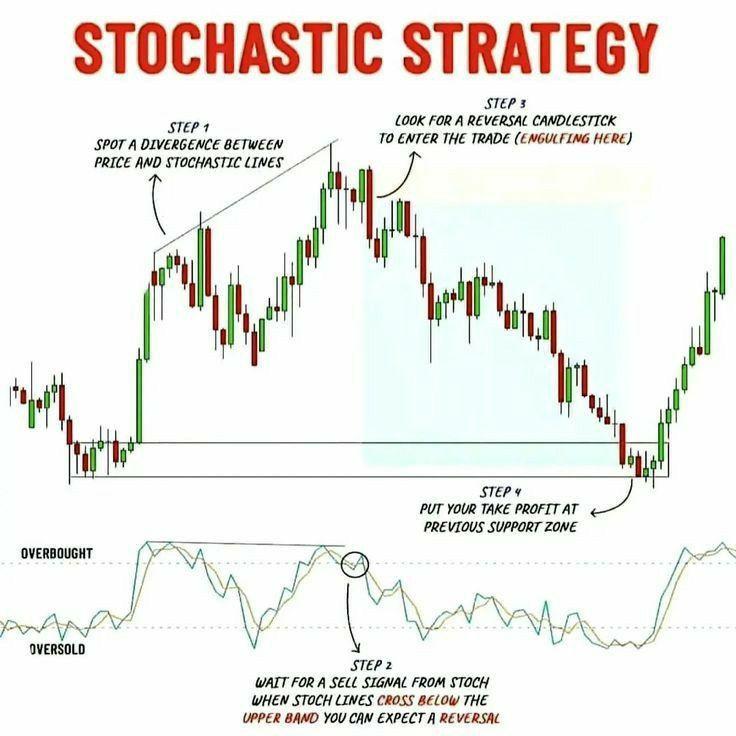

Stochastic Oscillator

The Stochastic Oscillator is a popular technical analysis indicator used to measure the momentum of a financial asset — basically, how fast the price is moving compared to its recent range.

- It compares the closing price of an asset to its price range over a specific period of time.

- It helps traders identify overbought or oversold conditions in the market.

- Values range between 0 and 100.

How it works

- When the oscillator is above 80, the asset is considered overbought (price might be too high, possible reversal or pullback soon).

- When it is below 20, the asset is considered oversold (price might be too low, possible upward reversal).

- It’s often used to spot potential trend reversals or entry/exit points.

Typical usage

- Traders watch for crossovers between %K and %D lines for buy/sell signals.

- Also, look for divergences between price and the oscillator to spot weakening trends.

Notes

- %K and %D are the two main lines used to generate signals:

- %K — The Fast Stochastic Line

- %D — The Slow Stochastic Line

Average True Range (ATR)

Average True Range (ATR) is a technical analysis indicator that measures market volatility.

- It was introduced by J. Welles Wilder Jr. in his 1978 book New Concepts in Technical Trading Systems.

- ATR shows how much an asset’s price moves, on average, during a given period.

- It helps traders understand the degree of price fluctuations or volatility.

How is ATR calculated

- True Range (TR) for each period is the greatest of:

- Current High − Current Low

- Absolute value of (Current High − Previous Close)

- Absolute value of (Current Low − Previous Close)

- Then, ATR is the moving average (usually 14 periods) of the True Range values.

Why use ATR

- It tells you how much the price typically moves, regardless of direction.

- Higher ATR = higher volatility (bigger price swings).

- Lower ATR = lower volatility (smaller price movements).

- Traders use ATR for:

- Setting stop-loss orders to avoid getting stopped out by normal volatility.

- Identifying periods of high or low market volatility.

- Confirming breakouts or trend strength.

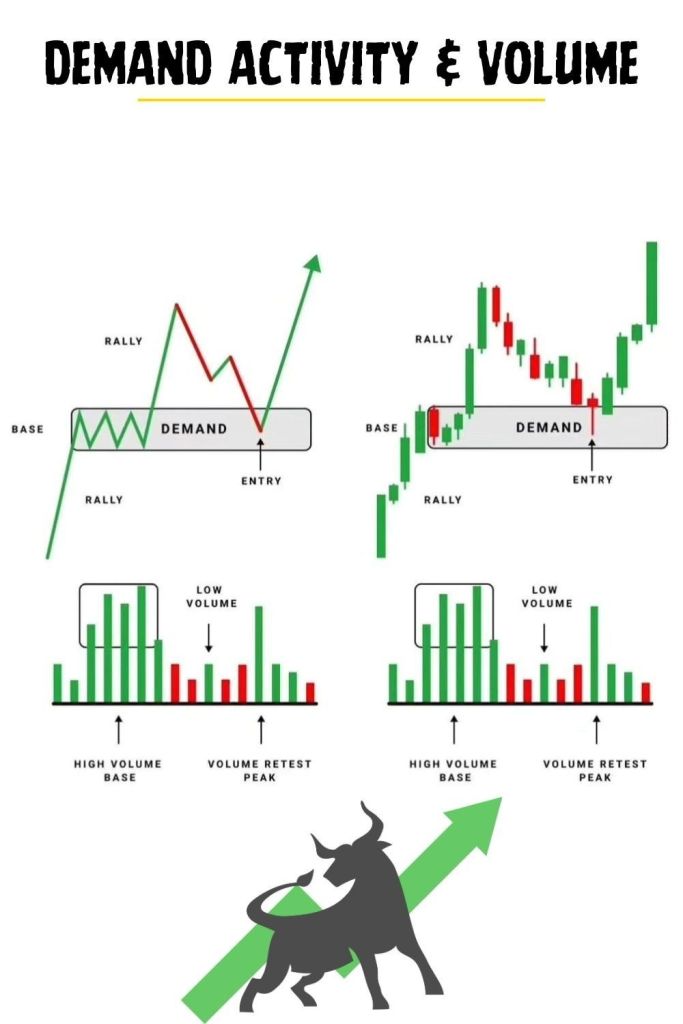

Volume indicators

Volume indicators are tools used in technical analysis to measure and analyze the amount of a security (like stocks, forex, crypto) traded during a specific period of time.

What do Volume Indicators tell you

- Trading activity strength: They show how strong or weak a price movement is by looking at the number of shares/contracts traded.

- Confirm trends: High volume during a price rise can confirm a strong uptrend, while low volume might indicate weakness.

- Spot reversals or breakouts: Sudden spikes or drops in volume often precede or accompany major price changes.

Common Volume Indicators

- On-Balance Volume (OBV):

It adds volume on up days and subtracts volume on down days to show cumulative buying or selling pressure. - Volume Moving Average:

Smooths volume data over a period (like 20 days) to identify trends in trading activity. - Volume Rate of Change (VROC):

Measures the percentage change in volume between two periods to detect unusual volume spikes. - Chaikin Money Flow (CMF):

Combines price and volume to show buying or selling pressure over a period.

Important notes

These indicators are most effective when the market is moving sideways.