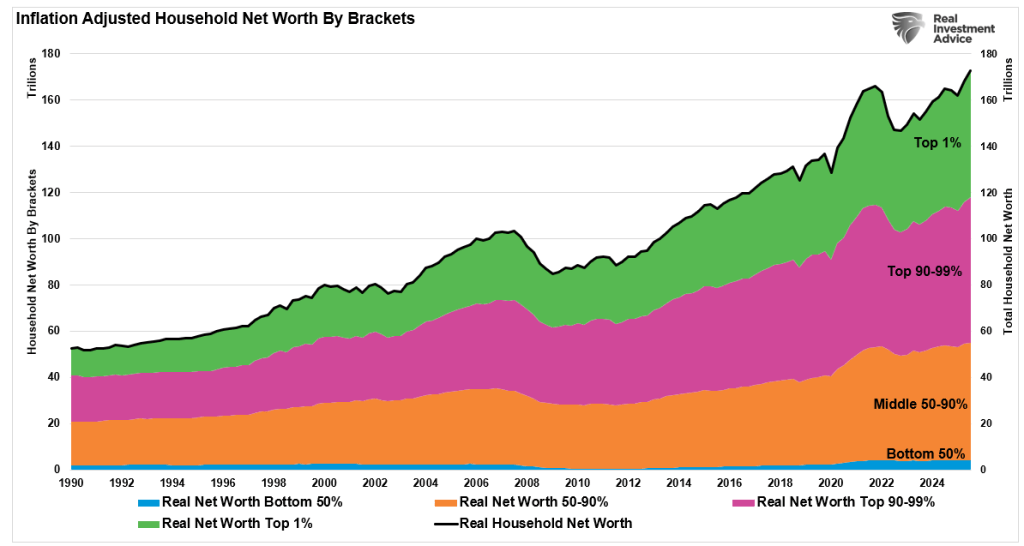

Money — everyone wants it, yet relatively few build lasting wealth. Recent data show the U.S. wealth gap continuing to widen, with the top 10% of earners controlling roughly two-thirds of total assets, while the bottom half owns only a small fraction. The frustration this creates fuels many narratives — corporatism, financial nihilism, inflation, stagnant wages, student debt, policy failures. These factors matter.

But they are not the root cause of individual financial outcomes.

At the personal level, wealth creation has always rested on a small set of enduring principles:

- Spend less than you earn.

- Save consistently.

- Invest intelligently.

These rules are not new. They worked before the internet, before credit cards, and before retail trading apps. Most importantly, they still work — regardless of background, education, age, or economic cycle. Wealth is not a viral trend or a lucky break. It is a disciplined process repeated over time.

That does not dismiss today’s challenges. Inflation remains elevated compared to early-2000s norms. Real wage growth has struggled to outpace living costs. Mortgage rates have constrained affordability. Yet history shows that disciplined financial behavior, applied consistently, can overcome difficult macro environments.

Many people can articulate why the system feels unfair. Fewer commit to the habits that compound into independence. The difference between chronic financial stress and gradual wealth accumulation is often not luck or privilege alone — it is adherence to a workable framework.

This framework is neither radical nor controversial. It is the same path generations have followed to build stability and prosperity.

One uncomfortable truth is that we have largely failed to teach foundational money skills. Not advanced portfolio theory — but basics: budgeting, understanding credit, living below one’s means, and managing cash flow responsibly.

With that foundation in mind, here are the 10 Immutable Laws of Money.

10 Fundamental Principles of Money

Wealth Isn’t Created Effortlessly

Growing up, my father loved to share stories that, over time, I realized were slightly exaggerated. A few of his classics were:

“When I was your age, I walked uphill to school in the snow — both ways.”

“I could see two movies, eat all the popcorn and drink all the soda I wanted for a nickel — and still get change back!”

And, of course: “Where do you think money comes from? It doesn’t grow on trees!”

That last line stuck with me the most. What he was really trying to teach was respect — respect for the time, energy, and sacrifice required to earn a living. He often worked two jobs, sometimes even three, to provide for our family. We always had what we needed, though not always everything we wanted. As a child, I didn’t fully grasp the weight of that lesson. It wasn’t until I had a family of my own that I truly understood.

Most people work incredibly hard for their income. Yet it’s surprising how casually many treat the money they earn. They undermine their own efforts by overspending, living beyond their means, or making careless investment choices. If you value the work it takes to earn money, you should value how it’s managed.

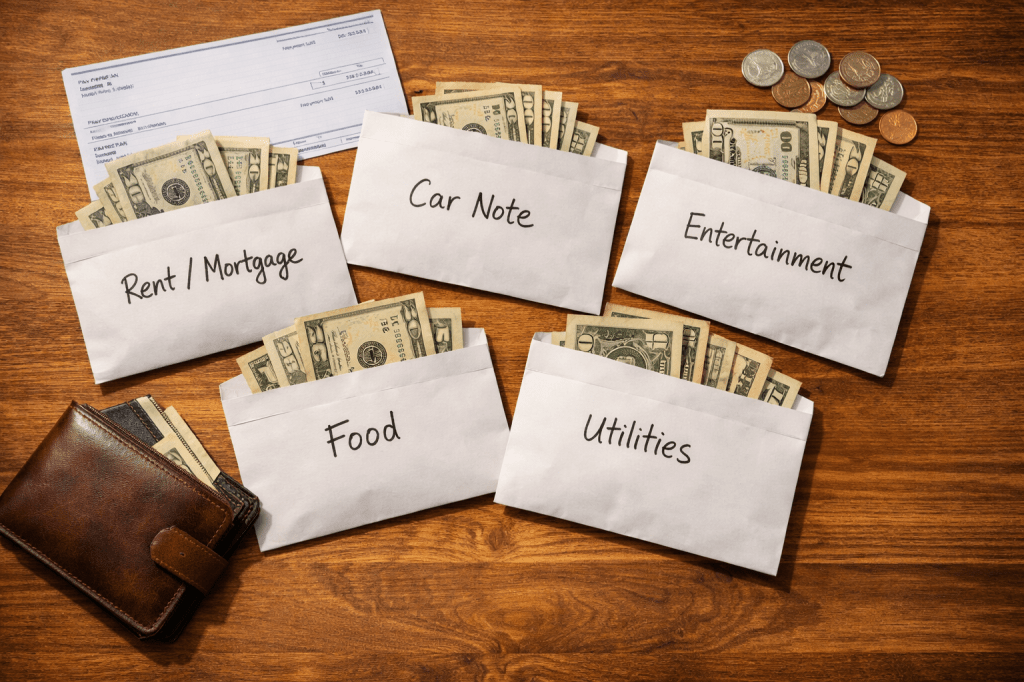

One practical way to build that respect is by using the “envelope system” for a few months.

The idea is simple: cash your paycheck and divide the money into separate envelopes labeled for expenses — rent or mortgage, car payments, groceries, utilities, entertainment, and so on. Then live normally. When an envelope runs out, that category is done for the month. No borrowing from another envelope.

This method quickly reveals where money is leaking away and forces awareness around spending habits. More importantly, it restores discipline and respect for the effort behind every dollar earned.

Note: The envelope system should cover about 80% of your overall budgeting approach, which we’ll explore shortly. The remaining 20% should be directed toward savings — but we’ll tackle that part step by step.

Desires Always Outpace Necessities

When I sit down with people to talk about financial planning, I’m always struck by the reaction the word “budget” triggers. The moment it’s mentioned, you’d think I had suggested something drastic — like giving up a limb.

But the reality is simple: financial success requires one fundamental rule — spend less than you earn.

I constantly hear people justify breaking this rule:

“You don’t understand — I needed a new car.”

“We needed a bigger house.”

“We have to take our annual vacation.”

The line between a “want” and a “need” can occasionally blur, but most of the time they are worlds apart. Did you truly need a brand-new car — or could a reliable two-year-old model have saved you 20% in depreciation? Did you genuinely require more space, or could you have managed in your current home?

These are uncomfortable but necessary questions.

If your goal is to build wealth, your true needs are very limited:

- Food

- Shelter

- Utilities

- Taxes

That’s it. Everything else is a want.

Learning to control your wants is one of the most powerful steps toward financial stability. Before making a purchase, pause and ask yourself: Is this a need — or just a desire?

Here’s a practical guideline:

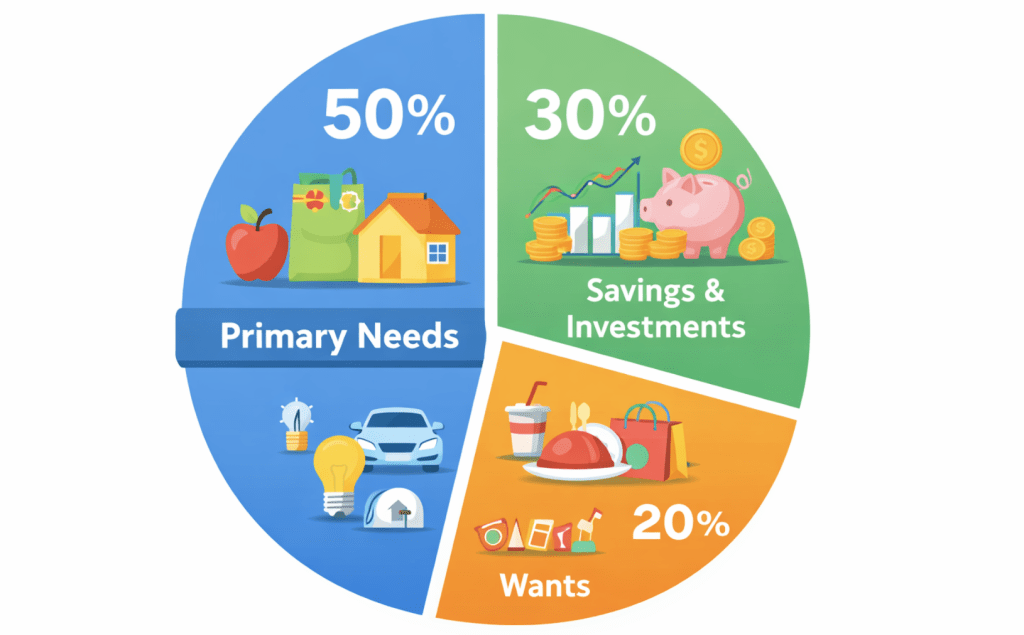

Your life should cost no more than 70–80% of your income.

When creating a budget, review your spending patterns and aim to keep your committed expenses at or below 70–80% of your gross income. That means 20–30% remains uncommitted — and that margin is where financial freedom begins.

This percentage isn’t a rigid law, but it’s a realistic and effective starting point. Once you structure your finances this way, constant expense tracking becomes less necessary. Your account balance itself becomes your guide. The real discipline lies in keeping those fixed obligations under control — and refusing to let wants quietly turn into “needs.”

What About the Remaining 20–30%?

That portion is what you “pay yourself first.”

Let’s break it down with a simple example.

Joe earns $100,000 per year and falls into a 25% tax bracket. If his goal is to save 30% of his income, he needs to set aside $22,500 annually.

Here’s how he does it:

- $20,000 goes directly into his employer-sponsored retirement plan on a pre-tax basis.

- He then contributes an additional $2,500 each year into a Roth IRA.

Just like that, Joe has hit his savings target.

After taxes and retirement contributions, the paycheck that lands in Joe’s bank account represents roughly 70% of his gross income. And here’s the beauty of the system: Joe is free to spend what’s in that account. He doesn’t have to think about saving — it’s already been handled.

Because the money moves into savings before he ever sees it, he adapts to living on the remaining amount. He never feels deprived because he never mentally counted that savings money as spendable income in the first place.

That’s the real secret to a budget that actually works.

Tracking every dollar you spend isn’t the magic solution — just like obsessively counting calories isn’t the true key to weight loss. The real power lies in building a financial structure that automatically balances income and spending, prioritizes saving, and leaves enough flexibility to absorb life’s inevitable surprises.

When the system is designed correctly, discipline becomes automatic — and wealth becomes a byproduct of structure, not willpower.

The Poor Owe — The Wealthy Own

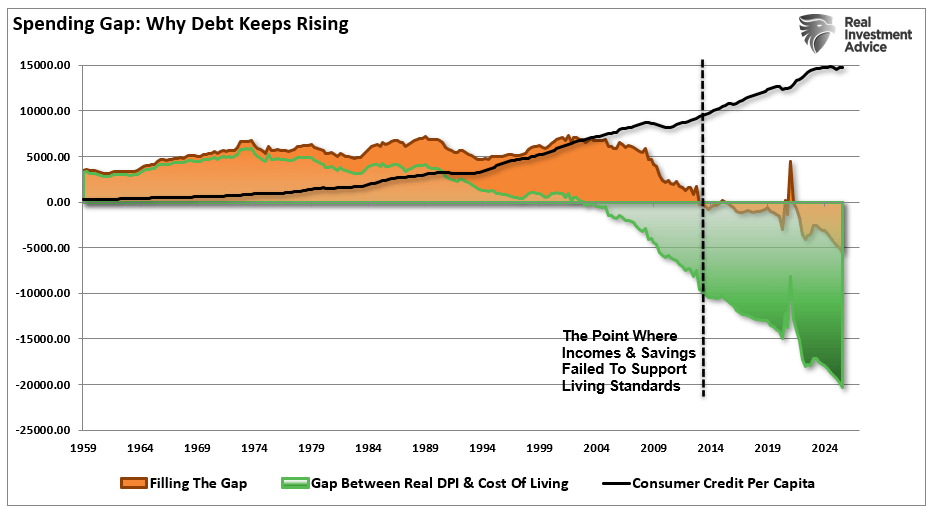

This principle is straightforward: you cannot borrow your way to wealth — period.

There’s no late-night seminar teaching people how to become rich by shuffling balances between low-interest credit cards. Debt is not a wealth-building tool for consumers — it’s a wealth transfer mechanism, usually in the wrong direction.

For many people, high monthly credit card payments are the very reason their expenses feel suffocating. If you’re carrying significant non-mortgage debt, consider redirecting the 20% earmarked for long-term savings toward aggressively paying it down — but only after you eliminate access to more borrowing.

Every dollar of interest you don’t pay is equivalent to earning a guaranteed, risk-free, tax-free return equal to the interest rate on that debt. Few investments offer that kind of certainty.

And once the debt is gone — which can happen faster than you think if you apply 20% of your gross income toward it — immediately redirect that same money back into savings.

Signs You’re Damaging Your Financial Future

You may be off track if you:

- See credit card balances rising while income is shrinking.

- Pay only minimums — or less.

- Shift balances or take cash advances to cover other cards.

- Carry more credit cards than you can track.

- Stay near your credit limits.

- Charge more monthly than you repay.

- Work overtime just to keep up with payments.

- Avoid calculating your total debt.

- Receive delinquency notices.

- Use credit cards for essentials like food or gas.

- Rely on credit because you lack cash.

- Dip into savings or retirement accounts to cover bills.

- Hide purchases from your spouse.

- Open every unsolicited card offer.

- Fear job loss because your debt load feels unmanageable.

The first step toward wealth is eliminating dependence on credit cards — for any reason. That may sound extreme, but you can’t break a habit while continuing the behavior. There’s no middle ground.

The Credit Card Roll-Up Strategy

If you’re serious about becoming debt-free, this structured approach works:

- Cut up all your credit cards. Every single one.

- List balances from largest to smallest, along with minimum payments.

- Pay minimums on all cards — but pay five times the minimum on the smallest balance.

- Repeat monthly. Ignore interest rates for now; the goal is quick psychological wins.

- Once the smallest card is paid off, roll that full payment (including its former minimum) onto the next smallest balance.

- Continue rolling payments upward until you attack the largest balance with significant monthly firepower.

Momentum builds quickly. What starts small becomes powerful.

When you eliminate your final credit card balance, reward yourself modestly — perhaps with two months’ worth of what used to be your debt payments.

Then immediately return to discipline.

Every dollar that once serviced debt now goes into savings and investment. You’ll have ground to make up — but you’ll also have the structure and momentum to build real wealth.

Debt keeps you working for your past.

Savings and investment put your money to work for your future.

You Are Not Immune to Moral or Physical Risk

I remember watching Fear Factor hosted by Joe Rogan and realizing something simple: people will do almost anything for fast, easy money.

“Sure, I’ll eat those South American hissing cockroaches for $50,000.”

Yet many of those same people won’t consistently skip luxuries, reduce spending, or sacrifice short-term comfort to save $50,000 the slow and responsible way.

We’ve been conditioned to look for shortcuts. Instead of discipline, we gamble. The lottery — essentially a tax on poor financial judgment — becomes the dream strategy. Yet roughly 80% of lottery winners end up broke within a decade because sudden money cannot compensate for weak financial habits.

If I borrowed a page from David Letterman, I’d create a segment called “Financially Stupid Human Tricks” — highlighting the so-called “smart” financial moves that often create long-term damage.

Borrowing From Your 401(k)

Many employer-sponsored retirement plans allow loans. It feels harmless. After all, you’re “paying interest to yourself,” right?

Technically true.

But here’s what gets overlooked:

- If you lose your job, the loan usually must be repaid within about 60 days.

- If you can’t repay it, the balance is treated as a distribution — taxed and penalized.

- Depending on your bracket, penalties and taxes can reach 40% or more.

And it gets worse: you can’t restore the lost compounding.

If you borrowed $7,000 and that money could have compounded at 8% annually, over time that single decision could cost tens of thousands — even $75,000 or more — in retirement value.

Your retirement account and your home equity should be financial “break glass only in absolute emergency” assets. If everything else in life goes wrong, those two pillars protect your shelter and your dignity.

Stretching to Buy a House

Homebuyers face enormous pressure.

Real estate agents earn more when you spend more. It’s no accident that you’re often shown a home slightly beyond your range first. Once you’ve walked through the upgraded kitchen and spa bathroom, the affordable house feels like a compromise.

Friends and family may encourage the stretch:

“It’s an investment.”

“You’ll earn more later.”

“Real estate always goes up.”

Maybe. Maybe not.

Being “house poor” is real. When too much of your income goes toward housing, everything else suffers — vacations disappear, dining out shrinks, retirement contributions stall, college savings fade. Instead of cutting lifestyle, many simply layer on more debt to preserve appearances.

A house should support your life — not dominate it.

The common thread in all of this is risk blindness. People assume bad outcomes won’t apply to them. They believe they’ll keep the job, the market will cooperate, income will rise, and nothing unexpected will happen.

But wealth isn’t built on optimistic assumptions.

It’s built on margin, discipline, and respect for risk.

Quick money excites.

Structured money endures.

The Most Valuable Things in Life Don’t Cost Money

Too often, we confuse “quality time” with “costly activity.” We assume that spending meaningful time with family or loved ones requires tickets, reservations, travel, and swiping a credit card.

But isn’t the real goal connection?

You don’t need a weekend getaway to build memories. You need presence.

Learn to be creative:

- Board games at home

- Playing sports in the yard

- A walk in the park with music or an audiobook

- Movie nights with homemade popcorn

- Sitting around talking, gaming, or reading together

The activity matters far less than the interaction. Some of the best moments in life cost absolutely nothing.

Laugh at the Joneses (Just a Little)

Petty? Maybe.

Effective? Absolutely.

Trying to “keep up with the Joneses” is one of the fastest paths to financial stress. The irony is that the Joneses often aren’t thriving — they’re financing appearances.

As of mid-2025, the average American household carried over $100,000 in consumer debt, including mortgages, credit cards, auto loans, personal loans, and student debt. Since that’s an average, half of households owe even more. Meanwhile, non-mortgage consumer debt has climbed to historic highs, while income growth hasn’t kept pace.

In other words, the lifestyle you envy may be leveraged.

Recognizing that reality makes it much easier to stop competing. Financial peace rarely comes from outward display — it comes from internal margin.

The best things in life — laughter, conversation, friendship, time, health — cannot be financed. And the more you understand that, the less tempted you’ll be to borrow in order to simulate happiness.

Wealth isn’t about looking rich.

It’s about being free.

If a little harmless comparison keeps you disciplined, use it.

Watching your neighbor finance every new car, remodel, and vacation can actually reinforce your own commitment to smart money management. Quietly appreciating that your lower debt load earned you a better mortgage rate — or that you sleep better at night — can be motivating.

Is it a bit petty? Sure.

Is it effective? Often.

This isn’t really a “law of money” as much as a psychological trick. Humans are wired for comparison. If observing someone else’s overextension strengthens your resolve to stay disciplined, that’s not the worst thing — just keep it internal. You still want the dinner invitations.

At the end of the day, frugality isn’t about deprivation. It’s about peace of mind.

You’re choosing restraint today to gain freedom tomorrow.

Whether you’re eliminating debt, increasing savings, or simply refusing to live beyond your means, the real goal is avoiding the anxiety and stress that come from financial chaos. That clarity — knowing you’re in control — is what sustains long-term discipline.

When you remember that financial stability equals emotional stability, it becomes much easier to avoid burnout, stay consistent, and reach your goals faster.

Wealth is not about impressing others.

It’s about sleeping well at night.

Money Cannot Purchase Happiness

That familiar cliché is often dismissed as something people say to justify not pursuing financial success. And while it’s technically true that money cannot directly purchase happiness, it can certainly acquire many of the things that make happiness easier to experience.

Money doesn’t guarantee joy.

But neither do debt, stress, anxiety, or 20% credit card interest.

Financial security won’t fix every challenge in life. It won’t repair broken relationships or create purpose. But it does eliminate many of the pressures that drain your mental energy — surprise expenses, medical bills, job uncertainty, emergencies.

A strong financial foundation buys breathing room.

And breathing room reduces stress. Reduced stress improves relationships, decision-making, and overall well-being.

A healthy bank balance is far more valuable than another gadget, another upgrade, or the newest phone release. Financial stability may not buy happiness — but it buys freedom, options, and peace of mind.

And those are often much closer to happiness than most purchases ever will be.

There’s No Such Thing as “Five Easy Payments”

Don’t fall for flashy financing tricks. People often justify using a certain credit card or payment plan because it advertises 0% interest — but that’s beside the point. A good rule of thumb: if you can’t pay for it in cash right now, you probably shouldn’t buy it. Chances are, it’s a “want,” not a necessity.

Debt is still debt, no matter how attractive it looks. In the end, it’s the fine print that catches you off guard and pulls you further away from your financial goals.

Cash in your pocket beats being stretched too thin.

About half of marriages in the U.S. end in divorce, with two leading causes often cited: infidelity and money problems. Financial pressure can strain relationships, and many of our spending choices are driven more by emotion than logic. If you want to eliminate debt and the stress that comes with it, here are seven hard truths to help you regain control and build real financial cushion:

1) Cut Housing Costs.

Do you really need the pool or those extra bedrooms filled with clutter? Many people buy more house than they actually use. Downsizing and lowering your mortgage payment can free up significant monthly cash flow.

2) Reduce Car Expenses.

Consider going from two cars to one, carpooling, or using alternative transportation. Even trading in for a reliable two- or three-year-old vehicle could shrink your monthly payment, insurance, fuel, and maintenance costs.

3) Take on Extra Income (Temporarily).

A part-time job bringing in an additional $1,000 per month adds up to $12,000 a year toward debt repayment. It doesn’t have to be permanent — just long enough to reset your finances.

4) Eliminate Costly Habits.

Smoking, frequent dining out, and impulse spending drain money quickly. Cooking at home and cutting unnecessary indulgences may not feel convenient, but it’s both financially smart and often healthier.

5) Live Below Your Means.

Adjusting priorities, expectations, and even location can help you scale your lifestyle to something sustainable.

6) Reconsider Private School.

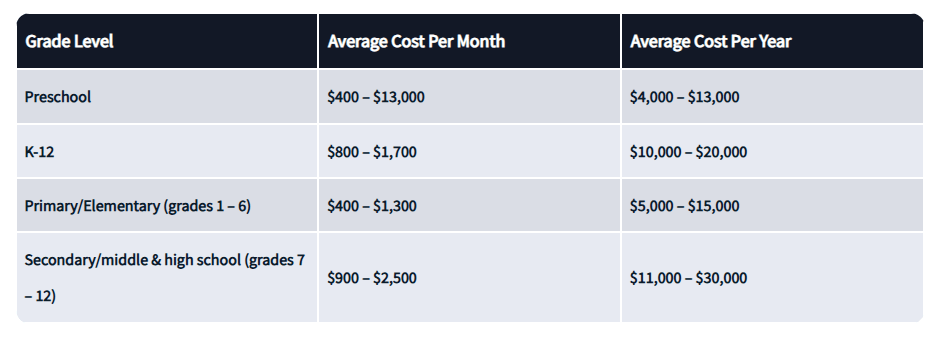

Private education can cost around $15,000 per year, while you’re already funding public schools through taxes. Supplementing public education with involvement at home can strengthen both your child’s learning and your relationship — at little to no financial cost.

Getting out of debt requires tough choices, but each decision moves you closer to financial freedom and peace of mind.

7) Turn Clutter into Cash.

Garage sales, eBay, and countless online marketplaces make it easier than ever to unload the stuff you’ve accumulated over the years. What’s collecting dust in your home could translate into extra money to put toward paying down debt.

You might resist some of these ideas at first — and they are only suggestions. But once you begin applying even a few of these principles, you’ll likely uncover additional ways to live within your means and take meaningful steps toward a less stressful, more financially secure life.

Dress with purpose, not pressure.

Millionaires with $2–$5 million in assets tend to look very different from the flashy stereotype.

Research by Thomas J. Stanley found:

- Modest Homes: Among estates valued at $3.5 million or more, the median home value was about $469,000.

- Small Share of Net Worth: Their primary residence typically represented less than 10% of total net worth.

- Broader Trend: About 90% of millionaires live in homes worth $1 million or less, and nearly a third live in homes valued at $300,000 or less.

- Income-Producing Assets First: They invest more in businesses and income-generating real estate than in luxury personal residences.

Stanley’s rule of thumb: your home’s market value should ideally be less than three times your annual realized household income. Even affluent households ($1M–$10M+) often stay in the same, practical homes for decades.

Other Key Patterns

- Entrepreneurial Roots: Many built wealth by starting businesses and carving out profitable niches. They’re driven by building enterprises — wealth is the byproduct.

- Comfortable, Not Flashy: They buy quality items but avoid waste. For example, they may purchase expensive shoes — but they resole them instead of replacing them.

- Stable Households: They’re often married to financially responsible partners who run efficient homes — clipping coupons, buying in bulk, and managing spending carefully.

- Simple Formula: They consistently spend less than they earn.

Investing Habits

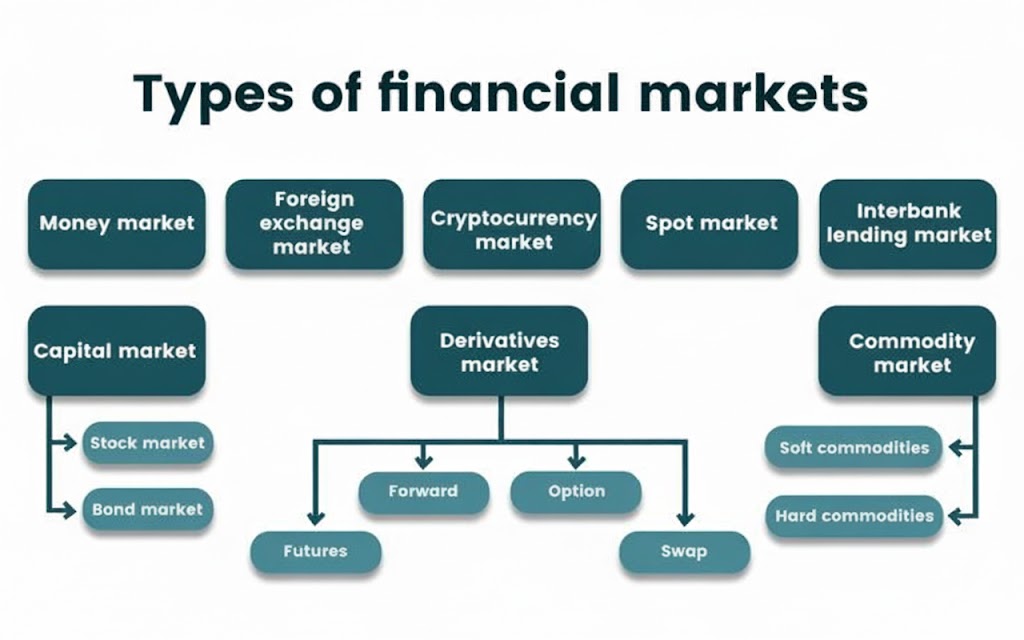

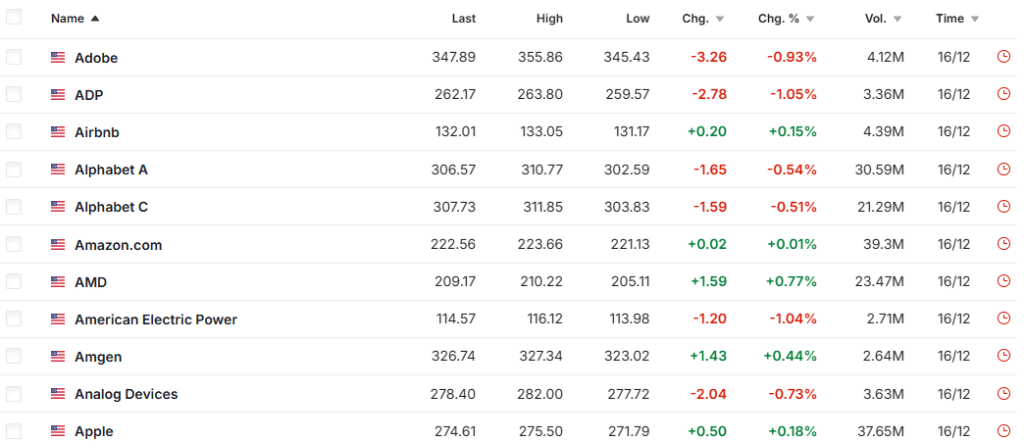

Once their businesses mature, they turn to the stock market for steady capital growth. They are rarely speculators, seldom gamble, and almost never buy lottery tickets.

You might assume they avoid speculation because they’re already wealthy — but more likely, they became wealthy because they avoid speculation.

And if you think wealth comes from flashy appearances or shortcuts, you might as well put pantyhose over your head and ask strangers for cash — it’s about as effective.

Money Law #9: Dress for success — but build wealth quietly.

Start Living Differently from Everyone Else Today

As Dave Ramsey often says:

“If you live like no one else today, you’ll be able to live like no one else tomorrow.”

Building wealth isn’t complicated. Retiring comfortably isn’t reserved for the lucky. It starts with committing to disciplined money habits and consistent saving. That path may put you at odds with credit card companies, frustrate the banks, and make you stand out from the “keep up with the Joneses” crowd—but that’s the point.

Sacrifice isn’t suffering. It’s a calculated move.

Pass on the new car today, and you keep more cash.

Save that cash, and you can invest in assets that appreciate.

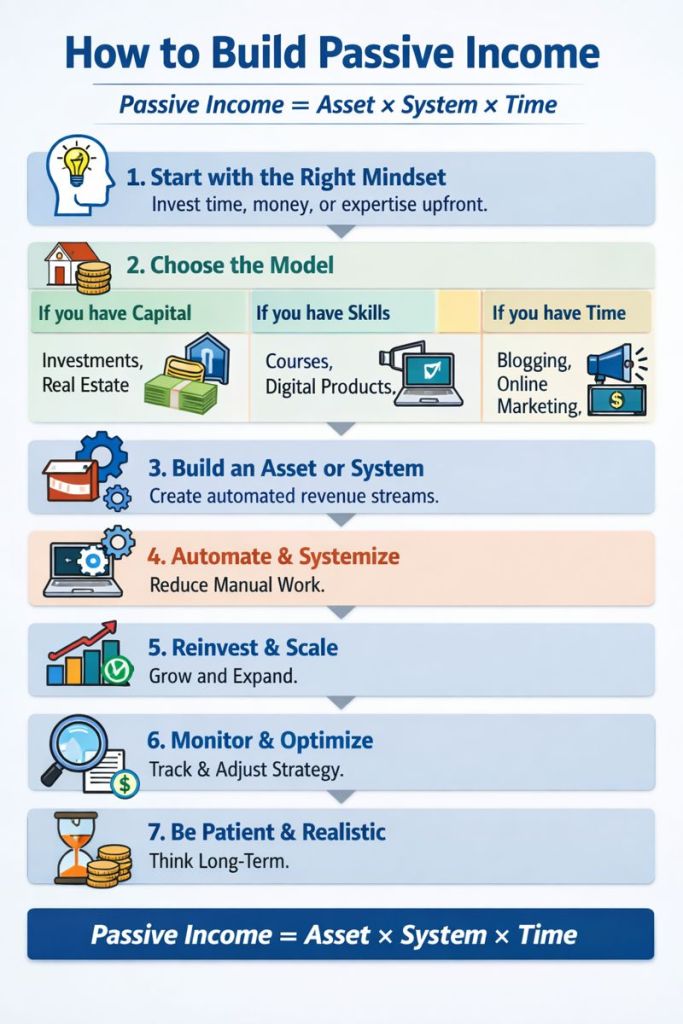

Invest steadily, and your money begins working for you.

Compound growth drives the engine—but your savings fuel it.

That’s how ordinary people build extraordinary retirements.

Stop blaming circumstances. Start making intentional decisions. Your future won’t be shaped by what you post, wish for, or complain about.

It will be shaped by what you actually do.

And one day, you may find yourself financially secure—with cash reserves, a solid emergency fund, reliable investment income, and peace of mind.

Looking back, the early sacrifice won’t feel like loss.

It will feel like leverage.

Sources: Lance Roberts