Bitcoin (BitfinexUSD) is rebounding from its weekend slide, trading above the $67,000 mark as investors process a dramatic shift in Middle Eastern geopolitics.

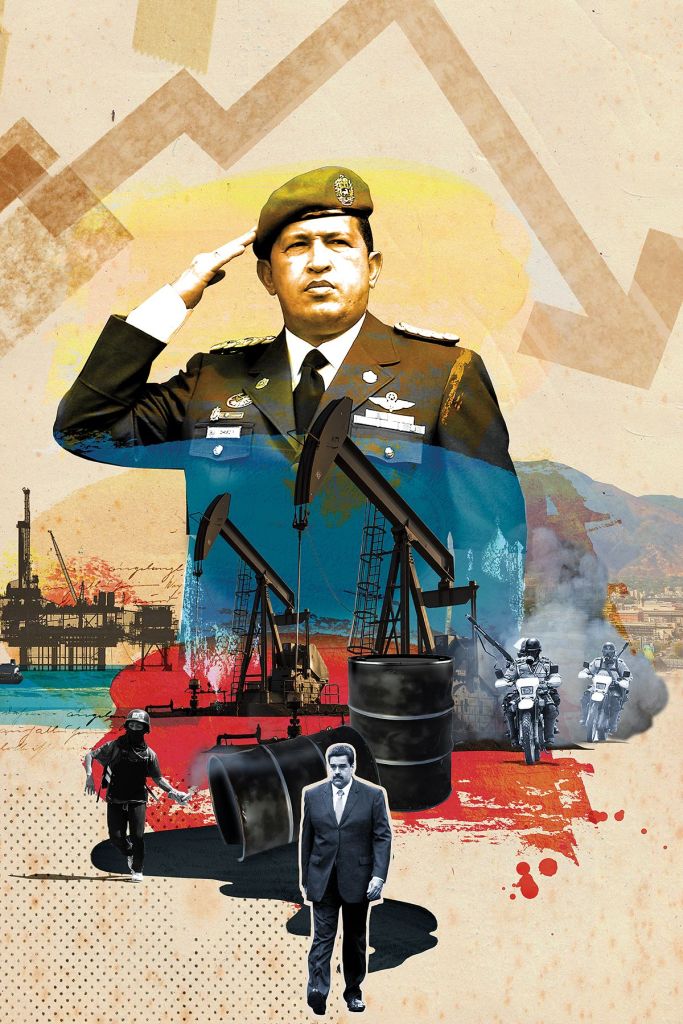

The bounce comes after intense volatility sparked by coordinated U.S. and Israeli strikes on Iran. President Donald Trump stated that the operation led to the death of Supreme Leader Ayatollah Ali Khamenei. Although Tehran initially rejected the reports, Iranian state media later confirmed his death, triggering sharp reactions across global financial markets.

As highlighted in Saturday’s analysis, Bitcoin has a consistent pattern of sharply dropping on unexpected geopolitical shocks before stabilizing. That pattern appears to be unfolding again. After falling to nearly $63,000 yesterday, the cryptocurrency has gradually attracted renewed capital flows as the initial wave of panic selling eases.

Ethereum and XRP are also participating in the broader recovery. ETH/USD has moved back toward the $2,000 level, while XRP is trading near $1.40, with investors anticipating a key March 1 deadline that could bring greater regulatory clarity in the United States.

Regime change dynamics and shifting sentiment

Khamenei’s death was a decisive and largely unforeseen development. The swift return of buyers into Bitcoin reflects a growing belief among traders that the most severe phase of military escalation may have already passed.

At the same time, optimism is tempered by uncertainty surrounding the power vacuum in Tehran. As Iran’s highest authority for decades, Khamenei’s absence leaves open questions about the country’s leadership transition and broader regional stability.

President Trump’s remarks encouraging Iranians to “reclaim their country” indicate that Washington may be aiming for structural regime change. For crypto investors, the coming days represent a critical period of observation. If Iran manages a controlled leadership transition without broadening the conflict, Bitcoin’s rebound could remain intact. However, a drawn-out internal or regional confrontation could quickly pressure the $67,000 support level once more.

Escalation risks and Bitcoin’s “safe haven” debate

Despite the recovery, the possibility of a wider regional conflict persists. Iran’s Revolutionary Guards have reportedly carried out strikes against neighboring states hosting U.S. forces, and casualties have been reported following retaliatory action involving Israel. This ongoing cycle of retaliation continues to unsettle institutional crypto participants.

The central issue now is whether Bitcoin can genuinely function as a “digital gold” hedge during geopolitical crises — or whether it will keep behaving like a high-beta technology asset that reacts sharply to shifts in global risk sentiment.

Sources: Simon Mugo