U.S. stock index futures were largely unchanged Wednesday night after the minutes from the Federal Reserve’s January meeting delivered mixed signals on interest rates, adding to uncertainty about the longer-term policy path.

Investors are now turning their attention to upcoming earnings from retail heavyweight Walmart Inc (NYSE:WMT) for fresh insight into the health of the U.S. economy.

Markets were also pressured by rising geopolitical tensions involving Iran, as reports pointed to a stronger U.S. military presence in the Middle East despite continued talks between Tehran and Washington.

As of 20:00 ET (01:00 GMT), S&P 500 Futures dipped slightly to 6,892.0, Nasdaq 100 Futures edged down nearly 0.1% to 24,942.75, and Dow Jones Futures slipped 0.1% to 49,685.0.

Futures held steady after Wall Street posted gains in the regular session, driven mainly by an ongoing rebound in technology stocks and data showing resilience in the U.S. economy. However, caution surrounding the Fed’s outlook kept major indexes below their intraday peaks.

Fed minutes reveal divisions on inflation and rates

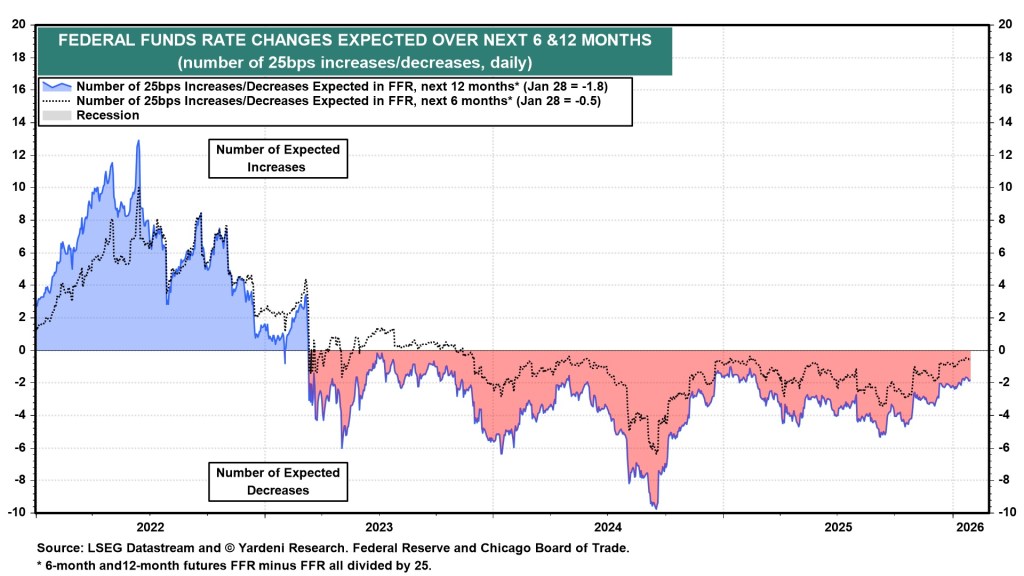

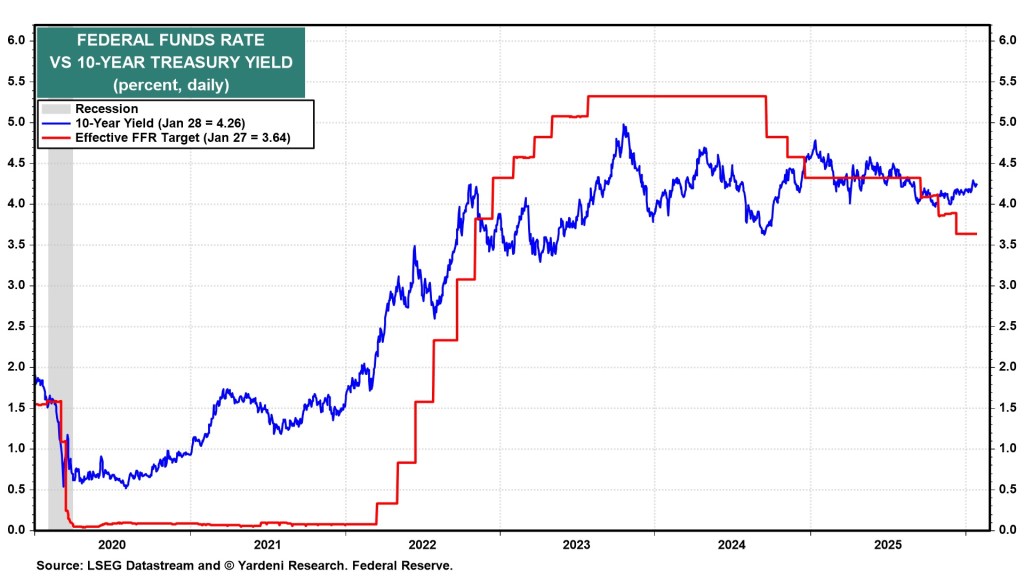

Minutes from the Fed’s January meeting showed officials unanimously agreed to keep interest rates steady at 3.50%–3.75%. Still, policymakers appeared divided over the next move. Several members warned that inflation could take longer than expected to return to the central bank’s 2% target.

A number of officials also suggested that rate hikes could be considered if inflation remains elevated for an extended period — a tone that contrasts with market expectations for further easing this year.

Artificial intelligence emerged as a key area of debate, with officials split on whether the rapidly expanding sector will ultimately fuel inflation or help contain it.

Walmart earnings in focus

Walmart Inc (NYSE:WMT) is scheduled to report fourth-quarter results on Thursday, with particular attention on its 2026 outlook, which may offer broader clues about U.S. consumer strength.

According to Investing.com data, Walmart is expected to post earnings per share of $0.7269 on revenue of $190.4 billion.

As the world’s largest retailer by valuation and a widely followed barometer of U.S. consumer spending, Walmart’s results come at a time when sticky inflation is showing signs of straining retail demand.

Also due Thursday are U.S. December trade data and weekly jobless claims.

Wall Street gains led by tech rebound

Wall Street ended higher on Wednesday, led by technology stocks as the sector extended its recovery from recent declines.

Still, both major indexes and tech shares retreated from session highs amid lingering concerns about the impact of artificial intelligence. Worries over AI-driven disruption have recently weighed on software and logistics companies, while concerns about heavy AI-related capital spending have pressured firms exposed to data centers.

The S&P 500 rose 0.6% to 6,881.32, the NASDAQ Composite gained 0.8% to 22,753.64, and the Dow Jones Industrial Average added 0.3% to 49,662.66.

Sources: Ambar Warrick