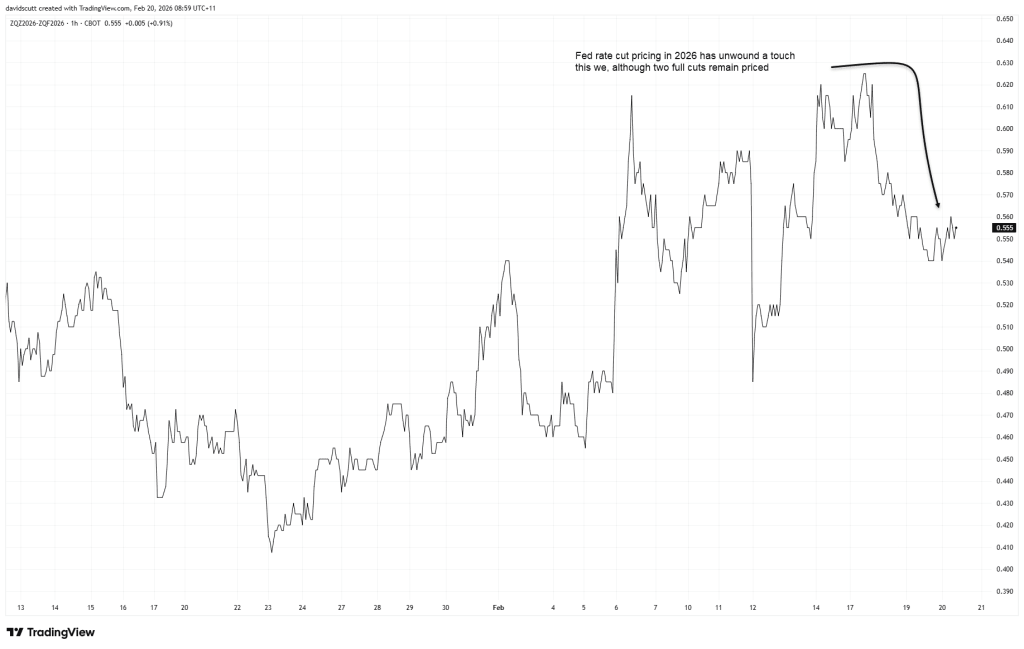

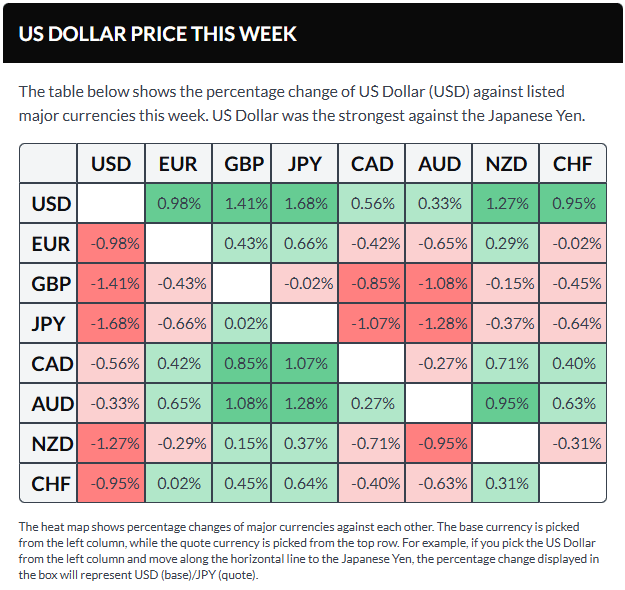

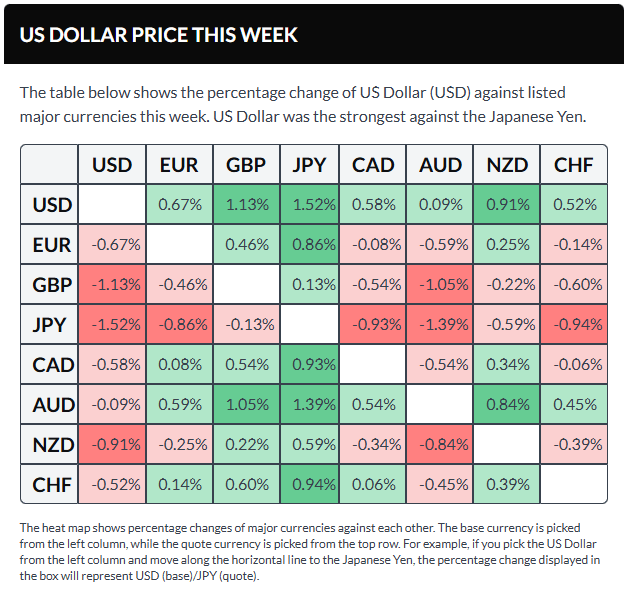

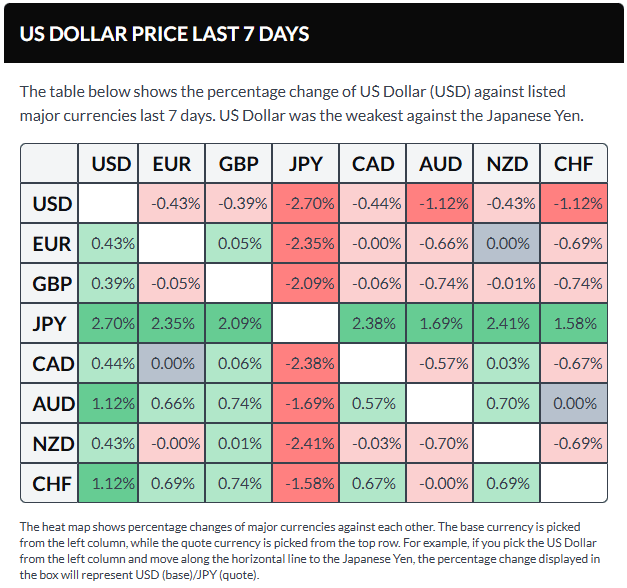

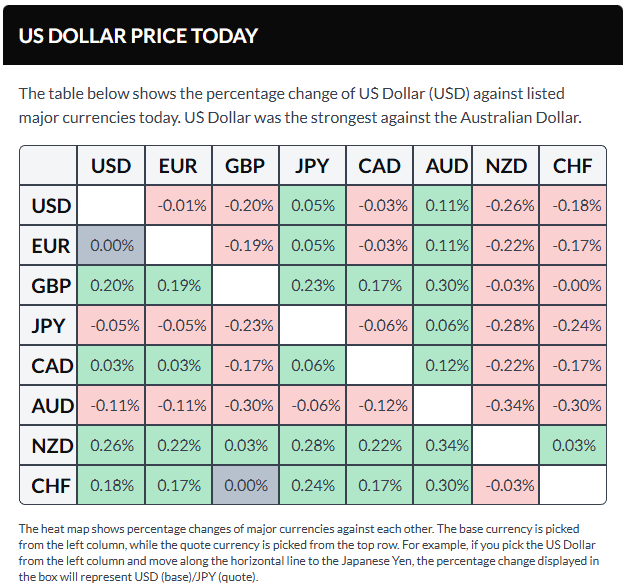

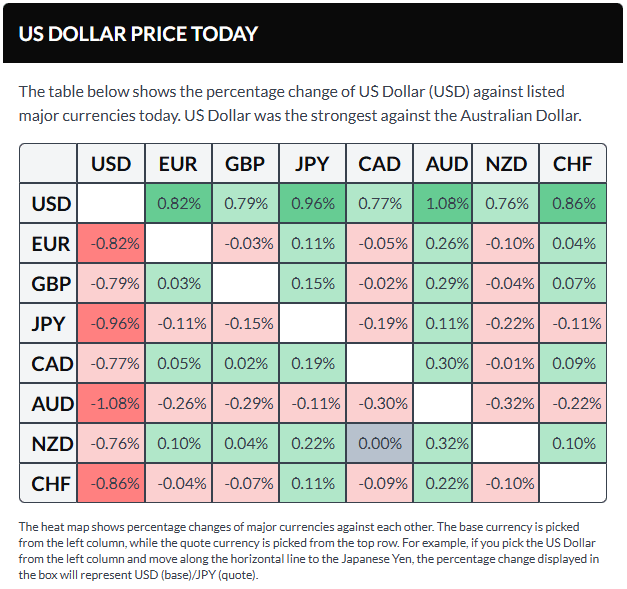

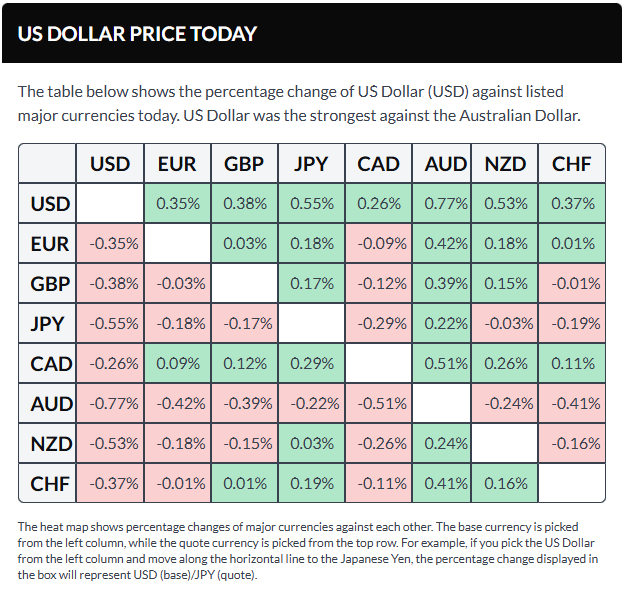

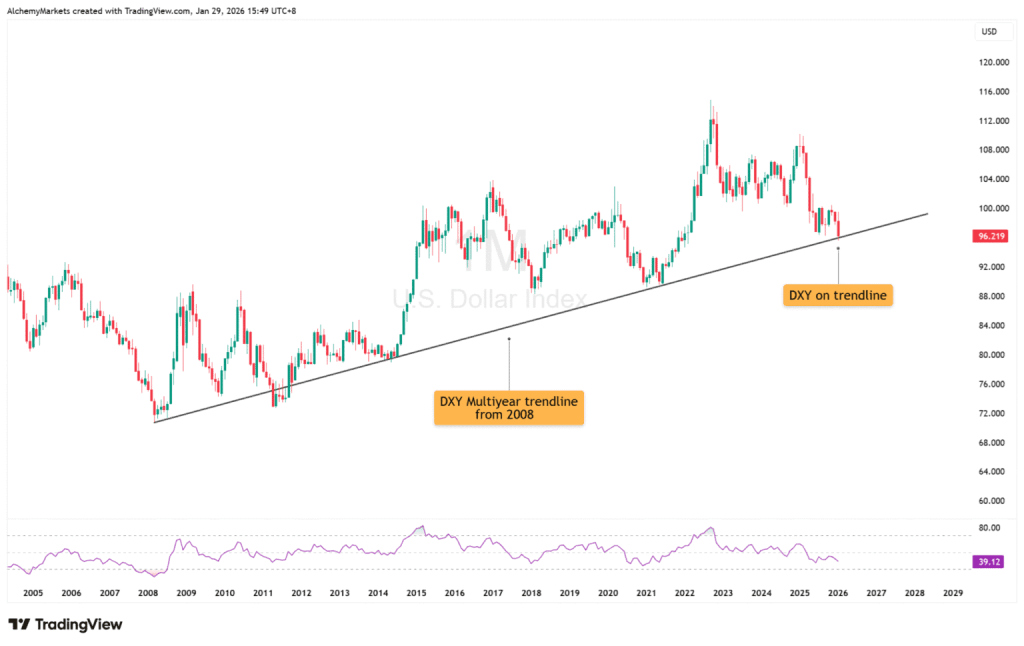

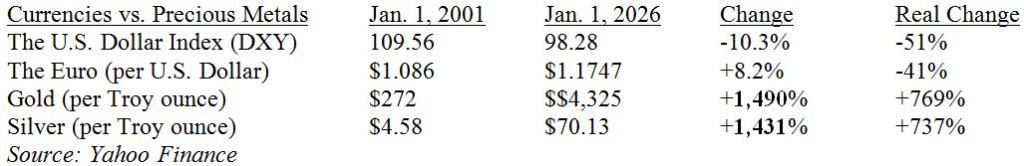

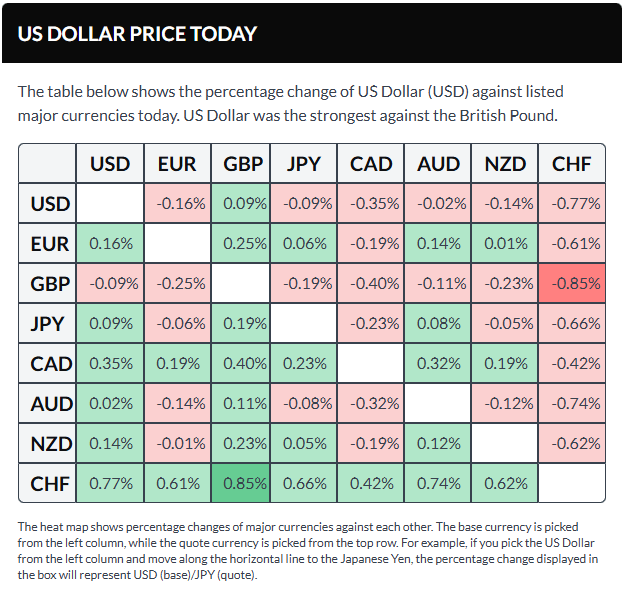

The U.S. dollar weakened this week amid ongoing geopolitical tensions and renewed uncertainty over U.S. trade policy. The setback followed a ruling by the Supreme Court of the United States declaring the Trump administration’s tariffs illegal, prompting President Donald Trump to announce a fresh round of levies. Even stronger-than-expected Producer Price Index (PPI) data failed to revive the greenback.

The U.S. Dollar Index (DXY) hovered near the 97.60 area, down about 0.20% on the day and ending the week modestly lower, as traders remained cautious amid trade and geopolitical uncertainty.

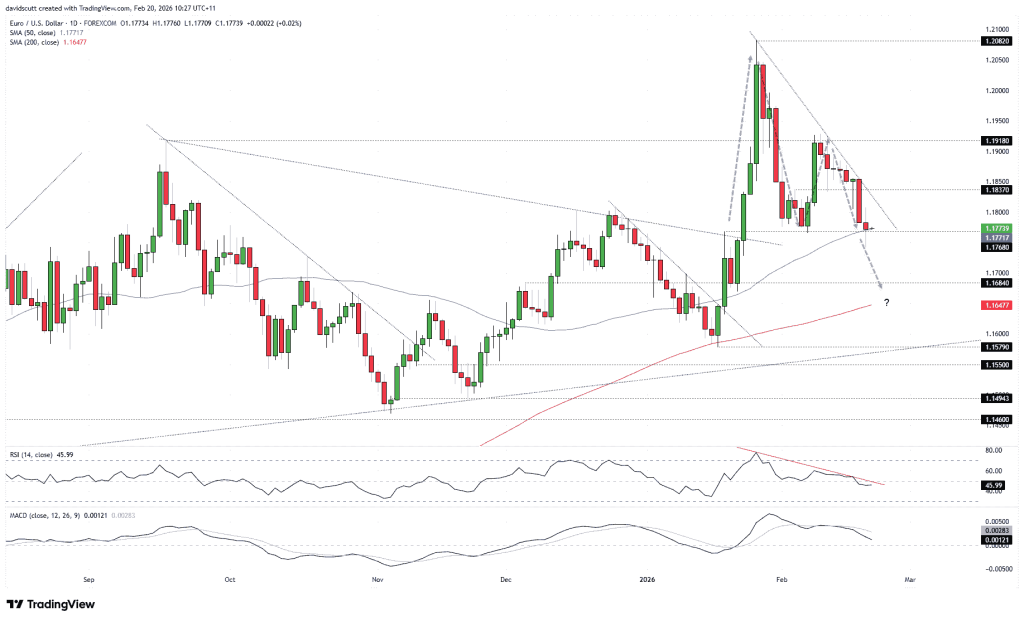

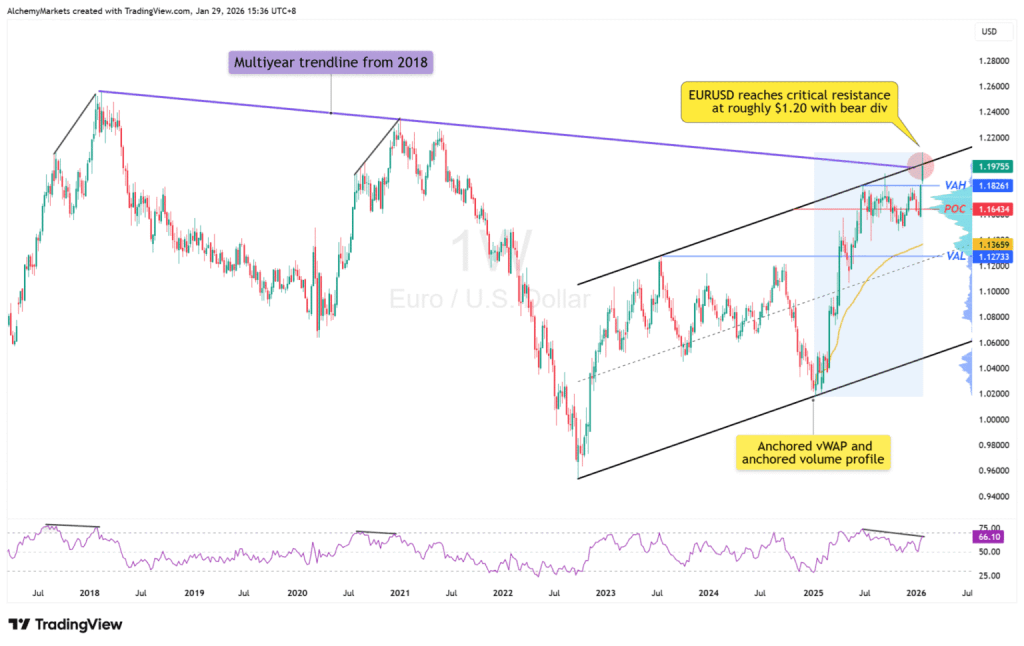

EUR/USD traded around 1.1810, edging higher during the U.S. session after Germany’s flash Harmonized Index of Consumer Prices (HICP) for February came in softer than expected at 2% year-on-year (vs. 2.1% forecast) and 0.4% month-on-month (vs. 0.5%). Investors also evaluated testimony from Christine Lagarde, President of the European Central Bank, before the European Parliament. Lagarde reiterated that inflation is gradually returning to the 2% target and said she intends to complete her term, dismissing speculation about an early departure.

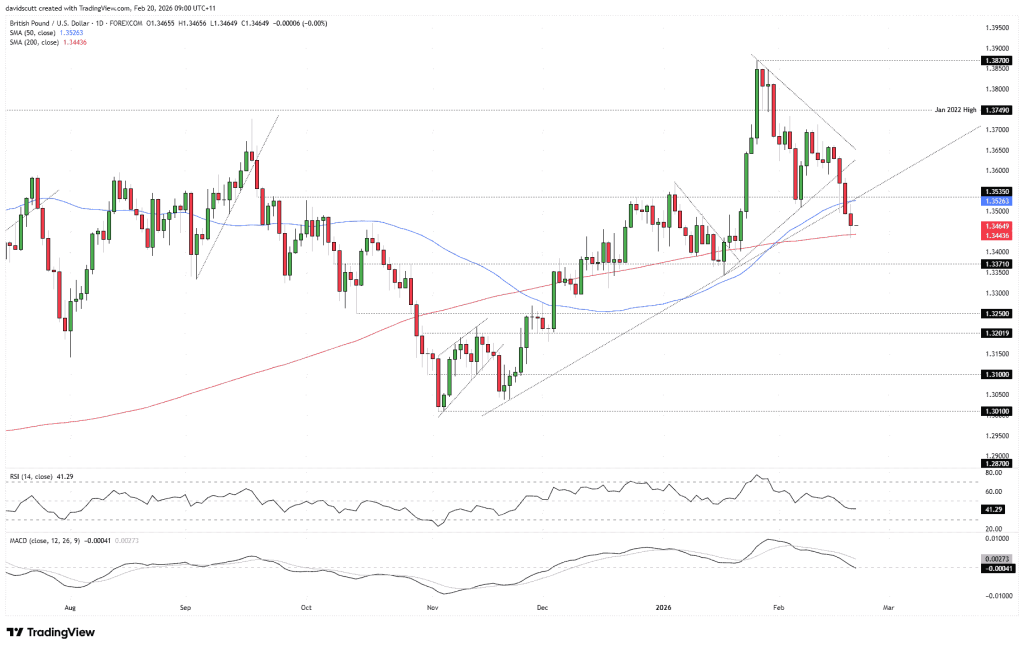

GBP/USD hovered near 1.3470, rebounding after nearly revisiting a one-month low earlier in February. Meanwhile, Andrew Bailey, Governor of the Bank of England, indicated there is room for rate cuts as inflation is expected to move back toward the 2% target.

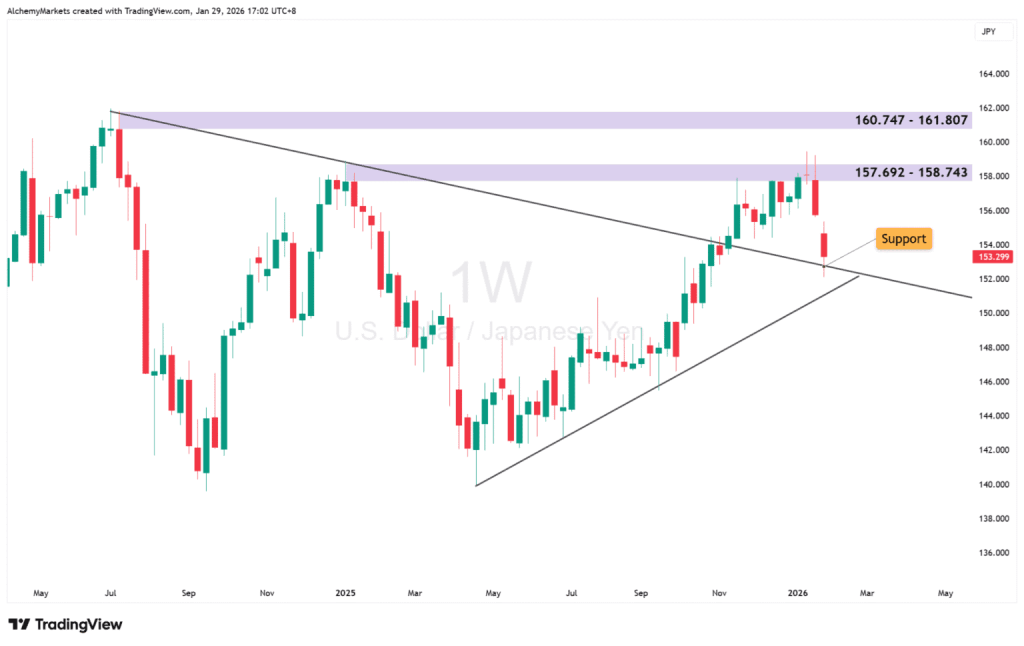

USD/JPY traded near 156.00, stabilizing after recouping most of its intraday losses. Tokyo’s February CPI rose 1.6% year-on-year, with the core measure excluding fresh food falling below the Bank of Japan’s 2% target for the first time since 2024.

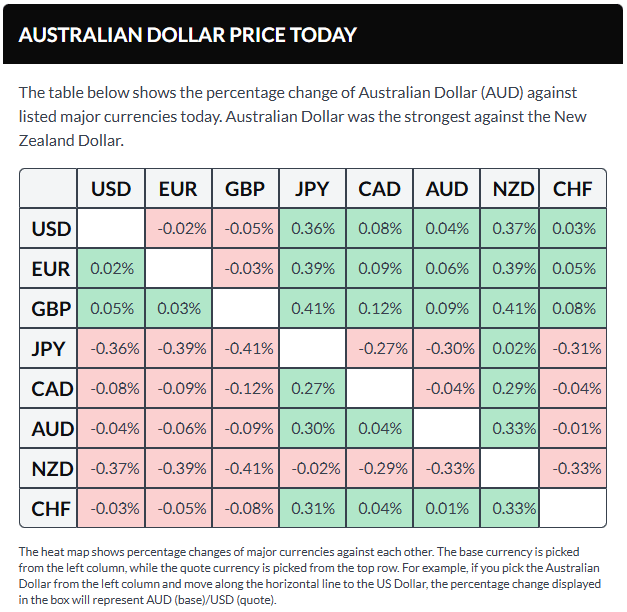

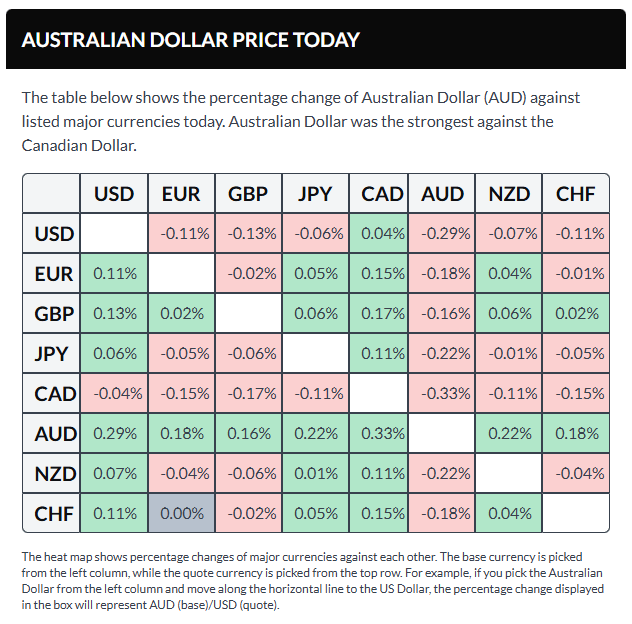

AUD/USD climbed back toward 0.7120, turning positive after reversing earlier declines. Attention now shifts to Australia’s TD-MI Inflation Gauge, due Monday.

USD/CAD hovered around 1.3630, marking nearly a two-week low, as markets assessed economic data from both sides of the border. According to Statistics Canada, Canada’s GDP contracted at an annualized 0.6% rate in the fourth quarter, following a revised 2.4% expansion in Q3.

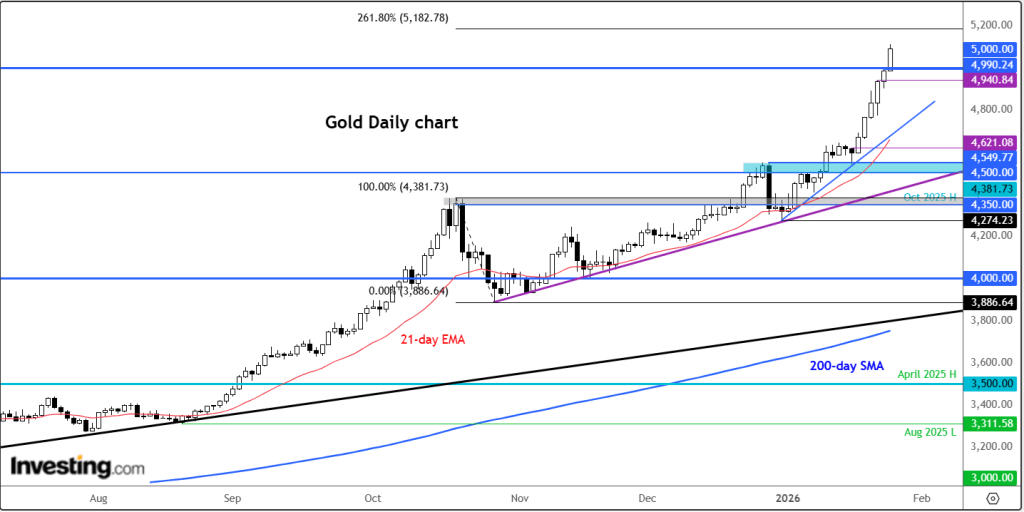

Gold traded near $5,260, reaching a one-month high amid persistent geopolitical uncertainty. The precious metal is attempting to retest its all-time high of $5,598 set earlier this year.

Anticipating economic perspectives: Key voices in focus

Sunday, March 1

- Joachim Nagel – European Central Bank

Monday, March 2

- Frank Elderson – European Central Bank

- Joachim Nagel – European Central Bank

- Christine Lagarde – European Central Bank

- Dave Ramsden – Bank of England

- Michele Bullock – Reserve Bank of Australia

Tuesday, March 3

- Kazuo Ueda – Bank of Japan

- John C. Williams – Federal Reserve

- Olaf Sleijpen – European Central Bank

- Martin Kocher – European Central Bank

- Neel Kashkari – Federal Reserve

Wednesday, March 4

- Piero Cipollone – European Central Bank

- Tiff Macklem – Bank of Canada

- Luis de Guindos – European Central Bank

Thursday, March 5

- Luis de Guindos – European Central Bank

- Martin Kocher – European Central Bank

- Christine Lagarde – European Central Bank

Friday, March 6

- Piero Cipollone – European Central Bank

- Mary Daly – Federal Reserve

- Beth Hammack – Federal Reserve

- Scott Paulson – Federal Reserve

Central bank meetings and key data releases set to steer monetary policy outlook

Monday, March 2

- Australia: TD-MI Inflation Gauge

- China: February RatingDog Manufacturing PMI

- Germany: January Retail Sales

- Switzerland: January Real Retail Sales

- Spain: February HCOB Manufacturing PMI

- Italy: February HCOB Manufacturing PMI

- Germany: February HCOB Manufacturing PMI

- Canada: February S&P Global Manufacturing PMI

- U.S.: February ISM Manufacturing Employment Index

- U.S.: February ISM Manufacturing New Orders Index

- U.S.: February ISM Manufacturing PMI

- U.S.: February ISM Manufacturing Prices Paid

- New Zealand: January Building Permits (s.a.)

- Japan: January Unemployment Rate

Tuesday, March 3

- Australia: January Building Permits

- Eurozone: HICP (Harmonized Index of Consumer Prices)

- Italy: February flash CPI

- Australia: AiG Industry Index

- Australia: February S&P Global Composite PMI

- Australia: February S&P Global Services PMI

Wednesday, March 4

- Australia: Q4 GDP

- China: February NBS Manufacturing PMIs

- China: February RatingDog Services PMI

- Switzerland: February CPI

- Spain: February HCOB PMI

- Germany: February HCOB PMI

- Eurozone: February HCOB PMIs

- Eurozone: January PPI

- Italy: Q4 GDP

- U.S.: ADP Employment Change

- U.S.: February S&P Global Composite PMI

- U.S.: February ISM Services Employment Index

- U.S.: February ISM Services New Orders Index

- U.S.: February ISM Services PMI

- U.S.: February ISM Services Prices Paid

- U.S.: Federal Reserve Beige Book

Thursday, March 5

- Australia: January Trade Balance

- Eurozone: January Retail Sales

- U.S.: February Challenger Job Cuts

- U.S.: Initial Jobless Claims

- U.S.: Flash Nonfarm Productivity (Q4)

- U.S.: Flash Unit Labor Costs (Q4)

Friday, March 6

- Germany: January Factory Orders (n.s.a.)

- Eurozone: Employment Change (Q4)

- Eurozone: GDP (QoQ) (Q4)

- U.S.: February Average Hourly Earnings

- U.S.: February Labor Force Participation Rate

- U.S.: February Nonfarm Payrolls

- U.S.: January Retail Sales

- U.S.: February U6 Underemployment Rate

- U.S.: February Unemployment Rate

- Canada: February Ivey PMIs

Sources: Agustin Wazne