Continuation Patterns are technical chart patterns that signal a temporary pause or consolidation in the market before the price continues in the same direction as the existing trend.

The trend takes a break — then continues.

Why Continuation Patterns Matter

Traders use them to:

- Identify trend-following entry points

- Add positions during pullbacks or consolidation

- Set clear breakout levels

- Manage risk more effectively

Common Types of Continuation Patterns

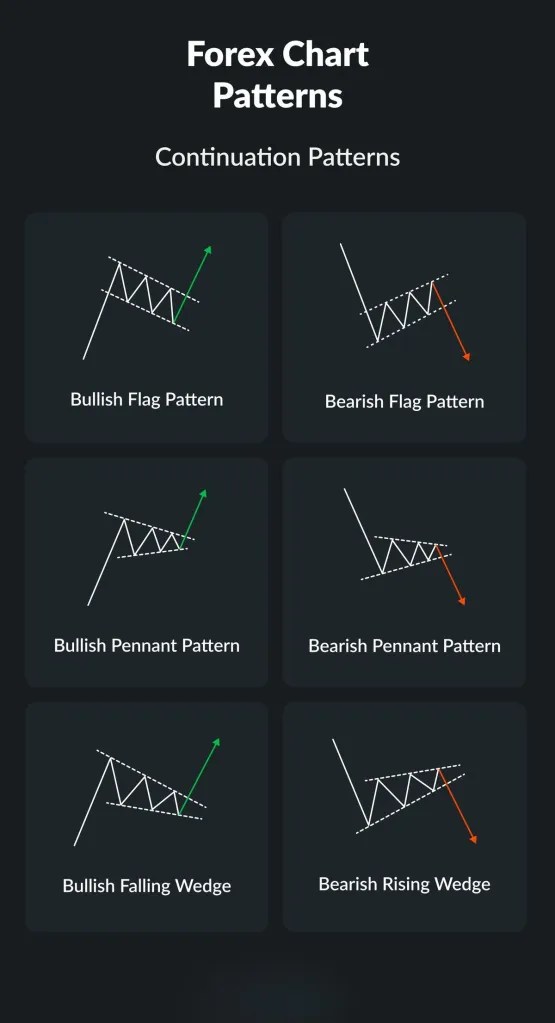

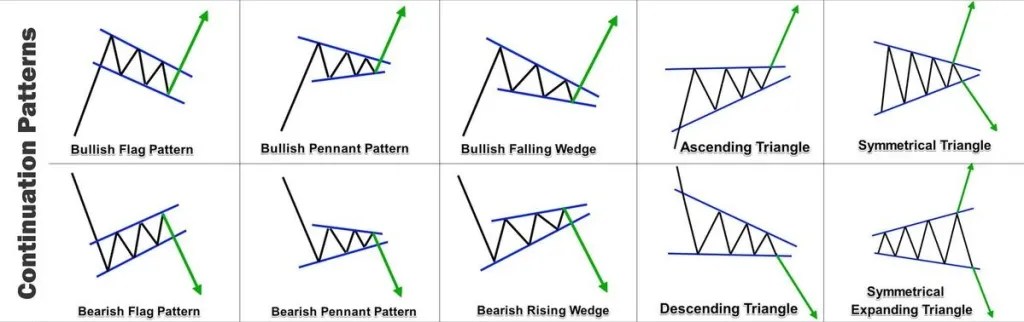

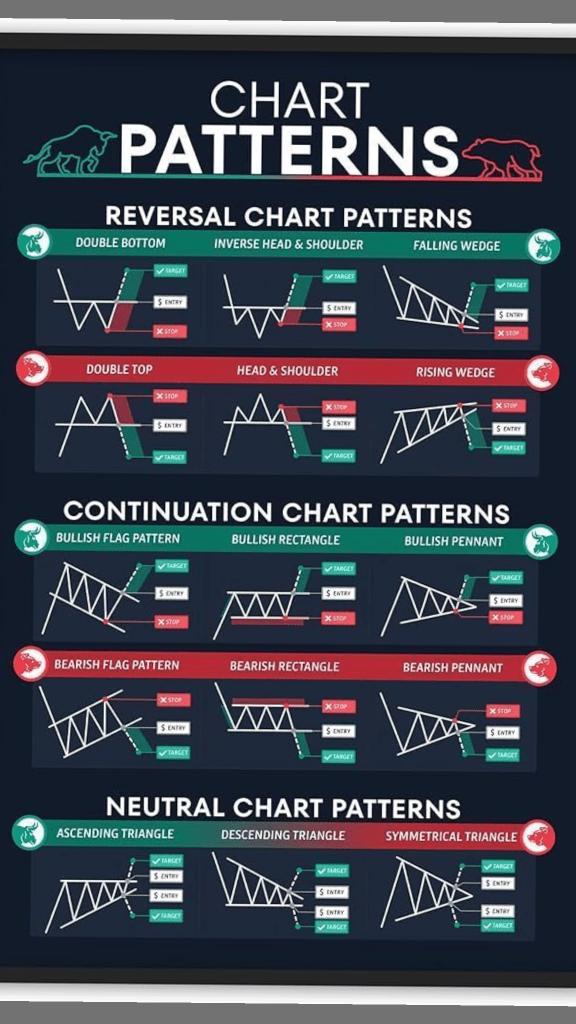

1️⃣ Flags

- Short-term consolidation after a strong move

- Slopes against the main trend

- Indicates strong momentum continuation

📌 Bull Flag / Bear Flag

2️⃣ Pennants

- Small symmetrical triangle after a sharp move

- Decreasing volume during consolidation

- Breakout usually follows the prior trend

3️⃣ Triangles

- Ascending Triangle → bullish continuation

- Descending Triangle → bearish continuation

- Symmetrical Triangle → continuation or breakout (needs confirmation)

4️⃣ Rectangles (Trading Range)

- Price moves between horizontal support and resistance

- Breakout direction usually follows the previous trend

5️⃣ Wedges (in some cases)

Falling wedge → bullish continuation

(context is very important)

Rising wedge → bearish continuation

Key Characteristics

✔ Occur mid-trend

✔ Volume often declines during consolidation

✔ Breakout volume typically expands

✔ Best used with trend confirmation tools

Continuation Patterns vs Reversal Patterns

Best Confirmation Tools

- Trendlines

- Support & Resistance

- Volume

- Moving Averages

- Fibonacci levels

Key Takeaway

Continuation patterns help traders stay with the trend rather than fight it.

They work best when aligned with strong trend structure and volume confirmation.