A CFD (Contract for Difference) is a derivative financial instrument where two parties (a trader and a broker) agree to exchange the difference in the price of an asset between the time the position is opened and closed.

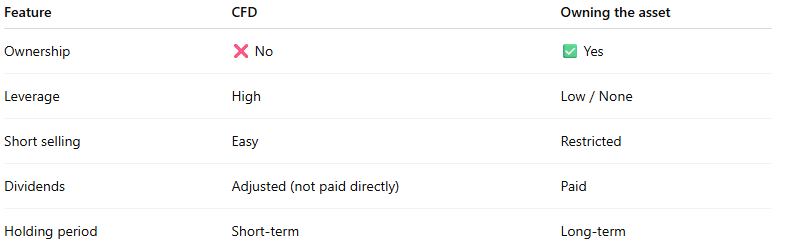

- You do NOT own the underlying asset (stock, gold, index, etc.).

- You are only trading price movements.

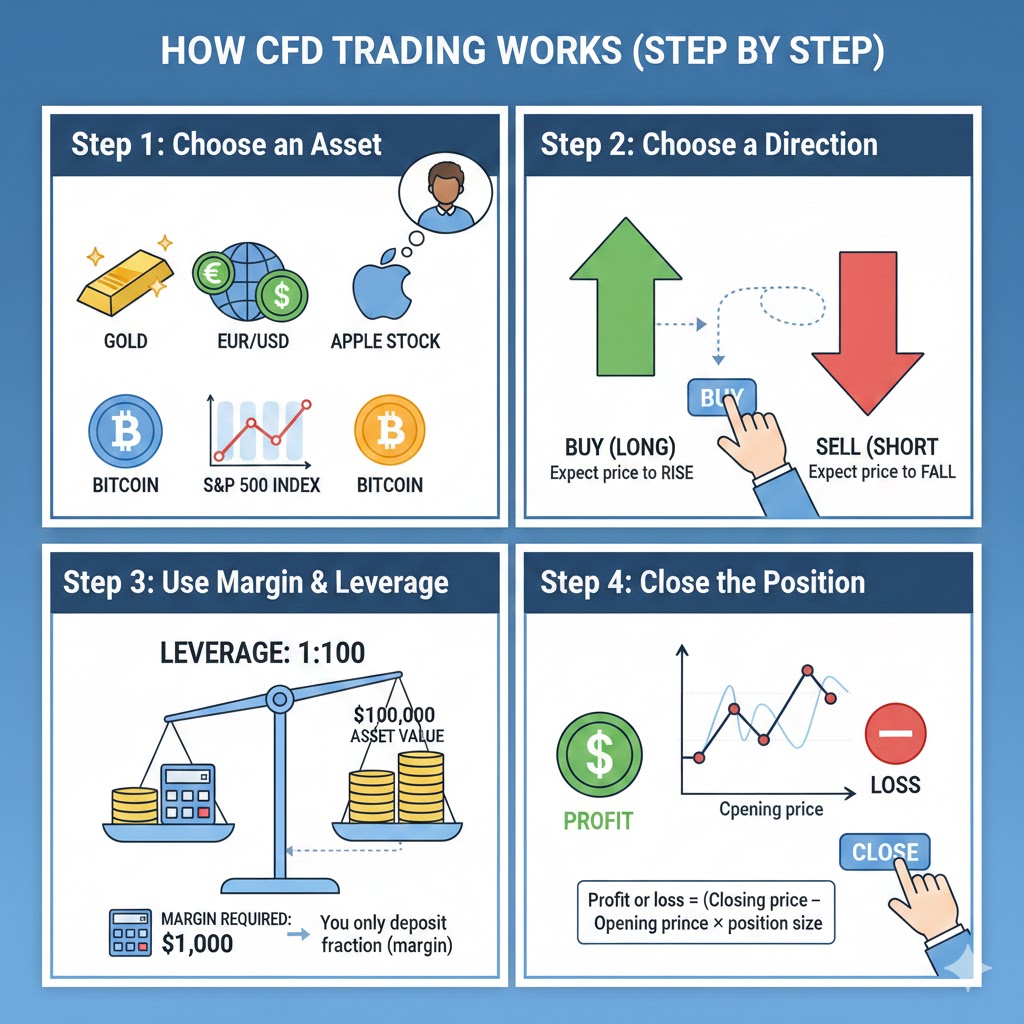

How CFD trading works (step by step)

Long vs Short (Very important)

🔼 Going Long

You profit when the price increases.

Example:

- Buy at 100

- Sell at 110

- Profit = +10

🔽 Going Short

You profit when the price decreases.

Example:

- Sell at 100

- Buy back at 90

- Profit = +10

⚠️ This ability to profit in falling markets is a key feature of CFDs.

Leverage explained in depth

Leverage allows you to control a large position with a small amount of capital.

| Leverage | Margin Required |

|---|---|

| 1:10 | 10% |

| 1:50 | 2% |

| 1:100 | 1% |

| 1:500 | 0.2% |

⚠️ Risk of leverage

- A 1% price move with 1:100 leverage = 100% gain or loss

- Losses can exceed expectations if risk is unmanaged

Costs in CFD trading

1️⃣ Spread

- Difference between Bid and Ask

- Paid when opening a trade

2️⃣ Commission

- Some brokers charge commission (usually on stocks)

3️⃣ Overnight / Swap fee

- Charged if you hold a position overnight

- Based on interest rate differentials

CFD vs Owning the asset

Markets available via CFDs

CFDs allow access to global markets from one account:

- Forex – currencies

- Commodities – gold, oil, silver

- Indices – Nasdaq, Dow Jones

- Stocks – global equities

- Cryptocurrencies – price exposure only

Are CFDs regulated?

- CFDs are legal and regulated in many jurisdictions

- Regulation depends on the broker’s license (FCA, ASIC, CySEC, etc.)

- Some countries restrict or ban retail CFD trading

👉 Broker selection is critical.

Key advantages & disadvantages

✅ Advantages

- Trade rising and falling markets

- High capital efficiency

- Access to global markets

- Fast execution

❌ Disadvantages

- High risk due to leverage

- No ownership benefits

- Psychological pressure

- Broker dependency