- The Australian Dollar ended its three-day slide on Monday.

- ANZ reported a 0.5% decline in job advertisements for December, following a revised 1.5% drop in the previous month.

- Meanwhile, the US Dollar weakened after federal prosecutors launched a criminal investigation into Federal Reserve Chair Jerome Powell.

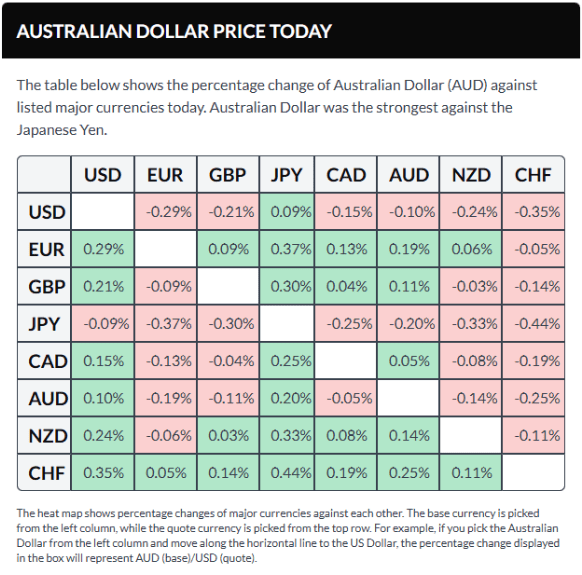

The Australian Dollar (AUD) gained ground against the US Dollar (USD) on Monday, reversing a three-day losing streak. The AUD/USD pair rose as the Greenback weakened, partly due to growing concerns about the Federal Reserve.

Federal prosecutors have launched a criminal investigation into Fed Chair Jerome Powell, focusing on the central bank’s renovation of its Washington headquarters and allegations that Powell may have misled Congress about the project’s details, according to a New York Times report on Sunday.

ANZ Job Advertisements fell by 0.5% in December, following a revised 1.5% decline in November. Meanwhile, household spending rose 1.0% month-on-month in November 2025, slowing from a revised 1.4% increase in October, reflecting consumer caution amid high interest rates and ongoing inflation.

Australia’s mixed Consumer Price Index (CPI) report for November has left the Reserve Bank of Australia’s (RBA) policy direction uncertain. However, RBA Deputy Governor Andrew Hauser stated that the inflation data largely met expectations and indicated that interest rate cuts are unlikely in the near term. Attention now turns to the quarterly CPI report due later this month for clearer insight into the RBA’s upcoming policy decisions.

US Dollar Slides Amid Federal Reserve Uncertainty

The US Dollar Index (DXY), which tracks the Dollar against six major currencies, is weakening and trading near 98.90 amid expectations of a dovish Federal Reserve. Slower-than-anticipated US job growth in December suggests the Fed may keep interest rates steady at its upcoming January meeting.

US Nonfarm Payrolls increased by 50,000 in December, below November’s revised 56,000 and the expected 60,000. Meanwhile, the unemployment rate fell to 4.4% from 4.6%, and average hourly earnings rose to 3.8% year-over-year from 3.6%.

CME Group’s FedWatch tool shows about a 95% chance that the Fed will hold rates steady on January 27–28. Richmond Fed President Tom Barkin welcomed the unemployment drop, describing job growth as modest but steady. He noted hiring remains limited outside healthcare and AI sectors and expressed uncertainty about whether the labor market will see more hiring or layoffs going forward.

US Treasury Secretary Scott Bessent told CNBC on Thursday that the Federal Reserve should continue cutting interest rates, emphasizing that lower rates are the “only ingredient missing” for stronger economic growth and urging the Fed not to delay.

The US Department of Labor reported that Initial Jobless Claims rose slightly to 208,000 for the week ending January 3, just below expectations of 210,000 but above the previous week’s revised 200,000. Continuing claims increased to 1.914 million from 1.858 million, signaling a gradual rise in those receiving unemployment benefits.

The Institute for Supply Management (ISM) revealed that the US Services PMI climbed to 54.4 in December from 52.6 in November, surpassing expectations of 52.3.

ADP data showed a gain of 41,000 jobs in December, improving from a revised 29,000 job loss in November, though slightly below the expected 47,000. Meanwhile, JOLTS job openings dropped to 7.146 million in November from a revised 7.449 million in October, missing forecasts of 7.6 million.

China’s Consumer Price Index (CPI) increased by 0.8% year-over-year in December, up from 0.7% in November but slightly below the 0.9% forecast. On a monthly basis, CPI rose 0.2%, reversing November’s 0.1% decline. Meanwhile, China’s Producer Price Index (PPI) fell 1.9% year-over-year in December, improving from a 2.2% drop the previous month and slightly beating expectations of a 2.0% decline.

Australia’s trade surplus narrowed to 2.936 billion AUD in November, down from a revised 4.353 billion AUD in October. Exports declined 2.9% month-on-month in November, following a revised 2.8% increase the previous month. Imports edged up 0.2% in November, slowing from a revised 2.4% gain in October.

AUD rebounds, testing upper boundary of rising channel around 0.6700

On Monday, AUD/USD trades near 0.6700 as the pair attempts a rebound toward an ascending channel, indicating a renewed bullish outlook. The 14-day RSI at 58.33 remains above the neutral midpoint, supporting upward momentum.

A sustained move back into the channel would reinforce the bullish trend, potentially pushing the pair toward 0.6766—the highest level since October 2024. Further upside could target the channel’s upper resistance near 0.6860.

Immediate support is found at the nine-day EMA around 0.6700, followed by the 50-day EMA at 0.6631. A break below these levels could open the path to 0.6414, the lowest point since June 2025.

Sources: Fxstreet