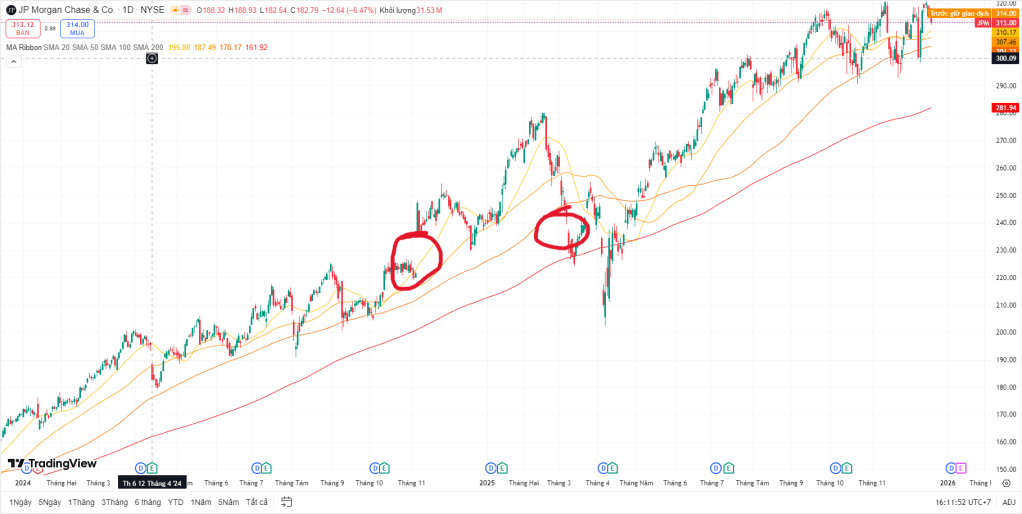

Price Gaps are areas on a price chart where no trading occurs between two consecutive periods, causing the price to “jump” up or down instead of moving smoothly.

A gap appears when the market opens significantly higher or lower than the previous close.

How Price Gaps Form

Price gaps usually happen because of:

- 📰 News or economic announcements

- 📊 Earnings reports

- 🌍 Geopolitical events

- ⏱️ After-hours or weekend trading (stocks & crypto)

Gap Fill (Important Concept)

- A gap fill happens when price returns to trade within the gap area

- Common gaps usually fill

- Breakaway & runaway gaps may not fill immediately

📌 Rule of thumb:

The faster a gap fills, the weaker the signal

How Traders Use Price Gaps

- 📍 Identify trend direction

- 🎯 Set entry & exit points

- 🛑 Place stop-loss levels

- 📊 Combine with volume, support & resistance, candlestick patterns

Markets Where Gaps Are Common

- 📈 Stocks (very common)

- 💱 Forex (mainly weekend gaps)

- 🪙 Crypto (less frequent but possible)