The Moving Average is the average of a selected range of prices, usually closing prices, over a specific number of periods (e.g., days, hours).

Purpose: To highlight the trend direction by smoothing price data.

Common Moving Average Periods (in days)

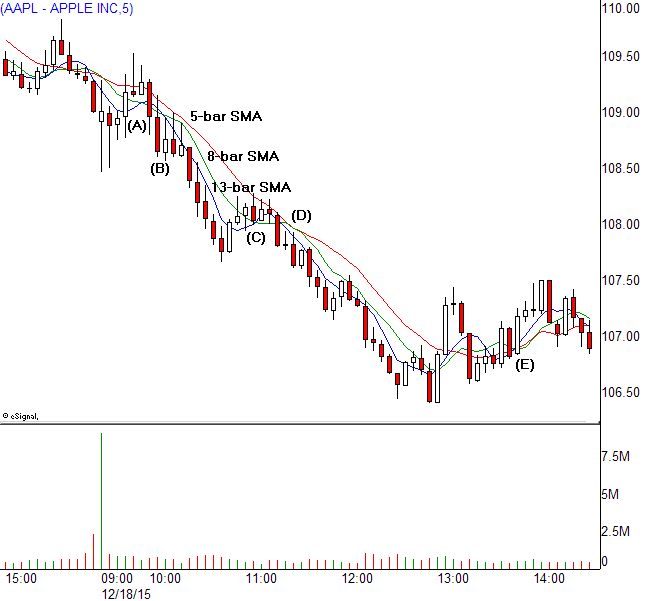

- Short-term MAs:

- 5-day, 10-day, 14-day

- Used for quick, responsive trend signals

- Useful for day trading or short-term swing trading

- Medium-term MAs:

- 20-day, 50-day

- Often used to identify intermediate trends

- Popular among swing traders and position traders

- Long-term MAs:

- 100-day, 200-day

- Used to spot long-term trend direction

- Very common for investors and longer-term traders

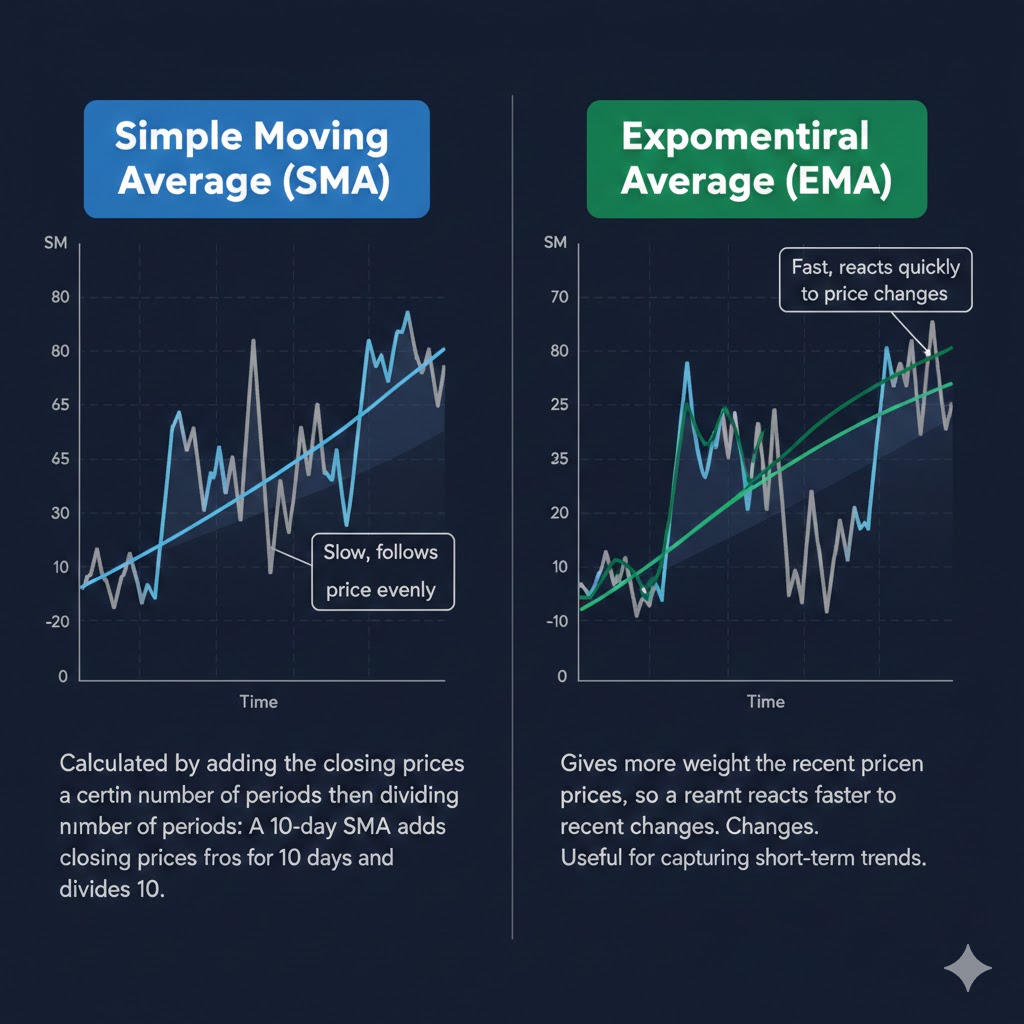

Types of Moving Averages

How Moving Averages Are Used

- Trend Identification:

- When price is above the MA, the trend is usually considered up.

- When price is below the MA, the trend is usually considered down.

- Support and Resistance:

- MAs can act as dynamic support or resistance levels.

- Crossovers:

- When a short-term MA crosses above a long-term MA, it can signal a potential buy (bullish crossover).

- When it crosses below, it may signal a sell (bearish crossover).

How to Choose the Number of Days?

- Shorter MA (e.g., 5 or 10 days): More sensitive to price changes but more prone to false signals.

- Longer MA (e.g., 100 or 200 days): Smoother and better for filtering out noise, but slower to react.