Microsoft Corp. stock has risen over 15% in 2025 and remains up about 3% in the last month despite a recent tech sell-off.

However, investors have mixed feelings as the stock trades roughly 12% below its 52-week high reached in late October. Analyst sentiment remains bullish, yet elevated short interest—up nearly 27% in the past month—continues to weigh on the shares.

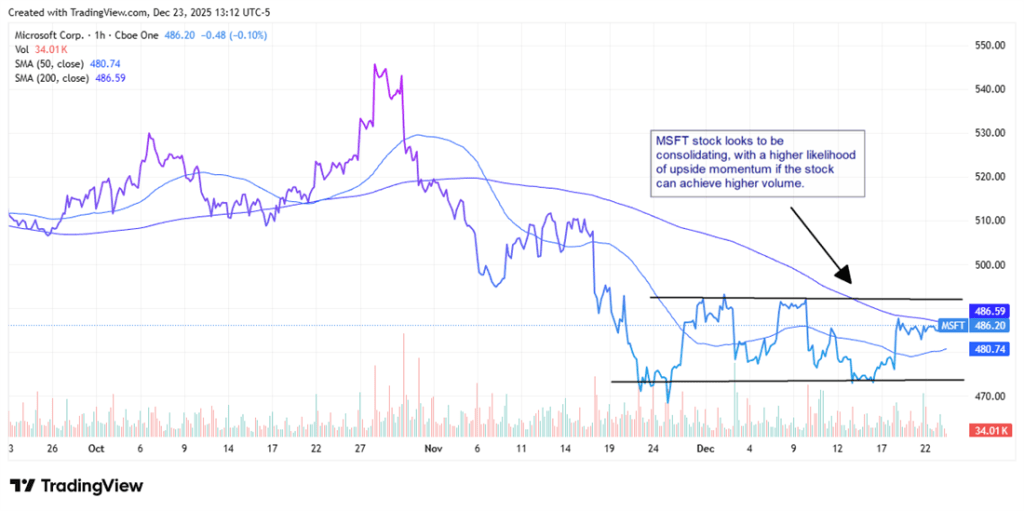

Positively, Microsoft appears to have found solid support around $473 per share recently. At the same time, it faces resistance near $493, indicating either a phase of healthy consolidation or lingering investor concerns about valuation amid potential business challenges.

Market watchers will be closely monitoring whether MSFT can break above this resistance zone to resume its upward momentum.

Why Some Investors Remain Cautious on Microsoft Stock

Despite trading at about 37x forward earnings, only a slight premium to its historical average, many investors still view Microsoft as expensive.

A key concern centers on Microsoft’s Copilot AI initiative—the company’s agentic AI solution—which recent reports suggest has yet to gain the broad adoption that was initially expected.

Meanwhile, Microsoft’s close relationship with OpenAI has been a significant growth driver throughout 2024 and 2025, providing a first-mover advantage in artificial intelligence.

However, as competition in the AI sector intensifies, OpenAI is beginning to be seen by some investors as a potential liability rather than an unqualified asset, raising questions about Microsoft’s future AI positioning.

Microsoft’s Switching Costs Remain a Powerful Competitive Moat

Microsoft exemplifies a company with a robust competitive moat, anchored by its deeply embedded platforms across enterprise ecosystems. Its Windows 365 and Office suites are integral to daily workflows, while Azure forms a foundational pillar of global cloud infrastructure.

This deep integration creates extremely high switching costs for customers. As organizations increasingly adopt Microsoft’s ecosystem—including Copilot-branded AI features embedded within productivity and business applications—the combined value of the suite grows stronger through network effects.

Replacing Microsoft’s stack involves not only migrating identity management, productivity, collaboration, and data platforms but also the growing AI components. Such a transformation is complex, costly, and time-consuming, often spanning years and involving millions in expenses.

Moreover, long-term licensing agreements, potential penalties, and the significant risk of business disruption make a full-scale switch a critical, board-level decision—one many CIOs approach with caution rather than as a routine vendor change.

Technical Indicators Suggest Potential Turning Point for MSFT

Microsoft shares surged following cooler-than-expected inflation data for November, easing fears of an AI-driven bubble.

As a key player in AI, Microsoft has committed billions to expanding data center capacity to support its ambitious AI projects. The recent price action and technical signals may indicate a potential inflection point as investors reassess the company’s growth outlook amid a changing macro environment.

Technical indicators like the MACD and Relative Strength Index (RSI) currently signal a neutral stance for Microsoft stock. What is notably missing at this stage is strong trading volume.

A bullish scenario would see MSFT pushing above its 50-day simple moving average (SMA), potentially signaling upward momentum. Conversely, a Death Cross—where the 50-day SMA falls below the 200-day SMA—could herald further downside risk as the new year begins.

Volume will be crucial to confirm any sustained move. While a Santa Claus rally could provide near-term upside, investors are likely to wait for the new year to determine if gains can hold.

Sources: Investing