Leverage is the use of borrowed resources (money or financial instruments) to increase exposure to an investment or activity, aiming to amplify potential returns.

Leverage = controlling a larger position with a smaller amount of your own capital

How it works

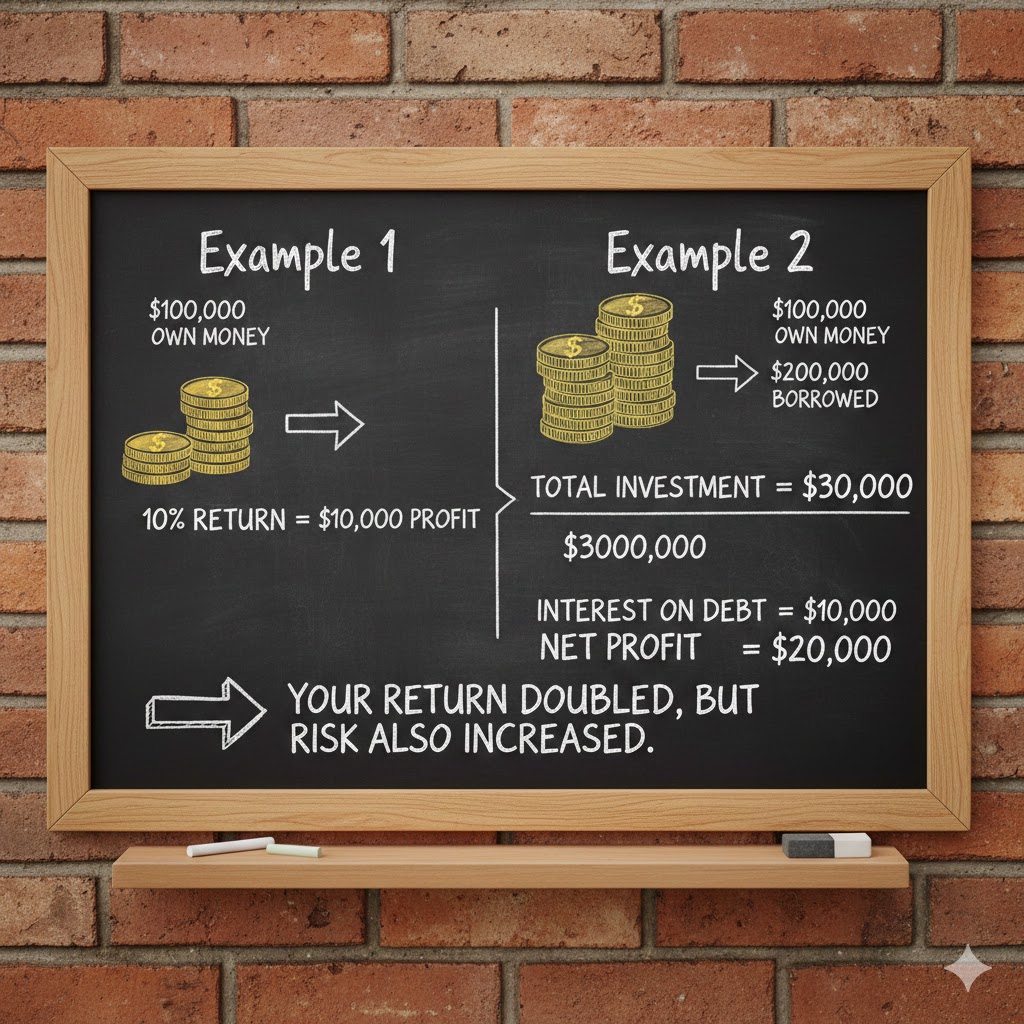

When a company or investor uses debt instead of only their own capital:

- If returns are higher than the cost of debt, leverage amplifies profits

- If returns are lower than the cost of debt, leverage amplifies losses

So leverage increases both opportunity and risk.

Where financial leverage is used

- Corporate finance (business expansion, acquisitions)

- Investment & trading (stocks, derivatives, forex, crypto)

- Real estate (mortgages)

- Private equity & IPO structuring

Key takeaway

Financial leverage magnifies outcomes:

higher leverage = higher potential return + higher risk.

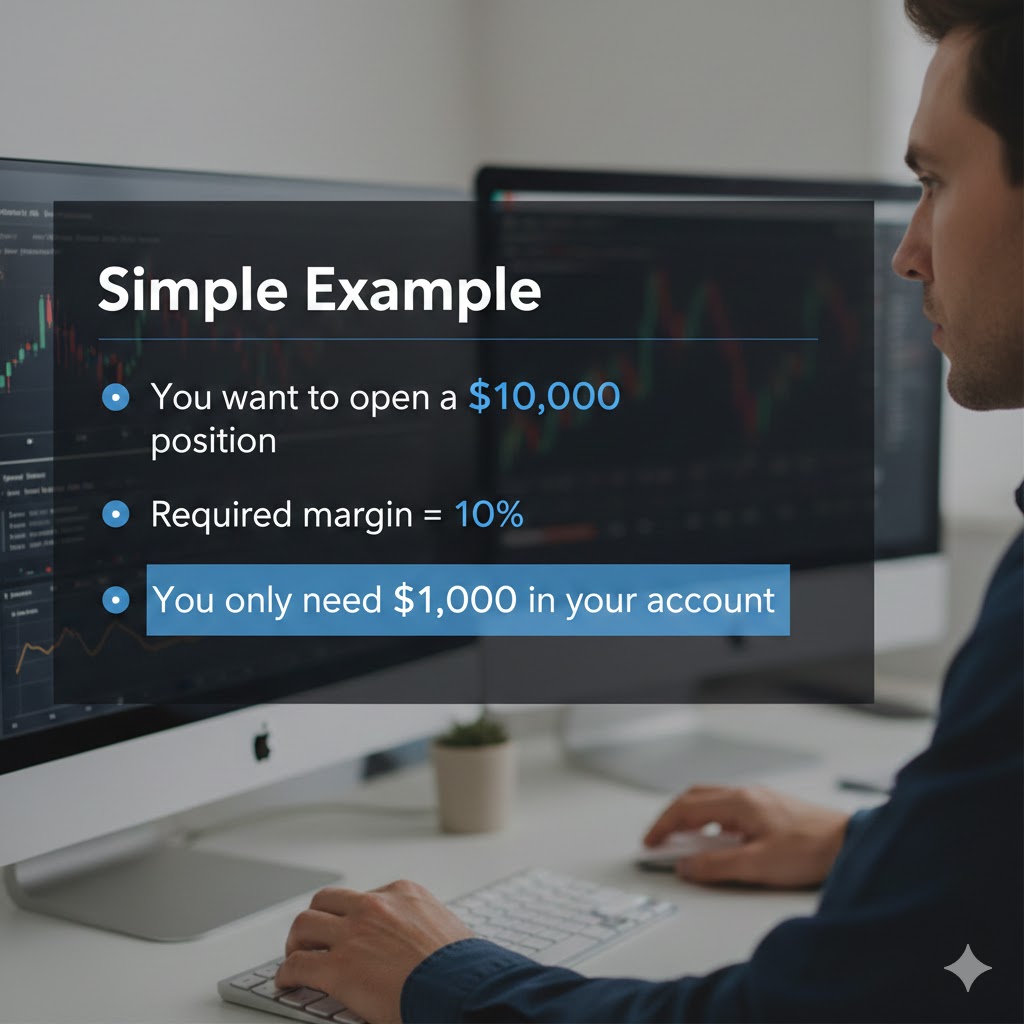

Margin is the money you deposit with a broker to open and maintain a leveraged trading position.

Margin is a security deposit, not a fee, that allows you to trade a larger position than your actual cash.

How margin works

- You deposit a small amount of capital (margin)

- The broker allows you to control a larger position

- The remaining amount is effectively borrowed from the broker

Key Margin Terms

Key takeaway

Margin enables leverage, but poor margin management is the main cause of trading losses.