Optimized Summary

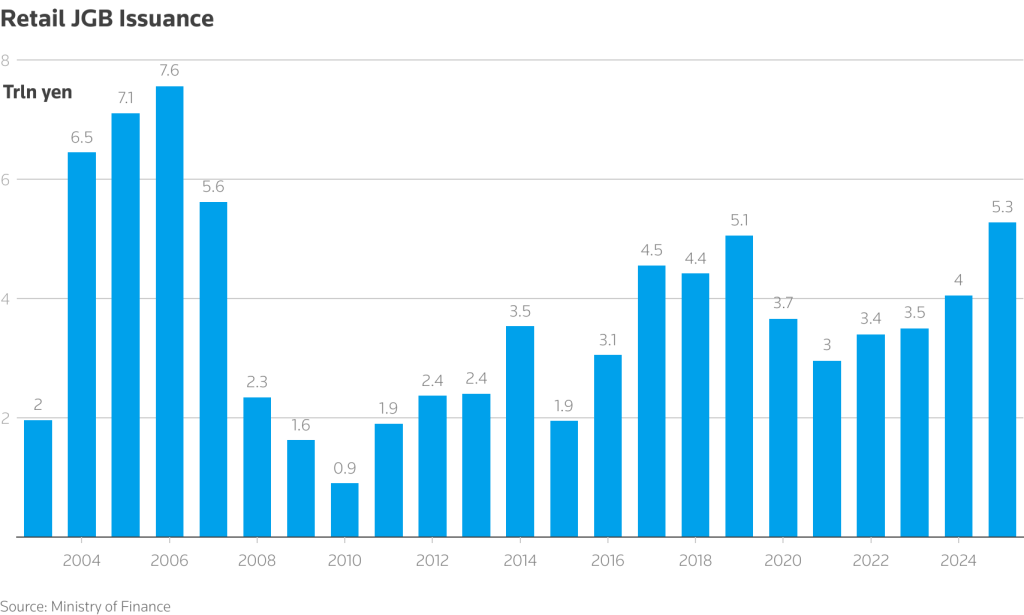

- Retail JGB sales surged in 2025 to their highest level since 2007

- Japan’s Finance Ministry expanded the range of retail government bonds

- Investment trusts tied to 30-year JGBs were launched amid a sharp rise in yields

Japan is turning to its $7 trillion household savings pool to bolster bond demand, planning to introduce new products and incentives as strong recent retail sales gain momentum and central bank purchases decline.

Efforts to attract Japanese households are not new. In 2010, the Finance Ministry introduced the mascot Kokusai-sensei, or “Professor JGB,” to promote government bonds, and later even offered gold coins to buyers of special reconstruction bonds.

But where mascots and shiny metals struggled, higher yields have succeeded in drawing in buyers this year. Retail Japanese government bond (JGB) sales jumped 30.5% in 2025 to 5.28 trillion yen ($33.55 billion), the highest since 2007.

Enthused by strong momentum, at a meeting with more than a dozen institutional investors in late November, the finance ministry faced calls to step up efforts to attract retail buyers, minutes of the meeting released by the ministry showed.

Broadening the investor base for JGBs has become critical for market stability as Prime Minister Sanae Takaichi’s reflationary policies fuel concerns about the government’s plans to borrow and spend.

FINDING NEW INVESTORS

Japan’s 10-year government bond yield surged above the 2% threshold on Friday for the first time in 26 years, after the Bank of Japan raised interest rates to their highest level in three decades and signalled further policy tightening ahead.

Households are increasingly viewed as a critical source of new demand as the BOJ scales back its bond purchases, while commercial banks face constraints on bond-buying capacity due to capital rules limiting interest rate risk exposure.

However, retail JGBs have historically been difficult to sell, as they typically offer lower yields than bonds marketed to banks.

Currently, domestic households hold less than 2% of the ¥1.06 quadrillion in outstanding JGBs, even though roughly half of Japan’s ¥2.20 quadrillion in household financial assets remains parked in cash or low-yield deposits.

HIGHER YIELDS

In recent months, Daiwa Asset Management and Amova Asset Management launched investment trusts focused on 30-year JGBs, targeting domestic retail investors for the first time.

Amova began developing the trust when the 30-year JGB yield reached 3%, said Takuya Kanazawa, senior vice president of the firm’s product development department. The yield first surpassed 3% in May and climbed to a record 3.445% on Monday.

“The 3% yield is high enough to outpace inflation,” Kanazawa noted.

“When retail investors consider high-yield debt, they usually look at U.S. or Australian bonds, but those carry currency risks,” he added. “This fund offers higher yields without such risks.”

Revamping Retail JGBs to Boost Household Ownership

NUCB Business School professor Nana Otsuki, who participated in the Finance Ministry’s investor meeting, suggested that household ownership of JGBs could rise to 5–6% if product designs are revamped.

“Encouraging people to hold government bonds would be a meaningful step forward, fostering a sense of responsibility aligned with the Takaichi administration’s ‘responsible proactive fiscal policy,’” she said.

In response to investor proposals, a senior Finance Ministry official told Reuters the government plans to expand the retail JGB target market from January 2027 to include non-profit corporations and unlisted companies. The ministry is also collecting opinions on additional measures.

The University of Tokyo’s Center for Applied Capital Markets Research, where Otsuki is a fellow, recently urged the government to overhaul retail JGB products to make them more attractive. Proposed reforms include making retail JGBs eligible for NISA tax-free investment accounts and revising the coupon-setting formula, which currently discounts benchmark yields in exchange for principal protection.

Takahiro Otsuka, senior fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities, pointed to Italy’s example, where retail bond sales were boosted by incentives such as higher coupons rewarding longer holding periods.

“That said, such incentives are essentially akin to tax breaks, raising questions about the trade-offs involved,” Otsuka noted.

(Current exchange rate: $1 = 157.3600 yen)

Sources: Reuters