The difference between investment and speculation lies mainly in objectives, time horizon, decision-making approach, and risk level. In simple terms:

Investment

Allocating capital to an asset with intrinsic value, expecting it to grow sustainably over time and/or generate cash flow.

Key characteristics

- ⏳ Long-term (several years or more)

- 🔍 Based on fundamental analysis (financials, business model, management quality, industry outlook, etc.)

- 💰 Focused on stable, sustainable returns

- ⚖️ Controlled risk

- 📈 Willing to tolerate short-term volatility

Examples

- Buying shares of a strong company and holding for 5–10 years

- Investing in rental real estate

- Investing in a Shan Tuyet tea business to build a long-term brand and ecosystem

Speculation

Allocating capital to profit from short-term price movements, with little emphasis on intrinsic value.

Key characteristics

- ⚡ Short-term (days, weeks, or a few months)

- 📊 Heavily reliant on technical analysis, news, and market sentiment

- 🎯 Aimed at quick profits

- 🔥 High risk

- 💥 Significant losses if the market moves against expectations

Examples

- Short-term stock trading based on rumors

- Short-term forex or crypto trading

- Buying assets simply because “prices are rising fast”

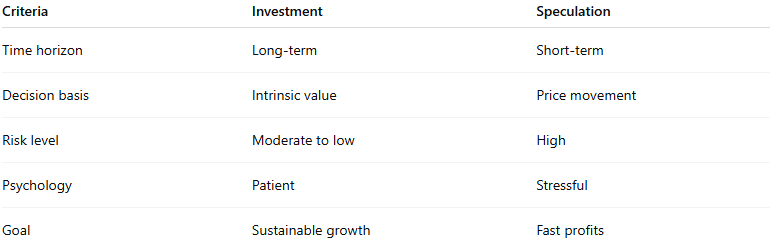

Quick comparison

An important point

It is not the asset itself that determines whether an activity is investment or speculation, but how it is used.