Inflation and deflation describe opposite movements in the general price level of goods and services in an economy, and both have significant impacts on economic activity, businesses, and individuals.

Inflation

Inflation is a sustained increase in the general price level over time, which reduces the purchasing power of money.

Key characteristics:

- Money buys less over time

- Usually measured by indicators like the Consumer Price Index (CPI)

- Moderate inflation is considered normal in growing economies

Effects

- Higher living costs

- Borrowers benefit, savers lose purchasing power

- Can encourage spending and investment if inflation is stable and predictable

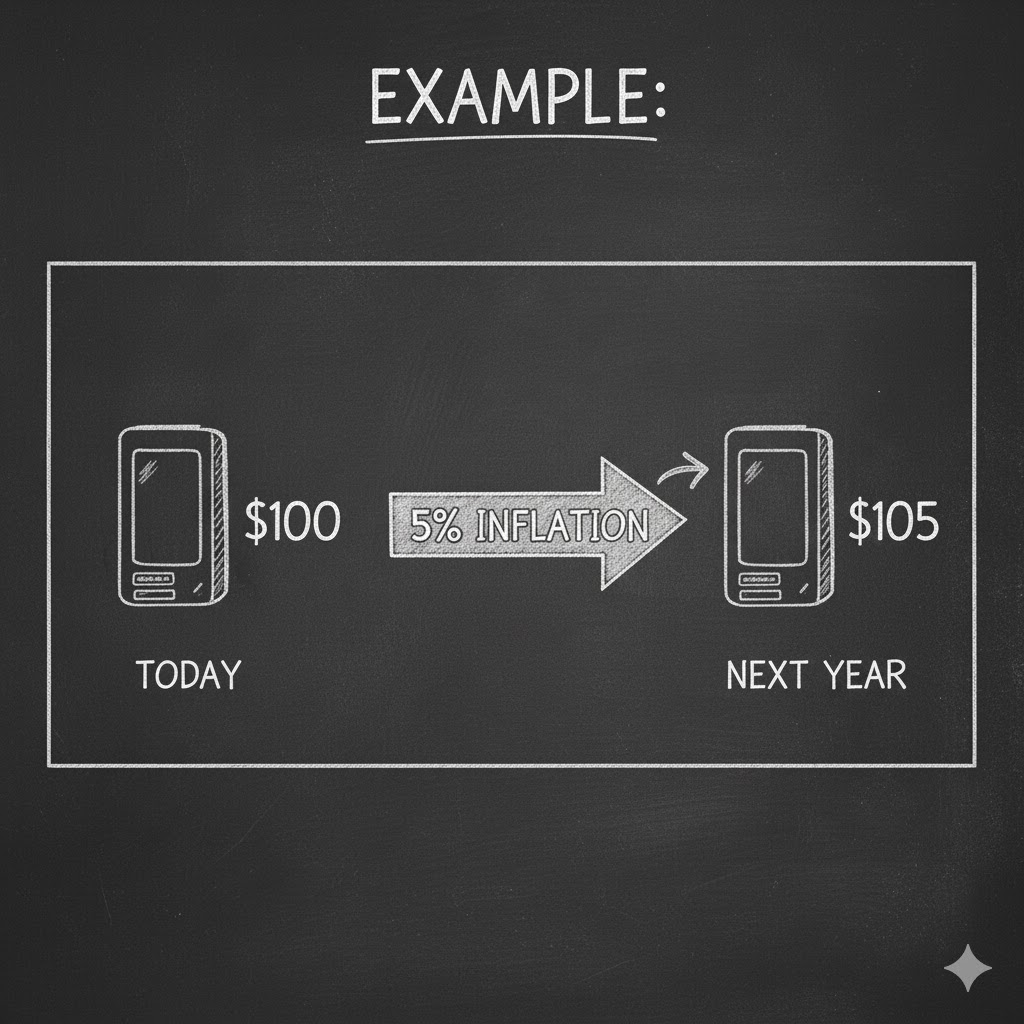

If inflation is 5% per year, an item costing $100 today will cost $105 next year.

Deflation

Deflation is a sustained decrease in the general price level, increasing the purchasing power of money.

Key characteristics

- Money buys more over time

- Often associated with economic slowdowns or recessions

Effects

- Consumers delay spending, expecting lower prices

- Business revenues and profits decline

- Higher real value of debt, harming borrowers

- Can lead to rising unemployment

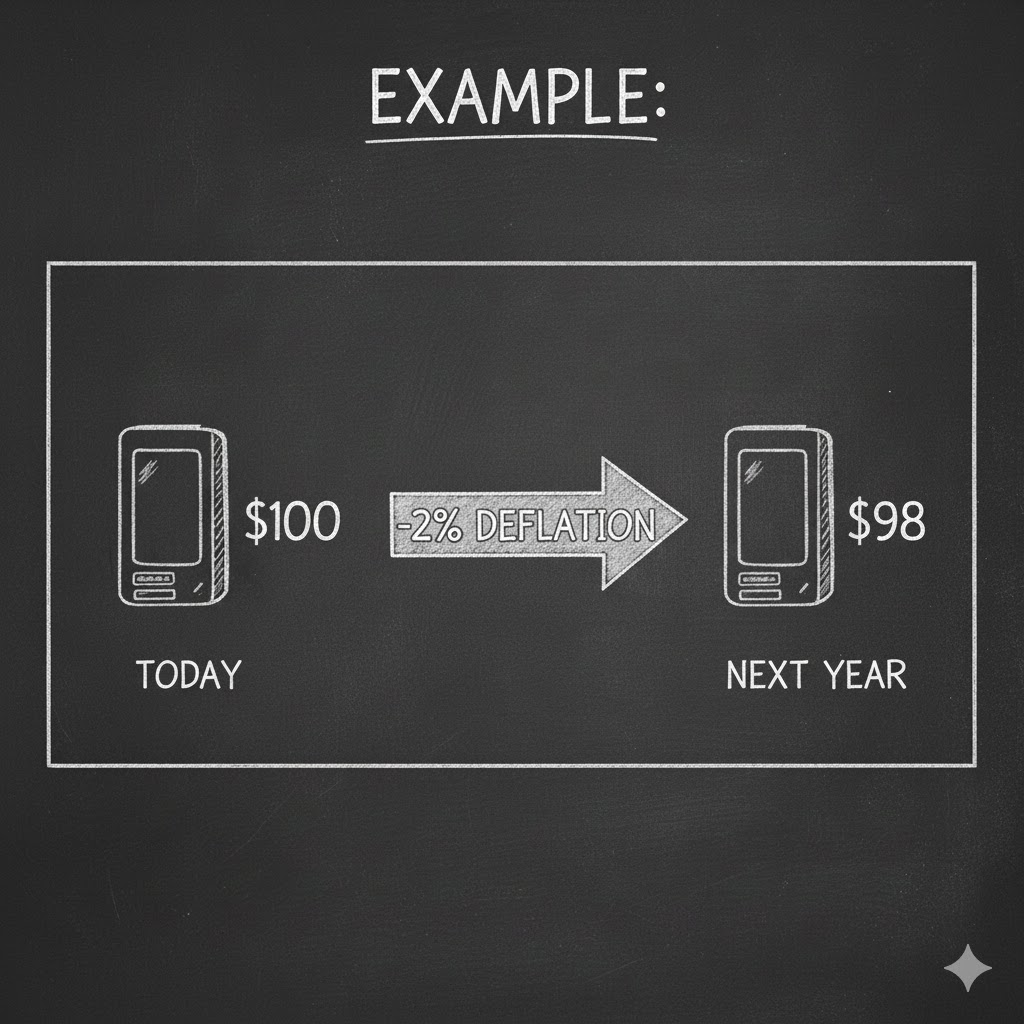

If deflation is −2%, an item costing $100 today will cost $98 next year.

Which is More Dangerous?

- Moderate inflation is generally manageable and often preferred by policymakers.

- Deflation is considered more dangerous because it can create a deflationary spiral—lower prices → lower profits → layoffs → lower demand → even lower prices.