- Gold is likely to consolidate between $4,000 and $4,500 unless macroeconomic uncertainty intensifies significantly.

- A breakout above the $4,550 to $4,600 zone could unlock further upside potential toward $5,050 in risk-driven scenarios.

- Conversely, a sustained drop below $4,450 risks a deeper correction toward the $4,000 to $4,100 support zone.

Gold delivered an impressive rally of over 70% in 2025, significantly outperforming the 27% gain recorded in 2024. This surge was driven by a blend of reinforcing macroeconomic uncertainties rather than a single event.

Key factors behind this strong performance included heightened geopolitical risks, shifting growth and inflation dynamics, expectations regarding the Federal Reserve’s interest rate path, a weakening US dollar, and an increased push for global portfolio diversification. As 2026 begins, the central question for gold is no longer if safe-haven demand will continue, but which macro conditions will amplify that demand and which technical price levels will confirm it.

Geopolitical and economic uncertainty proved the most visible catalyst in 2025, with issues such as trade tariffs during the Trump administration and ongoing conflicts in the Middle East and Ukraine increasing risk aversion and reinforcing gold’s status as portfolio insurance.

In addition, expectations of Federal Reserve rate cuts provided a supportive monetary backdrop throughout the year. Meanwhile, the US dollar index fell by approximately 10% in 2025, making gold more affordable for non-US investors and further boosting demand.

Rising demand for portfolio diversification emerged as a key structural driver behind gold’s strong 2025 performance. Amid volatile and sometimes disappointing returns in equity and bond markets, investors increasingly sought assets that could reduce portfolio correlation and risk.

This shift was evident in substantial inflows into gold investment products. In Q3 2025 alone, gold investments in U.S. mutual funds hit a record $26 billion, underscoring the growing importance of institutional demand. Meanwhile, continued gold purchases by central banks added further support to prices.

Together, these trends reaffirmed gold’s role as both a safe haven asset and a critical tool for portfolio insurance in 2025.

Gold Price Outlook 2026: Key Scenarios and Price Targets

Looking ahead to 2026, gold’s outlook is expected to unfold within a high-uncertainty, multi-scenario framework. Many analysts anticipate that gold will remain elevated, with a consolidation range between $4,000 and $4,500 forming the base case.

This range supports the continuation of the broader uptrend without losing momentum, allowing prices to digest the sharp gains seen in 2025. Base case forecasts from Goldman Sachs, which projects gold ending 2026 near $4,900, and Morgan Stanley, with a target around $4,400, indicate that the market still assigns significant probability to further upside.

However, renewed geopolitical tensions or a deeper macroeconomic slowdown could push prices beyond these levels.

The World Gold Council’s scenario-based framework provides a practical approach to evaluating gold’s 2026 outlook. Under the consensus scenario, prices are expected to remain broadly stable, but shifts in macroeconomic conditions could quickly shift gold into a different price regime.

If global growth slows and the Federal Reserve delivers deeper rate cuts than currently anticipated, gold could gain an additional 5% to 15%. In a more adverse scenario—where trade tensions escalate or new regional conflicts compel the Fed into aggressive easing—upside potential may expand further to 15% to 30%.

Conversely, a reflation environment could pose challenges for gold. Stronger economic growth combined with rising inflation pressures might prompt the Fed to maintain elevated policy rates, potentially strengthening the U.S. dollar and pushing real yields higher. This scenario could lead to a correction of 5% to 20% in gold prices.

Overall, gold’s trajectory in 2026 will likely depend less on headline geopolitical risks and more on how evolving macroeconomic conditions shape the Fed’s policy response, as outlined by the World Gold Council.

From a macroeconomic perspective, monetary policy stands out as a critical variable for gold next year. The Fed’s decisions on interest rate cuts will directly affect the opportunity cost of holding gold, making policy expectations a central driver of price direction.

Other key factors include the balance between inflation and growth. Elements such as energy prices, China’s growth trajectory, and the global demand outlook will influence inflation dynamics, while the risk of recession versus a soft landing will shape overall risk appetite. Currency movements will also play a significant role.

A weaker U.S. dollar generally supports gold prices, while a stronger dollar tends to weigh on them. At the same time, geopolitical tensions and conflicts can boost gold demand through higher safe-haven buying and rising inflation expectations driven by energy and commodity price shocks.

Technical Outlook for Gold: Key Support and Resistance Levels to Watch

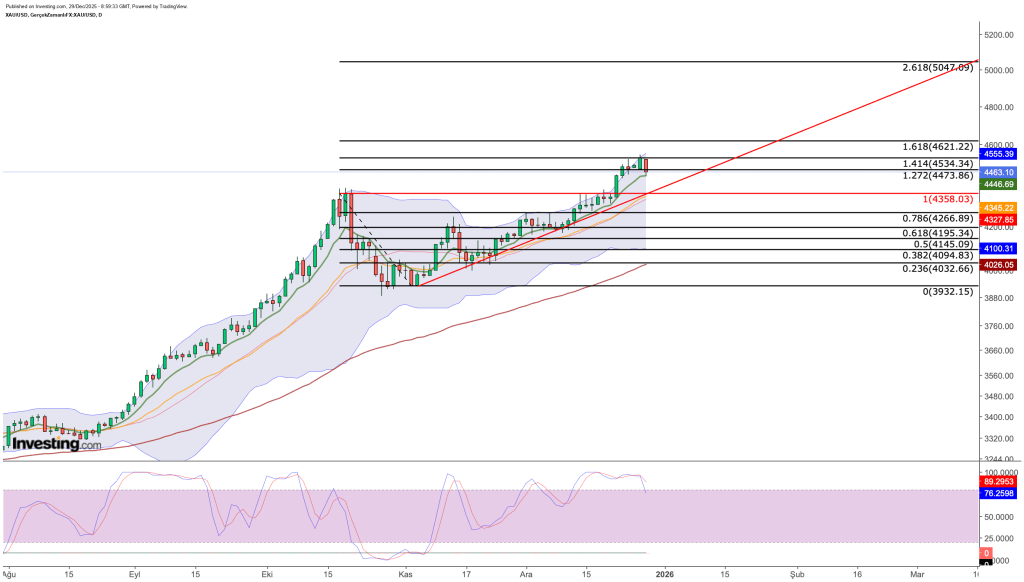

While fundamentals set the broader backdrop, technical analysis provides critical insights for gold’s 2026 outlook through key price levels. On the daily chart, the primary uptrend remains intact as prices hold above a rising trend line. However, the Stochastic RSI is turning down from overbought territory, signaling the risk of a pause or corrective phase early in the year.

Consequently, the market will closely watch where pullbacks find support and which resistance levels are cleared and sustained on the upside. These price reactions will be crucial in determining whether any early-year weakness is merely corrective or signals a more significant trend reversal.

On the resistance side, the first critical zone lies between $4,550 and $4,600. The lower edge of this range serves as a key pivot area, where price has frequently accelerated and retraced. Without daily closes above this band, it is challenging to argue that the uptrend can continue uninterrupted. A clear breakout and sustained hold above this zone would signal that buyers are regaining control and could pave the way for further gains.

On the resistance side, the next key level to watch is $4,620, aligning with the 1.618 Fibonacci extension. If gold prices hold above this level, attention shifts to the $5,050 area, which corresponds to the 2.618 Fibonacci extension. Given its proximity to the psychological $5,000 mark, this zone is likely to experience increased volatility and profit-taking.

On the support side, the $4,460 area represents the first line of defense for 2026. Pullbacks that stabilize here would indicate a healthy correction. If this level fails, the next critical support lies at $4,360. A break below this could signal a deepening correction, prompting the market to seek a lower equilibrium.

In that case, the $4,260 to $4,200 zone, defined by the 0.786 and 0.618 Fibonacci retracements, becomes the next key support area. A retreat into this band, especially amid a strengthening U.S. dollar and rising real interest rates, will be crucial in determining whether the broader uptrend remains intact. Sustained moves below this zone would shift focus to the final major support between $4,000 and $4,100. A decline into this range raises the risk that gold’s bullish structure for 2026 has weakened, potentially leading to an extended consolidation phase.

Putting these elements together, the base case for 2026 suggests gold will hold elevated levels while trading broadly within the $4,000 to $4,500 range. During periods of heightened macro uncertainty, a breakout above the $4,550 to $4,600 resistance zone could open the path toward the $5,050 target. Conversely, in a reflationary or more hawkish Federal Reserve scenario, a dip below $4,450 may extend the correction toward the $4,000 to $4,100 support area.

Ultimately, gold’s trajectory in 2026 will hinge on the interplay between monetary policy, interest rates, inflation, the US dollar, and geopolitical developments. Equally important, price action will guide strategy—whether gold breaks key resistance levels and successfully defends support zones during pullbacks will determine if it consolidates or continues its upward trend.

Sources: Investing