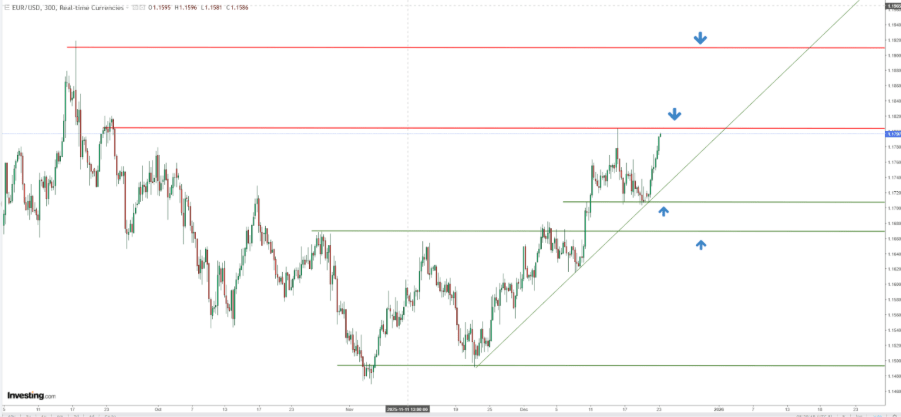

- EUR/USD hovers near the top of its yearly range amid cautious market sentiment.

- Weak US economic data may weigh on the dollar and fuel expectations of additional Fed rate cuts.

- A break above 1.1800 could pave the way toward 1.19 in early 2026.

EUR/USD is ending the year in a consolidation phase, trading within a range of roughly 1.15 to 1.19, currently closer to the upper boundary.

Ahead of the holidays, several key US economic data releases are expected. These reports could influence market direction into late December and early January, especially given the typically low liquidity during the Christmas and New Year period.

Weaker-than-expected data, particularly in GDP growth, may put downward pressure on the US dollar. This could occur even if inflation remains elevated, as slower growth would likely boost expectations for interest rate cuts in the coming year.

For now, the consensus favors interest rates holding steady at the Federal Reserve’s January meeting.

Fed Policy Outlook for Next Year

The Federal Reserve closed the year with a 25 basis point rate cut, responding to emerging signs of labor market weakness. Balancing its dual mandate of price stability and employment, the Fed’s easing cycle persists despite inflation remaining above target.

Recent CPI data brought some relief, with inflation easing to 2.7% year-on-year—below market expectations.

At the start of the new year, market attention typically centers on the labor market, inflation, and key economic growth indicators. Should these data points remain weak, the Federal Reserve might consider more rate cuts than the two currently priced in by markets.

It’s also important to note that a change in Fed leadership is expected next year. Kevin Hassett is widely regarded as the likely successor, and he may advocate for deeper rate cuts, aligning with the policy preferences of the current US administration.

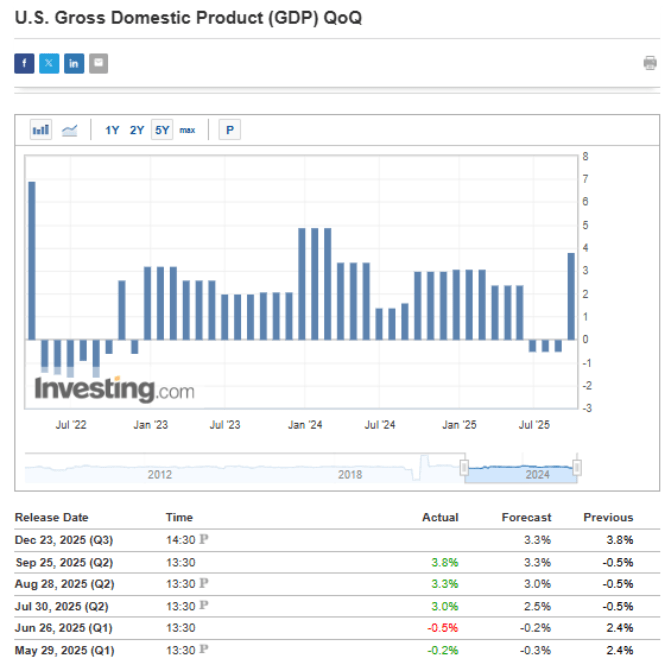

GDP and PCE Data Awaited Before the Holidays

As the year ends, markets await key releases: GDP figures and the Federal Reserve’s preferred inflation gauge, the PCE index.

GDP forecasts suggest quarter-on-quarter growth above 3%, which would be a positive signal if confirmed by the data.

With tomorrow being Christmas Eve, most market moves are expected to occur during today’s session.

EUR/USD Technical Analysis

The critical resistance level for EUR/USD is the December high near 1.1800. Should today’s data weaken the US dollar, a breakout above this level could occur, paving the way toward 1.19 in the early weeks of the new year

The uptrend line continues to act as the primary boundary for any correction, with immediate support near 1.17, tested late last week.

Sources: Investing